Three Solutions To The Podcast Ad Frequency Problem: “Remind The Many, Don’t Lecture The Few”

Click here to view an 11-minute video of the key findings.

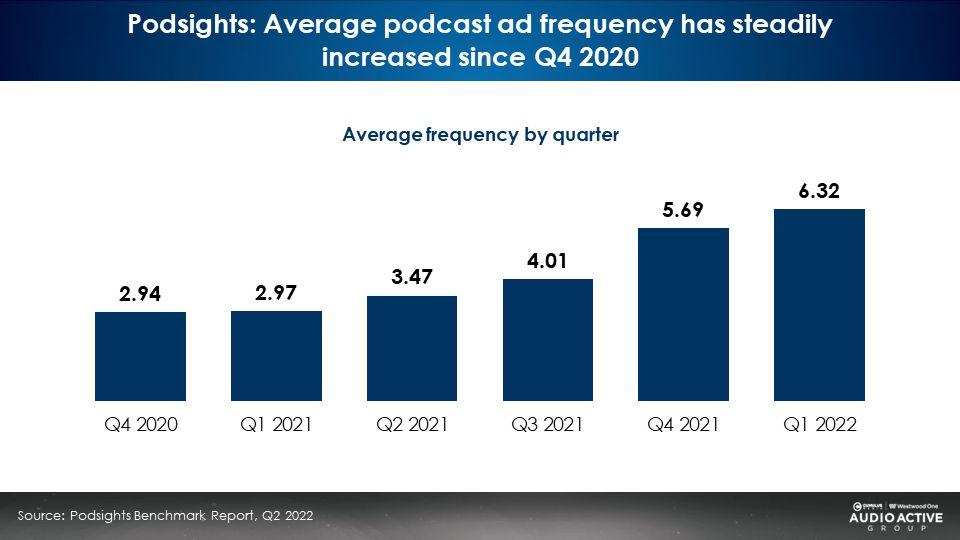

The number of times podcast listeners hear an ad campaign is soaring. According to Podsights, the leading podcast attribution measurement firm, average podcast ad frequency has doubled in the past year, reducing podcast conversions.

In Q1 2022, the average podcast campaign ad frequency measured by Podsights was 6.32, a twofold increase from Q1 2021 (2.97).

Over the last year, Podsights measured $408 million dollars of podcast ad campaigns, about one in three dollars of total podcast ad spend. They studied 3,000 podcast campaigns from 870 brands.

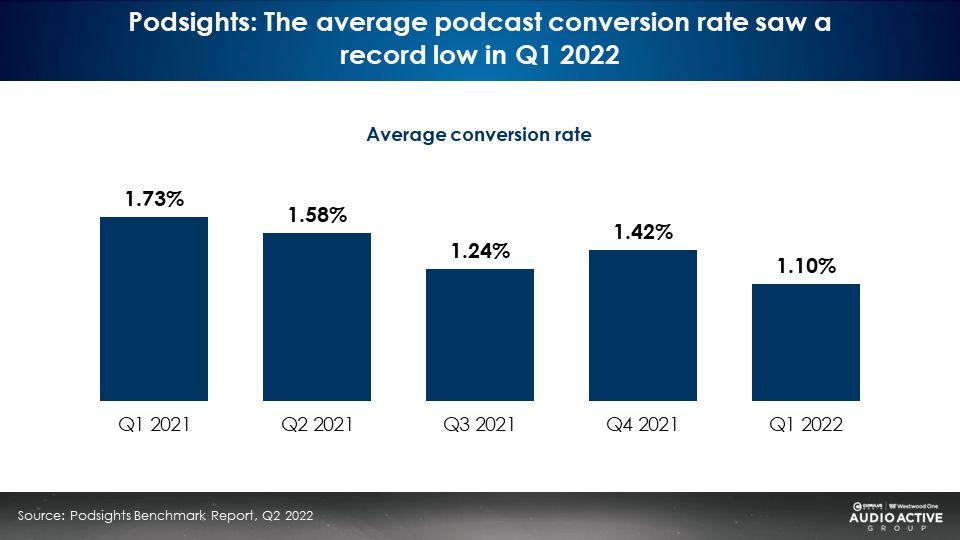

Soaring frequency reduces podcast conversion: At 1.1%, conversion was a record low in Q1 2022

Podsights reports that site visits based on podcast ads (1.1%) hit a record low in Q1 2022. They attribute the falling conversion rates to the higher ad frequency.

Conversion rate is calculated as the percentage of homes exposed that visited the advertiser’s website. In Q1 2021, the average conversion rate was 1.73%. A year later, in Q1 2022, the 1.1% conversion rate represents a -36% decrease.

The same consumers are hearing the same ads more often and as such, the proportion of advertiser site visits is down.

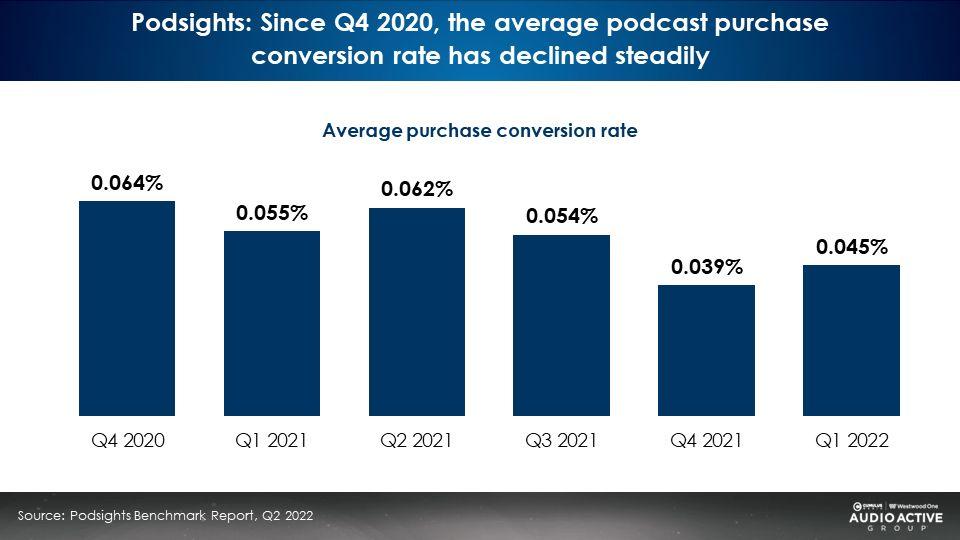

Higher campaign frequency pushes down purchase conversion rate

Podsights reports the proportion of exposed consumers who made a purchase is down -18% from the prior year. Hitting the same consumers over and over means less sales conversion.

An easy fix to reduced conversion: Prioritize reach over frequency

Podsights recommends increasing the number of publishers purchased to grow reach and improve conversions.

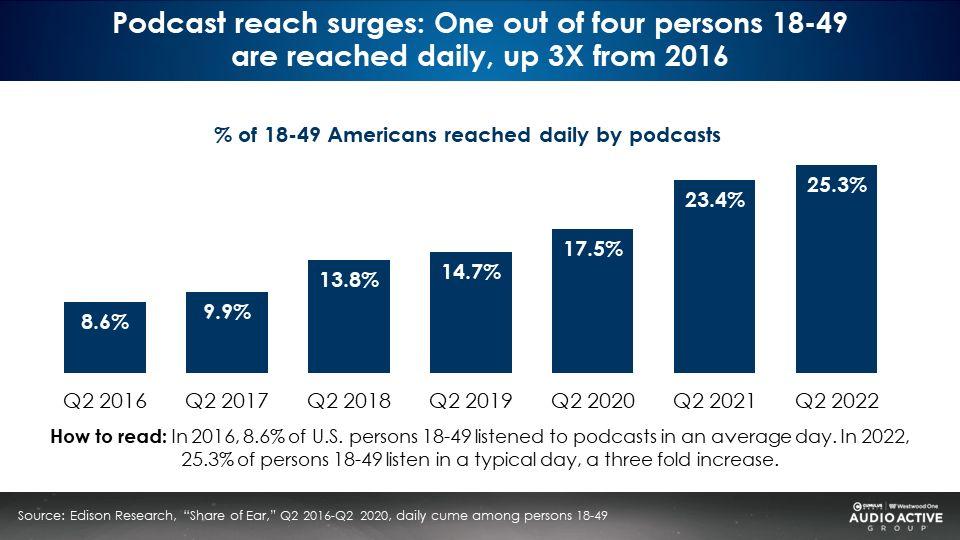

There is no lack of reach in podcasting: Reach is up 3X since 2016

A few years ago it was easy for marketers to dismiss podcasting as lacking scale. No longer.

In 2016, only 8.6% of U.S. persons 18–49 listened to podcasts in a typical day. According to Edison’s just-released Q2 2022 “Share of Ear,” daily podcast reach has tripled. Today, one out of four 18–49 Americans are reached daily by podcasts.

Since 2020, an additional 8% of the 18-49 demographic began listening to podcasts. That is almost the total number of daily podcast listeners from 2016 that begin listening in the last two years!

Since 2020, daily podcast reach has grown 45%! Given this massive surge in listeners, it will not be difficult for brands to increase reach, reduce frequency, and grow conversions.

Podcast audiences have scale: Almost one-third of persons 18-34 listen daily

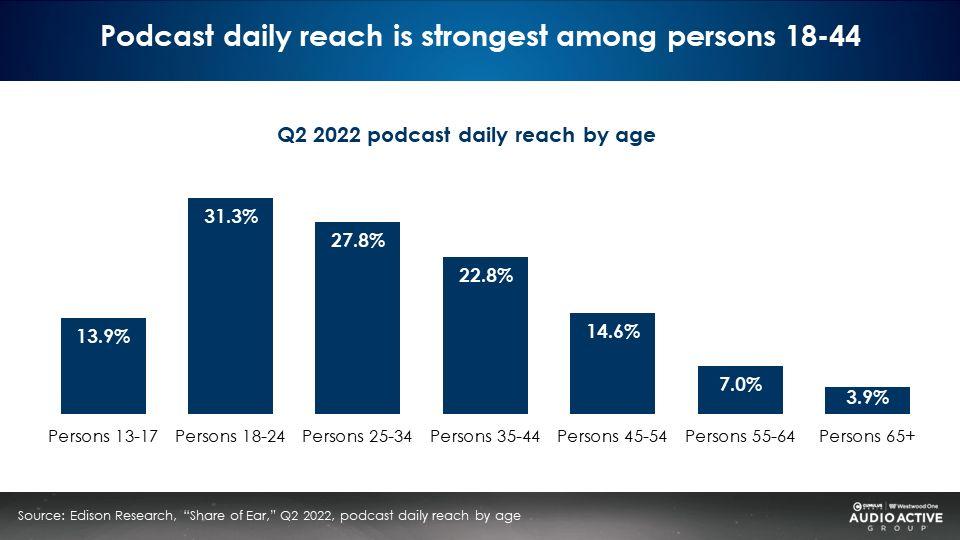

Edison’s Q2 2022 “Share of Ear” study reveals significant podcast daily reach among persons 18-44.

31% of U.S. persons 18-24 listen to podcasts in a typical day. 28% of persons 25-34 listen daily. There is a lot of available podcast reach.

Linear television only reaches 65% of American persons 18-49 in a week. According to Edison’s Infinite Dial study, the 18-49 weekly reach for podcasts is 33%. Podcasts are gaining fast on TV.

Here are three strategies to grow podcast reach:

1. Buy more shows and genres than the “obvious fit” podcasts: Consult Nielsen’s Scarborough Podcast Buying Power study or MRI to find additional shows and genres to purchase

Many brands buy just the shows that seem immediately logical. Online therapy ads run in mental health shows. Online sports betting apps run in Sports podcasts.

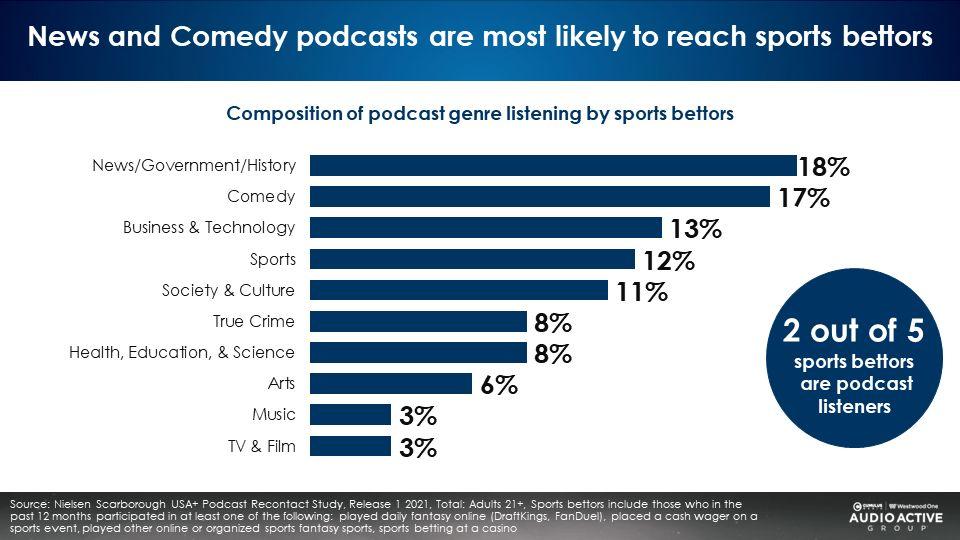

Only placing ads in “obvious fit” podcasts and podcasts genres misses 80% to 90% of category buyers. Consider this Nielsen Scarborough ranker of the podcast genres listened to among sports bettors:

Among sports bettors, Sports podcasts rank number four and only generate a 12% share of audience. News/Government/History and Comedy are the leading podcast genres among sports bettors.

Use the MRI or Nielsen Scarborough data to run podcast genre listening among category buyers. Allocate share of buy based on share of genre category listening.

For the sports bettors example, 18% of impressions would be placed into News/Government/History podcasts, 17% into Comedy, 13% into Business/Tech, etc. A far more diverse media plan is generated with much greater reach.

2. Purchase genres and shows based on reach among category buyers, not index

Planning tools like MRI and Nielsen Scarborough Podcast Buying Power report the number of category listeners to a podcast or podcast genre as well as an index. Beware the index!

An index compares purchase behavior in a purchaser segment to the total U.S. An index does not report audience volume, only likelihood to purchase.

An index of 120 means people who listen to a podcast or genre are 20% more likely than the U.S. average to purchase that category or brand. Index does not reveal the size of the audience.

Selecting podcasts and genres based on index results in tiny audiences. It is better to rank shows and genres for a product category based on actual listeners in the purchase category.

For example, podcast genre A might have a category purchase index of 105 with 500,000 listeners. Podcast genre B might have purchase index of 125 with 100,000 listeners. Go for podcast genre A – it has five times more category purchasers!

3. Spread impressions further down the ranker and buy more than just top shows

The same impressions spread over more shows grow reach and results.

Edison’s Podcast Metrics audience service is the only measurement service that reports people-based reach and duplicated and unduplicated audiences between podcasts.

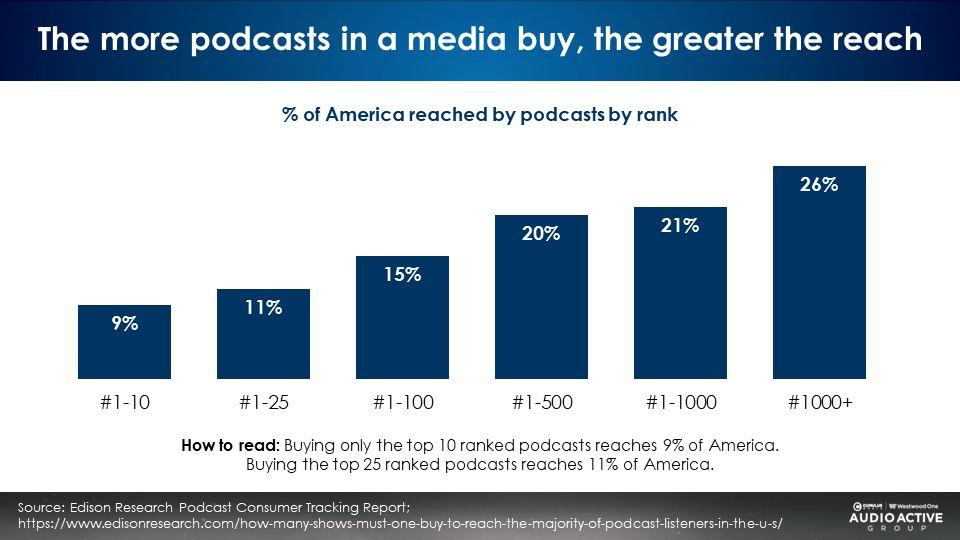

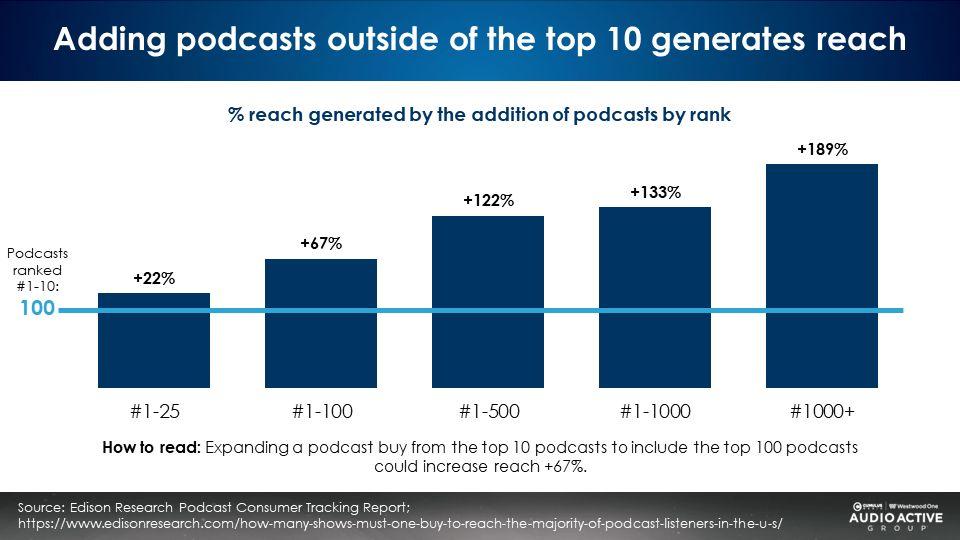

Edison’s data reveals just buying top podcasts misses huge amounts of audience. According to Edison, two-thirds of podcast reach occurs to titles outside the top 10.

The top 500 podcasts reach one out of five Americans weekly, double the number reached by the top ten shows (9%).

Taking the same impressions and buying deeper down the ranker grows reach impressively. Per Edison, the top 100 titles have a 67% greater reach than the top ten podcasts. The top 500 titles have 122% more reach than the top ten podcasts.

Big Audio Datamine: Campaigns that focus on building reach deliver stronger effects

Last month, Big Audio Datamine, the world’s largest and most comprehensive audio advertising effectiveness dataset was released by RadioCentre in the UK. The report studied 1002 discrete advertising campaigns for 463 brands covering 14 categories involving over 100 media and creative agencies.

According to the study, “The most influential planning variable is weekly reach. The average uplift rate in effectiveness outcomes is significantly greater for higher-reach campaigns than for lower-reach campaigns.”

The conclusion? Marketers should prioritize campaign reach over frequency.

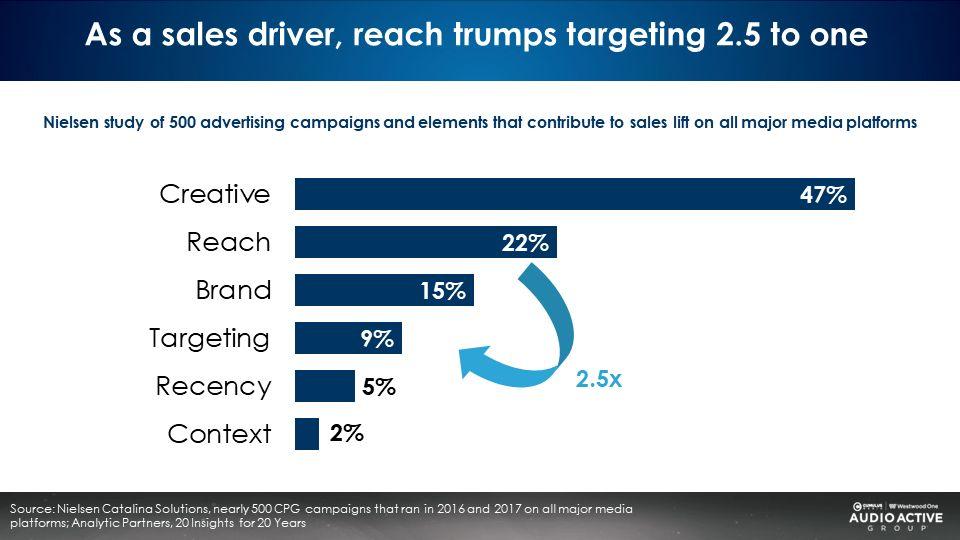

Nielsen: As a sales driver, reach trumps targeting 2.5 to one

Nielsen sales effects studies of nearly 500 brands reveal reach represents 22% of sales lift. Targeting only generates 9% of sales growth. Reach creates two and half times more sales than targeting.

Erwin Ephron: “Remind the many, don’t lecture the few”

Erwin Ephron, the father of modern media planning, famously said:

“Most advertising usually works by reminding people about brands they know, when they happen to need that product. Ads work best when the consumer is ready to buy. Reminding a lot of consumers is better than lecturing a few.”

Key takeaways:

- Podsights reports podcast ad campaign frequency is soaring, causing the proportion of site visits (conversions) and purchase rate to fall

- The solution is to grow reach at the expense of frequency

- Podcasts have audience scale; Podcast reach has tripled since 2016 as one-fourth of 18-49-year-old Americans are reached daily

- Three strategies to optimize reach:

1) Buy more shows and genres than just the “obvious” fit podcasts; Consult Nielsen’s Scarborough Podcast Buying Power study or MRI to find additional shows and genres to purchase

2) Purchase podcast genres and shows based on reach among category buyers, not index

3) Spread impressions further down the ranker and buy more than just top shows

- Take the advice of Erwin Ephron, the father of modern media planning: “Remind the many, don’t lecture the few”

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.