Amazon Prime Day Is Powered By AM/FM Radio And Podcast Listeners; Plus, Why Retailers Should Give Audio A Starring Role In Holiday Media Plans

Click here to view a 15-minute video of the key takeaways.

Click here to view or download the slides.

This week, Amazon will debut its 10th Prime Day event. From July 16 at 12:01 a.m. PDT through July 17, Prime members will get exclusive access to millions of deals. Since the inception of Amazon Prime Day, the audio audience has been the engine of e-commerce purchases.

Key takeaways:

- AM/FM radio and podcasts are ideal medium platforms for retailers and e-commerce brands: Heavy audio listeners are more likely to shop online. Heavy AM/FM radio and podcast listeners also spend more on online than TV viewers. AM/FM radio listeners and heavy podcast listeners over-index on Amazon Prime membership and purchase intent.

- AM/FM radio makes your TV better – “20 gets you 50”: Nielsen Media Impact optimizations reveal shifting more media weight to AM/FM radio generates significantly more reach, especially among younger demographics 18-49. AM/FM radio does an extraordinary job in increasing campaign reach among light TV viewers who are far less likely to see retailer TV ads. The rule of thumb is “20 gets you 50”: a 20% shift of a TV media budget to AM/FM radio generates a 50% increase in reach.

- Audio holiday AM/FM radio campaigns work: Consumers exposed to an Amazon holiday AM/FM radio campaign have higher brand equity (awareness, ad recall, prior purchase, and purchase intent). Nielsen sales effect studies reveal AM/FM radio campaigns for retailers generate significant return on advertising spend: $15 dollars of incremental sales for every dollar of AM/FM radio advertising.

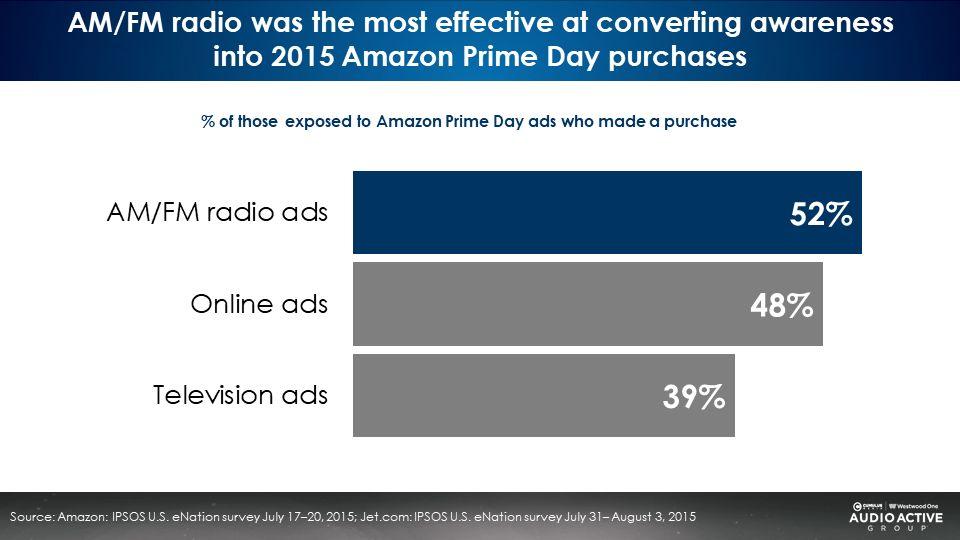

AM/FM radio ads drove the strongest purchase conversion for the very first Amazon Prime Day

In 2015, an IPSOS study commissioned by the Cumulus Media | Westwood One Audio Active Group® revealed AM/FM radio ads were the most effective at converting awareness into Prime Day purchases. Of those exposed to AM/FM radio ads, 52% made a purchase versus TV (39%) and online (48%).

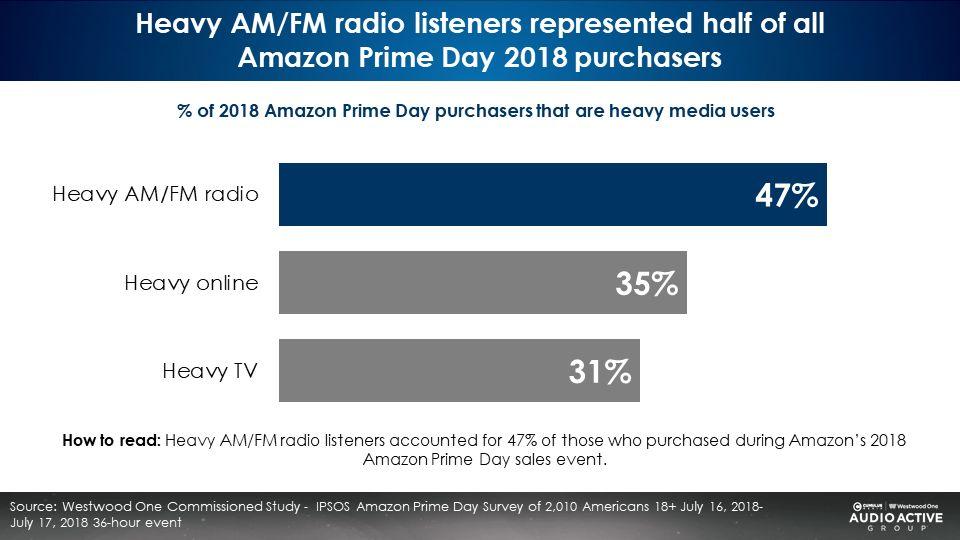

A 2018 IPSOS study revealed heavy AM/FM radio listeners represented half of all Amazon Prime Day purchasers

AM/FM radio was the engine of Amazon Prime Day in 2018. Far more heavy AM/FM radio listeners were purchasers (47%) compared to heavy online users (35%) and heavy TV viewers (31%). Heavy AM/FM radio listeners were 51% more likely to be Amazon Prime Day 2018 purchasers compared to heavy TV viewers.

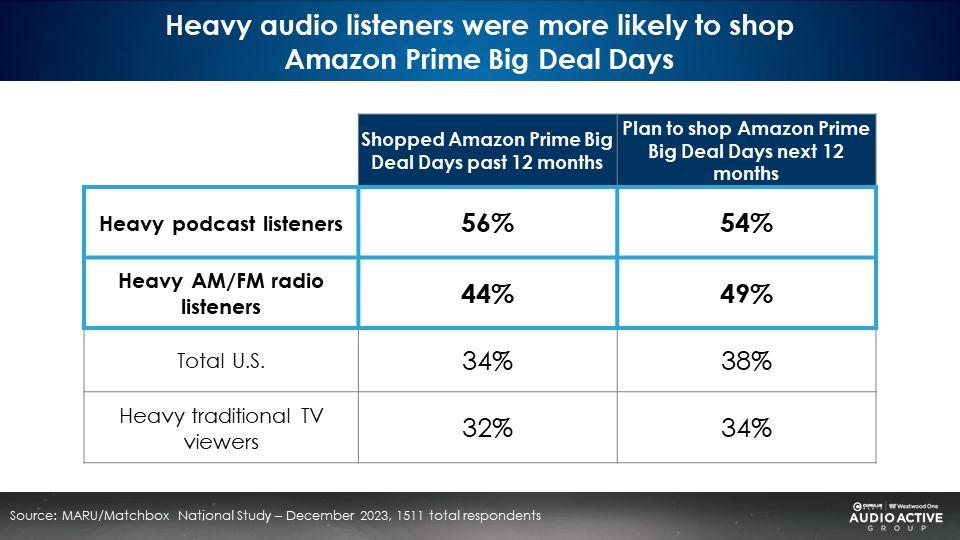

Heavy podcast and heavy AM/FM radio listeners are more likely to purchase at Amazon sales events

A December 2023 MARU/Matchbox study found heavy podcast and heavy AM/FM radio listeners were far more likely to have purchased at the October 10-11, 2023 Amazon Prime Big Deal Days event. The study also found heavy audio listeners are more likely to shop at future Amazon shopping events. Heavy TV viewers are far less likely to shop Amazon sales events.

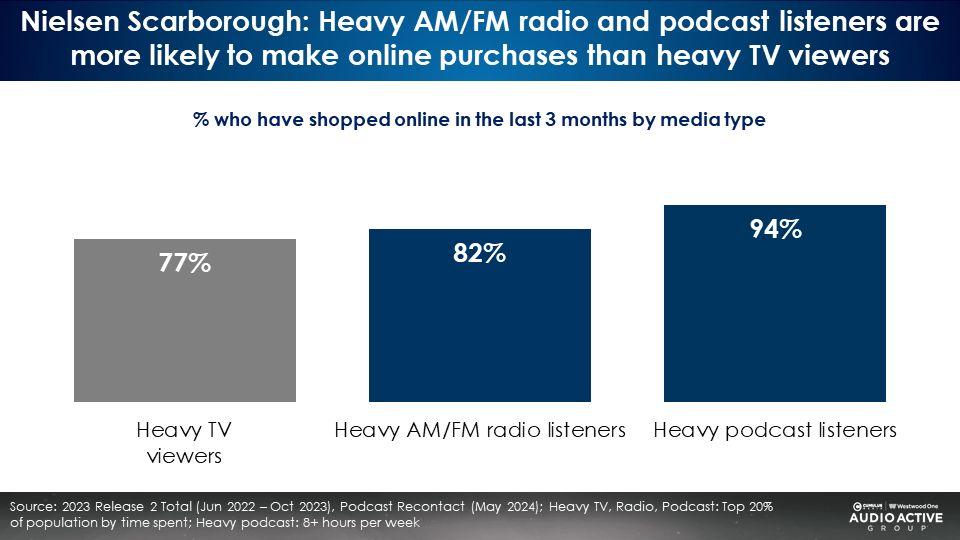

Nielsen Scarborough: Audio listeners are far more likely to purchase online; TV viewers? Less likely

Nielsen reveals the vast majority of podcast and AM/FM radio listeners have purchased online in the last three months.

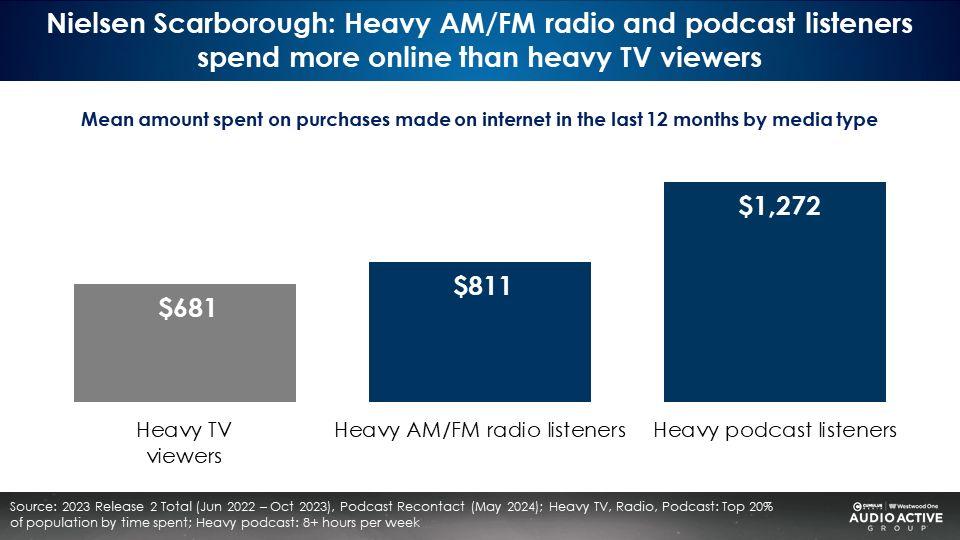

Nielsen Scarborough: Audio listeners spend more online than TV viewers

The audio e-commerce ad reaches an audience with far more spending power than on TV. Heavy AM/FM radio listeners spent 19% more online than heavy TV viewers. Heavy podcast listeners spend nearly 2X more online than heavy TV viewers (+87%).

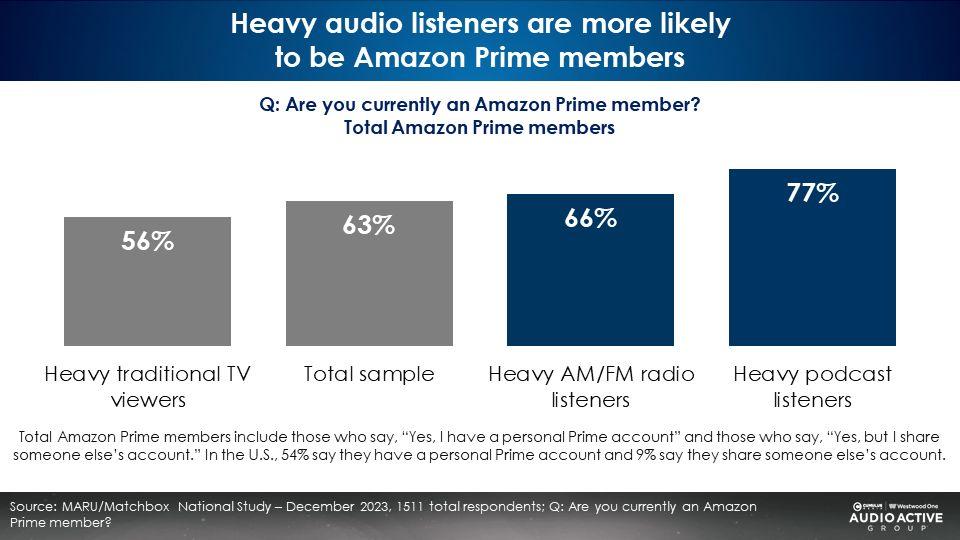

MARU/Matchbox: Heavy audio listeners are more likely to be Amazon Prime members

A media investment in audio affords a greater concentration of Amazon Prime members than TV. If you have a product sold via Amazon, audio is an ideal media platform for your brand.

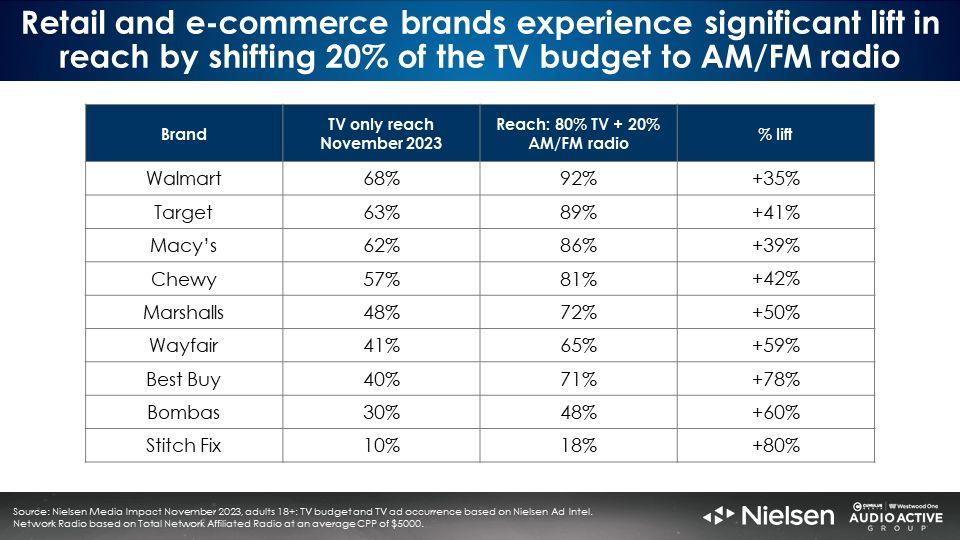

“20 gets you 50”: Retailers can generate a 50% incremental reach increase to their TV investment by shifting just 20% of their holiday media plan to AM/FM radio

An analysis conducted via Nielsen Media Impact, the media planning and optimization platform, reveals shifting just 20% of a linear television buy can generate significant growth in campaign reach. The November 2023 television holiday campaigns from a variety of retailers are detailed below.

Shifting 20% of TV investment to a mix of AM/FM radio and podcasts grows reach by an average of +54%. The smaller the retailer’s TV investment, the greater the incremental reach lift achieved with the addition of AM/FM radio.

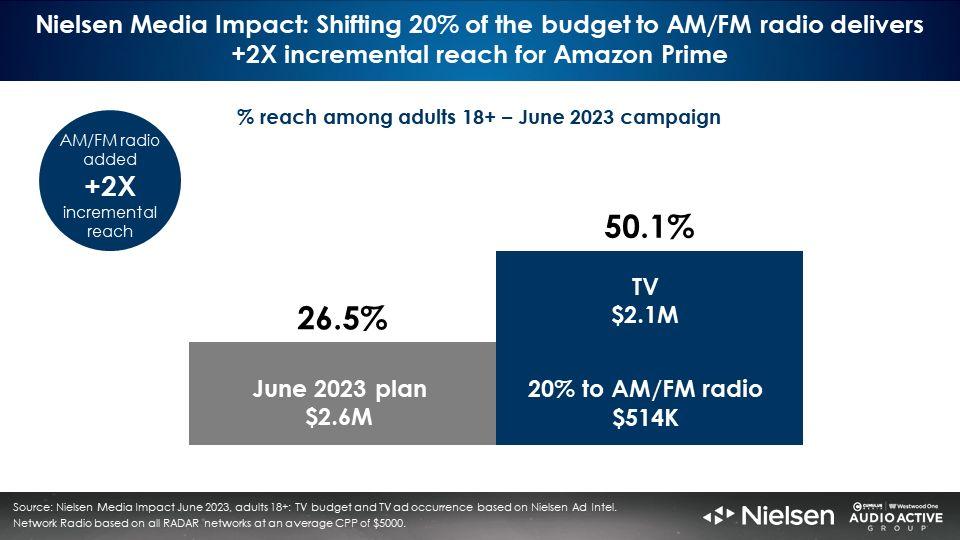

Nielsen Media Impact: AM/FM radio elevates the Amazon media plan; Amazon experiences a 2X increase in reach with a 20% reallocation to AM/FM radio

In June of 2023, Amazon Prime spent $2.6M on network television and reached 26.5% of adults 18+, according to Nielsen Media Impact, the media planning and optimization platform. Shifting just 20% of the TV budget to AM/FM radio generates nearly an over 2X increase in reach (26.5% to 50.1%). Double the reach for the same budget!

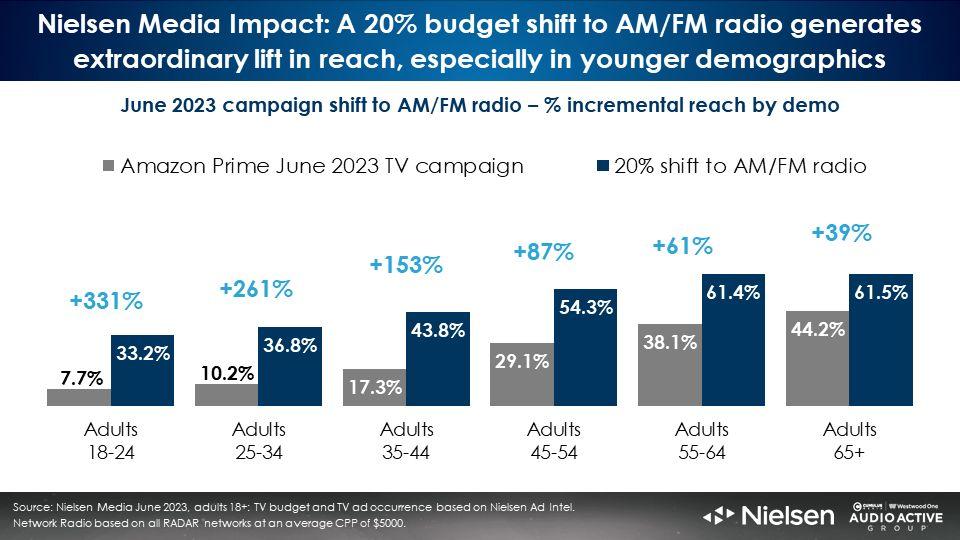

Adding AM/FM radio to the Amazon TV media plan generates significant younger demo incremental reach growth

The grey bars below represent the monthly reach of the Amazon TV buy. The Amazon buy reached nearly half of persons 65+ but lacked reach in the younger demos.

The blue bars represent the combined reach of the 80% TV and 20% AM/FM radio media plan. The 20% share shift to AM/FM radio generates astonishing lifts in reach in younger demographics:

- 18-24: +331%

- 25-54: +261%

- 35-44: +153%

- 45-54: +87%

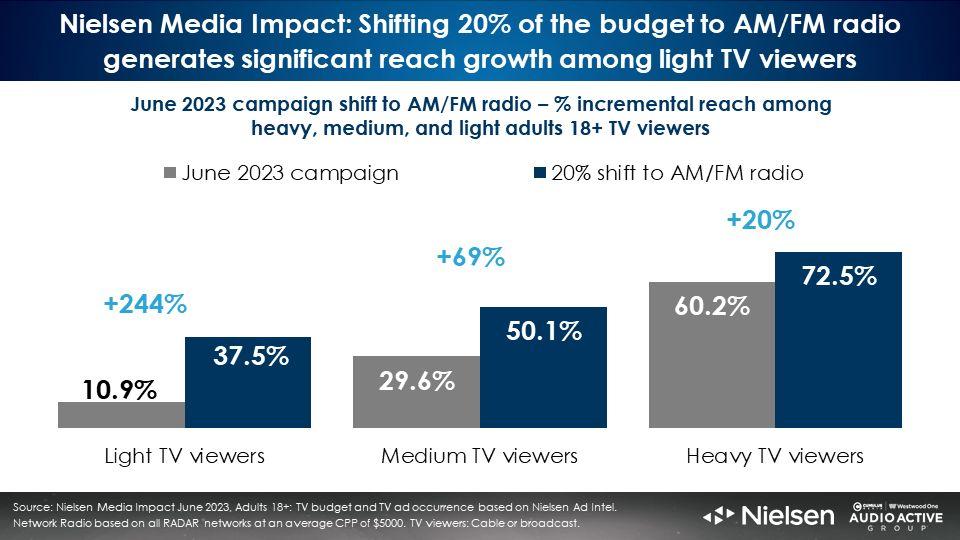

Adding AM/FM radio to the Amazon Prime media plan generates massive reach growth among light and medium TV viewers

A wise media planner once said, “You cannot solve your light TV viewing problem by buying more TV!”

The 20% reallocation of the Amazon media plan to AM/FM radio results in significant incremental reach increases among light (+244%) and medium (+69%) TV viewers. Younger demographics are very light users of linear television, while older demographics are heavy users of TV.

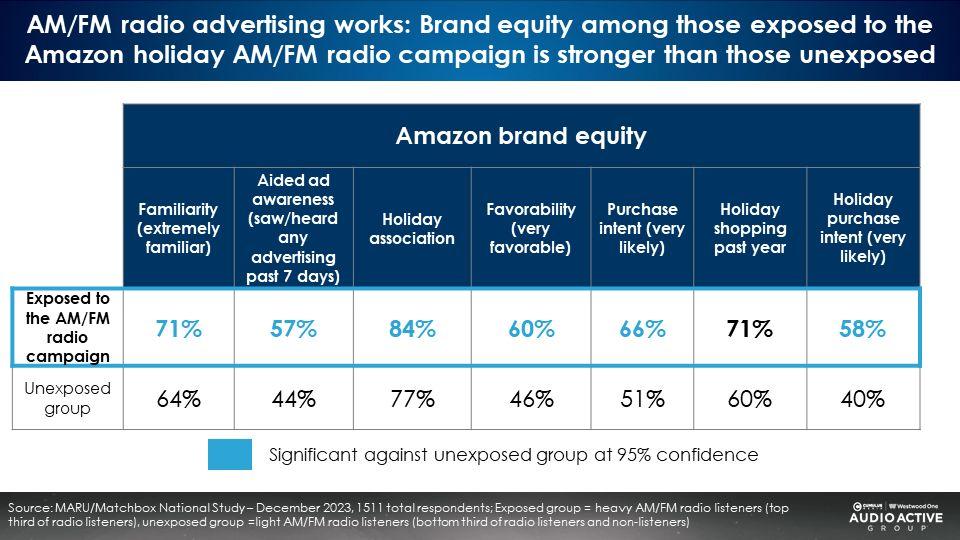

A holiday AM/FM radio campaign generates strong brand equity and purchase intent

MARU/Matchbox conducted a campaign effect study of the December 2023 Amazon holiday campaign. Comparing those exposed to the AM/FM radio campaign versus those not exposed reveals stronger brand familiarity, advertising recall, holiday association, favorability, purchase intent, and prior purchase.

Nielsen: AM/FM radio campaigns generate extraordinary return on advertising spend; For every dollar spent, $15 dollars of incremental sales are generated

Key takeaways:

- AM/FM radio and podcasts are ideal medium platforms for retailers and e-commerce brands: Heavy audio listeners are more likely to shop online. Heavy AM/FM radio and podcast listeners also spend more on online than TV viewers. AM/FM radio listeners and heavy podcast listeners over-index on Amazon Prime membership and purchase intent.

- AM/FM radio makes your TV better – “20 gets you 50”: Nielsen Media Impact optimizations reveal shifting more media weight to AM/FM radio generates significantly more reach, especially among younger 18-49 demographics. AM/FM radio does an extraordinary job in increasing campaign reach among light TV viewers who are far less likely to see retailer TV ads. The rule of thumb is “20 gets you 50”: a 20% shift of a TV media budget to AM/FM radio generates a 50% increase in reach.

- Audio holiday AM/FM radio campaigns work: Consumers exposed to an Amazon holiday AM/FM radio campaign have higher brand equity (awareness, ad recall, prior purchase, and purchase intent). Nielsen sales effect studies reveal AM/FM radio campaigns for retailers generate significant return on advertising spend: $15 dollars of incremental sales for every dollar of AM/FM radio advertising.

Click here to view a 15-minute video of the key takeaways.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.