8 New Findings About The Podcast Audience From Cumulus Media’s 2024 Audioscape

Click here to view or download the slides.

Click here to view a 14-minute video of the key findings.

Audio is a huge part of American life. While AM/FM radio dominates the audio landscape with mass reach and significant time spent, podcasts are a fast-growing platform representing an engaging environment for brands.

Cumulus Media’s 2024 Audioscape report examines the latest podcast consumer trends from Edison Research’s Q4 2023 “Share of Ear” study and from Nielsen Scarborough’s Fall 2023 Podcast Buying Power report.

Here are the eight key findings:

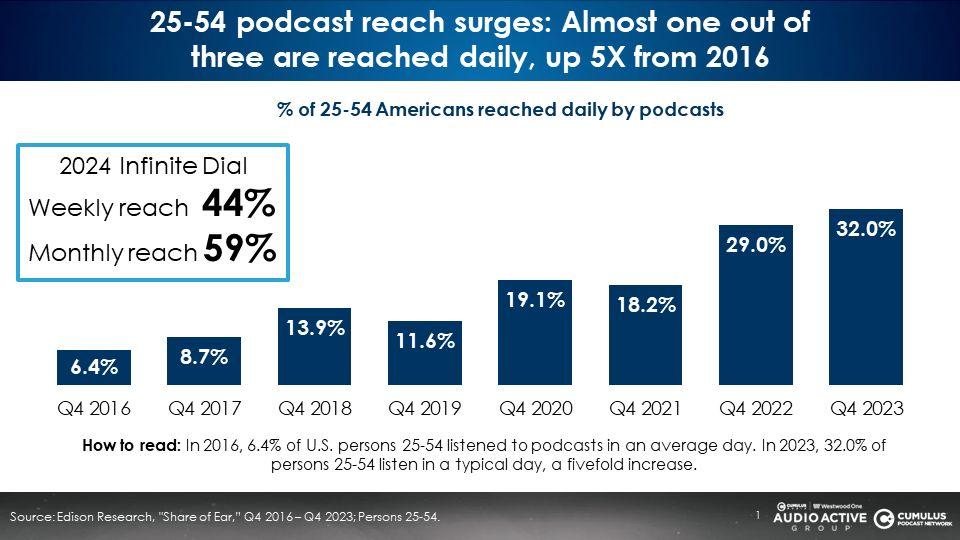

1. Podcast audiences have scale: Among 25-54s, one-third listen daily, 44% listen weekly, and 59% listen monthly

According to Edison Research’s Q4 2024 “Share of Ear,” 32% of U.S. 25-54s listen to podcasts daily. Edison’s “Infinite Dial” study reports 25-54 weekly podcast reach is 44% and 59% listen monthly.

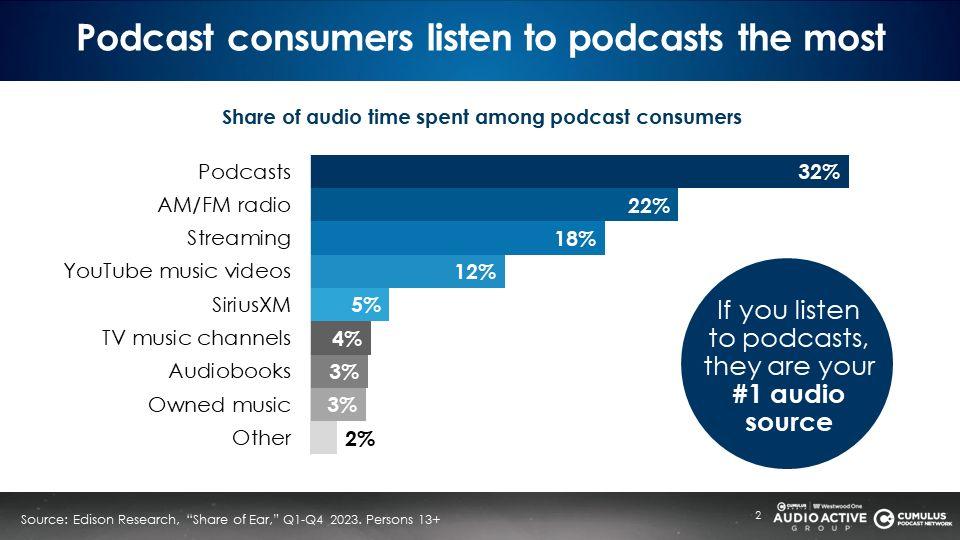

2. If you listen to podcasts, they are your number one audio platform

Once people get hooked on podcasts, it quickly becomes their most listened to audio platform. Back in 2016, among podcast listeners, the number one audio source was podcasts at a 26% share, followed by AM/FM radio (22%) and streaming (17%). Today, among podcast listeners, podcasts have a 32% share followed by AM/FM radio (22%) and streaming (18%).

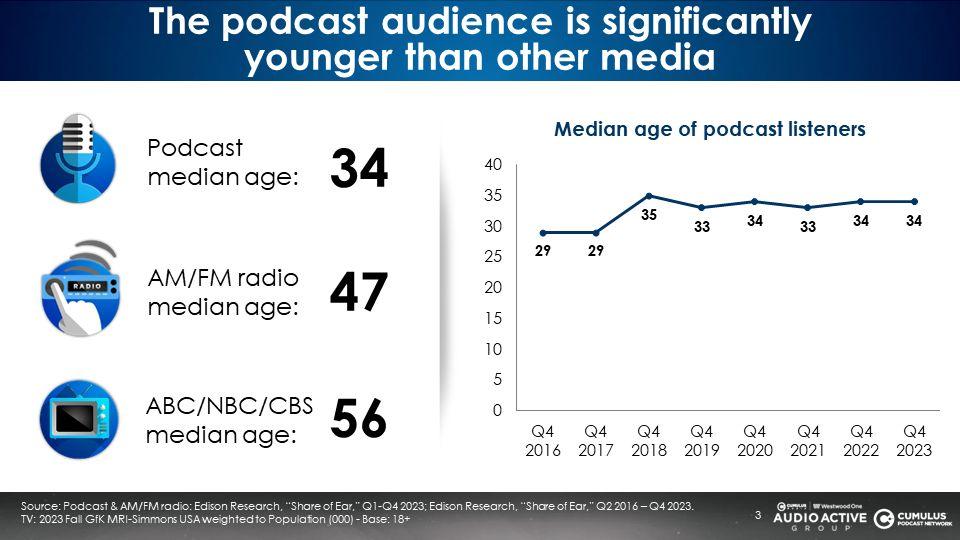

3. The median age of the podcast audience has held at 34 despite massive audience growth

The podcast audience is thirteen years younger than the median age of AM/FM radio listeners and 22 years younger than linear television where audiences have a median age of 56. TV is what’s playing in God’s waiting room.

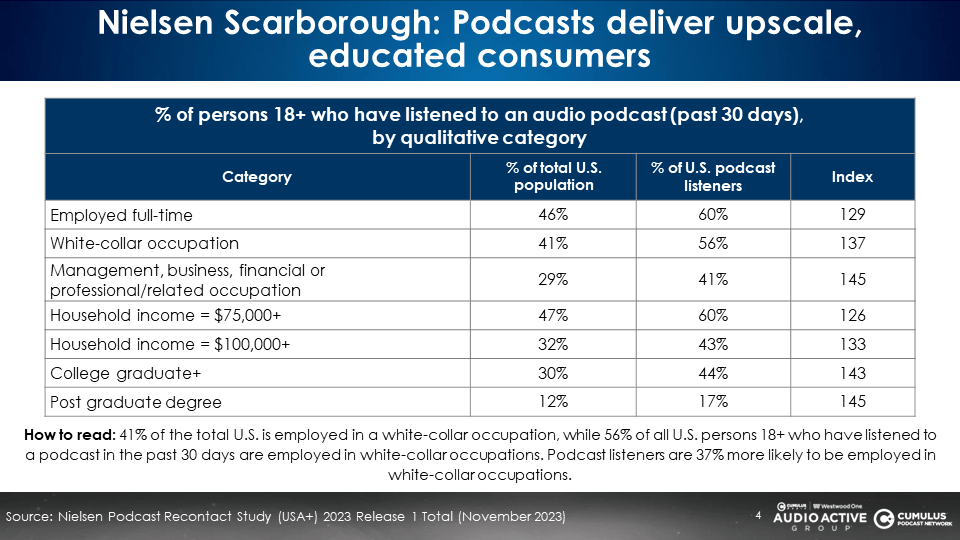

4. The podcast audience profile is employed, upscale, and educated, according to Nielsen Scarborough

Compared to the total U.S. average, the podcast audience is 43% more likely to have graduated college and have a post-graduate degree (+45%). From an employment standpoint, podcast listeners are 29% more likely to be employed full time, 37% more likely to work in a white-collar role, and 33% more likely to have a $100K+ household income.

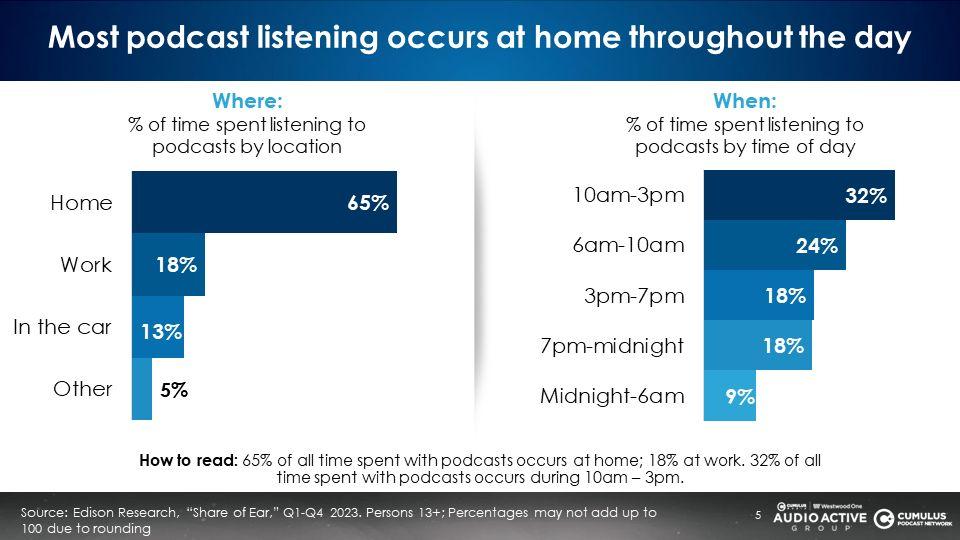

5. Most podcast listening occurs at home throughout the day

Podcast listening occurs throughout the day and night. A third of podcast time spent occurs 10AM-3PM followed by 6AM-10AM (24%). While podcast audiences have soared, the vast majority of listening still occurs at home (65%).

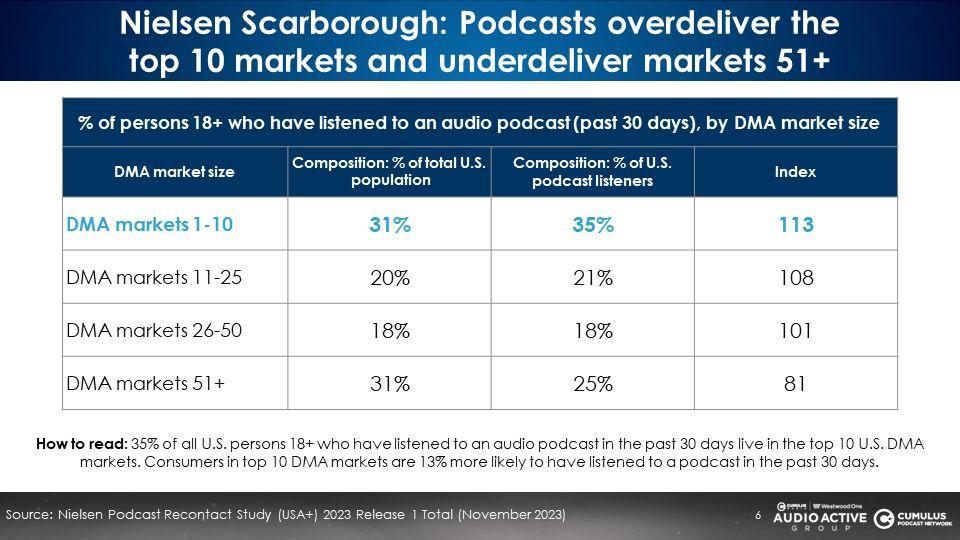

6. Podcasts have opportunities for growth in markets 51+ where listening is underrepresented

Nielsen Scarborough’s Podcast Recontact Study finds podcast listeners over index in the top ten markets (+13%) and are underrepresented in DMAs 51+ (-19%).

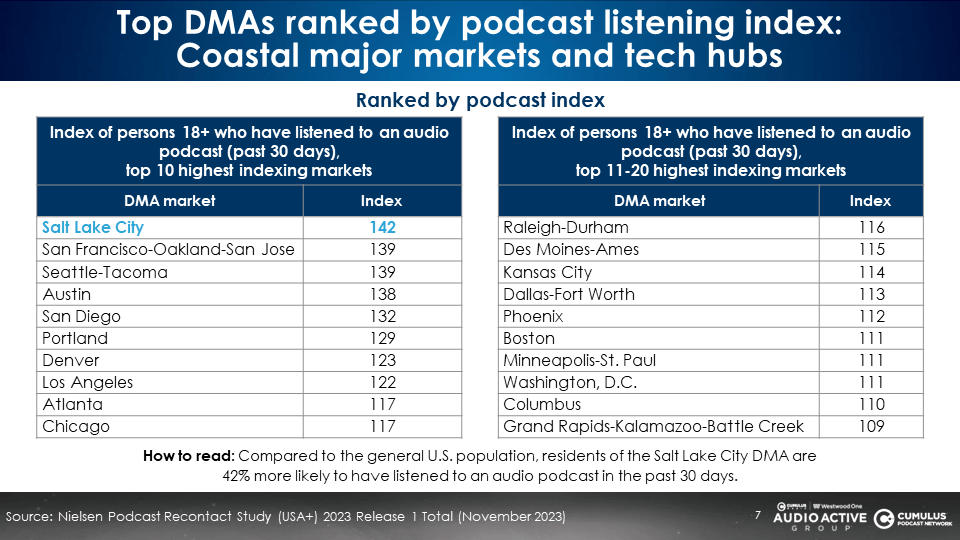

According to Nielsen Scarborough, the markets with the highest incidence of monthly podcast listening are coastal DMAs and tech hubs. Salt Lake City, San Francisco, Seattle, and Austin exhibit exceptionally strong levels of monthly podcast listening.

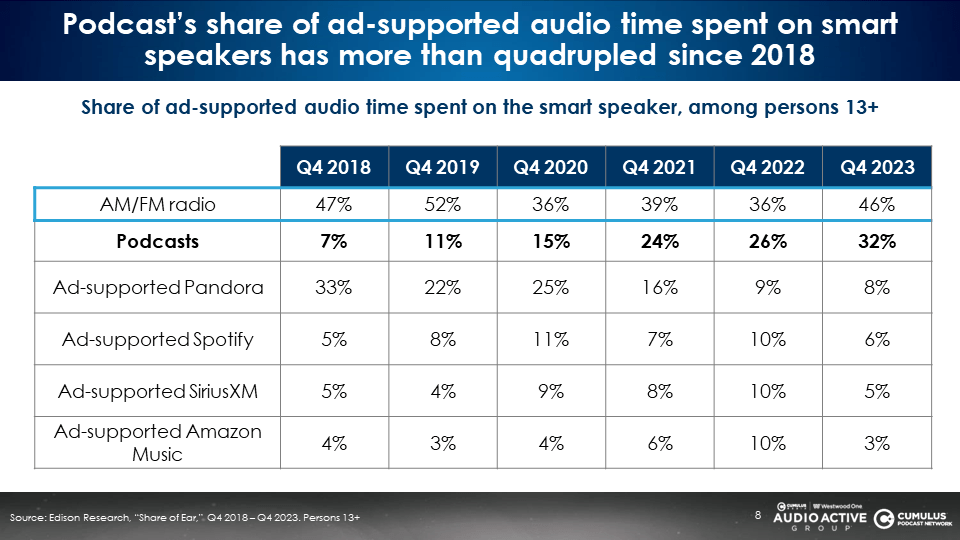

7. Podcast’s share of time spent on the smart speaker is up 4X since 2018

In 2018, podcasts only had a 7% share of smart speaker ad-supported audio. Today, podcasts have soared to a 32% share of ad-supported smart speaker listening.

AM/FM radio has held firm as the most listened to ad-supported audio platform on the smart speaker at a 46% share. Pandora’s smart speaker share has completely collapsed from a 33% to an 8% share.

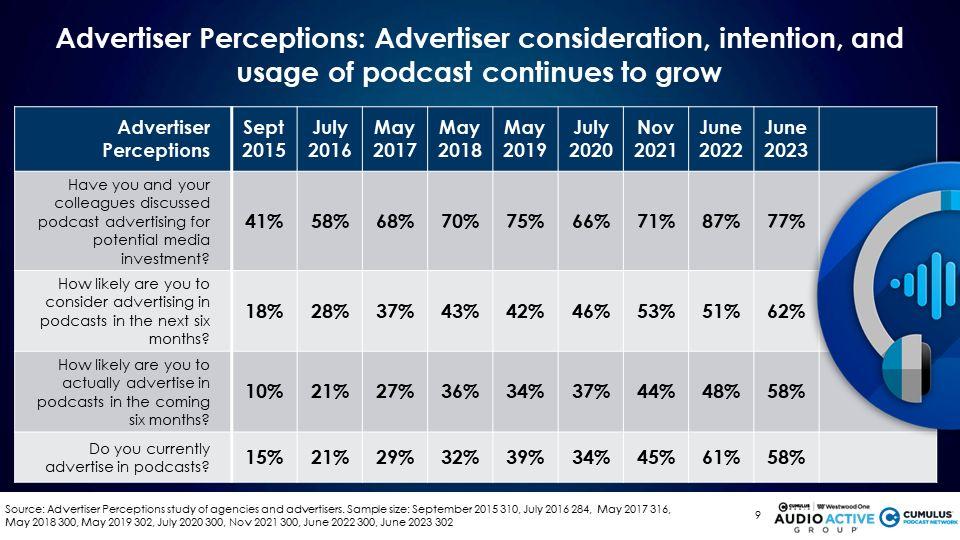

8. Advertiser Perceptions: Marketer/agency podcast advertising spending consideration and intention are at record highs

Over the last nine years, the Cumulus Media | Westwood One Audio Active Group® has commissioned Advertiser Perceptions, the industry leader in measuring media agency and marketer sentiment, to conduct an annual study of 300 executives responsible for media budgets. Four questions have been asked each year since 2015:

- Have you and your colleagues discussed podcast advertising for potential media investment?

- How likely are you to consider advertising in podcasts in the next six months?

- How likely are you to actually advertise in podcasts in the coming six months?

- Do you currently advertise in podcasts?

Since 2015, the proportion of agencies and advertisers who say they are likely to consider advertising in podcasts in the next six months has jumped from 18% to 62%. Those who say they are likely to actually advertise in podcasts have increased 6X from 10% in 2015 to 58% in 2023. Brands and media agencies who say they currently advertise in podcasts have grown from 15% to 58% nearly a 4X increase.

Key takeaways:

- Podcast audiences have scale: Among 25-54s, one-third listen daily, 44% listen weekly, and 59% listen monthly

- If you listen to podcasts, they are your number one audio platform

- The median age of the podcast audience has held at 34 despite massive audience growth

- The podcast audience profile is employed, upscale, and educated, according to Nielsen Scarborough

- Most podcast listening occurs at home throughout the day

- Podcasts have opportunities for growth in markets 51+ where listening is underrepresented

- Podcast’s share of time spent on the smart speaker is up 4X since 2018

- Advertiser Perceptions: Marketer/agency podcast advertising spending consideration and intention are at record highs

Click here to view a 14-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.