Auto Dealers Remain The Centerpiece Of The Purchase Process: Cumulus Dallas-Ft. Worth Auto Buyer Study

Click here to view a 12-minute video of the key findings.

Click here to view or download a PDF of the slides.

According to recent data from Cox Automotive, the U.S. auto marketplace is continuing to recover:

- “For the full calendar month of May, total new-vehicle sales jumped by 23% compared with the year earlier. Sales volume was roughly even with April. This May’s seasonally adjusted annual rate (SAAR), or sales pace, was 15.0 million, again solidly beating analysts’ forecasts.

- New-vehicle inventory in May reached its highest level in two years, according to Cox Automotive’s analysis of vAuto Available Inventory data, with a notable increase from the previous month.

- The total U.S. supply of available unsold new vehicles stood at 1.96 million units at the end of May … the highest level of supply since mid-April 2021. Supply was up 73% from a year ago, or 825,000 units higher.

- Days of supply edged up to 55 at the end of May from an upwardly revised 54 at the end of April. That was 46% higher than the same time a year ago. Historically, 60 days’ supply across the industry was considered normal and ideal.

- With some brands and segments experiencing excessive inventory and demand softening slightly, discounts and incentives will increase.”

Cumulus Media Dallas-Ft. Worth auto buyer study

In the context of these encouraging national trends, Cumulus Media sought an in-depth understanding of Dallas-Ft. Worth auto buyers. The Cumulus Media | Westwood One Audio Active Group® retained MARU/ Matchbox to conduct a study in March/April 2023 of 600 auto buyers.

The study consisted of 285 consumers who had purchased or leased a vehicle in the past year. 442 consumers who plan to buy a vehicle in the next 12 months were also surveyed. 127 respondents were both prior year purchasers and auto intenders in the market for another vehicle in the next year.

Here are the key findings:

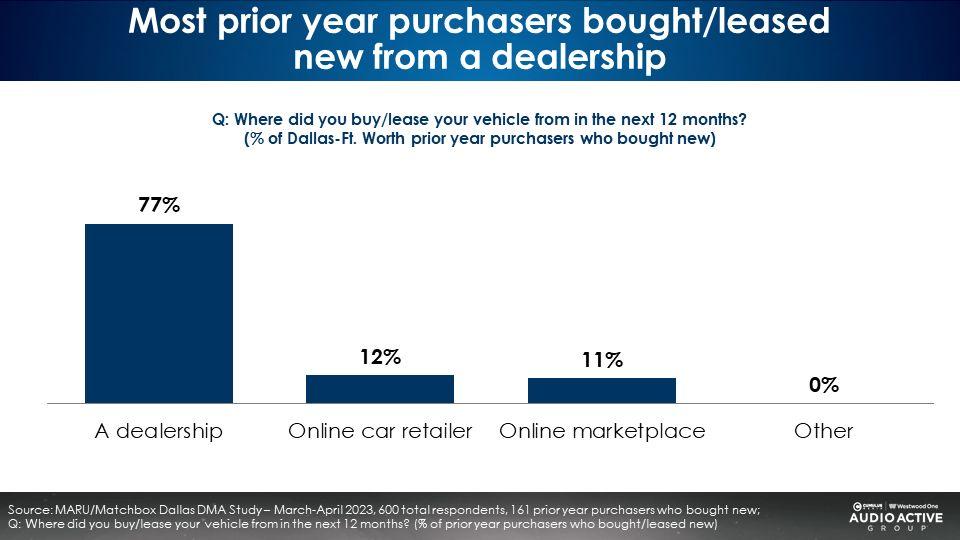

77% of prior year new car buyers purchased from an auto dealer

23% used an online car retailer or an online marketplace. Despite all of the online purchase options, nearly four out of five new vehicles were purchased at a Dallas-Ft. Worth auto dealer.

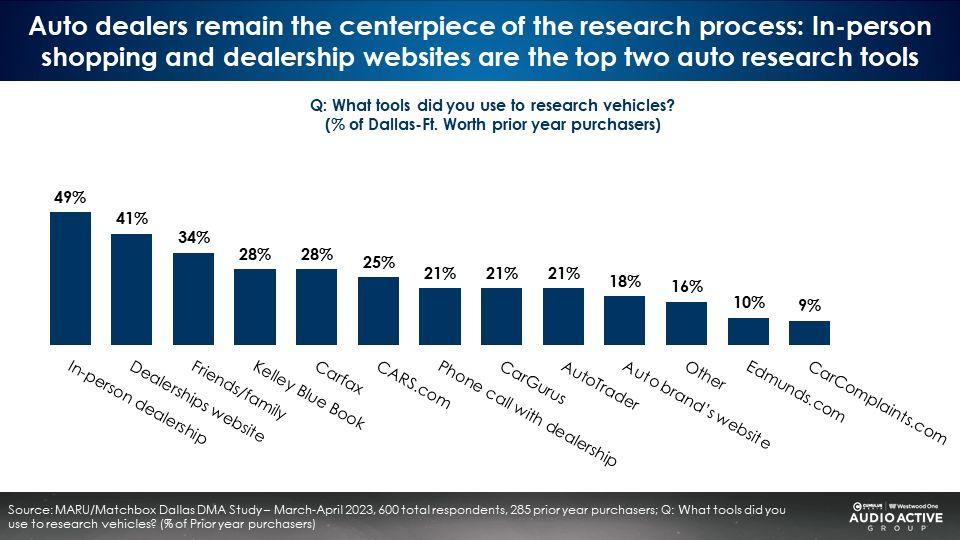

Auto dealers remain the centerpiece of the research process: The top two most used research methods are in-person auto dealer shopping and dealer websites

Among those who purchased new or used in the past year, 49% researched their purchase in person at a dealer. 41% reviewed dealership websites. A third consulted family or friends.

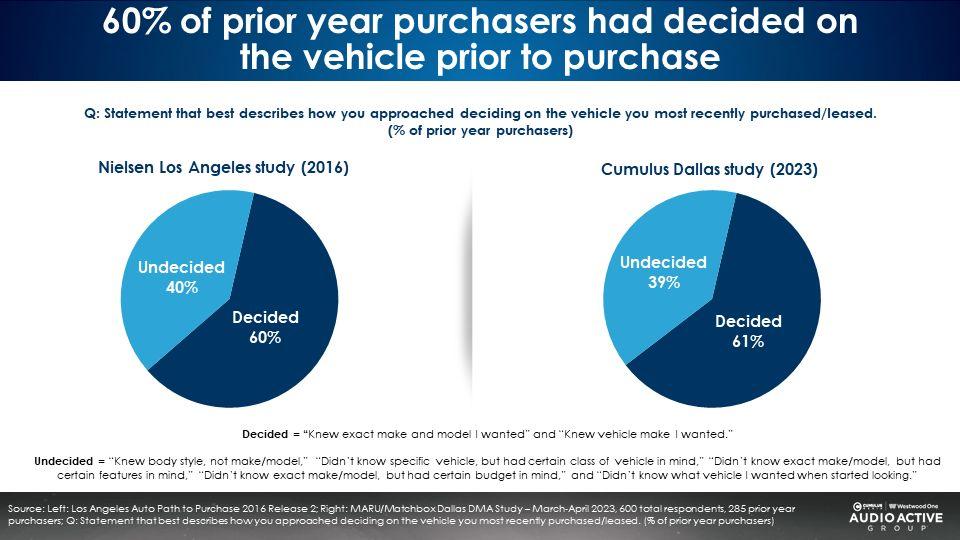

40% of prior year purchasers were undecided on their vehicle prior to the purchase process

These findings mirror an auto buyer study conducted by Nielsen in Los Angeles in 2016.

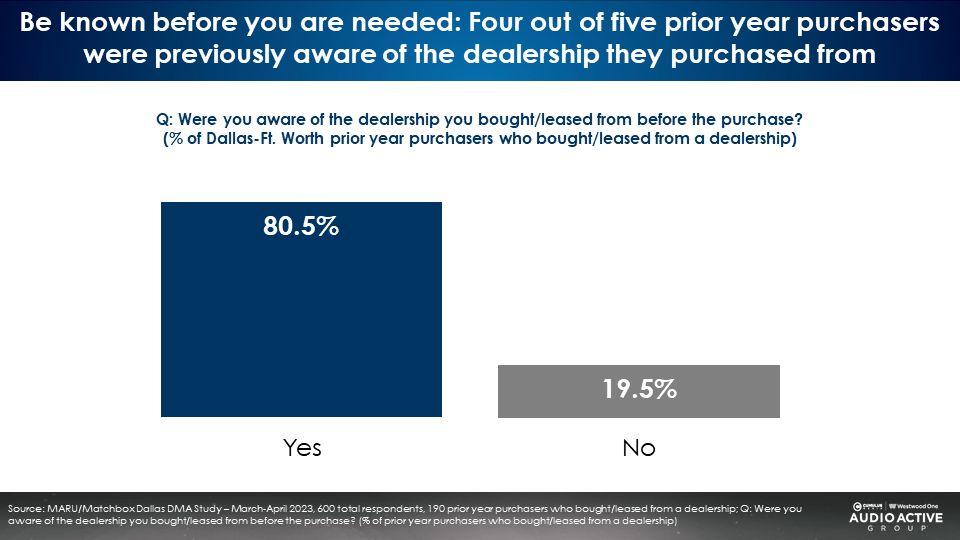

Dealers must “be known before they are needed”: 81% of prior year purchasers were aware of the dealer prior to their purchase

Successful auto dealers have something called “mental availability.” Les Binet and Sarah Carter, two of the world’s leading experts on marketing effectiveness, explain, “The single most important factor driving brand preference is ‘mental availability’: how well known a brand is, and how easily it comes to mind. Brands with low mental availability tend to struggle, rejected in favour of more familiar rivals. Or not considered in the first place. Brands with high mental availability don’t have to push so hard to sell, so tend to have higher market shares and better margins.”

According to James Hurman, author of the book Future Demand, one of the most important jobs of an auto dealer is to build future demand, or “advertising to that much larger group of consumers who are not ready to buy now, but will be in [the] future, and making them feel familiar with and positively toward us, so that they gravitate to [them] when they enter the category.”

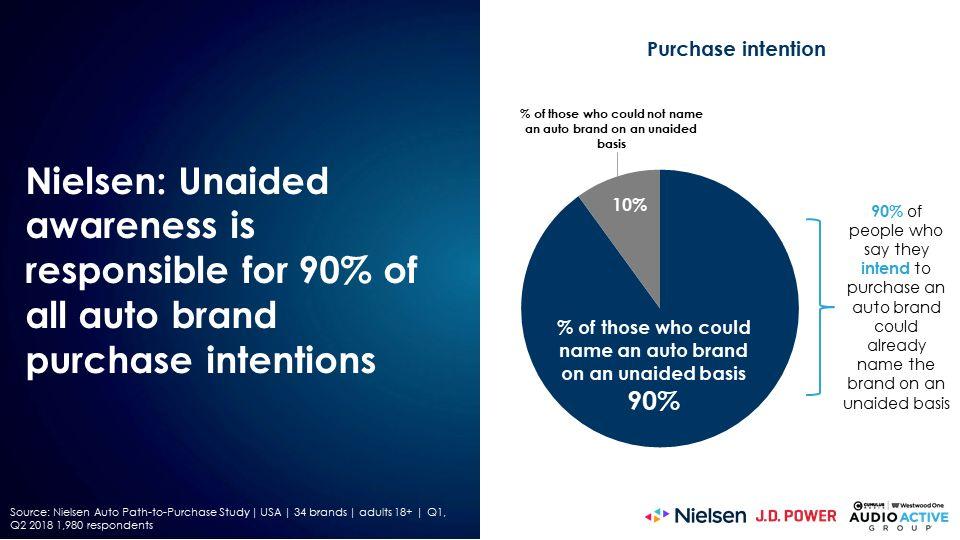

“Easy to mind, easy to find”: Nielsen reports unaided awareness is responsible for 90% of all auto brand purchase intentions

A major national automotive study conducted by Nielsen found that 90% of those who say they intend to purchase an auto brand could already name the brand on an unaided basis. Both dealers and auto brands must “be known before they are needed.”

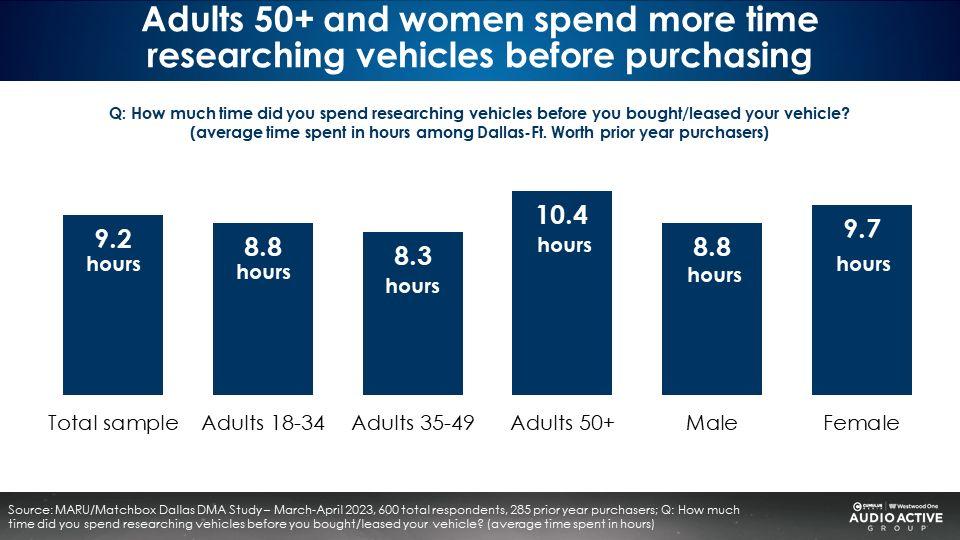

The auto buying process takes nine hours of research; Some spend over ten hours

Prior year auto purchasers report spending 9.2 hours researching their vehicle. Women spent an additional hour on research compared to men. Consumers over the age of 50 report spending 10.4 hours researching vehicles.

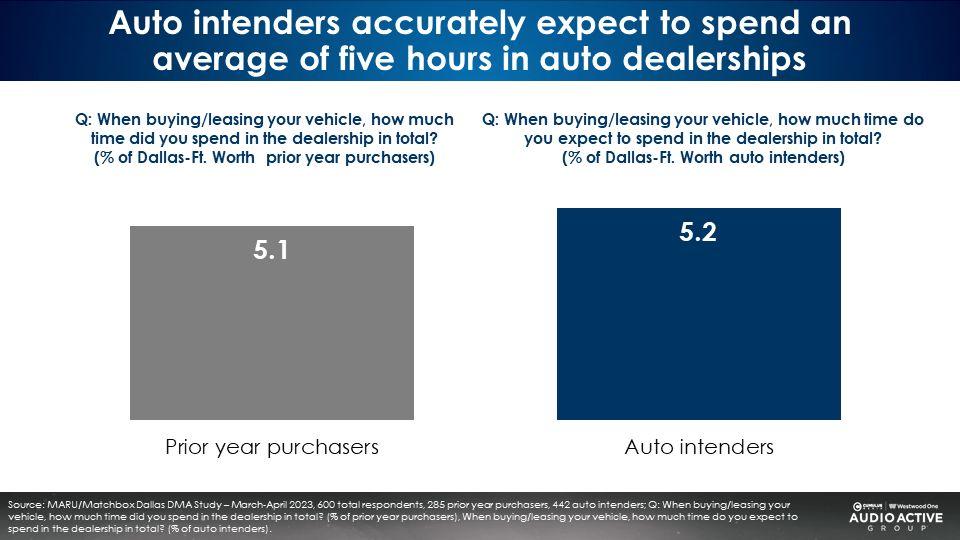

Auto buyers say the in-person dealer purchase process takes five hours

Those who purchased a vehicle in the past year report they spent five hours at the dealer finalizing the sale. Interestingly, those who intend to purchase a vehicle in the next year also expect to spend five hours on the purchase process at the dealer.

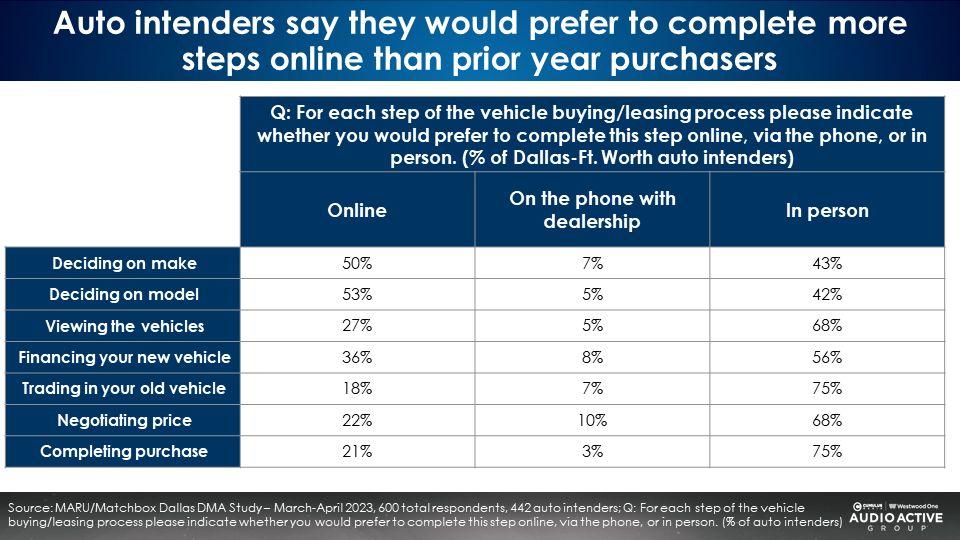

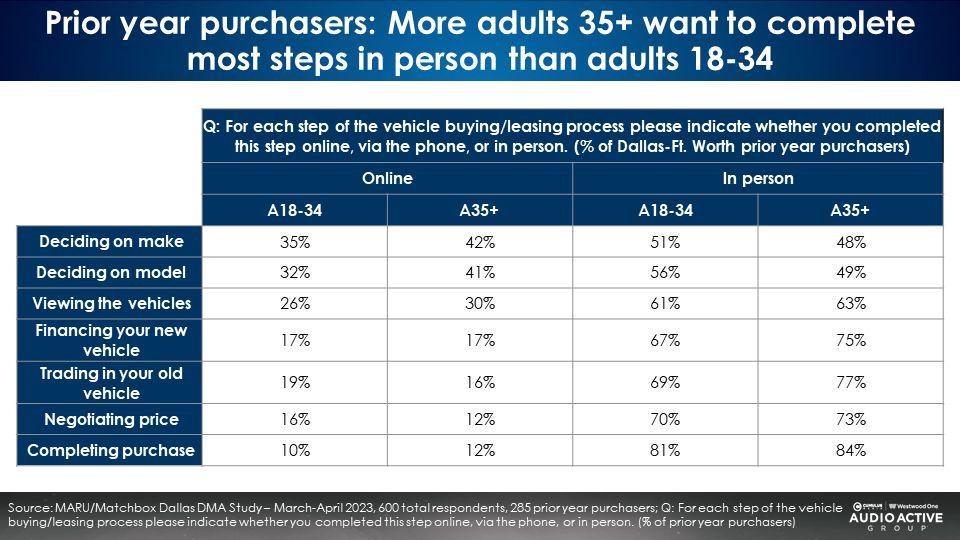

The in-person auto dealer experience is important: The further into the purchase process, the greater the need for an in-person scenario

While two out of four report their make/model decision occurred online, half say make/model decisions occurred in person at the dealer. Over 70% report financing, trade in, price negotiation, and purchase completion occurred at the dealer.

The in-person dealer experience is equally important to younger auto purchasers

Across the seven stages of the auto purchase process, younger and older auto buyers have a very similar online/in-person profile. Interestingly, a slightly greater proportion of 18-34s decide on the model of their purchase in person versus adults 35+.

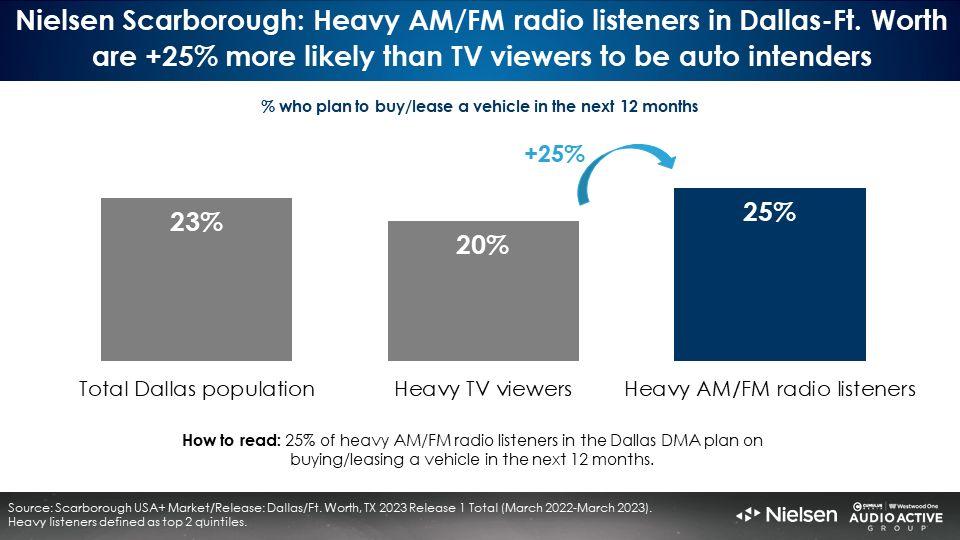

Nielsen Scarborough: AM/FM radio delivers +25% more auto buyers than television

Nielsen Scarborough reports AM/FM radio listeners are +25% more likely to be auto intenders compared to TV viewers. Scarborough’s just released Dallas-Ft. Worth study reveals 25% of heavy AM/FM radio listeners are in the market for a vehicle versus only 20% of heavy TV viewers.

AM/FM radio listeners are +25% more likely to be in the market for a vehicle. Thus, 100 GRPs of AM/FM radio are worth +25% more than the same GRP level on TV.

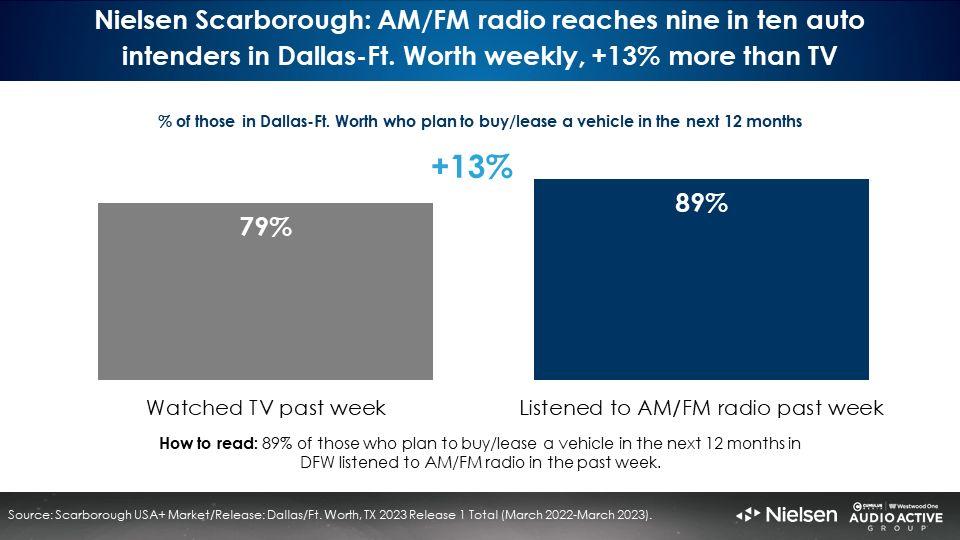

AM/FM radio reaches +13% more auto intenders than linear TV

Dallas-Ft. Worth AM/FM radio reached nine of ten auto intenders, +13% more than television, according to Nielsen Scarborough.

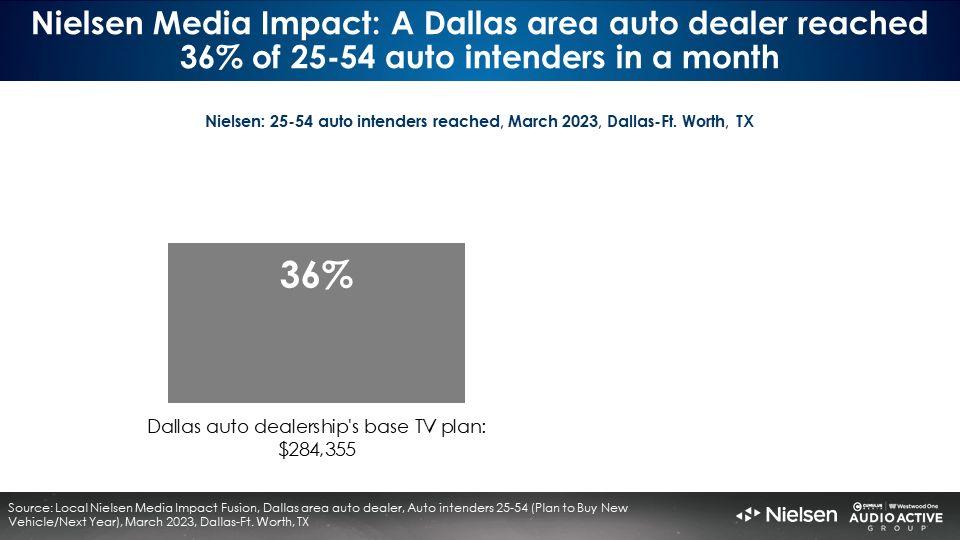

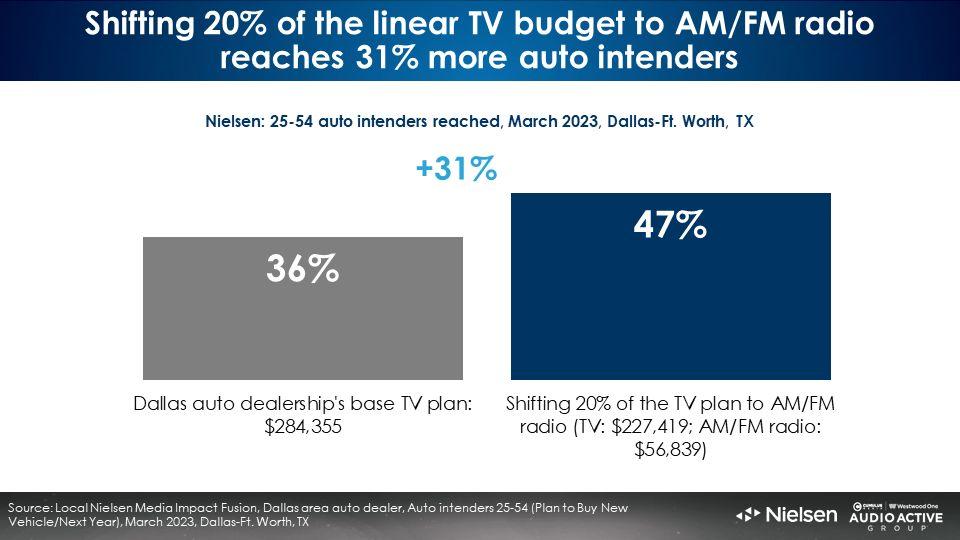

Nielsen Media Impact: A dealer not advertising on AM/FM radio would generate a massive +31% increase in auto intender reach by shifting 20% of their TV budget to AM/FM radio

In March 2023, Nielsen reported a Dallas auto dealer spent $284,355 on TV and reached 36% of 25-54 auto intenders. The dealer was not advertising on AM/FM radio.

Nielsen Media Impact, the media optimization and planning platform, reveals that shifting 20% of the dealer’s TV investment to Dallas-Ft. Worth AM/FM radio would generate a massive +31% increase in 25-54 auto intender reach at the same spend.

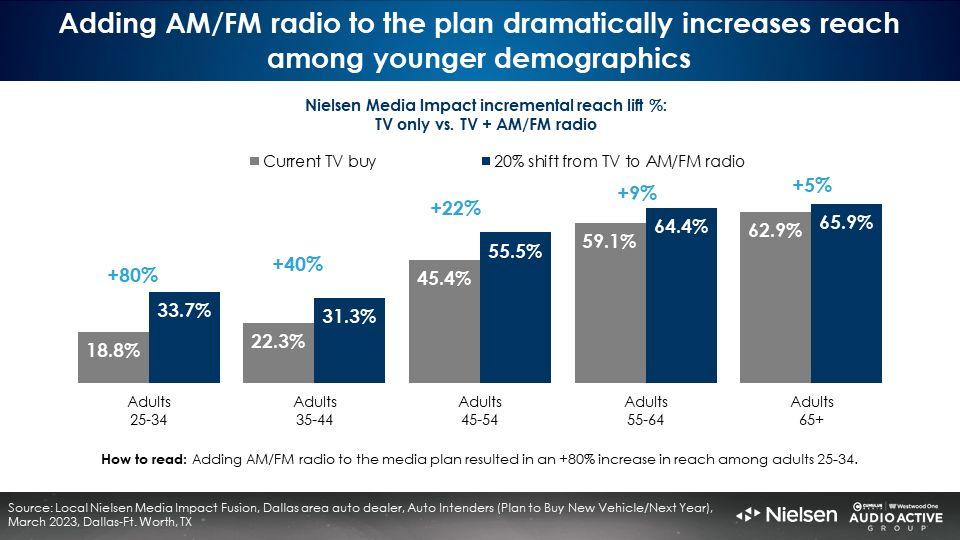

The addition of AM/FM radio into the media plan generates significant lifts in auto intender reach among auto buyers under the age of 55. The grey bars below represent the demo reach of the March TV plan. The blue bars represent the combined AM/FM radio/TV demo reach. Among 45-54s the addition of AM/FM radio lifts auto intender reach by +22%. Among 35-44s reach soars by +40%.

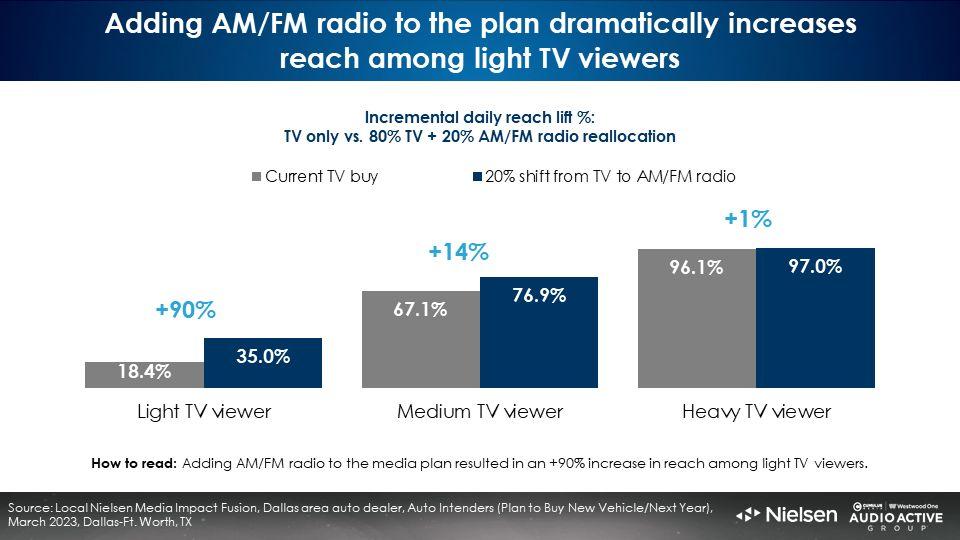

AM/FM radio’s superpower: Reaching auto intenders who are light TV viewers

Nielsen Media Impact reveals the secret of how AM/FM radio elevates the auto dealer media plan – by reaching auto buyers who cannot be reached on TV. Nielsen’s analysis reveals the addition of AM/FM radio into the media plan doubles reach among auto intenders who are light TV viewers.

The auto dealer’s TV-only media plan reached only 18% of light TV auto intenders. Shifting 20% of the TV budget to AM/FM radio lifts light TV viewer reach from 18% to 35%. This represents an astonishing +90% increase in auto intender light TV viewing reach.

Key findings:

- Auto dealers remain the centerpiece of the purchase process: The majority of prior year purchasers bought their vehicle from a dealership and the majority of auto intenders intend to do the same. The dealer website and the dealer showroom are the most used auto shopping research tools.

- Be known before you are needed: Four out of five prior purchasers who bought from a dealership were aware of the dealership before their purchase. In a Nielsen study, 90% of people who say they intend to purchase an auto brand could already name the brand on an unaided basis.

- As purchasers get further into the sale process, they want to complete steps at the dealer: While some prior year purchasers and auto intenders would like to complete car-buying steps online, in-person interactions increase as the shopper gets closer to purchasing.

- AM/FM radio ad impressions are worth +25% more than TV impressions when it comes to auto intenders: AM/FM radio reaches more vehicle buyers than television. AM/FM radio listeners are +25% more likely to be auto intenders than TV viewers. Auto dealer media allocations on AM/FM radio is worth +25% more.

- Nielsen Media Impact – AM/FM radio makes your automotive TV better: A 20% reallocation of a local dealership’s TV buy to AM/FM radio increased reach by +31% among 25-54 auto intenders. AM/FM radio’s superpower is reaching auto intenders who are light TV viewers and cannot be reached on TV. Nielsen’s analysis reveals the addition of AM/FM radio in the media plan doubles reach among light TV auto intenders.

Download the slides:

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.