Your Media Plan Has Streaming Music And Podcasts; Can You Check The Box On Audio? Not So Fast – Here’s Why

Click here to view a 15-minute video of the key findings.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Edison surveys 4,000 Americans annually to measure daily reach and time spent with all forms of audio. This analysis focuses on what advertisers care about – ad-supported audio.

Here are six key findings from the Q1 2024 “Share of Ear” study:

- In a typical day, ad-supported digital audio reaches a third of America; AM/FM radio reaches two-thirds of America; Combined, digital audio and AM/FM radio reach 75% of the U.S. daily

- Between ad-supported Spotify and AM/FM radio, most people only listen to AM/FM radio

- Between ad-supported Pandora and AM/FM radio, most people only listen to AM/FM radio

- The U.S. ad-supported audio clock: Podcasts and AM/FM radio represent nearly 90% of tuning minutes

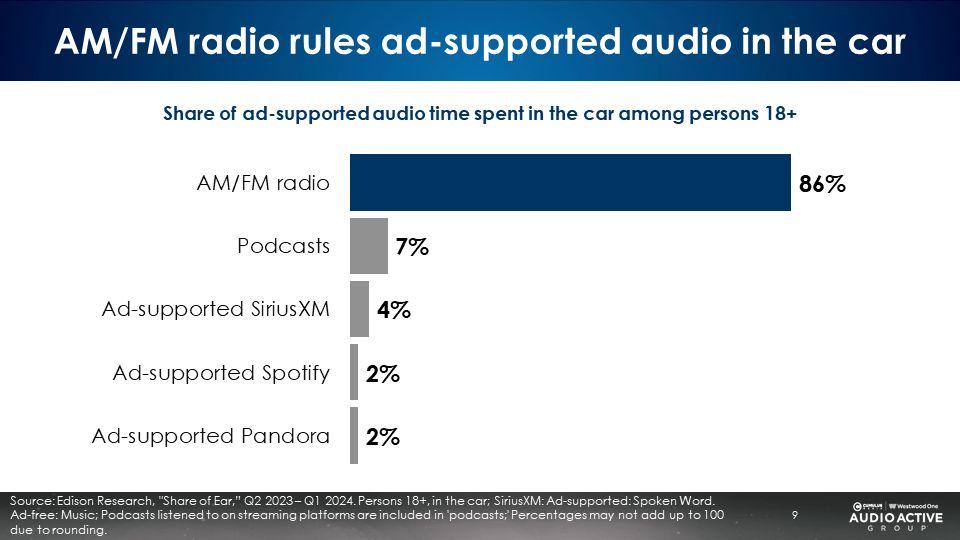

- With a towering in-car share of 86%, AM/FM radio is the primary way to reach consumers on the path to purchase; The proportion of AM/FM radio in-car listening has surged, returning to pre-pandemic norms

- Among registered voters across the political spectrum, AM/FM radio is the dominant ad-supported audio platform

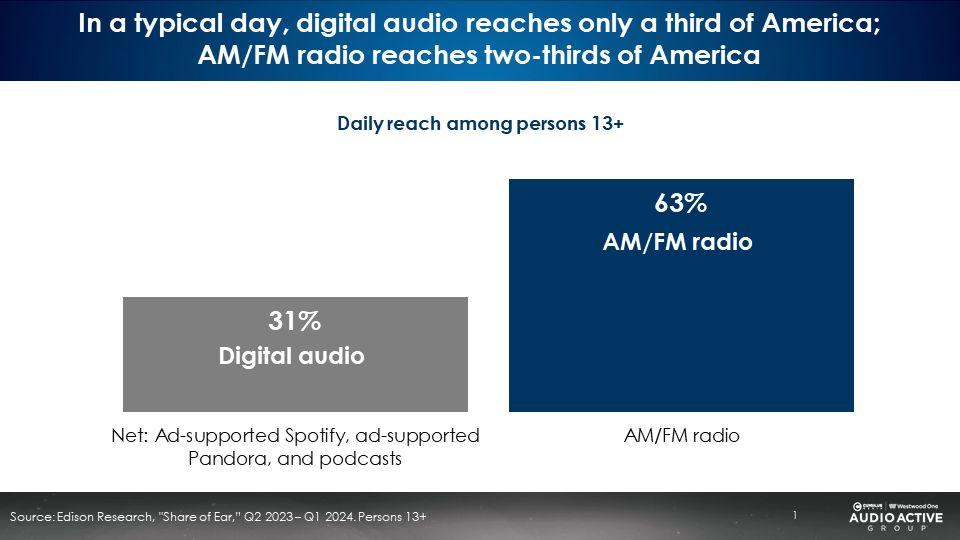

In a typical day, digital audio reaches a third of America; AM/FM radio reaches two-thirds of America

As the visual reveals below, the net reach of ad-supported Spotify, Pandora, and podcasts combined reaches one-third of the U.S. (31%). AM/FM radio reaches twice as many (63%).

The addition of AM/FM radio to digital audio causes reach to soar to 75% of the U.S.

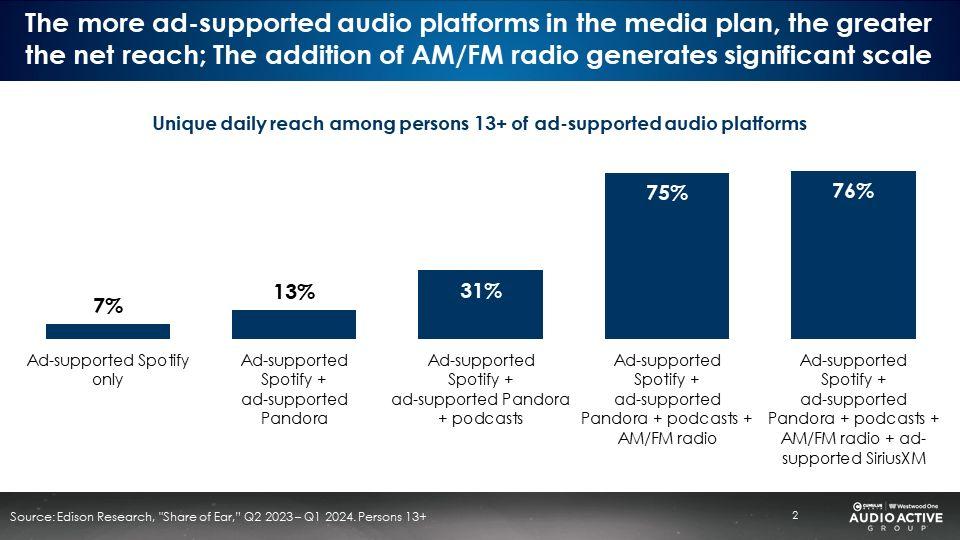

The graph below reveals the daily net reach accumulation of ad-supported audio platforms. Ad-supported Spotify reaches just 7% of the U.S. each day. Combined, ad-supported Spotify and ad-supported Pandora reach only 13% of the U.S.

The addition of podcast audiences grows daily reach to 31%. The addition of AM/FM radio grows daily reach to an a stunning 75%. An audio media plan can achieve true scale with the inclusion of AM/FM radio.

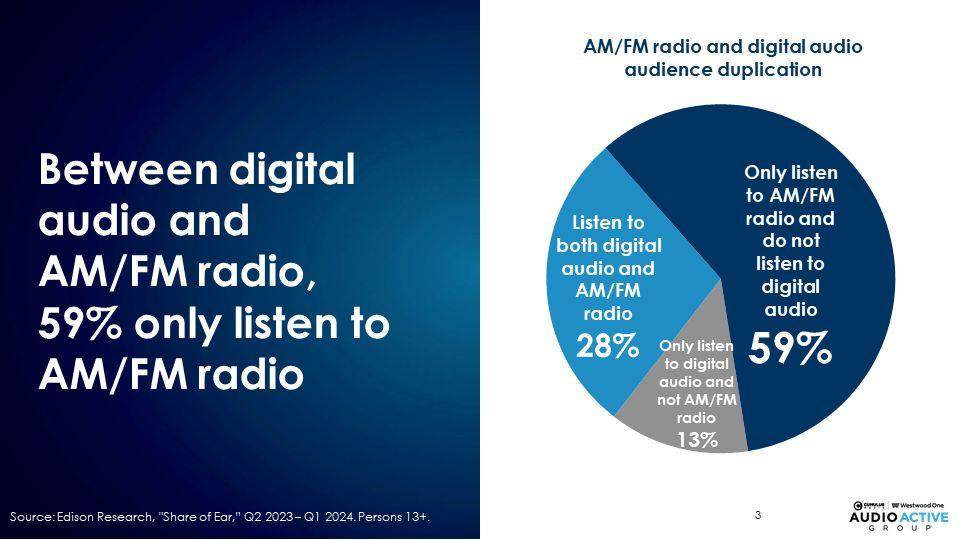

An audio investment that does not include AM/FM radio misses a large portion of audience: 59% only listen to AM/FM radio

Examining the combined audience of digital audio (ad-supported Spotify, ad-supported Pandora, and podcasts) and AM/FM radio reveals in a typical day:

- 13% only listen to digital audio and not AM/FM radio

- 28% listen both to digital audio and AM/FM radio

- 59% listen only to AM/FM radio and not digital audio

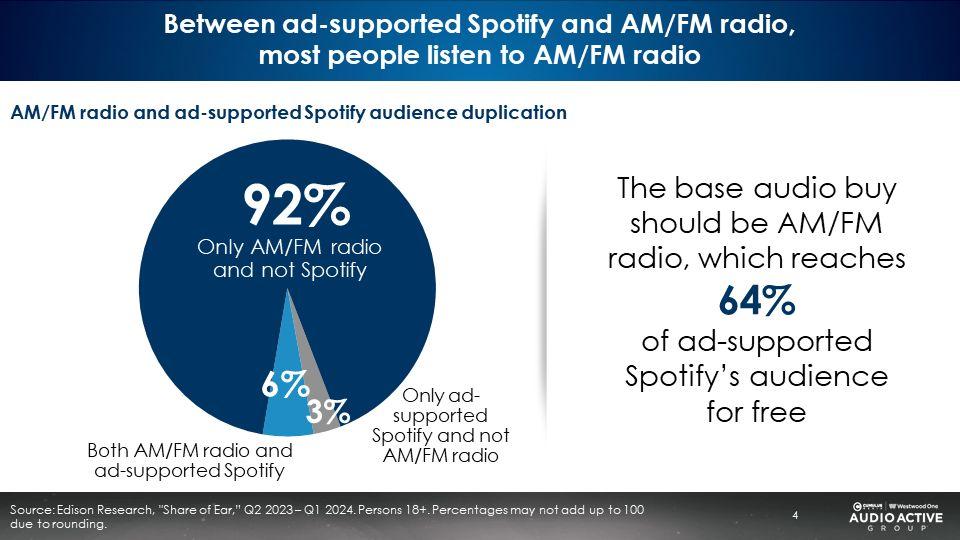

Between ad-supported Spotify and AM/FM radio, 92% only listen to AM/FM radio

Edison examined the daily reach of AM/FM radio and ad-supported Spotify.

- 3% listen just to ad-supported Spotify and not AM/FM radio

- 6% listen to both ad-supported Spotify and AM/FM radio

- 92% only listen to AM/FM radio and do not listen to ad-supported Spotify

A buy that just has Spotify in the plan misses the vast majority of Americans. Interestingly, an AM/FM radio buy reaches two-thirds of Spotify’s audience.

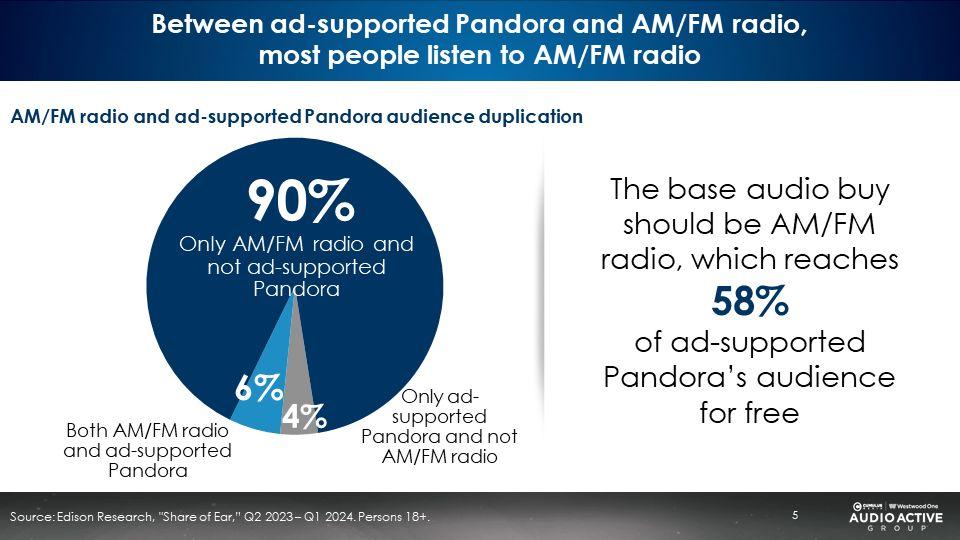

Between ad-supported Pandora and AM/FM radio, 90% only listen to AM/FM radio

Edison examined the daily reach of AM/FM radio and ad-supported Pandora.

- 4% listen just to ad-supported Pandora and not AM/FM radio

- 6% listen to both ad-supported Pandora and AM/FM radio

- 90% only listen to AM/FM radio and do not listen to ad-supported Pandora

A buy that just has Pandora in the plan misses the vast majority of Americans. Interestingly, an AM/FM radio buy reaches 60% of Pandora’s ad-supported audience.

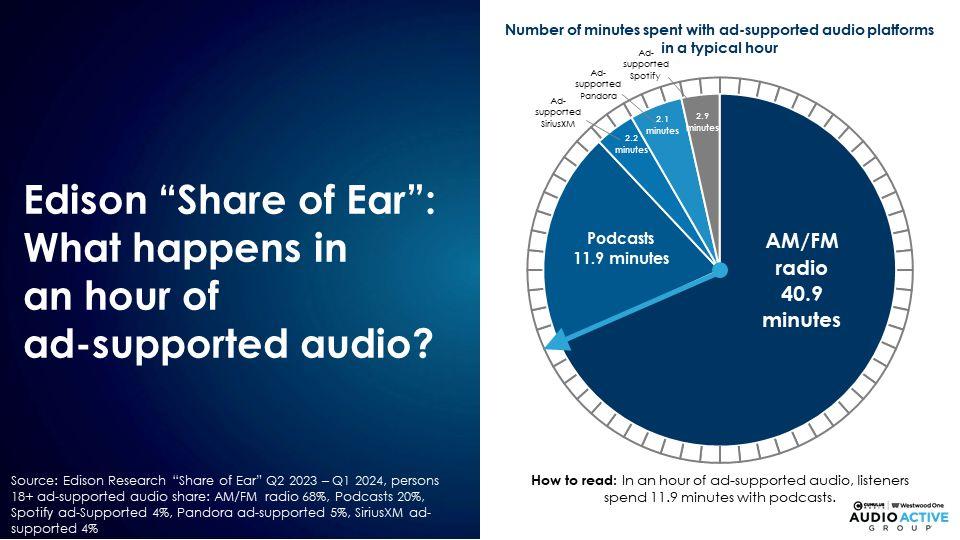

The U.S. ad-supported audio clock: Podcasts and AM/FM radio represent the most tuning minutes

What happens in an hour of U.S. ad-supported audio? The clock below portrays minutes spent in an hour of ad-supported audio. The clock was determined by multiplying “Share of Ear” ad-supported audience shares by 60 minutes.

In an hour of U.S. ad-supported audio:

- AM/FM radio represents 40.9 minutes of listening

- Podcasts are 11.9 minutes of listening

- Ad-supported Spotify is 2.9 minutes

- Ad-supported SiriusXM is 2.2 minutes

- Ad-supported Pandora is 2.1 minutes

Podcasts and AM/FM radio represent 52.8 minutes in an hour of ad-supported audio in the U.S. 88% of U.S. ad-supported audio consists of podcasts and AM/FM radio.

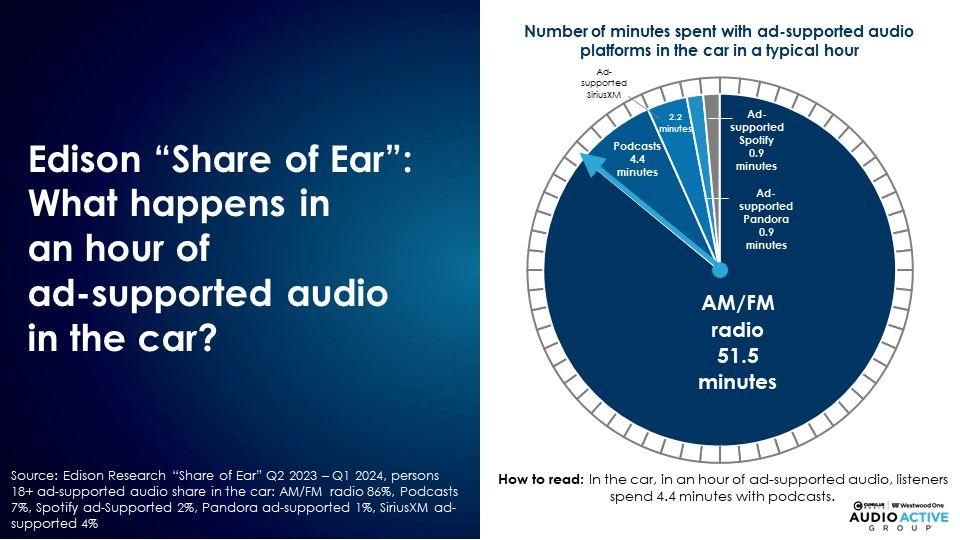

The in-car ad-supported audio clock: AM/FM radio represents the vast majority of tuning minutes in vehicles

What happens in an hour of U.S. ad-supported audio in the car? The clock below was determined by multiplying “Share of Ear” in-car shares of ad-supported audio time spent by 60 minutes.

In an hour of in-car U.S. ad-supported audio:

- AM/FM radio represents 51.5 minutes of listening

- Podcasts are 4.4 minutes of listening

- Ad-supported SiriusXM is 2.2 minutes

- Ad-supported Spotify is 0.9 minutes

- Ad-supported Pandora is 0.9 minutes

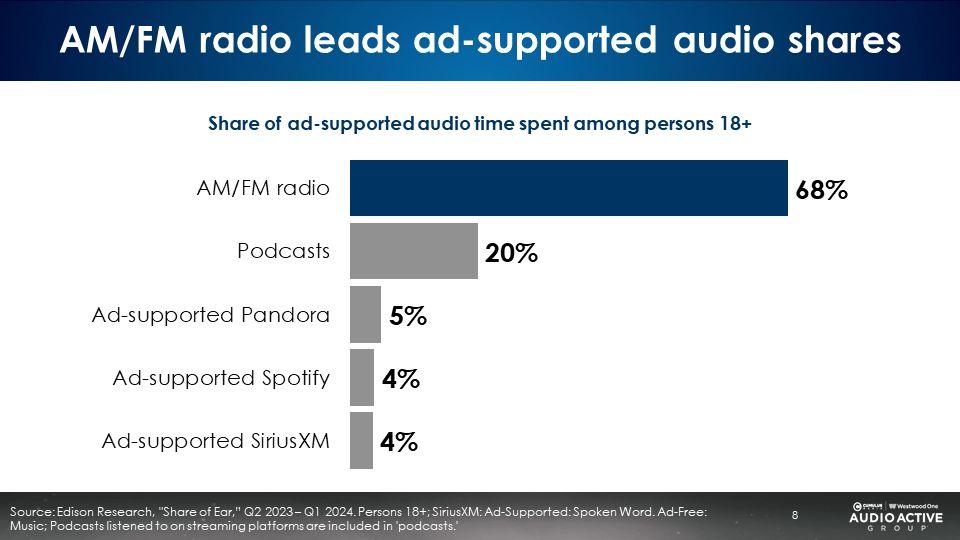

Overall, AM/FM radio has a dominant 68% share of ad-supported audio

Podcasts are number two with a 20% share. With low single digits shares, next are ad-supported Pandora (5%), ad-supported Spotify (4%), and ad-supported Sirius XM (4%).

Nielsen’s “The Record”, a new online dynamic visualization, brings Edison’s “Share of Ear” to the advertising industry

Edison’s “Share of Ear” is the definitive study of how Americans listen to all forms of audio. Nielsen is now marketing Edison Research’s audio planning tools to agencies and advertisers. Both “Share of Ear” and “Edison Podcast Metrics” subscriptions are being sold by Nielsen to marketers and their media agencies.

To generate awareness and interest in Edison’s “Share of Ear,” Nielsen recently introduced “The Record,” an online visual of U.S. ad-supported audio listening. Via this link, you can see ad-supported audio shares from the Q1 2024 Edison “Share of Ear” study. Demographics that can be selected include persons 18+, 18-34, 25–54 and 35+

With a towering in-car share of 86%, AM/FM radio is the primary way to reach consumers on the path to purchase

Over the last decade, AM/FM radio’s in-car share of ad-supported audio had hovered in the mid-80% share range.

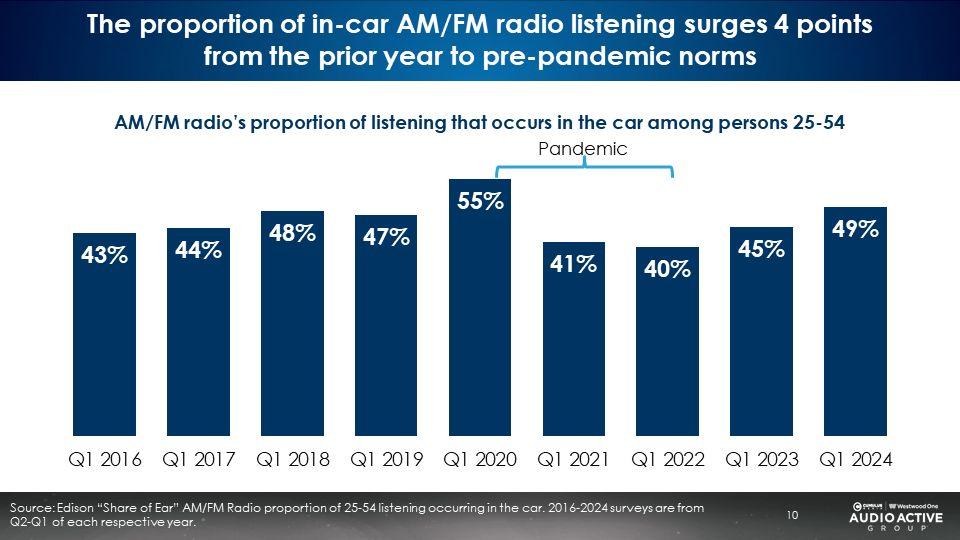

The proportion of AM/FM radio in-car listening has surged, returning to pre-pandemic norms

Here is the nine-year trend of the proportion of AM/FM radio listening occurring in the car:

In the five years before the pandemic (2016-2020), in-car listening represented 48% of all AM/FM radio listening. During the pandemic years (2021-2022), the in-car share dropped to a low of 40%.

Compared to 2022, the proportion of AM/FM radio listening in the car grew five points in 2023 and is now up another four points. Over the last two years, the share of AM/FM radio listening occurring in vehicles has jumped sharply from 40% to 49%, returning to the pre-pandemic norms.

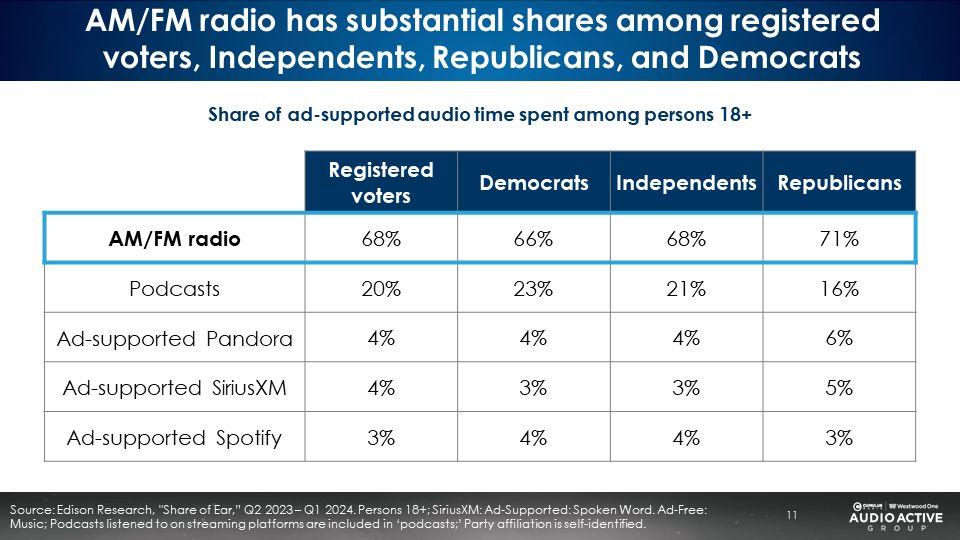

Among registered voters across the political spectrum, AM/FM radio is the dominant ad-supported audio platform

Podcast shares are stronger among Independents and Democrats. Only 10% to 14% of tuning goes to the combination of Pandora, Spotify, and SiriusXM.

Key takeaways:

- In a typical day, ad-supported digital audio reaches a third of America; AM/FM radio reaches two-thirds of America; Combined, digital audio and AM/FM radio reach 75% of the U.S. daily

- Between ad-supported Spotify and AM/FM radio, most people only listen to AM/FM radio

- Between ad-supported Pandora and AM/FM radio, most people only listen to AM/FM radio

- The U.S. ad-supported audio clock: Podcasts and AM/FM radio represent nearly 90% of tuning minutes

- With a towering in-car share of 86%, AM/FM radio is the primary way to reach consumers on the path to purchase; The proportion of AM/FM radio in-car listening has surged, returning to pre-pandemic norms

- Among registered voters across the political spectrum, AM/FM radio is the dominant ad-supported audio platform

Click here to view a 15-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.