Veritone One And Signal Hill Insights Pharma Study: Facial Aesthetics Category Skews Young And AM/FM Radio And Podcasts Offer Exceptional Reach Among Patients And Prospects/Considerers

Click here to view a 14-minute video of the key takeaways.

Click here to view or download the slides.

Editor’s note: Conor Doyle is SVP and Managing Director of Veritone One, a recognized leader in performance-based audio and creator-based video advertising that leverages AI to achieve maximum scale and return on investment. Conor currently oversees Veritone One’s strategic direction. This includes client activation and success, media investments, and product development.

While pharma remains a leading category on network radio with consistent campaigns from brands such a Pfizer, AbbVie, Skyrizi, and Boehringer Ingelheim, a new study commissioned by Veritone One, a leading audio advertising agency, reveals new opportunities in the growing facial aesthetics segment. The Signal Hill Insights report finds AM/FM radio and podcasts are both highly efficient at reaching the aesthetics market.

Key findings:

- Broad acceptance of non-surgical facial aesthetics suggests a large potential market

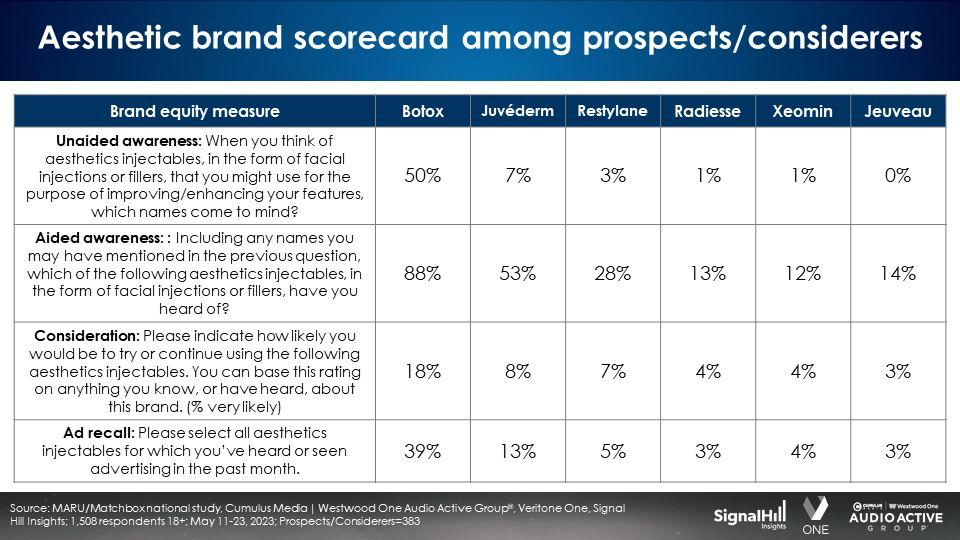

- Aesthetic brand scorecard: Botox is the dominant player; Brands ranked next in aided awareness include Juvéderm, Restylane, Jeuveau, Radiesse, and Xeomin

- Heavy AM/FM radio and podcast listeners over index on the aesthetic category; TV way under indexes

- Nielsen Media Impact: AM/FM radio elevates the aesthetic brand media plan; Botox experiences a 2X increase in reach with a 20% reallocation to AM/FM radio

- Botox’s TV buy does not reach the crucial 18-34 and 18-49 aesthetic demographics; Adding AM/FM radio to the TV media plan generates significant younger demo incremental reach growth

- A wide variety of AM/FM radio programming formats generate significant reach of the aesthetic prospects/considerer and patient target audience

McKinsey: “The medical-aesthetics market remains on track to maintain near double-digit growth through 2025”

Facial aesthetics are non-surgical, cosmetic procedures known as anti-wrinkle treatments that temporarily refresh, firm, or plump the skin on your face. Treatments include injections performed to relax tense facial muscles that can lead to wrinkles. Example brands include Botox, Xeomin, and Jeuveau. There are also injections of substances or gel that add volume back to sunken areas of the face. Example brands include Juvéderm, Restylane, and Radiesse.

How the study was conducted

Veritone One commissioned Signal Hill Insights to conduct a market and competitive assessment of the aesthetics injectables category to evaluate brand awareness, brand images, and advertising recall. The May 2023 study consisted of a nationally representative sample of 1,508 18+ Americans with health insurance. Results were weighted to reflect the age/gender distribution of the U.S. population.

Two key consumer segments were examined:

- Past 12-month aesthetics patients have had at least one facial non-surgical treatment in the past year. They are 7% of the U.S. population.

- Aesthetics injectables prospect/considerers are the 25% of the U.S. population who say they are very/somewhat likely to consider going to a professional for non-surgical treatment.

Here are the findings:

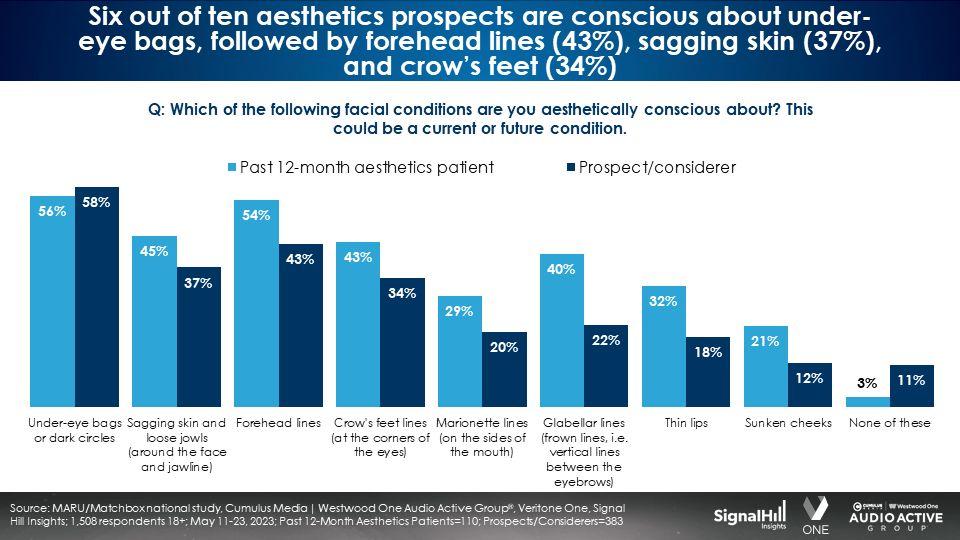

The facial conditions most aesthetic prospects are conscious about include under-eye bags, forehead lines, sagging skin, and crow’s feet

Those who have had treatments in the last year are more likely to cite other conditions to a much greater degree.

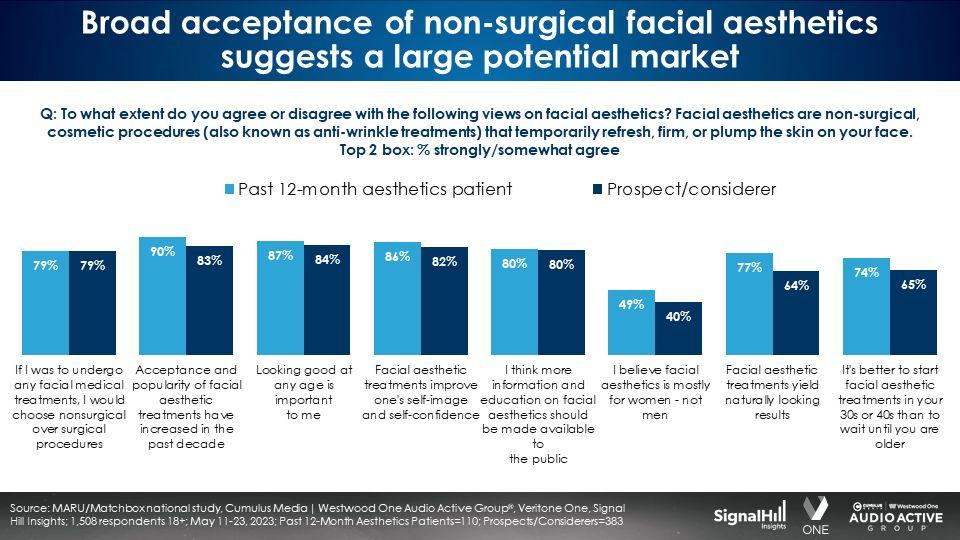

Broad acceptance of non-surgical facial aesthetics suggests a large potential market

Large proportions of aesthetic prospects feel the non-surgical treatments are popular, natural looking, and improve self-image and self-confidence.

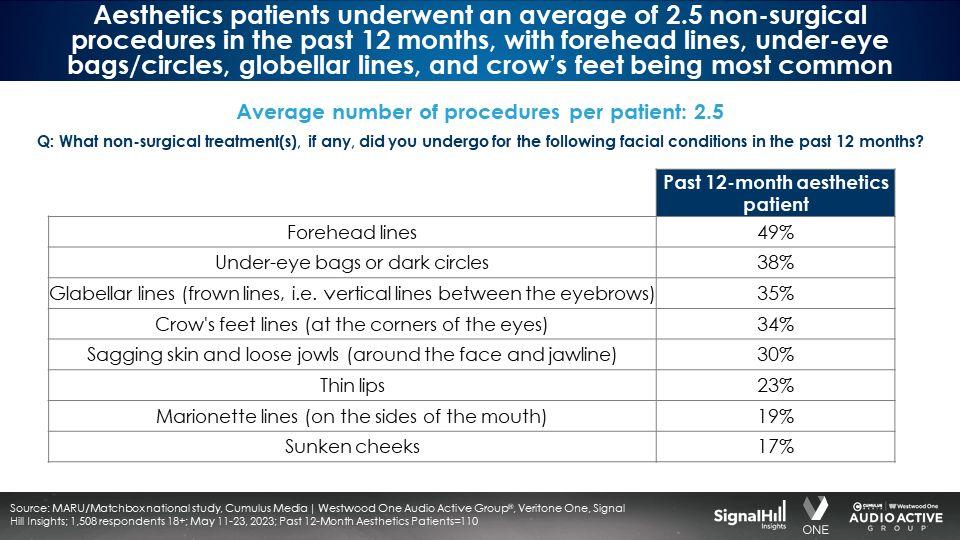

The treatments most utilized by past year patients include forehead lines, bags under the eyes, frown lines, crow’s feet, and sagging skin

The average patient has had 2.5 procedures in the last year.

Aesthetic brand scorecard: Botox is the dominant player; Brands ranked next in aided awareness include Juvéderm, Restylane, Jeuveau, Radiesse, and Xeomin

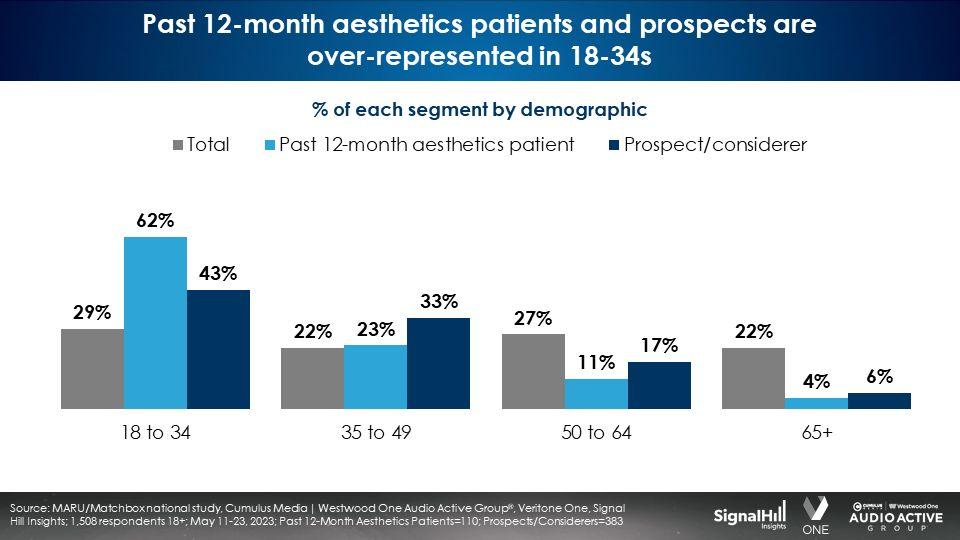

Aesthetics patients and prospects skew young

85% of recent 12-month patients are 18-49. 62% of past year aesthetic patients are 18-34. 23% are 35-49.

Three-quarters of aesthetic prospects and considerers are 18-49. 43% are 18-34 and 33% are 35-49.

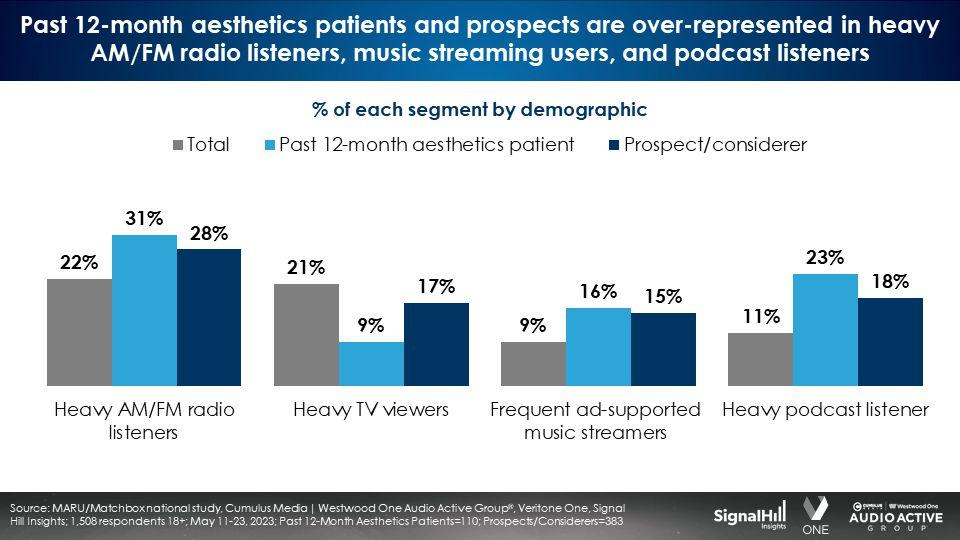

Heavy users of audio tower over TV among aesthetic consumer segments

Among past year aesthetic patients, 31% are heavy AM/FM radio listeners, 23% are heavy podcast listeners, and 16% are frequent ad-supported audio streaming listeners. At only 9%, few if any, aesthetic patients are heavy TV viewers.

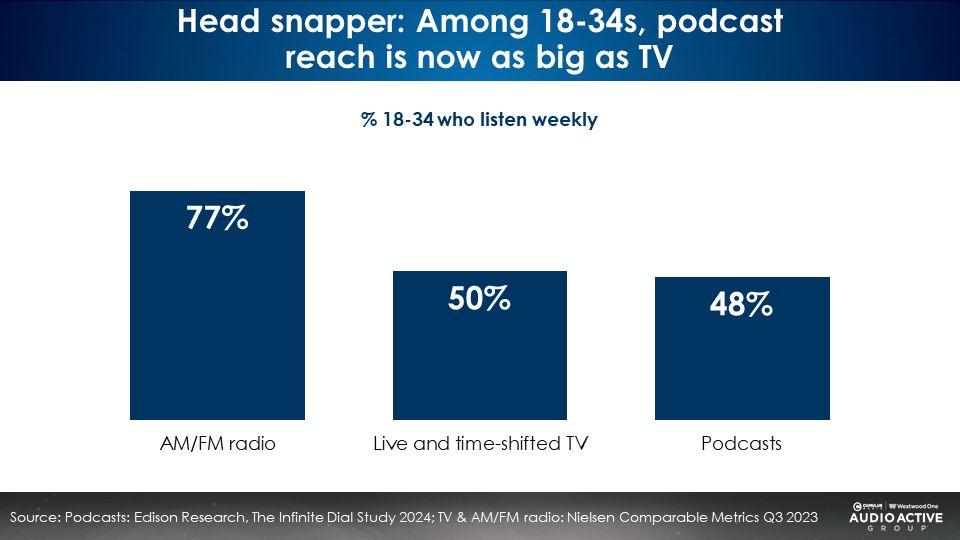

Why is TV is so dramatically under represented among aesthetic patients and prospects? Live and time-shifted TV has very low reach among younger demographics

In younger demos, TV is reach challenged. New Nielsen data reveals live and time-shifted TV misses half of American 18-34s weekly.

Surprisingly, podcast reach is now as big as TV among 18-34s. AM/FM radio is the dominant 18-34 reach player.

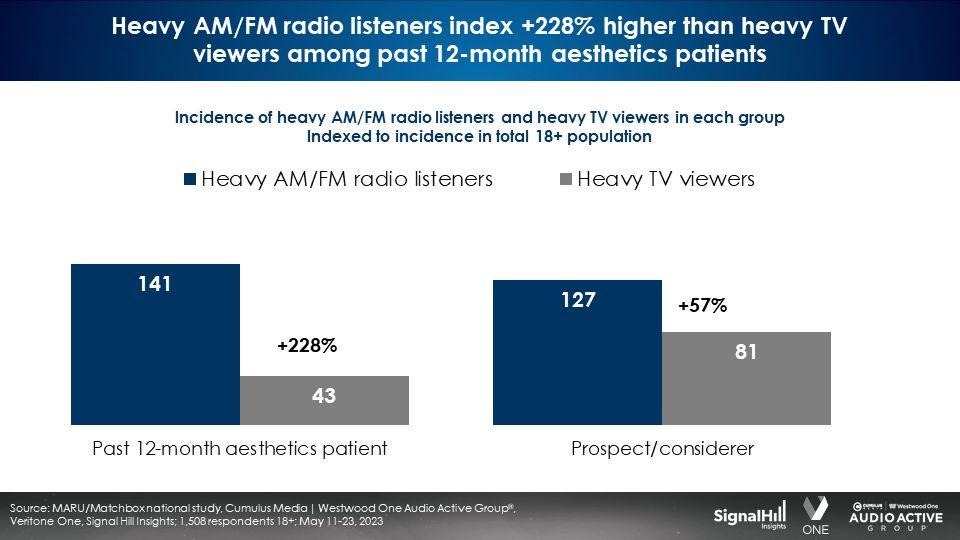

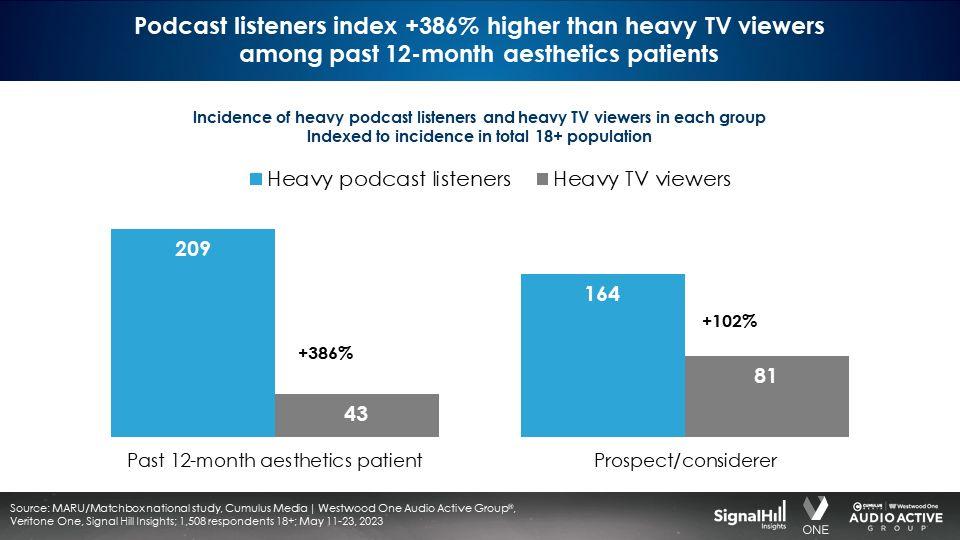

Heavy AM/FM radio and podcast listeners over index on the aesthetic category; TV way under indexes

Heavy AM/FM radio listeners are 41% more likely than the U.S. average to be aesthetics patients and 27% more likely than the U.S. average to be aesthetics prospects/considerers. TV viewers are much less likely to be either patients or prospects.

Heavy podcast listeners are twice as likely as the U.S. average to be past year aesthetics patients and 64% more likely than average to be aesthetic prospects. Again, TV viewers massively under index.

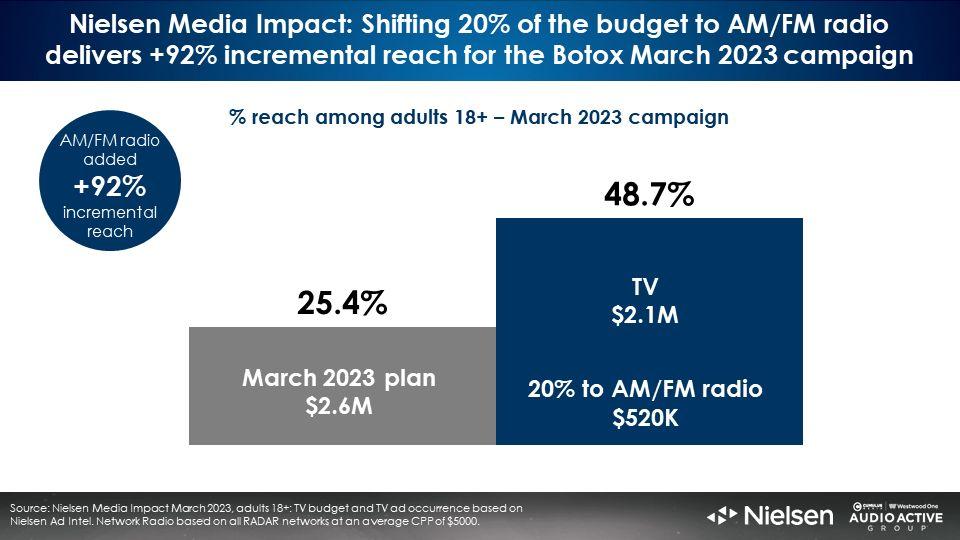

Nielsen Media Impact: AM/FM radio elevates the aesthetic brand media plan; Botox experiences a 2X increase in reach with a 20% reallocation to AM/FM radio

In March of 2023, Botox spent $2.6M on network television and reached a quarter of adults 18+, according to Nielsen Media Impact, the media planning and optimization platform. Nielsen reveals shifting 20% of the TV budget to AM/FM radio generates nearly a 2X increase in reach (25% to 49%). Double the reach for the same budget!

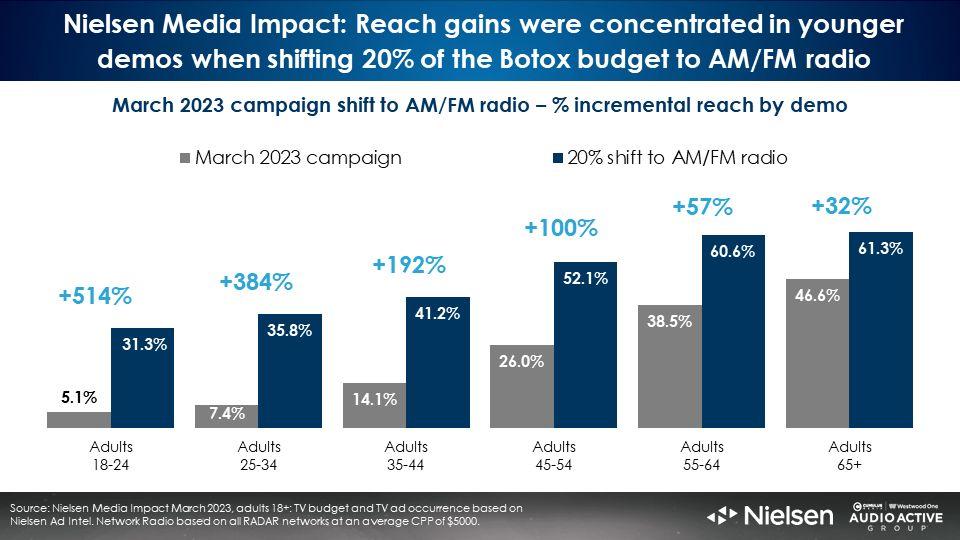

Botox’s TV buy does not reach the crucial 18-34 and 18-49 aesthetic demographics; Adding AM/FM radio to the TV media plan generates significant younger demo incremental reach growth

The grey bars below represent the monthly reach of the Botox TV buy. While the vast majority of aesthetic patients and prospects are 18-49 and 18-34, the Botox TV buy missed 93% of 18-34s and 80% of 35-54s. The Botox buy did reach nearly half of persons 65+, far older than the intended category target.

The blue bars represent the combined reach of the 80% TV and 20% AM/FM radio media plan. The 20% share shift to AM/FM radio generates astonishing lifts in reach in the demographics crucial to the aesthetic category:

- 18-24: +514%

- 25-54: +384%

- 35-44: +192%

- 45-54: +100%

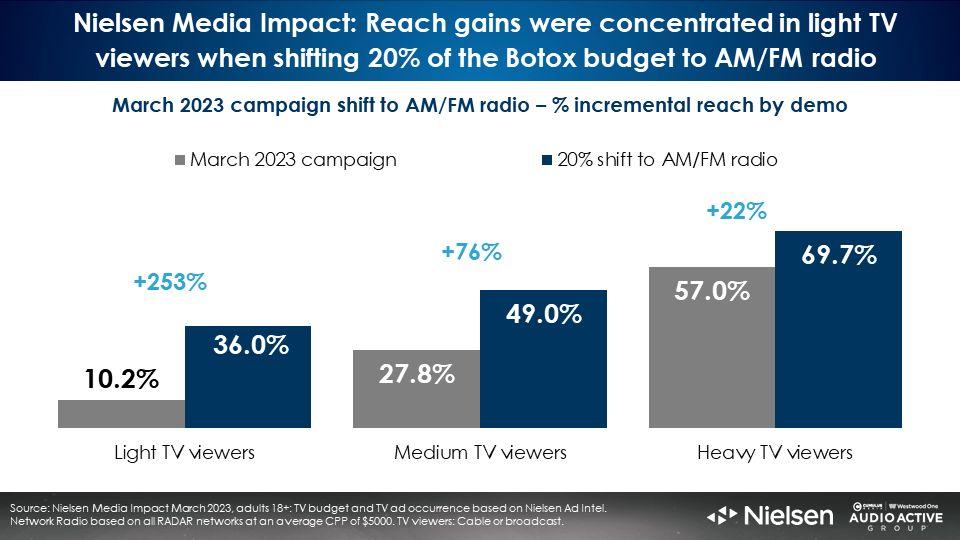

Adding AM/FM radio to the media plan generates massive reach growth among light and medium TV viewers

The 20% reallocation of the Botox media plan to AM/FM radio results in significant incremental reach increases among light (+253%) and medium (+76%) TV viewers. Younger demographics are very light users of linear television, while older demographics are heavy users of TV.

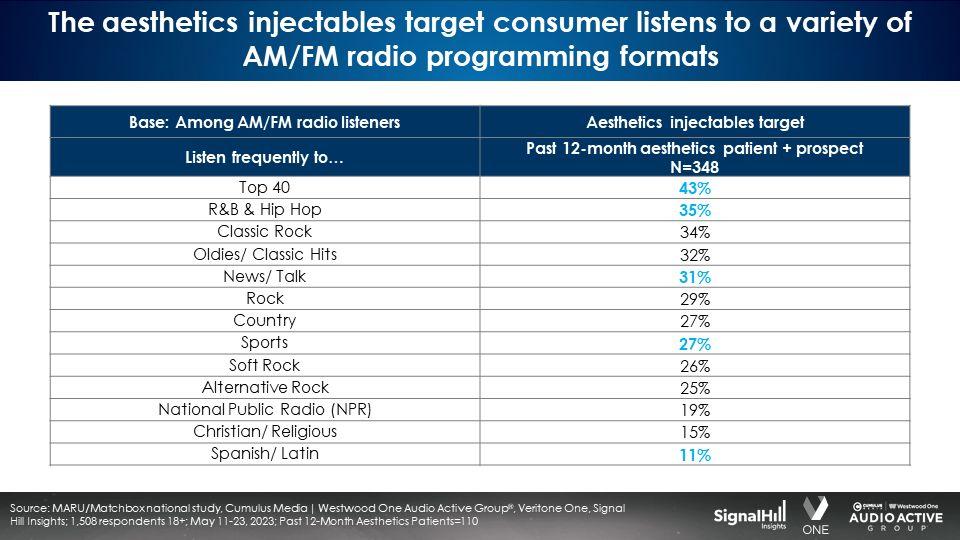

A wide variety of AM/FM radio programming formats generate significant reach of the aesthetic prospects/considerer and patient target audience

43% are reached by Top 40, followed by R&B/Hip Hop (35%), Classic Rock (34%), Oldies/Classic Hits (32%), News/Talk (31%), Rock (30%), and Country (27%).

Key findings:

- Broad acceptance of non-surgical facial aesthetics suggests a large potential market

- Aesthetic brand scorecard: Botox is the dominant player; Brands ranked next in aided awareness include Juvéderm, Restylane, Jeuveau, Radiesse, and Xeomin

- Heavy AM/FM radio and podcast listeners over index on the aesthetic category; TV way under indexes

- Nielsen Media Impact: AM/FM radio elevates the aesthetic brand media plan; Botox experiences a 2X increase in reach with a 20% reallocation to AM/FM radio

- Botox’s TV buy does not reach the crucial 18-34 and 18-49 aesthetic demographics; Adding AM/FM radio to the TV media plan generates significant younger demo incremental reach growth

- A wide variety of AM/FM radio programming formats generate significant reach of the aesthetic prospects/considerer and patient target audience

Click here to view a 14-minute video of the key takeaways.

Conor Doyle is SVP and Managing Director of Veritone One.