7 New Findings About The Podcast Audience: The Cumulus Media 2023 Audioscape

Click here to view a 5-minute video of the key findings.

Click here to download your copy of the Cumulus Media Audioscape.

Audio is a huge part of life for Americans. While AM/FM radio dominates the audio landscape with mass reach and significant time spent, podcasts and smart speakers are fast growing platforms representing engaging environments for brands.

The recently released Cumulus Media 2023 Audioscape examines the latest podcast consumer and smart speaker trends from Edison Research’s “Share of Ear” Report from Q4 2022 and Nielsen Scarborough’s Podcast Buying Power report. A few weeks ago, eight key findings on the smart speaker audience were covered.

This week, here are the seven key findings on the podcast audience:

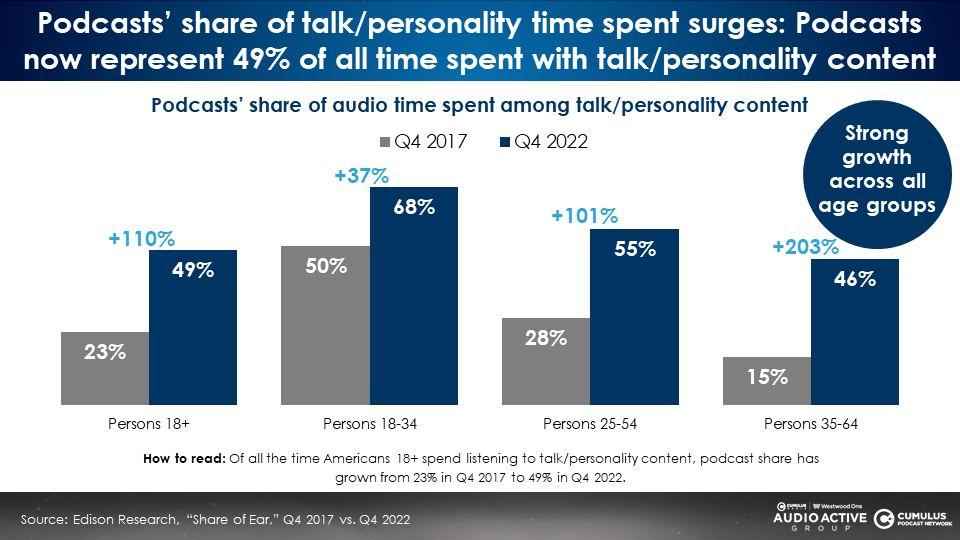

1. Over half of all U.S. 25-54 time spent with talk/personality content now occurs via podcast, up 2X in five years

Edison’s “Share of Ear” study quantifies time spent with four types of audio: music, news, sports, and personality/talk. In 2017, 28% of persons 25-54 time spent with personality/talk content occurred on podcasts. Today, podcasts’ share of 25-54 personality/talk time spent has doubled from 28% to 55% as of Q4 2022.

The older the demographic, the greater the podcast growth rate as the platform for personality/talk. Podcasts’ share of time spent for personality/talk is up +203% among 35-64s and +101% among 25-54s. Overall, half of U.S. time spent with personality/talk now occurs via podcast.

Among 18-34s, an astonishing 68% of all personality/talk time spent occurs via podcast.

In the 1970s, it took FM ten years to grow from a 20% share of radio listening to a 50% share. Podcasts have nearly secured a 50% share among persons 18+ of personality/talk time spent in half the time.

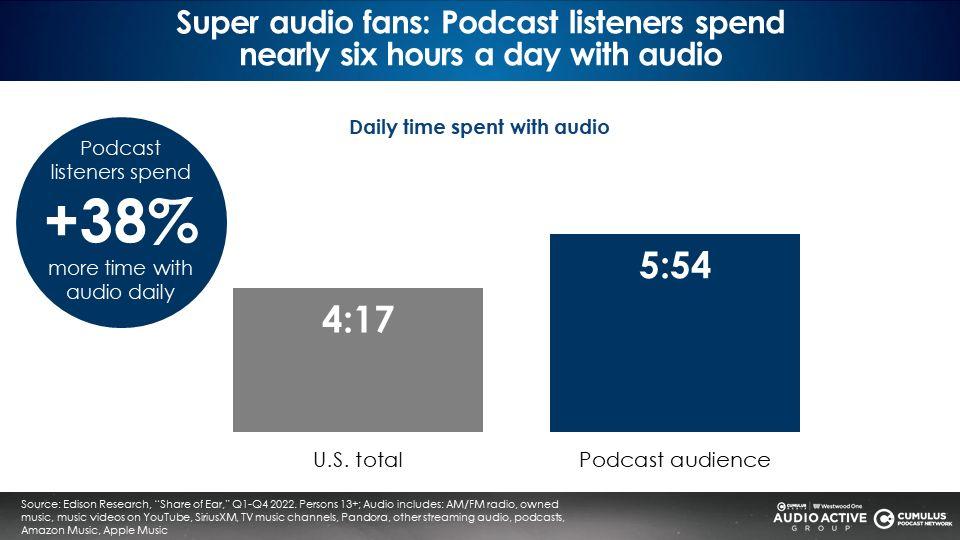

2. Podcast listeners are super audio fans spending nearly six hours a day with audio, +38% more time than the average American

Podcast listeners love audio and want more of it. They spend a stunning six hours each day with audio. Podcast listeners spend +38% more time with audio than the average.

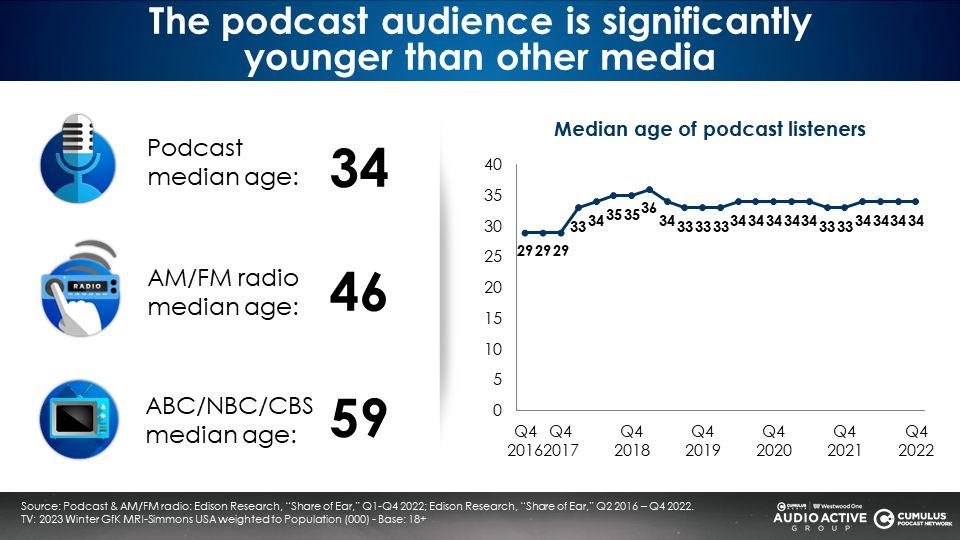

3. The median age of the podcast audience holds at 34 despite massive audience growth

The podcast audience is twelve years younger than the median age of AM/FM radio listeners and 25 years younger than linear television where audiences have a median age of 59.

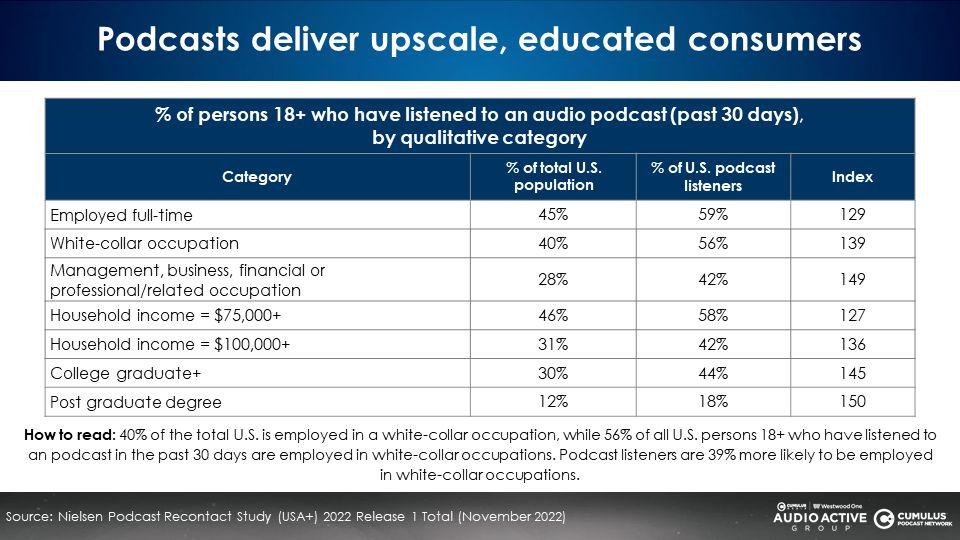

4. The podcast audience profile is employed, upscale, and educated, according to Nielsen Scarborough

The podcast audience is 50% more likely to have graduated college and have a post-graduate degree. From an employment standpoint, podcast listeners are 29% more likely to be full-time employed, 39% more likely to work in a white-collar role, and 36% more likely to have a $100K+ household income.

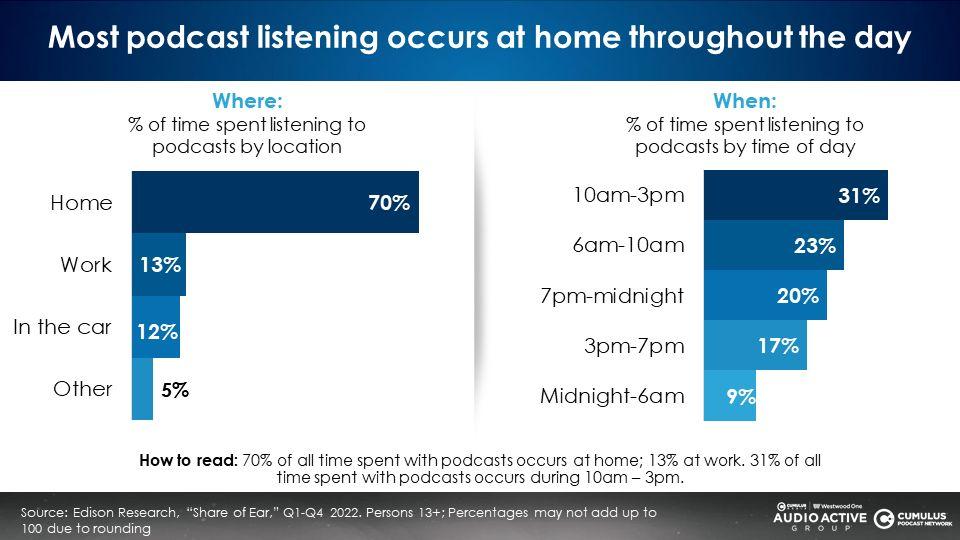

5. Most podcast listening occurs at home throughout the day

Podcast listening occurs throughout the day and night. While podcast audiences have soared, the vast majority of listening still occurs at home (70%). This is up considerably from before the pandemic where in Q3 2019, 60% took place at home.

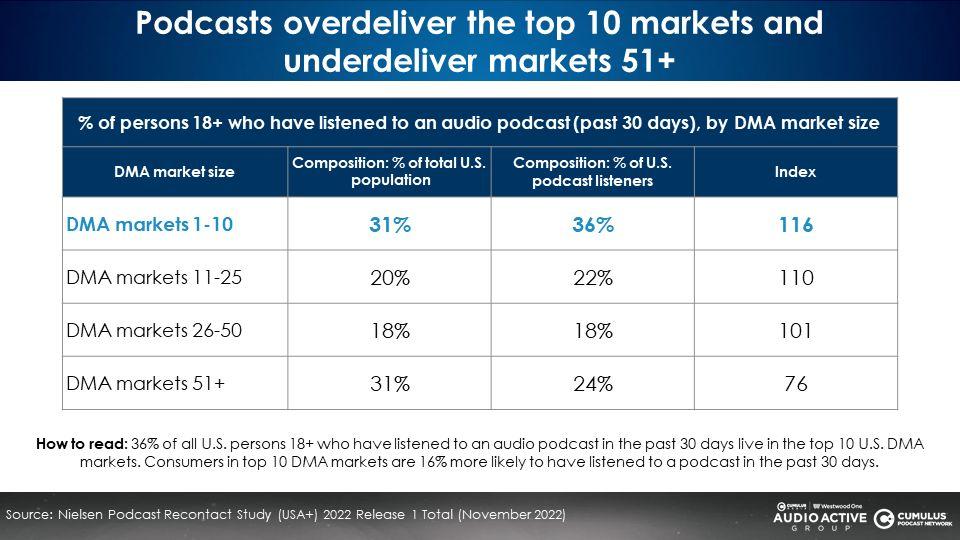

6. Podcasts have opportunities for growth in markets 51+ where listening is underrepresented

Nielsen Scarborough’s Podcast Recontact Study finds podcast listeners are overrepresented in the top ten markets (+16%) and underrepresented in DMAs 51+ (-24%).

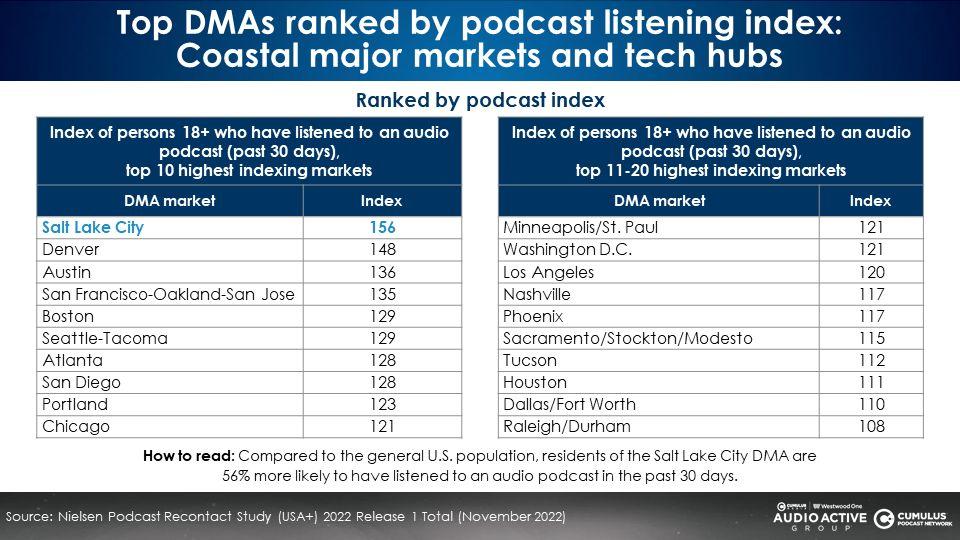

According to Nielsen Scarborough, the markets with the highest incidence of podcast listening are coastal DMAs and tech hubs. Salt Lake City and Denver exhibit exceptionally strong levels of podcast listening.

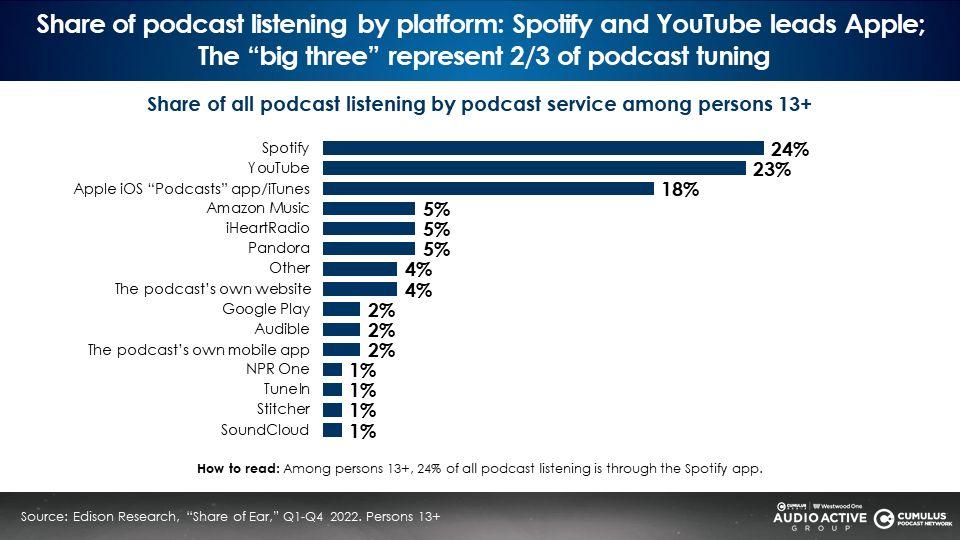

7. Over the last year, Spotify has surpassed Apple as the top podcast listening platform; YouTube is a close second and Apple is third

According to Edison’s Q4 “Share of Ear,” 24% of podcast tuning minutes occur on Spotify, 23% on YouTube, and 18% on Apple. The “big three” platforms account for two-thirds of podcast tuning.

Key takeaways:

- Over half of all U.S. 25-54 time spent with talk/personality content now occurs via podcast, up 2X in five years

- Podcast listeners are super audio fans spending nearly six hours a day with audio, +38% more time than the average American

- The median age of the podcast audience holds at 34 despite massive audience growth

- The podcast audience profile is employed, upscale, and educated, according to Nielsen Scarborough

- Most podcast listening occurs at home throughout the day

- Podcasts have opportunities for growth in markets 51+ where listening is underrepresented

- Over the last year, Spotify has surpassed Apple as the top podcast listening platform; YouTube is a close second and Apple is third

Click here to view a 5-minute video of the key findings.

Download your copy of the Cumulus Media Audioscape:

Liz Mayer is the Insights Manager of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.