Edison Q3 2023 “Share Of Ear”: AM/FM In-Car Listening Surges To Pre-Pandemic Norms, Spoken Word Grows To Highest Level, And Pandora and Spotify Are Down

Click here to view or download a PDF of the key slides.

Click here to view a 12-minute video of the key findings.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Edison Research surveys 4,000 Americans annually to measure daily reach and time spent for all forms of audio.

Since “Share of Ear” has been running continuously since 2015, it affords an opportunity to examine an eight-year view of American audio usage. Here are the major trends:

- The proportion of in-car AM/FM radio listening has surged from the prior year to pre-pandemic norms

- For all ad-supported audio, the proportion of at-home listening remains elevated

- Spoken word is on the rise: All forms of non-music content (News, Personalities/Talk, and Sports) increased strongly during the pandemic; Since then, spoken word growth has accelerated

- Podcast shares are up +575% since 2016

- Pandora/Spotify ad-supported music streaming shares are down -31% over the same period

- AM/FM radio streaming’s audience share is now greater than Pandora/Spotify combined

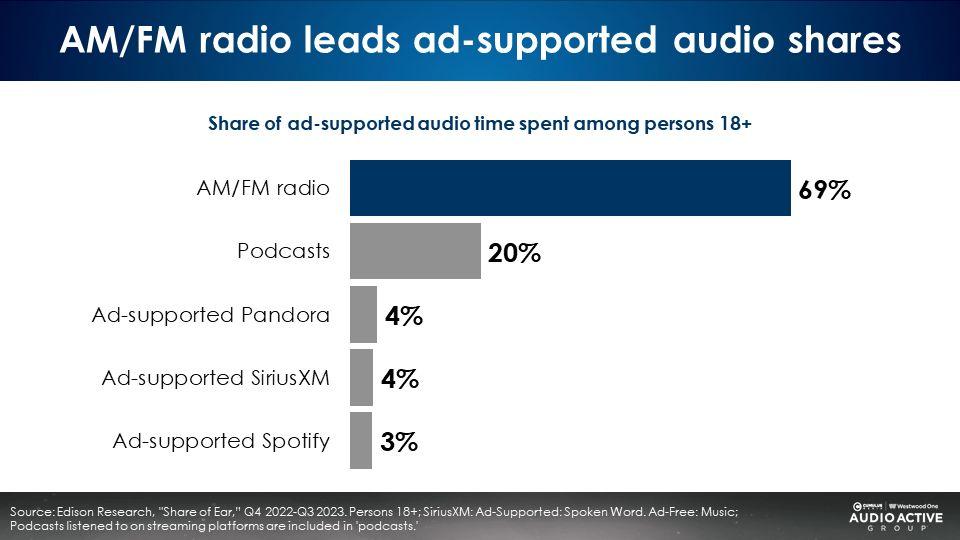

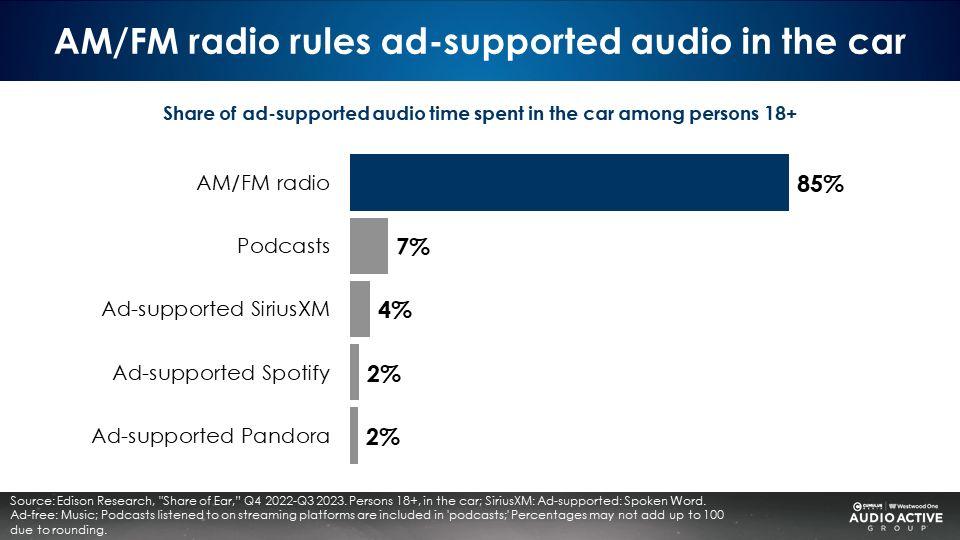

- At a 69% share overall and a massive 85% in-car share, AM/FM radio remains the dominant ad-supported audio platform

The proportion of AM/FM radio in-car listening has surged versus the prior year

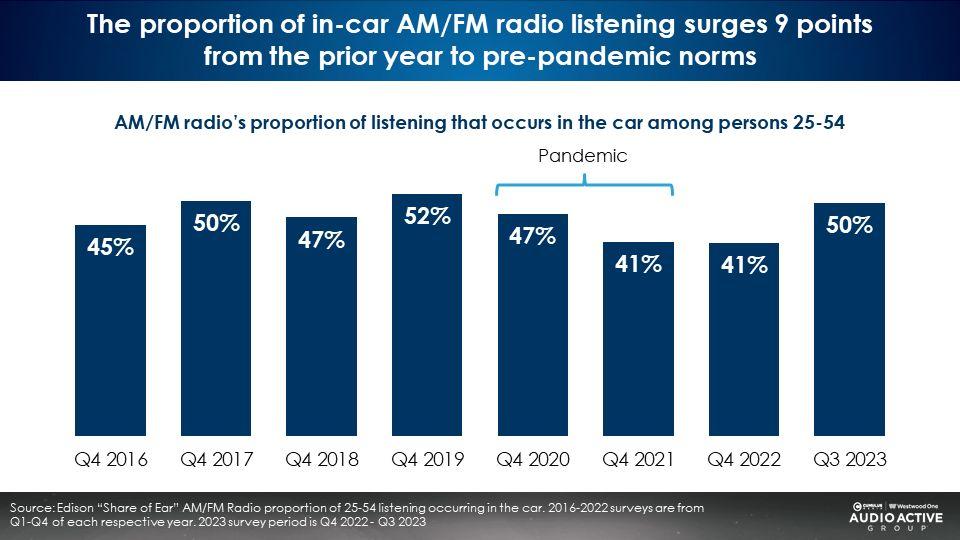

Here is the eight-year trend of the proportion of AM/FM radio listening occurring in the car:

In the four years prior to the pandemic (2016-2019), in-car listening represented 49% of all AM/FM radio listening. During the pandemic years (2020-2022) the in-car share dropped to a low of 41%.

Versus 2022, the proportion of AM/FM radio listening currently occurring in the car grew sharply from 41% to 50%, a nine-point increase, returning to the pre-pandemic norm of 49%.

At home ad-supported listening for all audio remains elevated as working from home persists

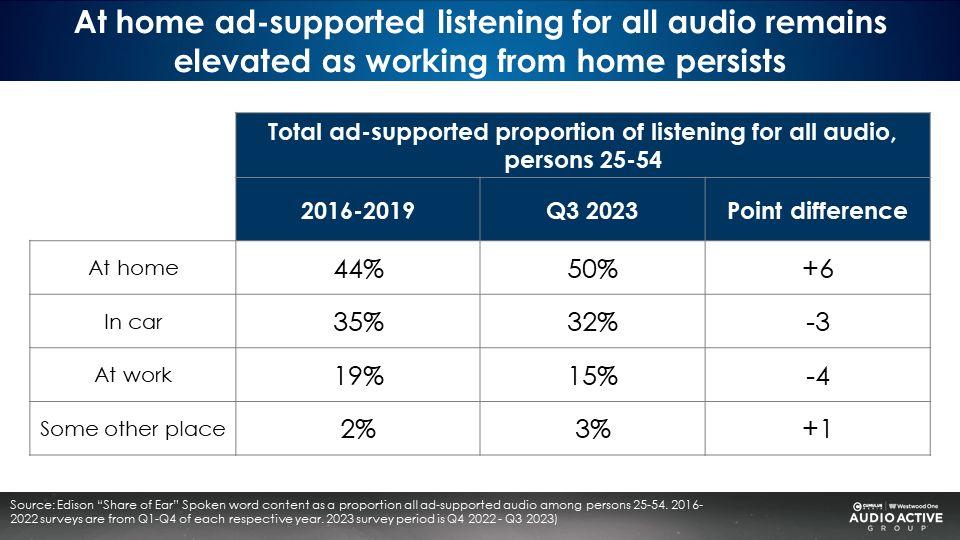

While AM/FM radio has returned to its typical proportion of listening by location, it is a different story for all ad-supported audio.

Comparing the pre-pandemic period of 2016-2019 to 2023, there is an average of six more points of at-home listening, four less points of listening at work, and three less points of in-car shares. While most who commuted prior to pandemic have returned to work, the number of days working from home remains elevated.

Powered by podcasts, the pandemic caused spoken word listening to grow; Since then, growth has massively accelerated

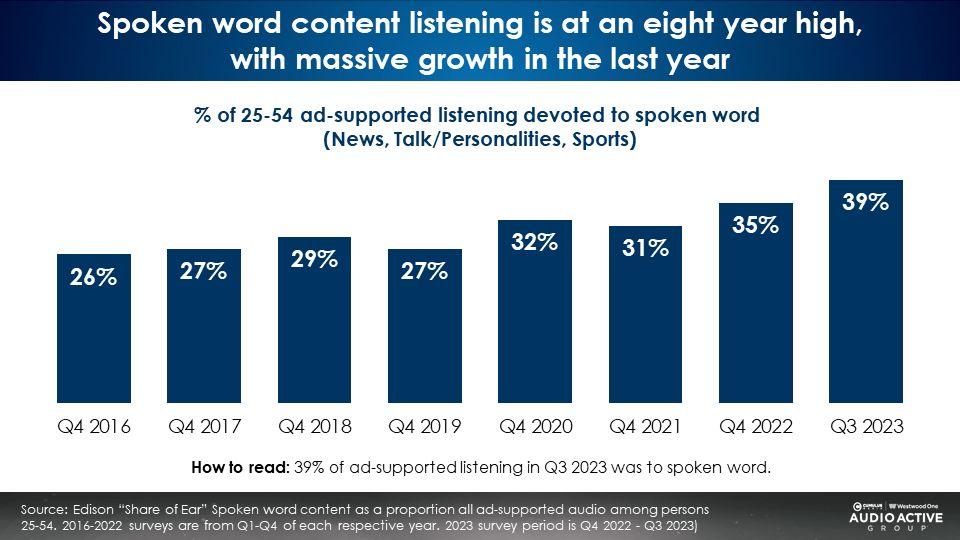

Here is the eight-year trend of 25-54 ad-supported listening to spoken word content:

In 2016, 26% of all 25-54 ad-supported audio time spent was devoted to spoken word and 74% to music. In 2023, the proportion of spoken word has jumped to 39% and music now represents 61% of ad-supported audio time spent.

Could spoken word represent half of ad-supported listening in 2028?

Since 2016, spoken word’s share of 25-54 tuning has grown an average of two points a year. If this trend continues at a similar pace, by 2028, spoken word could represent half of all ad-supported audio listening.

Personality/talk shows shares are up +76% since 2016

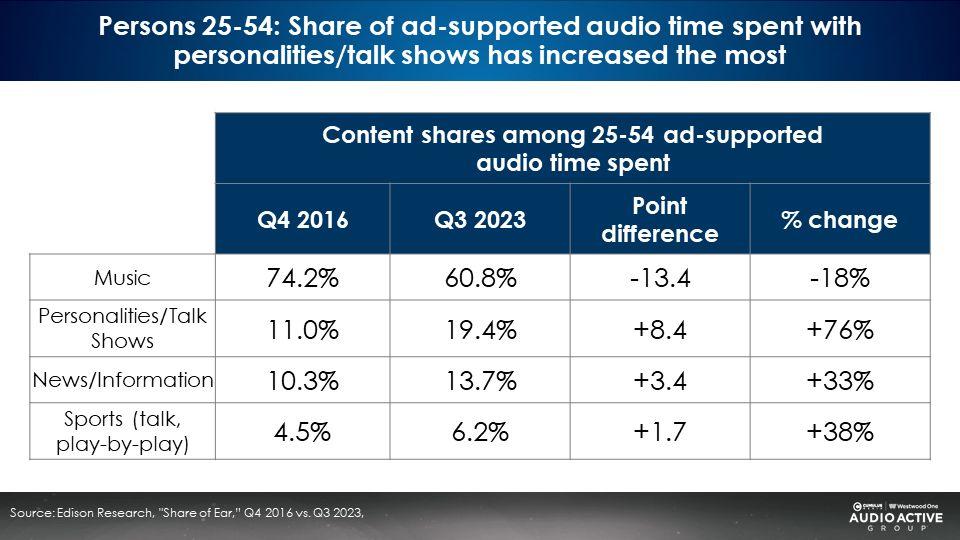

Here is a comparison of the 2016 and 2023 share ad-supported content listening among 25-54s:

The greatest growth in spoken word content comes from personalities/talk shows, which is mostly powered by podcasts.

Advertising-free time spent is dominated by music

Currently two-thirds (65%) of all 25-54 audio time spent occurs to ad-supported platforms. 35% of time spent is to advertising-free sources. Within ad-free listening, music represents 88% of time spent. Next is audio books at 9%.

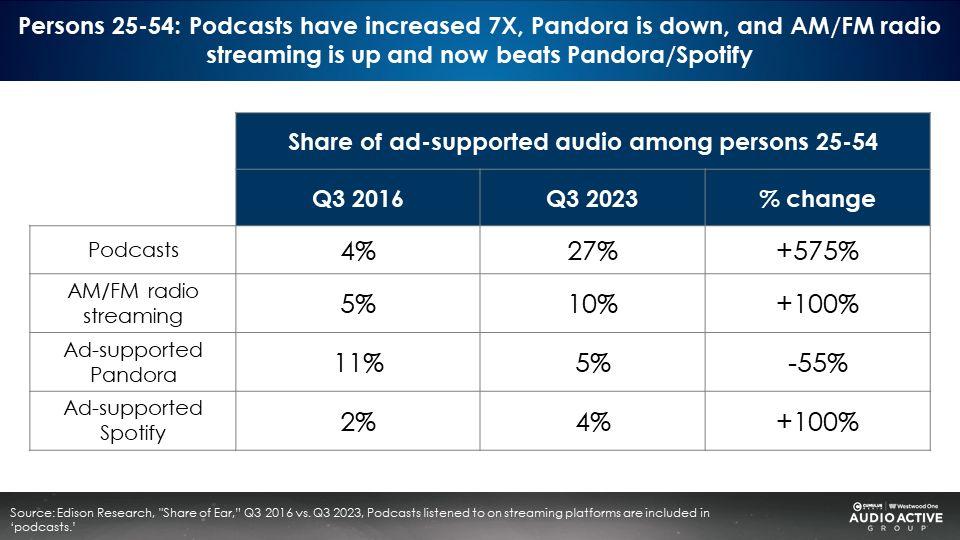

On the digital audio front, since 2016, podcasts have increased +575%, Pandora/Spotify and streaming music are down, and AM/FM radio streaming is up, now beating Pandora/Spotify

Here is a comparison of 25-54 ad-supported digital audio shares from 2016 to 2023:

From 2016 to 2023, not all digital audio has grown. Among ad-supported listening among 25-54s, Pandora/Spotify combined shares are down -31% (13% to 9%).

On the growth front, podcast shares have grown +575% and AM/FM radio streaming’s share has doubled.

It is interesting to note, AM/FM radio streaming’s share (10%) is greater than the combination of Pandora and Spotify (9%). Back in 2016, the Pandora/Spotify combined share was more than double that of AM/FM radio streaming.

AM/FM radio remains the dominant ad-supported audio platform with a 69% overall share and massive 85% in-car share

Key takeaways:

- The proportion of in-car AM/FM radio listening has surged from the prior year to pre-pandemic norms

- For all ad-supported audio, the proportion of at-home listening remains elevated

- Spoken word is on the rise: All forms of non-music content (News, Personalities/Talk, and Sports) increased strongly during the pandemic; Since then, spoken word growth has accelerated

- Podcast shares are up +575% since 2016

- Pandora/Spotify ad-supported music streaming shares are down -31% over the same period

- AM/FM radio streaming’s audience share is now greater than Pandora/Spotify combined

- At a 69% share overall and a massive 85% in-car share, AM/FM radio remains the dominant ad-supported audio platform

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.