Automakers: Want To Build An EV Brand? Place Podcasts And AM/FM Radio At The Centerpiece Of Your Media Plan!

Click here to view an 11-minute video of the key findings.

Click here to view or download a PDF of the slides.

New studies reveal audio platforms will be vital to building electric vehicle brands. Cox Automotive reports EV sales and consumer interest are picking up:

- Electric vehicle consideration spikes: The proportion of consumers who are considering purchasing a new or used EV has grown from 38% in 2021 to 51% in 2022.

- Consumers are ready for an electric future, but many dealers are not: 53% of consumers say EVs are the future and will replace gas engines over time. Only 31% of dealers feel that way.

- With new product launches, the EV march is underway: There will be 30+ brand launches in 2023 and 50+ in 2024.

- EV sales are soaring: Cox forecasts U.S. new electric vehicle sales will surpass one million units for the first time in 2023. EVs represented 6.5% of all sales in the first half of 2023, up from 2022 (5.2%), 2021 (2.5%), and 2020 (1.5%).

- Dealer EV supply has surged: In Q2 2023, new EV inventory at dealers was up an astonishing 4.7X versus Q2 2022. The current 92.2 days of EV inventory at U.S. dealers is nearly double Q2 2022 (38.5). EV’s 92 days of inventory is nearly 2X the total auto industry (51 days).

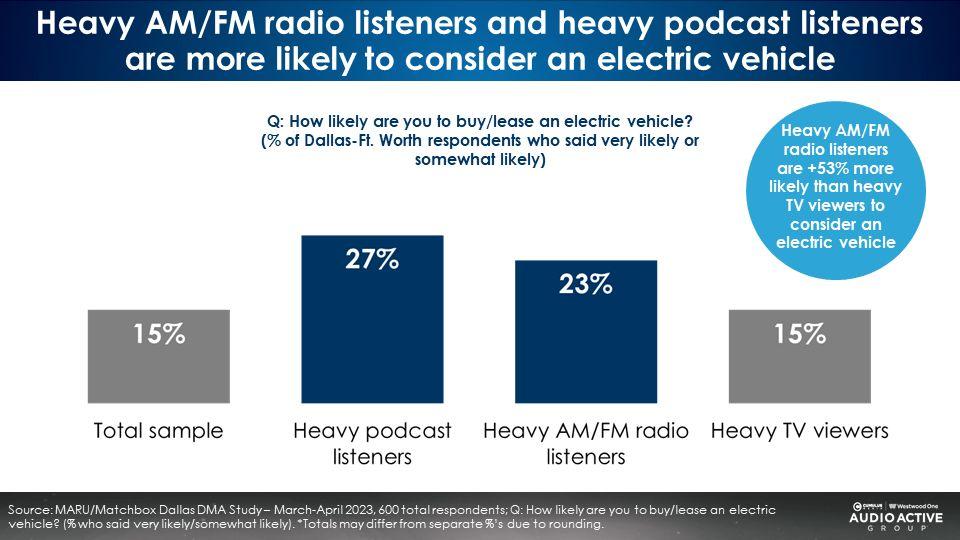

AM/FM radio and podcast listeners are much more likely to consider an EV

The Cumulus Media | Westwood One Audio Active Group® recently retained MARU/Matchbox to conduct a study in March/April 2023 of 600 Dallas Ft. Worth auto buyers. Auto intenders were asked, “How likely are you to buy or lease an electric vehicle?”

Overall, 15% of auto buyers said they would be very or somewhat likely to consider an EV. TV viewers were right in line with the market.

Audio listeners are powerful media platforms to launch EV brands. An astonishing 27% of podcast listeners and 23% of AM/FM radio listeners said they would consider purchasing an EV.

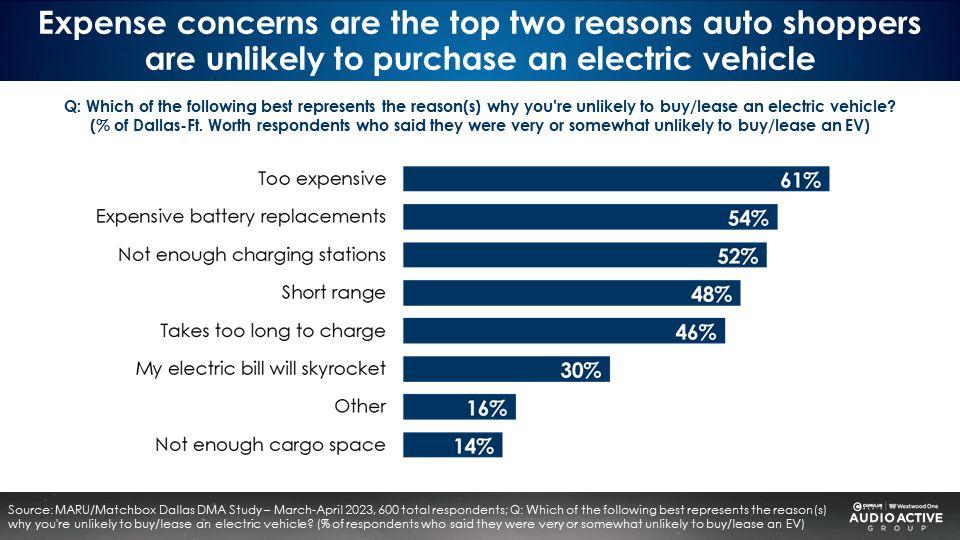

Expense concerns top EV hesitancy

Sticker price concern and the cost of battery replacements top the list of reasons why auto shoppers are unlikely to purchase an EV.

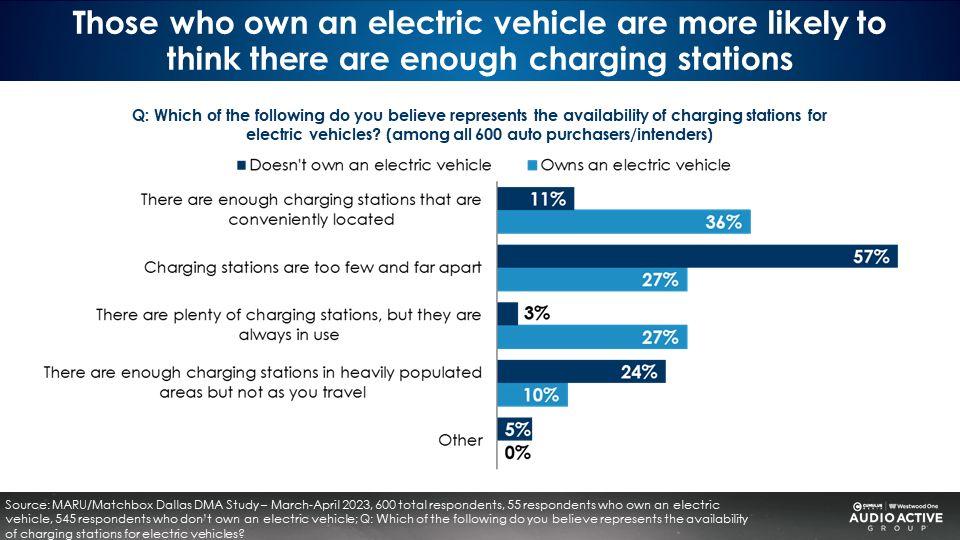

While those who do not own an EV feel charging stations are too few and far apart, EV owners think differently

EV owners feel better about charging stations. About three times as many EV owners say there are enough charging stations versus those who don’t own an EV. Still, nearly half of EV owners feel charging stations are too few and far apart or stations are always being used.

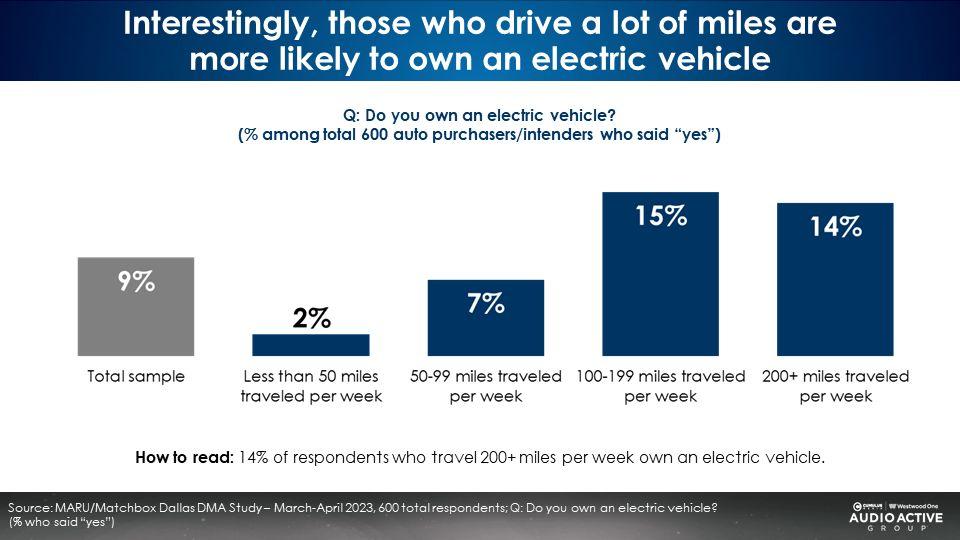

EV owners are mega-milers

Despite concerns over charging stations, EV owners clock lots of miles. The greater the weekly miles traveled, the greater the likelihood of EV ownership. 15% of those who travel 100+ miles own an EV versus 9% overall.

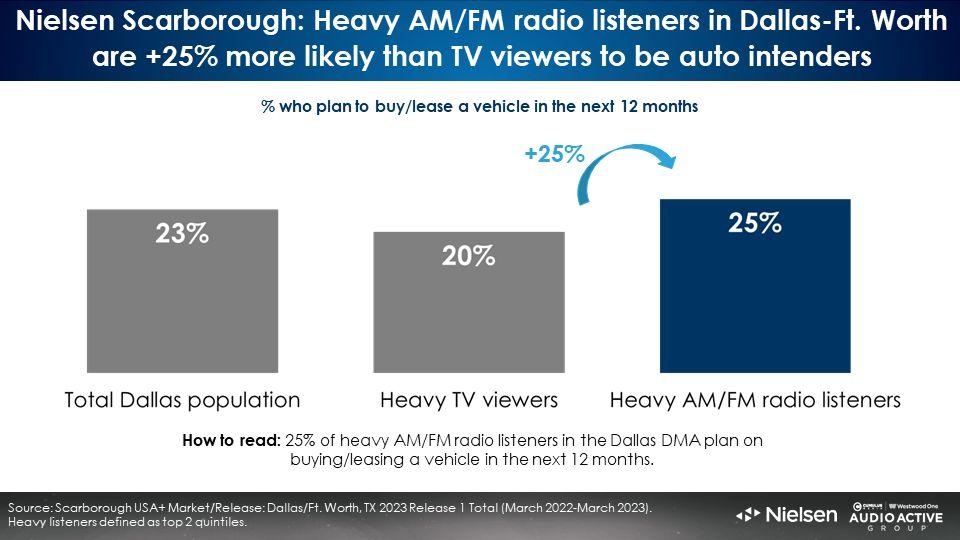

Nielsen Scarborough: AM/FM radio delivers +25% more auto buyers than television

Not only are audio listeners more likely to purchase a new EV, they are more likely to purchase any new vehicle. Nielsen Scarborough reports AM/FM radio listeners are +25% more likely to be auto intenders compared to TV viewers. Scarborough’s just released Dallas-Ft. Worth study reveals 25% of heavy AM/FM radio listeners are in the market for a vehicle versus only 20% of heavy TV viewers.

AM/FM radio listeners are +25% more likely to be in the market for a vehicle. Thus, 100 GRPs of AM/FM radio are worth +25% more than the same GRP level on TV.

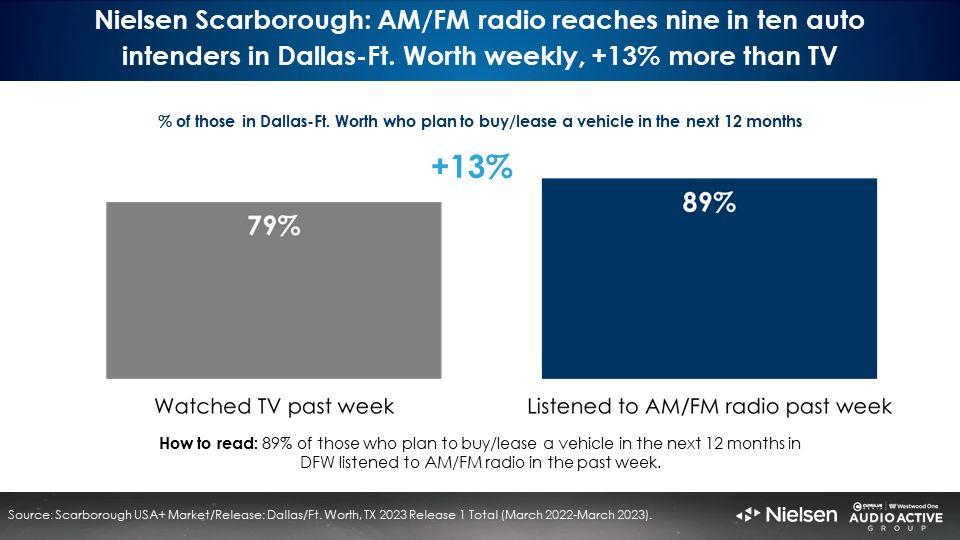

AM/FM radio reaches +13% more auto intenders than linear TV

Dallas-Ft. Worth AM/FM radio reached nine of ten auto intenders, +13% more than television, according to Nielsen Scarborough.

Key findings:

- EV interest and purchase trends are surging: Vehicles have flooded into dealers with 80+ new brands launching in the next two years.

- Charging anxiety is a concern, though less so among EV owners: While those who do not own an EV feel charging stations are too few and far apart, EV owners think differently.

- AM/FM radio and podcast listeners are much more likely to consider an EV: Audio like AM/FM radio and podcasts are ideal media platforms to launch EV brands. An astonishing 27% of podcast listeners and 23% of AM/FM radio listeners said they would consider purchasing an EV versus only 15% for TV viewers.

- AM/FM radio ad impressions are worth +25% more than TV impressions when it comes to auto intenders: AM/FM radio reaches more vehicle buyers than television. AM/FM radio listeners are +25% more likely to be auto intenders than TV viewers. Auto dealer media allocations on AM/FM radio are worth +25% more.

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.