Nielsen: AM/FM Radio Ratings Continue To Beat TV Among Persons 18-49

Click here to view or download a PDF of the slides.

Click here to view a 16-minute video of the key findings.

Four years ago, Duncan Stewart, Director of Research, Technology, Media & Telecommunications at Deloitte, made a surprising forecast. By 2025, he predicted, AM/FM radio audiences would overtake TV among 18-34s. Stewart’s prediction occurred four years earlier in 2021.

In 2019, Duncan Stewart, Director of Research, Technology, Media & Telecommunications at Deloitte, predicted that AM/FM radio would beat TV among 18-34s by 2025. His forecast occurred four years early in 2021.

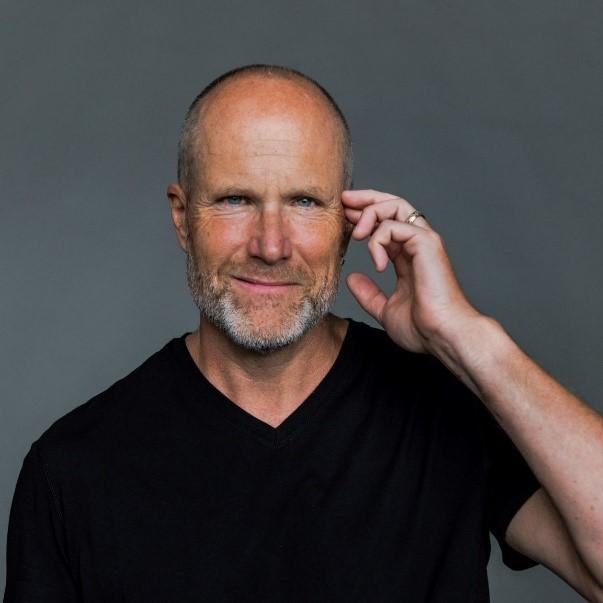

Now, in the latest Total Audience Report from Q2 2023, AM/FM radio continues to surpass TV in average audience among 18-49s.

Among persons 18-49, AM/FM radio beats TV in average audience and weekly reach

In 2018, AM/FM radio’s 18-49 average audience was 63% the size of live and time-shifted TV. Things have changed quickly. According to Nielsen’s Q2 2023 Total Audience Report, AM/FM radio’s persons 18-49 average audience is now +5% greater than television.

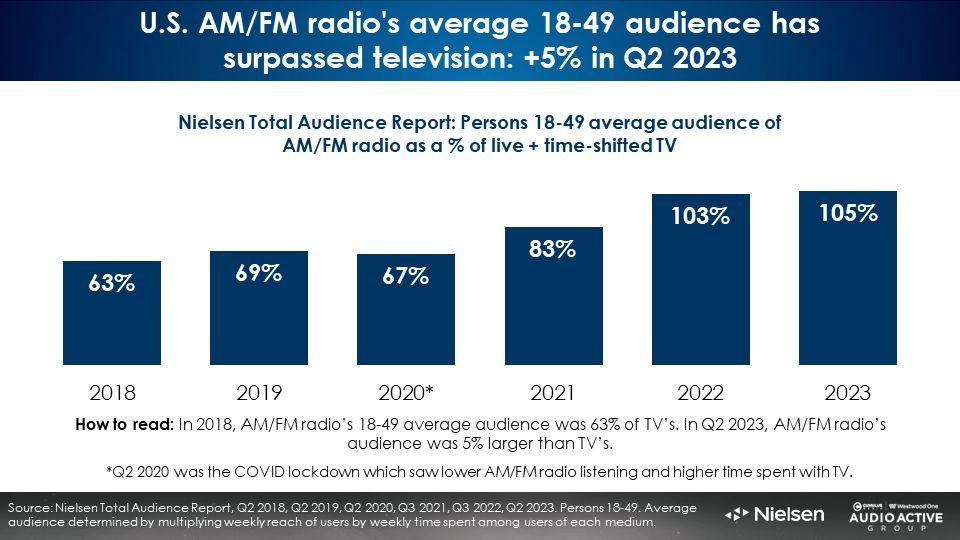

AM/FM radio’s weekly persons 18-49 reach of 81% is significantly larger than television’s 61%. Each week, 39% of U.S. persons 18-49 are not reached by live and time-shifted TV.

U.S. AM/FM radio reaches +33% more persons 18-49 than live and time-shifted television. 18-49 daily time spent of TV and AM/FM radio are now virtually tied.

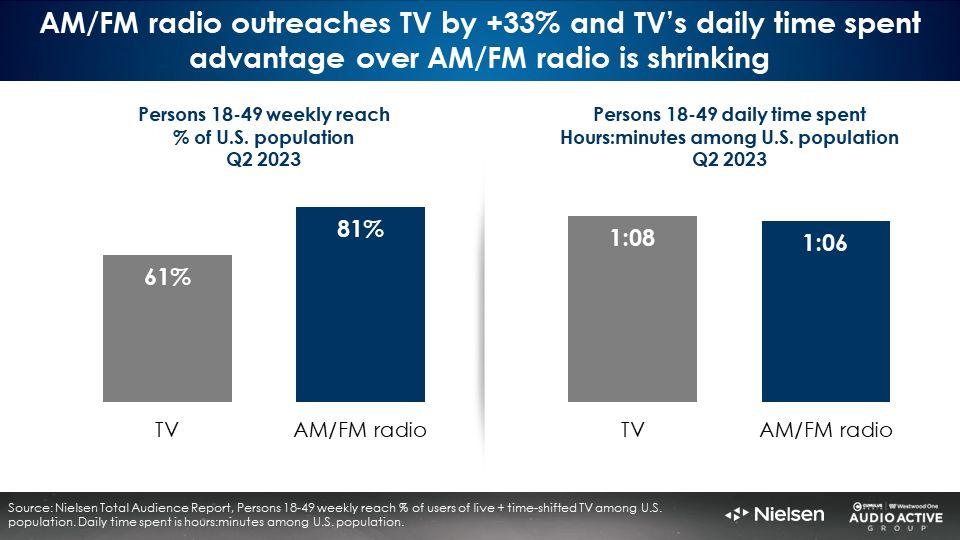

TV reach among persons 18-49 has dropped -26% and time spent viewing eroded -59%

Since 2018, Nielsen’s Total Audience Report reveals the 18-49 weekly reach of live and time-shifted TV has dropped -26%. Over the same period, TV’s daily time spent is down -59%.

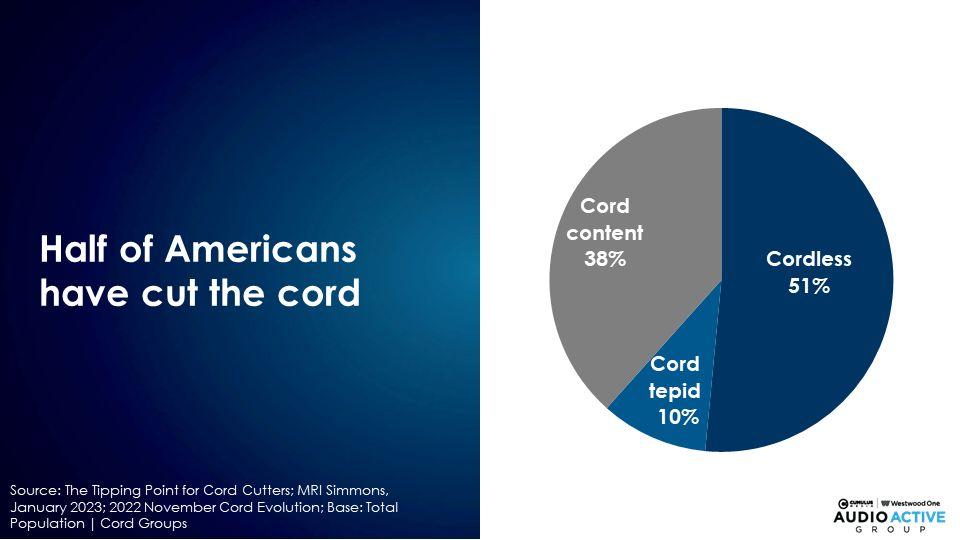

Cord cutting is a major driver of TV’s audience collapse

The MRI Simmons January 2023 “How Americans Watch TV” report reveals 51% have cut the cord. Another 10% are “cord tepid,” meaning they have cut back on their cable TV package or are contemplating “cord shaving.” Only 38% of Americans are “cord content.”

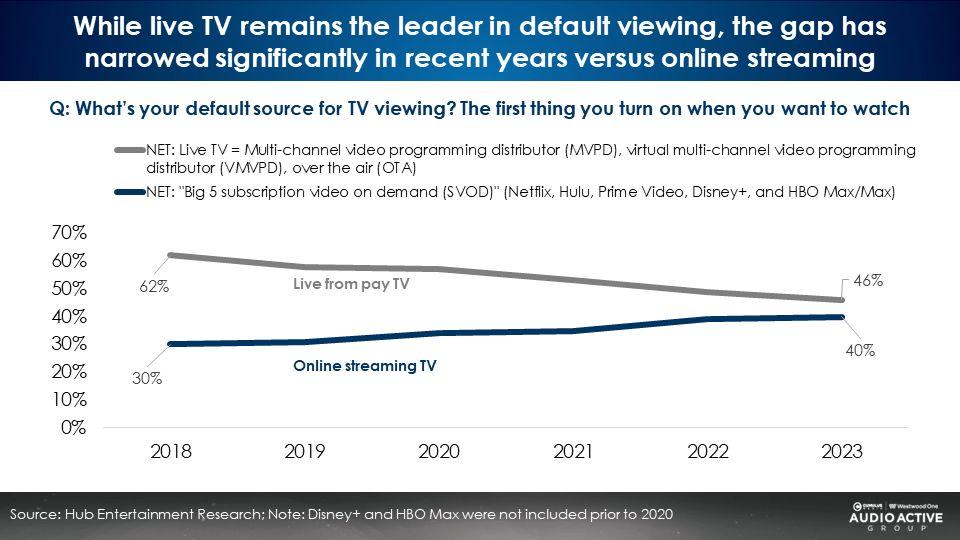

Streaming is now TV: Americans say streaming has replaced traditional TV

A Hub Entertainment study finds a major shift has occurred in the American mindset about streaming. Once thought of as an “add on” to regular TV, streaming is increasingly seen as America’s primary television platform.

From 2018 to 2023, those who said online streaming TV was “the first thing you turn on when you watch” grew from 30% to 40%. The proportion who said the first thing they turned on is “live from pay TV” dropped from 62% to 46%.

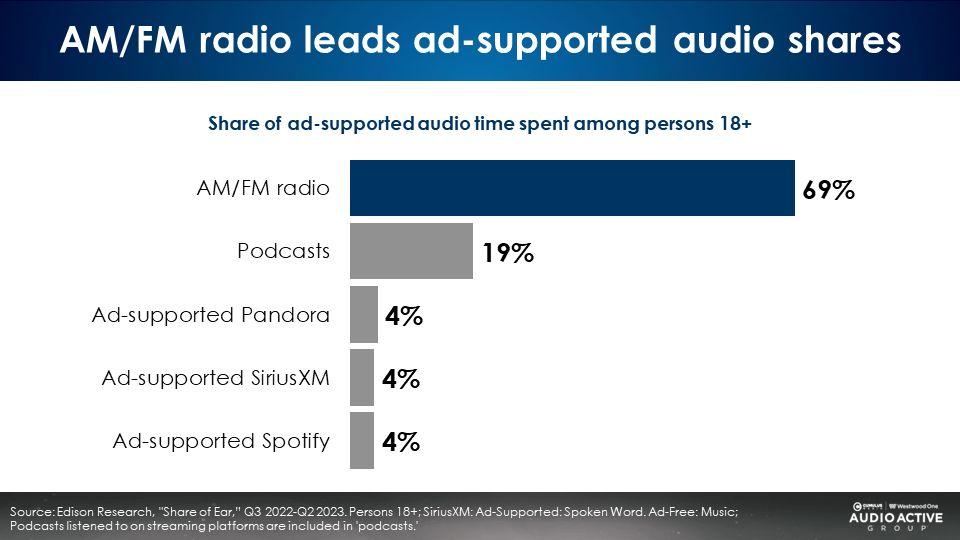

While a huge number of Americans have abandoned traditional TV for streaming, AM/FM radio remains the dominant audio platform

According to Edison Research’s Q2 2023 “Share of Ear,” AM/FM radio has a massive 69% share of U.S. ad-supported audio. AM/FM radio audience shares are over 17 times larger than ad-supported Pandora and ad-supported Spotify.

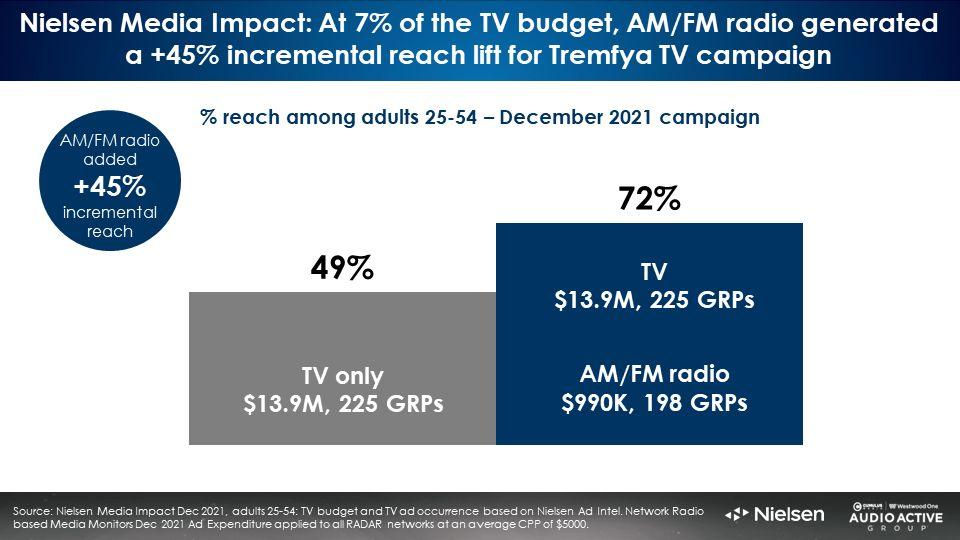

AM/FM radio makes TV better: J&J’s pharma brand Tremfya realizes a +45% reach increase by adding AM/FM radio to the media plan

When introduced into the media plan, AM/FM radio generates extraordinary incremental reach. Here is a case study of a heavy TV advertiser, J&J’s pharmaceutical brand Tremfya, that used AM/FM radio.

According to Nielsen Media Impact, the optimization platform, adding AM/FM radio to the media plan caused Tremfya’s persons 25-54 monthly reach to soar from 49% to 72%. At only 7% of the TV budget, the addition of AM/FM radio generated a massive +45% incremental reach lift for Tremfya.

Shifting 20% of GoodRx’s TV budget to AM/FM radio would generate a +31% increase in reach

Nielsen Media Impact can project the incremental reach growth of shifting the TV budget to AM/FM radio. GoodRx, an online pharmacy, is a heavy TV advertiser that does not use AM/FM radio.

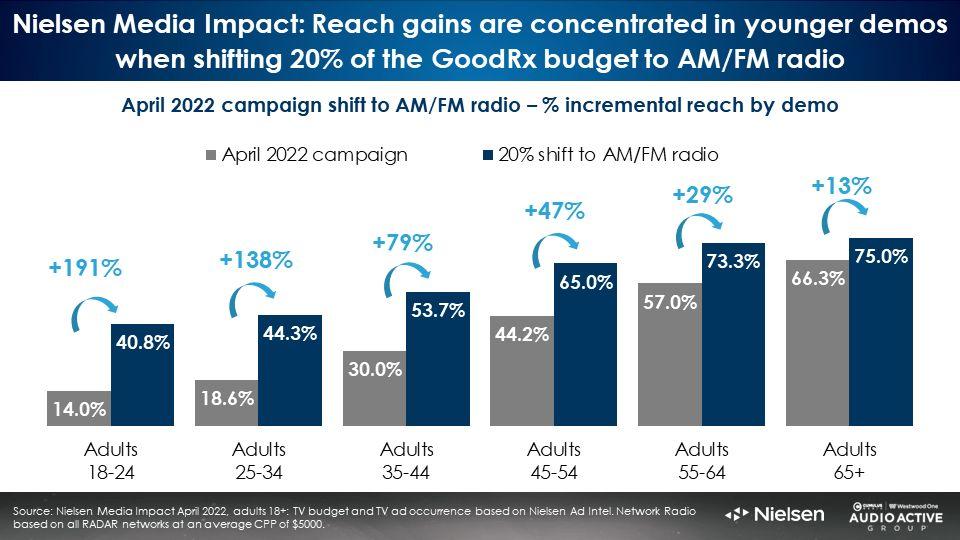

Shifting just 20% of GoodRx’s TV budget to AM/FM radio would generate a +31% increase in reach among persons 35+ with no increase in budget. The Nielsen Media Impact analysis reveals the younger the demographic, the greater the reach growth.

For GoodRx, adding AM/FM radio to the media plan generates:

- +47% increase in 45-54 reach

- +79% growth in 35-44 reach

- +138% lift in 25-34 reach

How AM/FM radio makes TV better: Driving reach growth among light and medium TV viewers

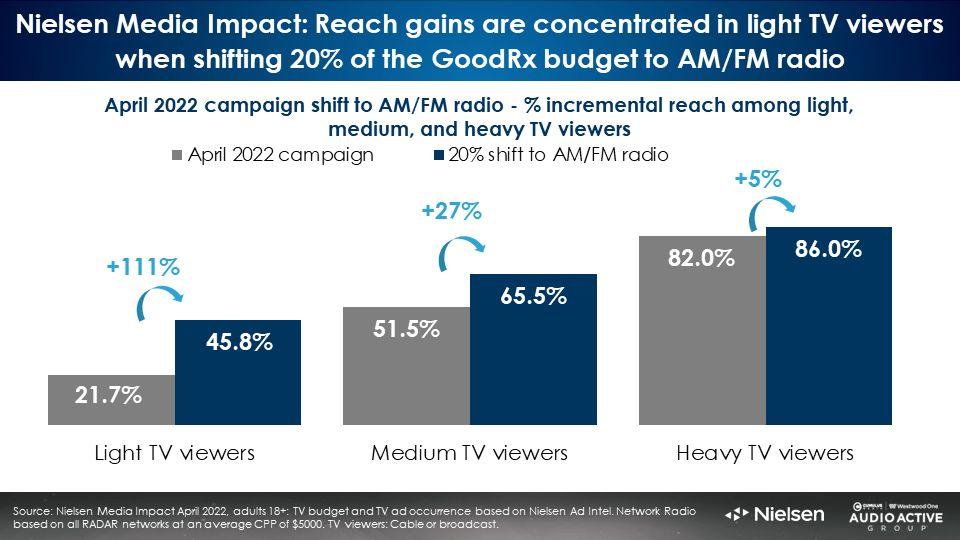

A wise media planner once said, “You cannot solve your light TV viewer problem by buying more TV.” Shifting 20% of GoodRx’s TV budget results in a doubling of reach among light TV viewers and a +27% reach growth among medium TV viewers. AM/FM radio delivers significant reach growth among Americans under 64 who are difficult to reach on linear TV.

Key findings:

- Among persons 18-49, AM/FM radio beats TV in average audience and weekly reach according to Nielsen’s Q2 2023 Total Audience Report

- TV reach among persons 18-49 has dropped -26% and time spent viewing eroded -59%

- Linear TV audience erosion is fueled by cord cutting and streaming

- AM/FM radio has a dominant 69% share of ad-supported audio

- AM/FM radio audience shares are 17 times larger than ad-supported Pandora and ad-supported Spotify

- When introduced into a TV media plan, AM/FM radio generates extraordinary increases in campaign reach among 18-64s who are light TV users

Click here to view a 16-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.