“Share Of Ear” Q2 2023: Podcasts And AM/FM Radio Represent The Vast Majority Of Time On The “U.S. Ad-Supported Audio Clock,” Podcast Growth Surge Continues, And Spotify’s Usage Growth Does Not Benefit Advertisers

Click here to view an 11-minute video of the key findings.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Edison Research surveys 4,000 Americans annually to measure daily reach and time spent for all forms of audio.

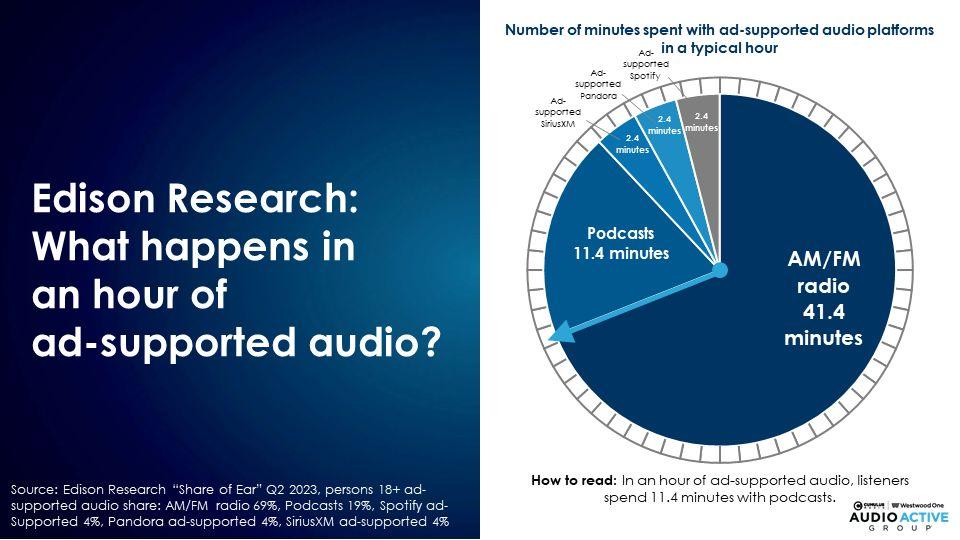

The U.S. ad-supported audio clock: Podcasts and AM/FM radio represent the most tuning minutes

Over the years, the visual created by social media guru Lori Lewis “What Happens in an Internet Minute” has been seen and quoted all the time. In the spirit of that visual, we created the “U.S. Ad-Supported Audio Clock.”

This graphic is designed to answer the question, “What happens in an hour of U.S. ad-supported audio?” The clock represents time spent in an hour of ad-supported audio in the U.S. The clock was determined by multiplying “Share of Ear” share of ad-supported audio time spent by 60 minutes.

In an hour of U.S. ad-supported audio:

- AM/FM radio represents 41.4 minutes of listening

- Podcasts are 11.4 minutes of listening

- Ad-Supported Spotify is 2.4 minutes

- Ad-Supported Pandora is 2.4 minutes

- Ad-Supported SiriusXM is 2.4 minutes

Podcasts and AM/FM radio represent 52.8 minutes, or 88% of an hour, of ad-supported audio in the U.S.

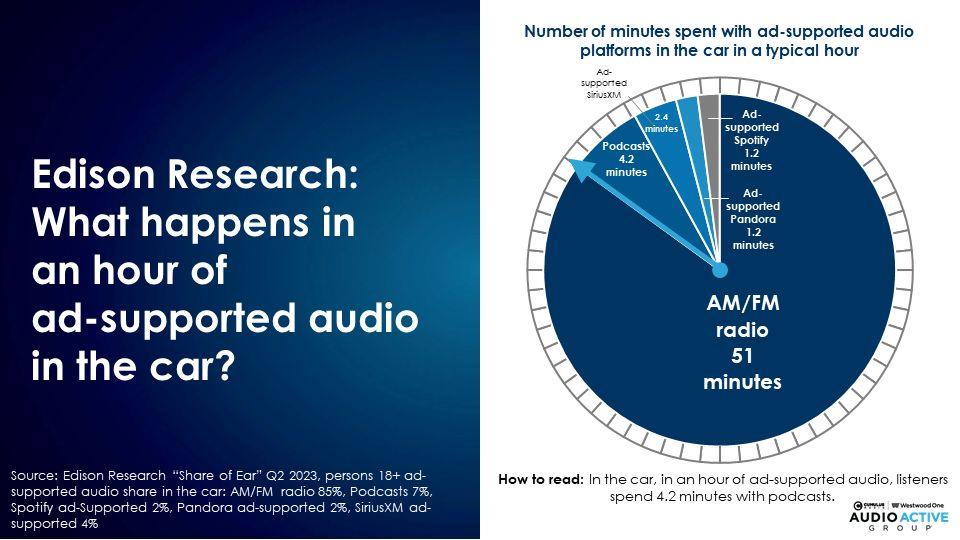

The in-car ad-supported audio clock: AM/FM radio represents the majority of tuning minutes in the car

Now our focus turns to ad-supported listening in the car. This graphic is designed to answer the question, “What happens in an hour of U.S. ad-supported audio in the car?”

This visual represents time spent with audio platforms in an hour of in-car ad-supported audio. The clock was determined by multiplying “Share of Ear” in-car shares of ad-supported audio time spent by 60 minutes.

In an hour of in-car ad-supported audio in the U.S.:

- AM/FM radio represents 51 minutes of listening

- Podcasts are 4.2 minutes of listening

- Ad-Supported SiriusXM is 2.4 minutes

- Ad-Supported Spotify is 1.2 minutes

- Ad-Supported Pandora is 1.2 minutes

AM/FM radio represent 51 minutes, or 85% of an hour, of ad-supported audio in the U.S.

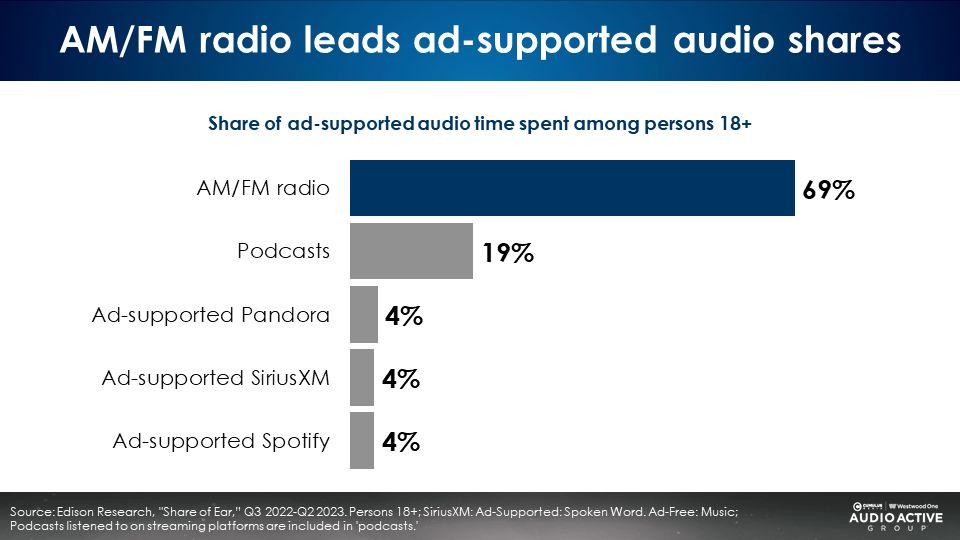

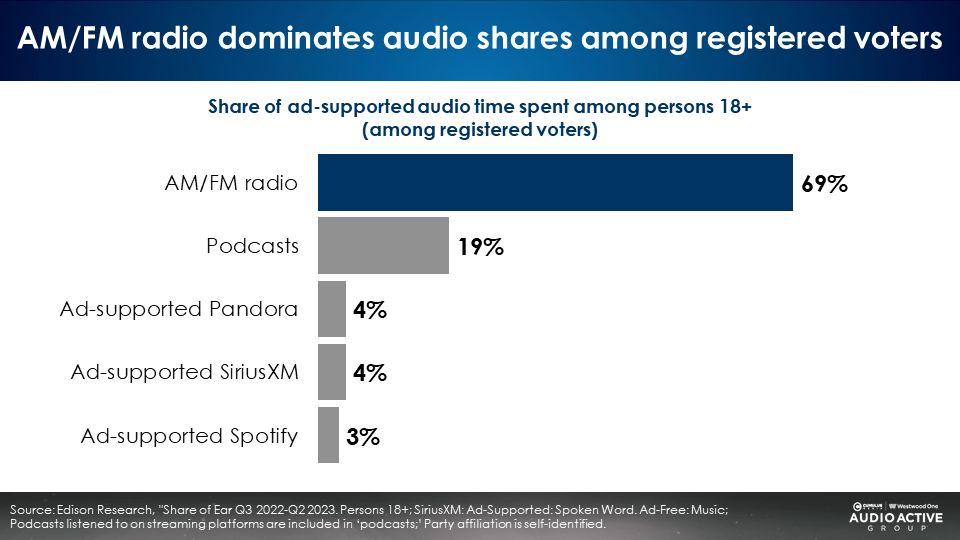

AM/FM radio dominates ad-supported audio shares; Podcasts soar to represent a stunning 19% share

From the Q2 2023 “Share of Ear,” here are the overall shares of ad-supported audio platforms:

- AM/FM radio: 69%

- Podcasts: 19%

- Ad-supported Pandora, ad-supported SiriusXM, and ad-supported Spotify: All at 4%

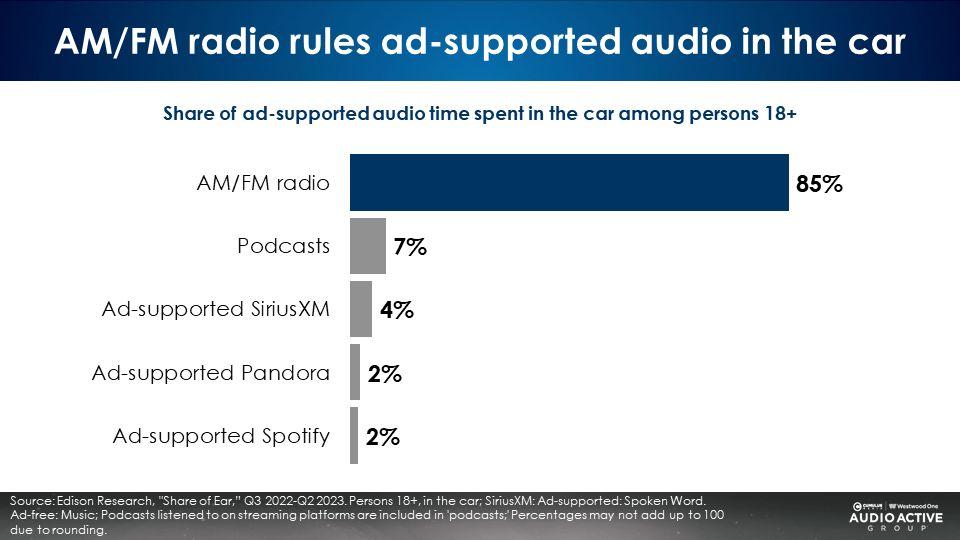

In the car, AM/FM radio is the queen of ad-supported audio at an 85% share

Here are the shares of in-car ad-supported audio:

- AM/FM radio: 85%

- Podcasts: 7%

- Ad-supported SiriusXM: 4%

- Ad-supported Pandora and ad-supported Spotify: Both at 2%

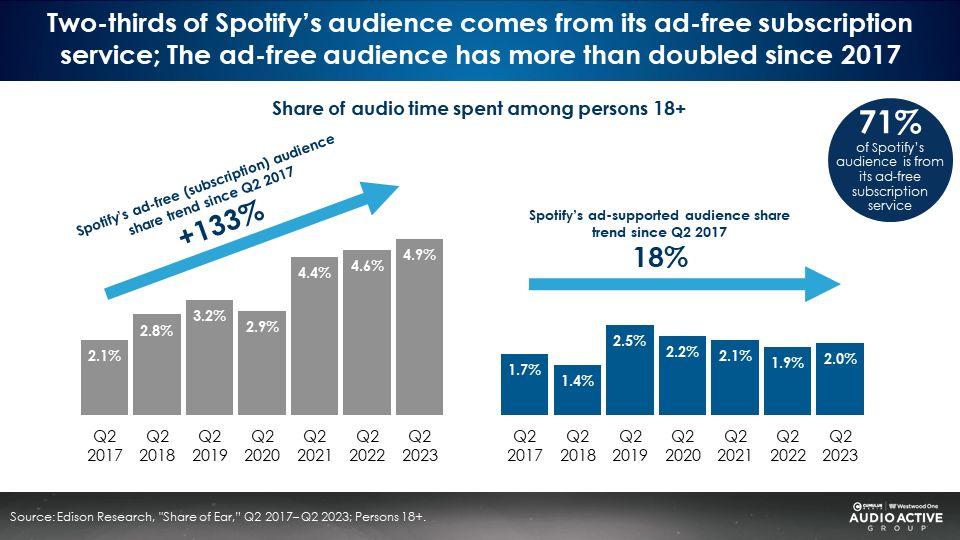

The growth in Spotify’s average monthly users does not translate to an advertiser benefit as Spotify ad-supported shares have not grown in seven years

Each quarter, Spotify’s earnings release highlights their growth in users and usage. These rosy reports imply good things for advertisers.

Unfortunately, over the last seven years, Spotify’s U.S. ad-supported audio shares have remained at a two share. All of Spotify’s growth has come from their subscription music streaming shares which do not accept advertising.

Spotify’s ad-free subscription service has grown dramatically from a 2.1% share in 2017 to a 4.9% share in 2023.

Spotify’s ad-supported audience shares are unchanged in seven years. Spotify’s ad-supported audio share was a 1.7% in 2017 and is now just a 2.0%. At present, AM/FM radio’s share is 17X larger than Spotify’s ad-supported share.

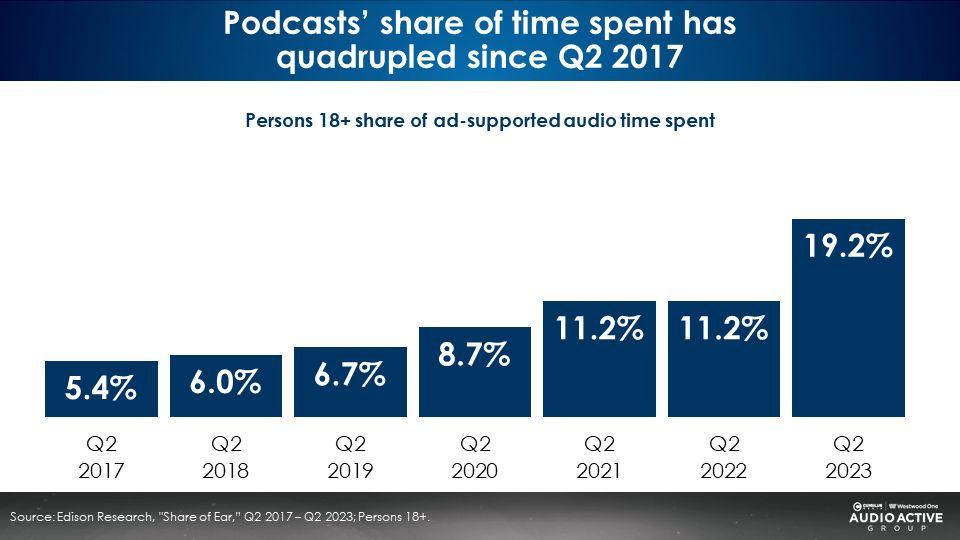

Marketers can no longer dismiss podcasts for lacking scale as podcasts’ share of time spent has quadrupled since Q2 2017

The seven-year trend of podcast’s ad-supported audio shares has seen a massive surge in the last year. At present, podcasts have a 19% share of all ad-supported audio time spent.

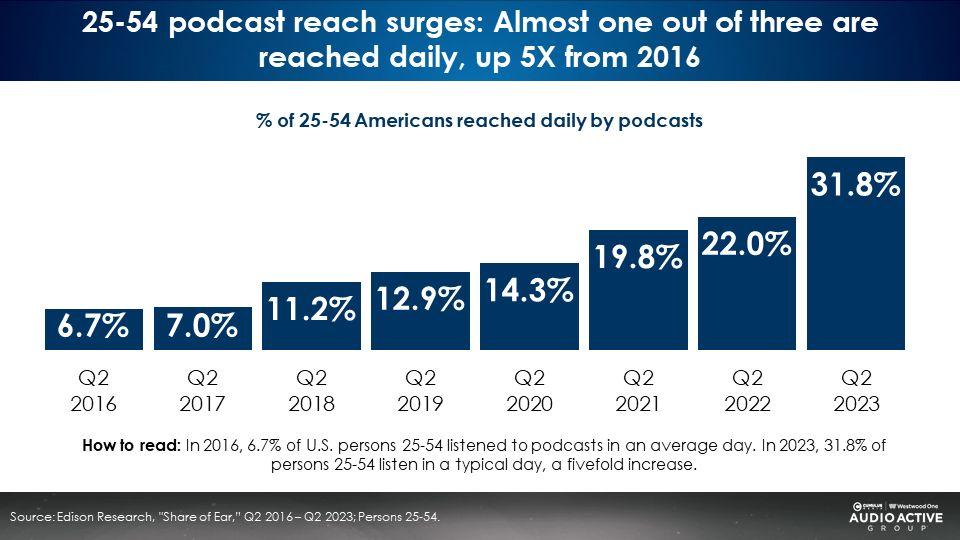

Podcasts have seen significant growth in daily reach. As of Q2 2023, Edison’s “Share of Ear” reports the daily reach of podcasts among 18-34s is 39%. Among 18-49s, podcasts reach 34% daily. Among persons 25-54, podcasts now have a 32% daily reach, a large increase over 2022.

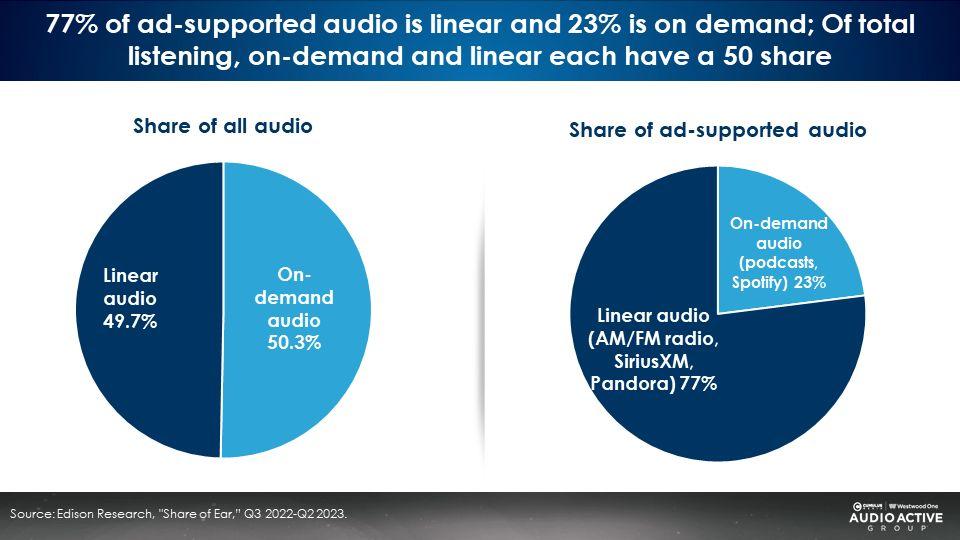

Powered by podcast audience growth, on-demand ad-supported audio grows

Last week, Edison released a new “Share of Ear” analysis that revealed on-demand audio has passed linear in total time spent. Edison attributes the surge in on demand to the growth of the podcast audience.

We wanted to examine the same on demand/linear dynamic among ad-supported listening. In this analysis, linear ad-supported audio is made up of AM/FM radio (over the air and streaming), ad-supported Pandora, and ad-supported SiriusXM. On-demand ad-supported audio includes podcasts and ad-supported Spotify.

When it comes to places advertisers can run ads, at 77%, linear still has a significant share advantage.

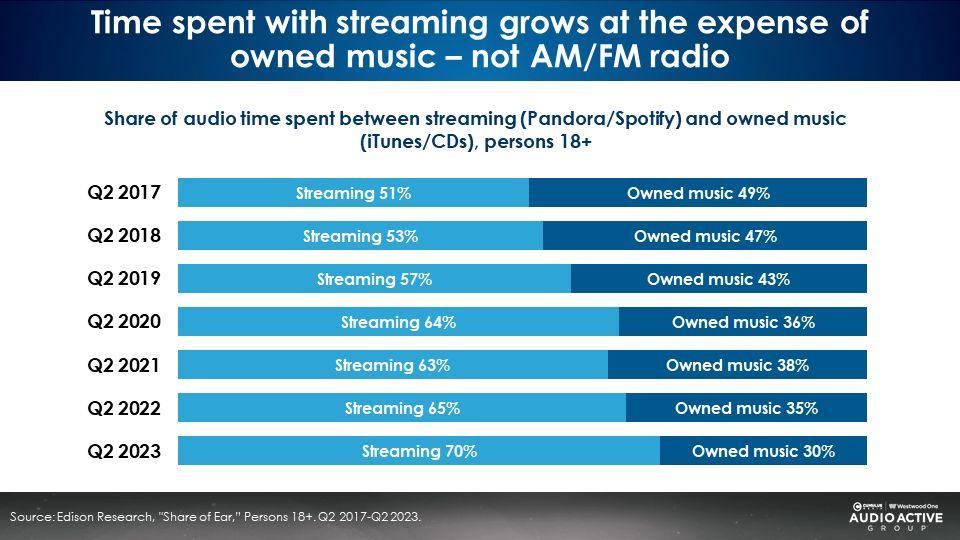

Time spent with music streaming comes at the expense of owned music, not AM/FM radio

When it comes to entertainment, America is transitioning from an ownership society to a rental society. We no longer buy DVDs. Instead, we rent videos via Netflix and video streaming services.

Edison finds time spent with “owned music” is decidedly shifting to music “rented” via music streaming services.

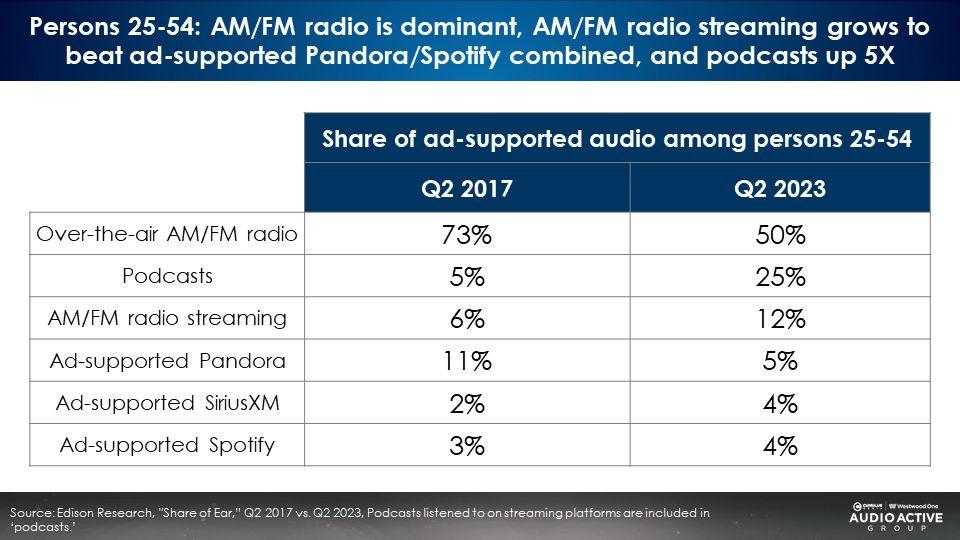

2017 versus 2023: The biggest share gainers are podcasts and AM/FM radio streaming

A comparison of 25-54 ad-supported audio shares from 2017 to 2023 reveals podcasts have grown 5X and AM/FM radio streaming has grown 2X.

AM/FM radio has not lost share to music streaming services. Pandora’s ad-supported share has been cut in half (11% to 5%). Spotify’s ad-supported share is up only marginally (3% to 4%).

AM/FM radio has lost share to the digital version of its broadcast (AM/FM radio streaming) and podcasts.

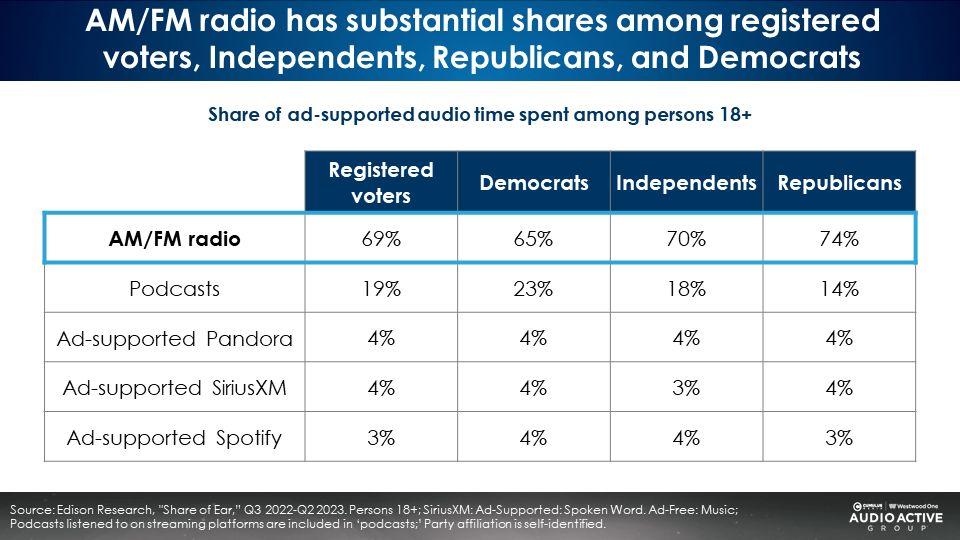

On the political front, AM/FM radio dominates ad-supported shares among registered voters

AM/FM radio has outsized shares across the entire political spectrum

Key takeaways:

- The U.S. ad-supported audio clock: Podcasts and AM/FM radio represent the most tuning minutes

- The in-car ad-supported audio clock: AM/FM radio represents 85% of tuning minutes in the car

- The growth in Spotify’s average monthly users does not translate to an advertiser benefit as Spotify ad-supported shares have not grown in seven years

- Marketers can no longer dismiss podcasts for lacking scale as podcasts’ share of time spent has quadrupled since Q2 2017

- Powered by podcast audience growth, on-demand ad-supported audio grows

- Time spent with music streaming comes at the expense of owned music, not AM/FM radio

- 2017 versus 2023: The biggest share gainers are podcasts and AM/FM radio streaming

- On the political front, AM/FM radio dominates ad-supported shares among registered voters

- AM/FM radio has outsized shares across the entire political spectrum

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.