5-Question Framework: How To Evaluate An Advertiser’s Position And The Ability Of A Media Vehicle To Scale

Click here to view or download the slides.

Editor’s note: John Fix is responsible for returning Procter & Gamble into the world of audio advertising. Since his recent retirement from P&G, John has opened his consultancy and Westwood One is excited to be one of his early clients. At P&G, John was one of the first to be dedicated to media analytics, from planning to attribution. He was responsible for the analysis and selection of media measurement applications and planning tools. At one point, John led U.S. media mix modeling, multi-touch attribution, and market testing. In his years at P&G, they went from non-existent to first in radio over a 5-year period.

These talking points form the basis of a 5-Question Framework applied to audio that covers the multi-year journey at P&G to address the viability of audio advertising (network radio and podcasting). This framework can be applied to any media.

5-Question Framework:

- Does audio work?

- Can audio be planned and purchased at scale?

- Are there creative best practices for getting audio right?

- Can audio be measured?

- Is the brand properly set up for success?

These five questions are important to advertisers, providers of audio, and the industry in general. Communication with advertisers is best when it is acknowledged as to the stage of the advertiser and the industry. Failure to identify and address each step in the 5-Question Framework will cause unnecessary delay.

1. Does audio work?

The initial barrier to the use of audio centers on whether or not it works.

There is a myth that advertising needs sight, sound, and motion. The prevailing wisdom is that audio lacks two of the three. The strength of audio in a media plan is that is serves to:

- Remind: Audio can create awareness. Done correctly, a branded message can describe how the brand delivers a meaningful benefit. The “theater of the mind” can remind a consumer that a product exists in a category and create top of mind awareness.

- Relate: Audio is most powerful when branded and a trusted voice delivers a message. Audio created the original influencers. The legacy of DJs delivering the advertising message in the “local language” emphasizes the power of the on-air read. Podcasts are lauded for their ability to reach an engaged audience as podcast content is inherently interesting to the audience that has chosen to interact.

- Reach: AM/FM radio and podcasts provide extensive reach and are very effective in creating incremental reach when coupled with a traditional media plan. Planning tools can show the incrementality of audio.

2. Can audio be planned and purchased at scale?

Once brands start to believe in audio, they want to see how it fits into the media plan. With this, there is a transition from “buying beads to buying a necklace.”

Brands will choose to “buy beads” (tentpoles or individual podcasts) when appropriate but a media plan is about putting together an investment that creates a holistic plan. This is where incorporating audio (AM/FM radio, streaming, and podcasts) into planning tools plays a major role.

The podcast industry grew as brands began to use podcasts as tentpoles. Podcasts were chosen, similar to AM/FM radio tentpole events (major sports events), to create one-time associations. The move from buying events to buying audiences is critical for brands and suppliers.

For brands, this takes audio from being an investment in the margins to becoming an important part of a media plan. AM/FM radio streams also have to be part of media planning tools in order for them to be part of the plan.

The ability to buy in scale is as important as the ability to plan. Broadcasters and those in the podcast industry have benefit in the understanding that the transaction is best when a brand can work with a network – moving from tentpoles and placements to a plan. Investment in scale doesn’t seem to happen when there is a need to cut a myriad of checks to execute a fragmented audio plan.

3. Are there creative best practices for getting audio right?

Audio best practices are the next key to success. A brand can believe in audio and can plan and buy audio but if poorly executed, the investment will be wasted and the media suppliers will suffer.

The industry needs to assert itself here to make sure that audio is done right. Briefs have to be meaningful. The industry needs to work with the agencies and the advertisers to make sure that the key levers of audio (creative, placement, audience matching, flighting, reach, weights, etc.) are sufficient.

Brands don’t want to be told after the fact that their execution was flawed. Information at a post-mortem is not helpful. Allowing an advertiser to fail will stop investment.

4. Can audio be measured?

While measurement is the 4th question, it is a topic that needs to be considered at all times. Many brands will not make an investment unless they know that they can have information that spans proof-of-performance to attribution. Audio, and all media done at scale, needs to have data that is available and in front of advertisers. Industry studies are not sufficient to support investment. Custom reporting should become customary and readily accessible.

The inclusion of audio data in syndicated data sets not only allows brands to make the investment but is a way for brands to learn where their competitors are and are not.

Advertisers’ knowledge of share of voice data can sell audio. Having 3rd party confirmation of delivery is table stakes. Having audio data that is sufficient for attribution (Multi-Touch Attribution, local market testing, Market Mix Modeling) is necessary but at that point the assumption is that a brand has done an execution.

Data must exist to allow the execution. Too many times support of MMM is touted as the right to succeed. MMM only happens after investment is made. Trusted data has to be readily available.

The best data input for Market Mix Modeling or Multi-Touch Attribution is weekly as-run campaign audience deliveries via Media Monitors and Nielsen. Generally, Market Mix Modeling requires two years of weekly as-run GRPs for total U.S. and by DMA. This is far superior to providing planned weekly weight.

5. Is your brand properly set up for success?

The 5th question puts some responsibility on the advertiser. Even though audio works and can be optimized with best executional practices, it can still be ineffective. It is the responsibility of the advertiser to make the message work.

Creative best practices of branding and consistency apply. The ability of a consumer to bridge all of the media elements is important as a brand needs to look, sound, and feel consistent to the consumer. Here is where sonic branding can play a role. A brand with a strong sonic identity on TV will break through in audio. A brand that uses its iconic assets, in this case its sound, can ensure that audio works.

Some brands have rightfully tested audio 4-5 times, with only the last execution proving to “work.” There were tweaks along that path (flighting, etc.) but the victory came when the audio asset was shown to work. Sonic branding may be a gold standard but there are some very strong examples of “jingles” and good studio work to show that proper branding takes audio effectiveness to the next level.

The brand name should be mentioned early, often, clearly, loudly, and slowly. The package can be described such that audio translates to the point of purchase. Brand association is a key measure and ideally spans across all media touchpoints through consistency.

For a marketer who is new to audio and seeks to test the medium, I highly recommend pre-testing the creative. Is your ad audible? Are emotions evoked to ensure memorability? Are there strong levels of brand linkage?

Failure to address the 5-Question Framework can prevent meaningful investment

Many media industry committees have focused on data for MMM. Seeing the necessity for planning and Proof of Performance was eye opening to them. Certain AM/FM radio broadcaster and podcast providers couldn’t understand their small piece of the pie. Seeing the “purchase at scale” point made them better understand why they were not favored.

Does audio work?: A brand that believes that a benefit can not be described with words will not consider audio.

Scale: Podcasters sell podcasts. Podcast networks sell audiences to media plans.

Do it correctly: Tests fail because the creative was not tested or the activation was insufficient for measurable impact.

Measurement: Investment will not be made if the media stream cannot be measured.

Every question has a real story behind it and experience shows that it can take a year to identify each one, unfortunately due to a failure. Acknowledge where the advertiser and the industry is, understand where each party is on this journey, and directly address the barrier.

Audio works at scale when done correctly and supported with available data. Advertising works when done well.

Across 45 brands and seven years, here’s what I found:

Yes, audio works! It can be planned and purchased at scale. If you follow audio creative best practices, you can be very effective. Whether your KPI is site traffic, brand lift, or sales effect, your audio campaign can be measured.

You can achieve audio success! Along with my Westwood One colleagues, I would love to help you begin your audio journey.

References to address the questions at each stage:

DOES AUDIO WORK – advertising without sight & motion

There is a lot of evidence to support audio advertising.

DOES AUDIO ADD VALUE TO A MEDIA PLAN?

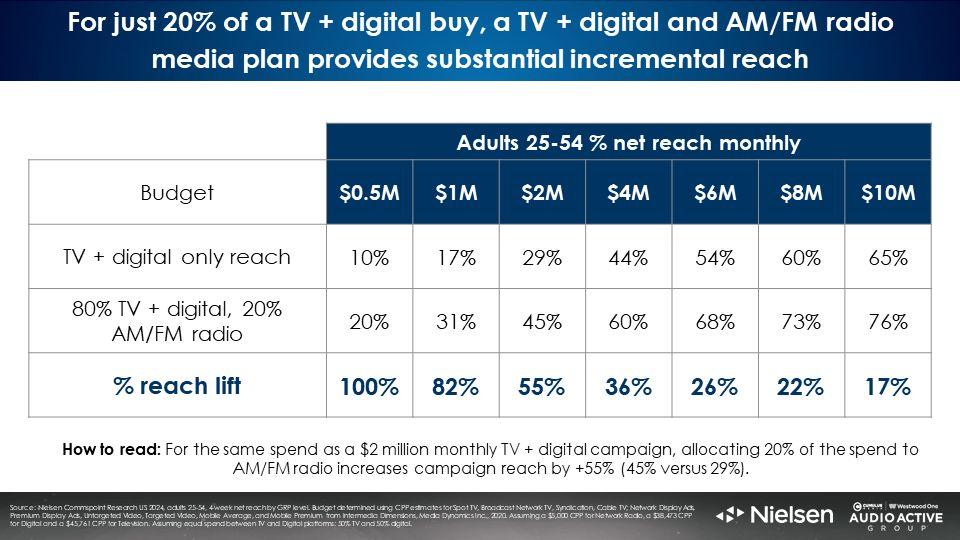

Nielsen Media Impact, the planning and optimization platform, makes a persuasive case for how AM/FM radio can elevate the media plan. The table below depicts monthly national media plans of varying sizes from very small to heavy.

The first line represents the reach of a typical media plan with TV, digital, and connected TV. The next line reveals a 10% reallocation to AM/FM radio at the same budget. Notice how campaign reach explodes at each spending level.

A monthly national investment of one million dollars across digital and TV achieves a 17% reach. Shifting just 20% to AM/FM radio causes reach to soar from 17% to 31%, an +82% increase at the same budget.

AUDIO BEST PRACTICES

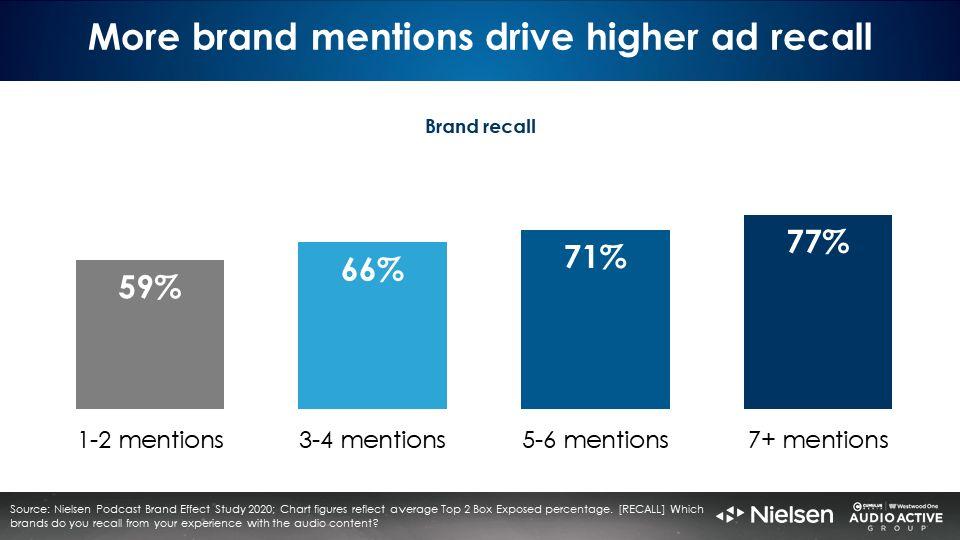

One of the most important audio creative best practices is “brand early and often.” Introduce the brand right at the beginning of the ad and repeat at least five more times throughout a thirty-second ad. The more times the brand is mentioned, the greater the ad recall and brand linkage, according to Nielsen.

The assumption has to be that audio works. Given this, advertisers should be guided to test new media following known best practices. Failure of a test tends to be an indication that the execution was poor. Advertisers will assume that the medium doesn’t work and investment will cease.

DATA AND MEASUREMENT

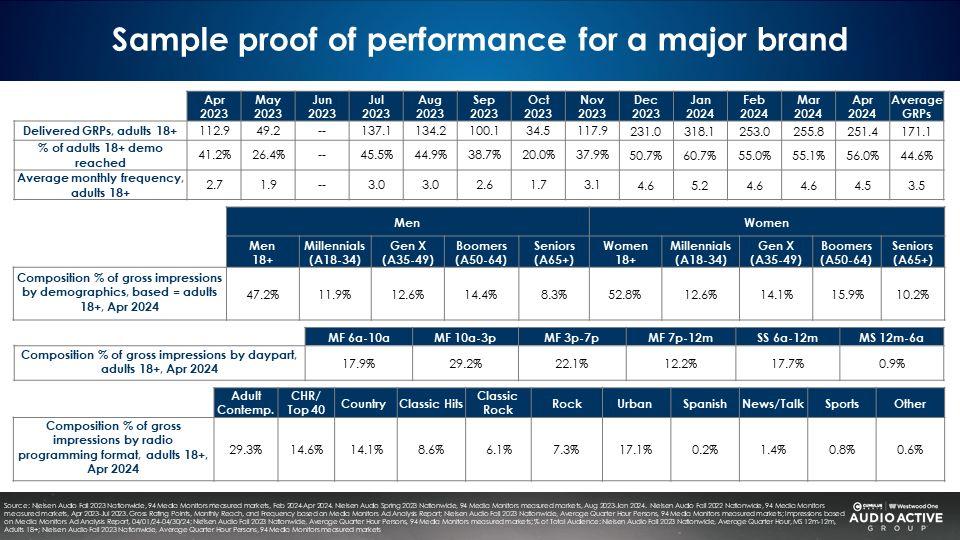

Here’s what is meant by proof of performance. The example below shows as-run audience deliveries for the brand campaign.

Take all of the brand’s AM/FM radio campaign ad occurrences from Media Monitors and run monthly Nielsen deliveries. Show GRPs, reach, and frequency. Depict share of impressions delivery by daypart, demographic, and by AM/FM radio programming format.

Download the slides:

John Fix can be reached at johnfixltd@gmail.com.