Home Improvement: New Studies Reveal Audio Is Sales Engine Of The Category

Click here to view or download the slides.

Click here to view a 16-minute video of the key takeaways.

New consumer studies commissioned by the Cumulus Media | Westwood One Audio Active Group® find audio listeners are the engine of home improvement sales and reveal media strategies that can optimize impact.

Key takeaways:

- Big audio users are massive home improvement shoppers: Podcast listeners and AM/FM radio listeners spend significantly more on home improvement than heavy TV viewers

- Audio is an ideal media platform to tout home improvement e-commerce as heavy AM/FM radio and podcast listeners are more likely to shop online

- AM/FM radio generates significant incremental reach for home improvement TV campaigns: Recent TV campaigns for The Home Depot saw significant lift in reach with the addition of AM/FM radio, especially among younger demos

- AM/FM radio generates three times the sales lift of TV in a historic Nielsen TV and AM/FM radio sales effect study for a home improvement retailer

- Home improvement media plans are overweight on linear TV and underweight on audio: The optimized plan should consist of 45% AM/FM radio, 30% linear TV, and 24% podcasts

- There is a wide variety of podcast genres and AM/FM radio programming formats with a rich concentration of home improvement shoppers

Big audio users are massive home improvement shoppers

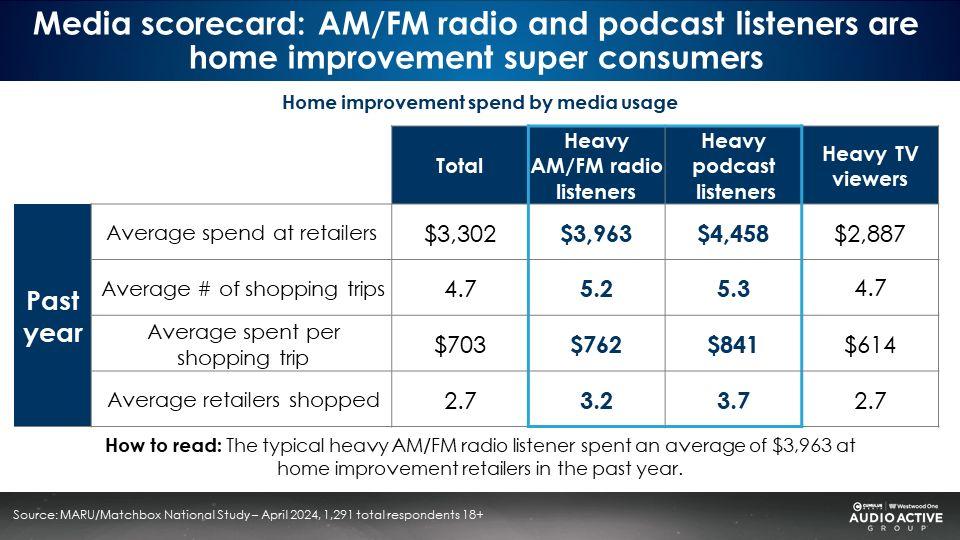

A recent study conducted by MARU/Matchbox examined home improvement shopping behavior among heavy AM/FM radio listeners, podcast listeners, and heavy TV viewers. The study took place in April 2024 among 1,291 homeowners. The study revealed audio listeners purchase from more retailers, shop more often, and spend far more than average.

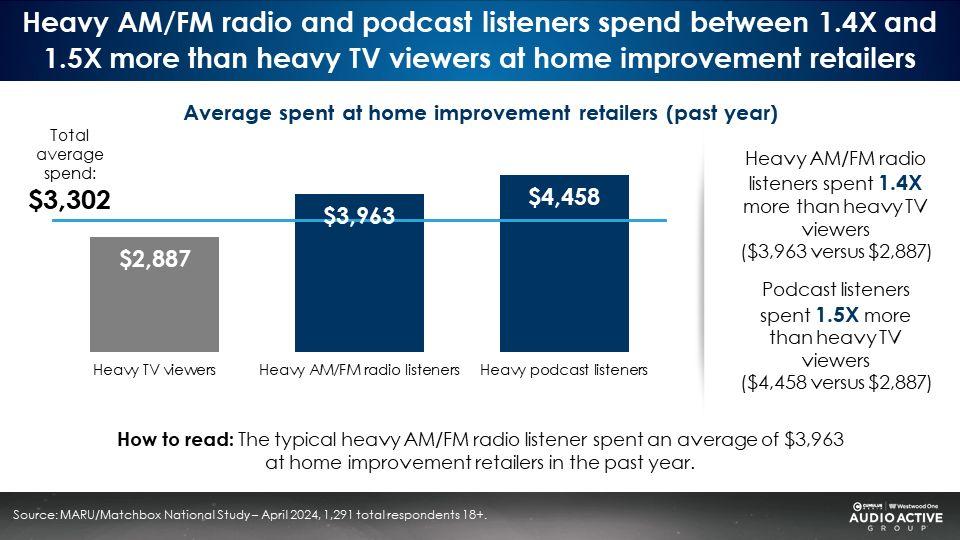

In the past year, podcast listeners spent $1.5X more than heavy TV viewers on home improvement ($4,458 versus $2,887). Heavy AM/FM radio listeners spend 1.4X more than heavy TV viewers ($3,963 versus $2,887).

Versus heavy TV viewers, heavy AM/FM radio listeners shop more retailers (3.2 versus 2.7) and make more shopping trips (5.2 versus 4.7). Podcast listeners also outperform TV viewers in home improvement purchases by sizable margins. Of all media, podcast listeners shop at the greatest number of home improvement retailers.

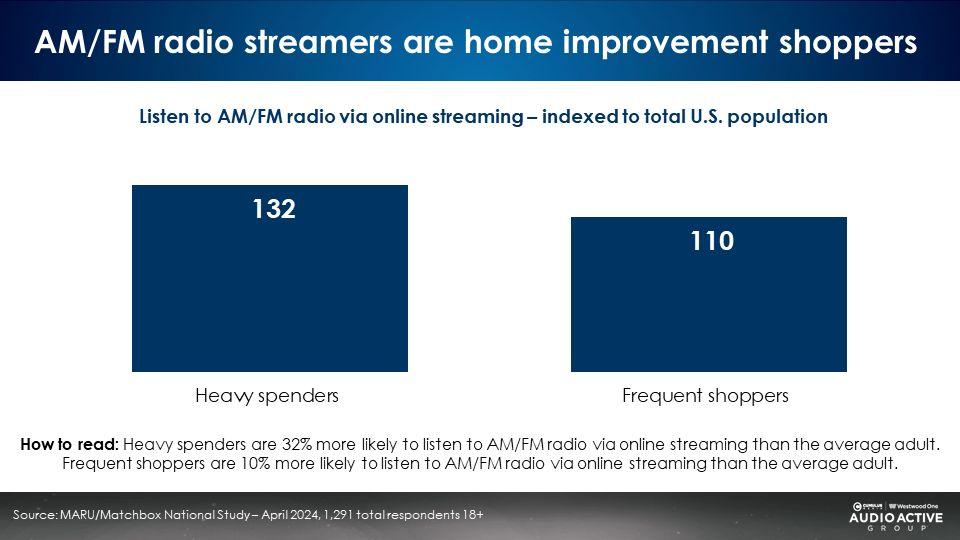

AM/FM radio streaming audiences are heavy home improvement shoppers

Heavy home improvement spenders are 32% more likely to listen to AM/FM radio streaming. Frequent home improvement shoppers are 10% more likely to listen to AM/FM radio streaming.

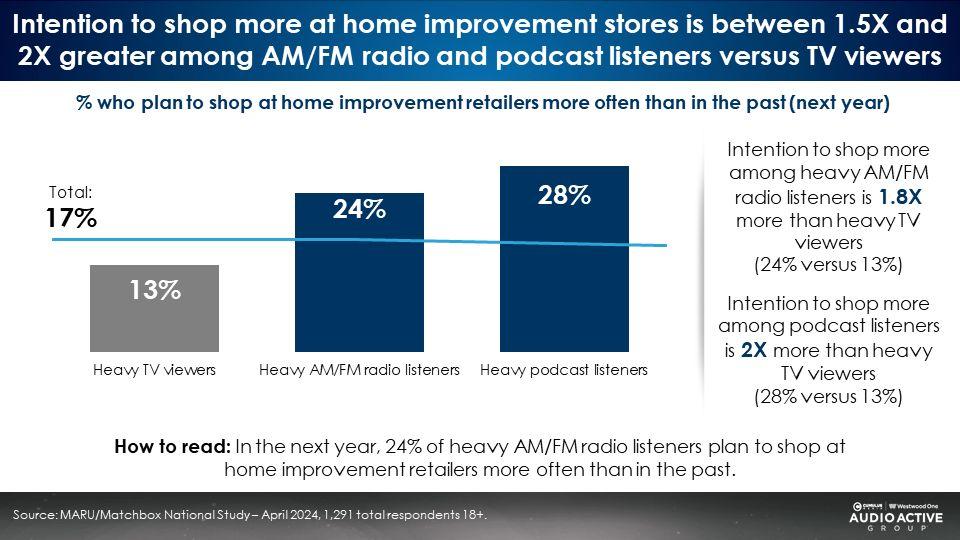

Intention to shop more at home improvement stores is between 1.5X and 2X greater among AM/FM radio and podcast listeners versus TV viewers

Looking ahead, a far greater proportion of audio listeners say they intent to spend even more that TV viewers on home improvement.

Audio is an ideal media platform to tout home improvement e-commerce as heavy AM/FM radio and podcast listeners are more likely to shop online

In the MARU/Matchbox study, home improvement customers were asked if, in the coming year, they would shop more in-store, more online, or the same amount in-store and online.

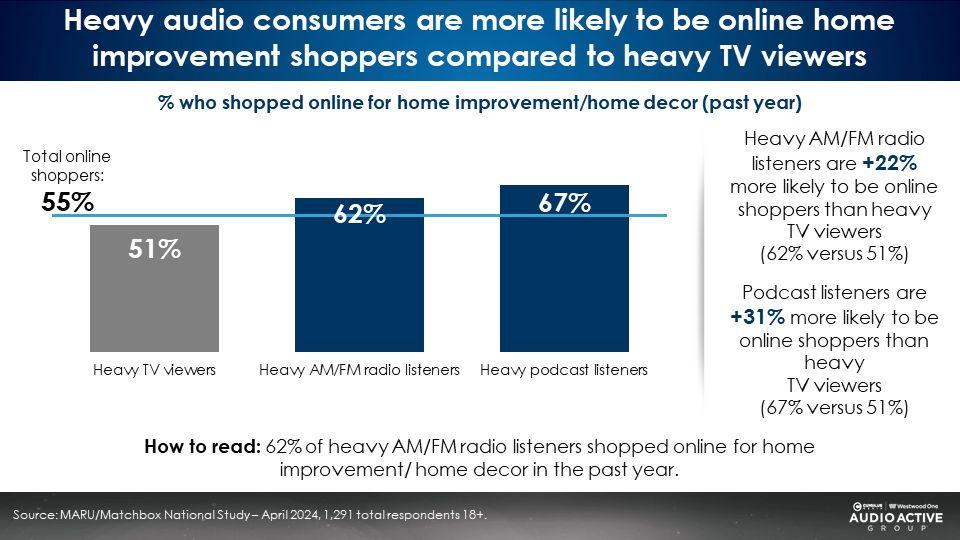

Home improvement shoppers were asked if they had shopped online in the last year. Overall, 51% said they had shopped online in the past year. Heavy AM/FM radio listeners (62%) and the podcast audience (67%) are far more likely to be online home improvement shoppers.

Podcast listeners are +31% more likely to have shopped online. Heavy AM/FM radio listeners are +22% more likely to shop online.

Versus linear TV viewers, audio listeners are more likely to shop online for home improvement. Audio is a much stronger sales channel for direct-to-consumer brands and retailers seeking online transactions.

AM/FM radio generates significant incremental reach for home improvement TV campaigns

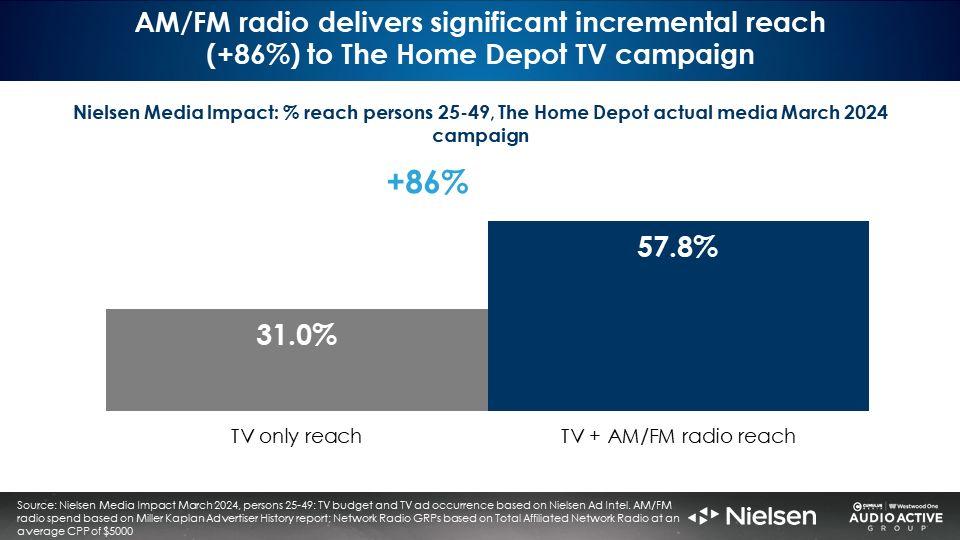

A Nielsen Media Impact analysis of recent home improvement retailer TV campaigns reveals significant lift in reach with the overlay of AM/FM radio.

Nielsen Media Impact reports The Home Depot’s March 2024 TV campaign reached 31% of American persons 25-49. The Home Depot’s AM/FM radio campaign caused their TV reach to soar by +86% for a total net reach of 58%.

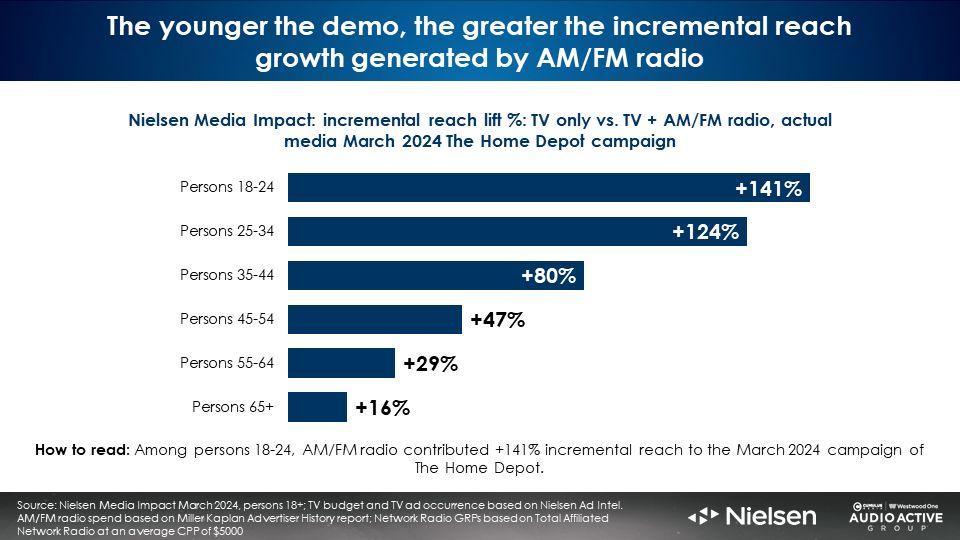

Nielsen Media Impact found the younger the demographic, the greater the lift in reach generated by AM/FM radio. The Home Depot’s AM/FM radio campaign increased reach by +124% among persons 25-34.

AM/FM radio generates three times the sales lift of TV in a historic Nielsen TV and AM/FM radio sales effect study for a home improvement retailer

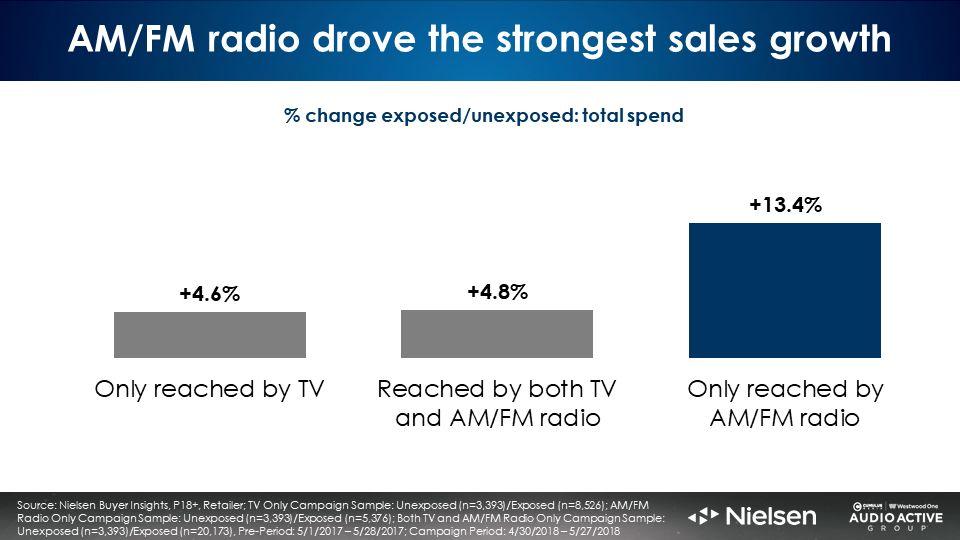

A home improvement retailer sought to understand the sales effect of their AM/FM radio spend in the context of their television campaigns. In a first for the category, Nielsen was commissioned to undertake a study of the entire TV and AM/FM radio investment for a given month.

Nielsen matched TV and AM/FM radio advertising exposures from the Portable People Meter to credit and debit card purchases from the same homes. Purchases among those not exposed to the campaign were compared to those exposed.

Consumers exposed to just the AM/FM radio campaign generated a +13.4% increase in sales, three times that of those who were only exposed to the TV campaign.

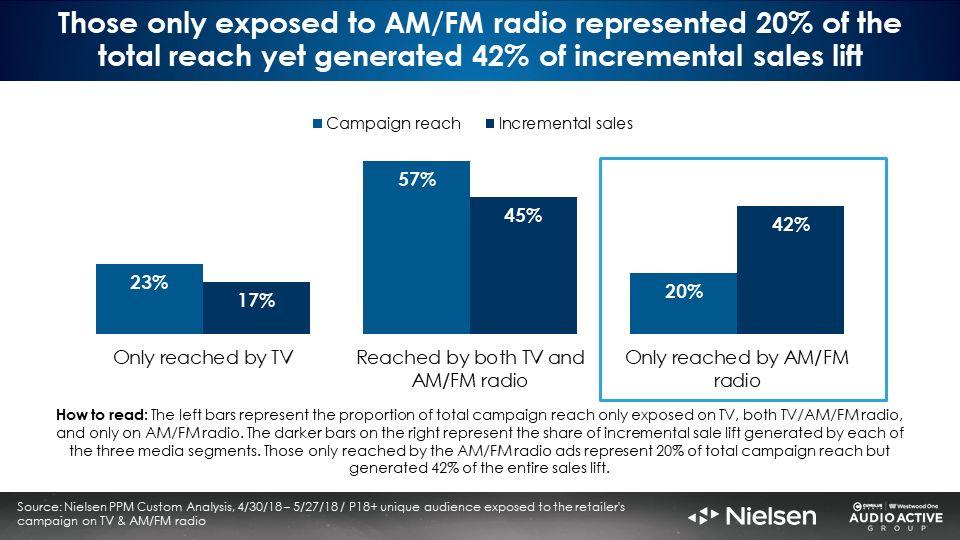

AM/FM radio advertising exposure drove the vast majority of the home improvement retailer’s sales. Those only reached by the AM/FM radio campaign represented 20% of total campaign reach but generated 42% of the incremental sales lift.

Consumers reached both by the TV and AM/FM radio campaign were responsible for 45% of the sales lift. Those just exposed to the TV campaign represented only 17% of incremental sales.

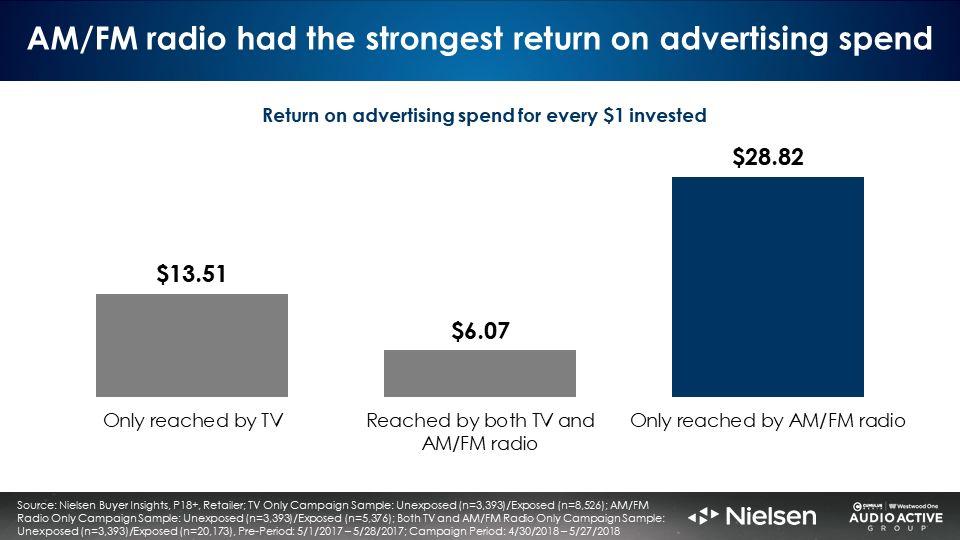

Not only was AM/FM radio the most effective media platform for the retailer, it was also the most efficient. AM/FM radio’s return on advertising spend was twice that of television.

A dollar of AM/FM radio advertising generated $28.82 in incremental sales. A dollar of TV advertising resulted in $13.51 of sales for the home improvement retailer.

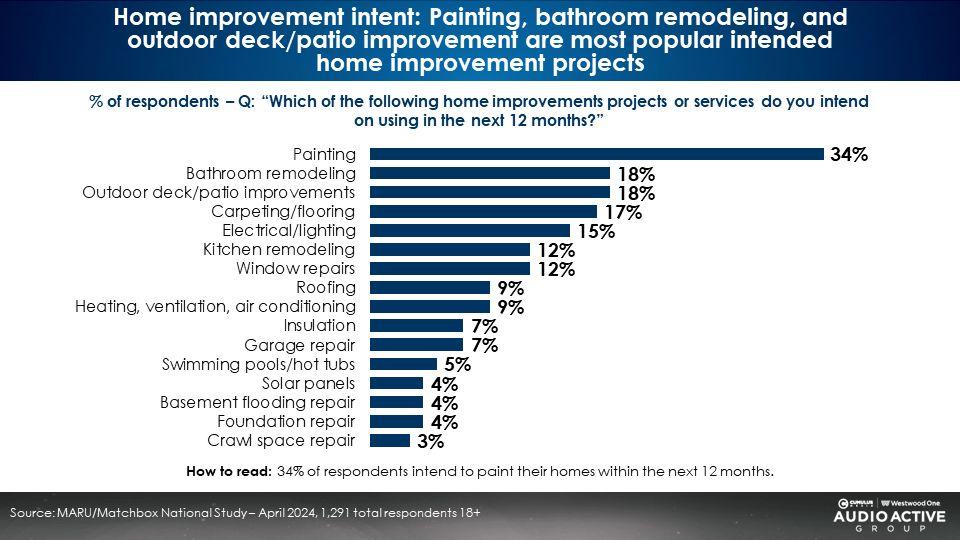

Home improvement intent: Painting, bathroom remodeling, and outdoor deck/patio improvement are most popular intended home improvement projects

When asked what type of home improvement project or service they planned on using in the next 12 months, painting led as the #1 category followed by bathroom remodeling and outdoor deck/patio improvements.

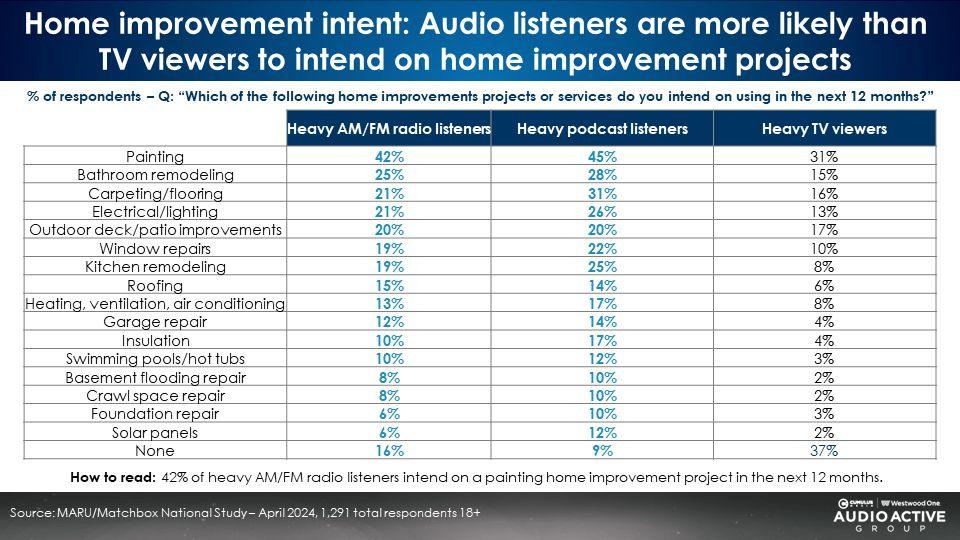

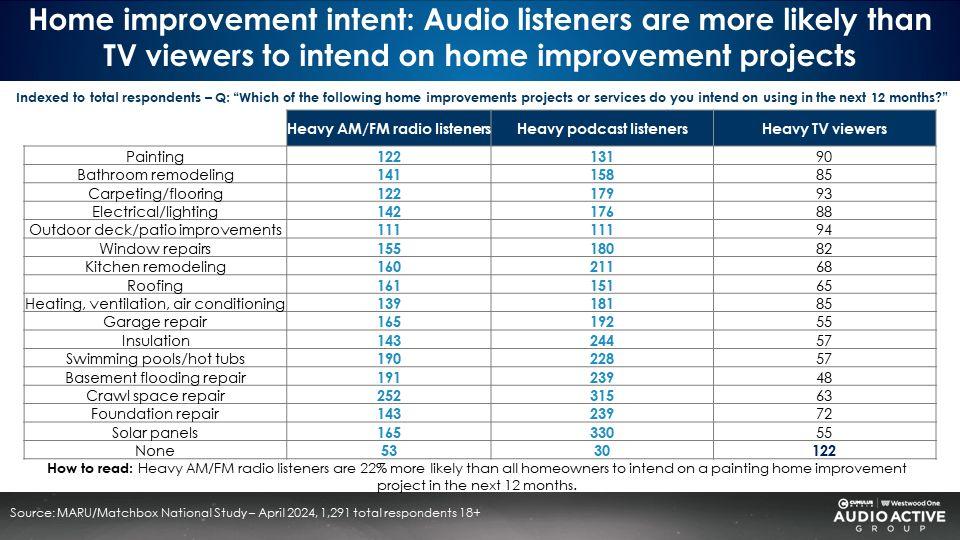

Home improvement intent: Audio listeners are more likely than TV viewers to take on a wide variety of home improvement projects

Versus heavy TV viewers, heavy AM/FM radio and heavy podcast listeners are more likely to intend to do all home improvement projects in the next year. Among heavy audio consumers, painting, bathroom remodeling, carpeting/flooring, and electrical work lead.

Here are the same home improvement purchase intention categories depicted by index, comparing heavy media users to the total U.S. As an example, heavy podcast listeners are 81% more likely than the U.S. average to undertake a heating, ventilation, and air conditioning project. Heavy AM/FM radio listeners are 39% more likely to do a HVAC project while TV viewers are 15% less likely.

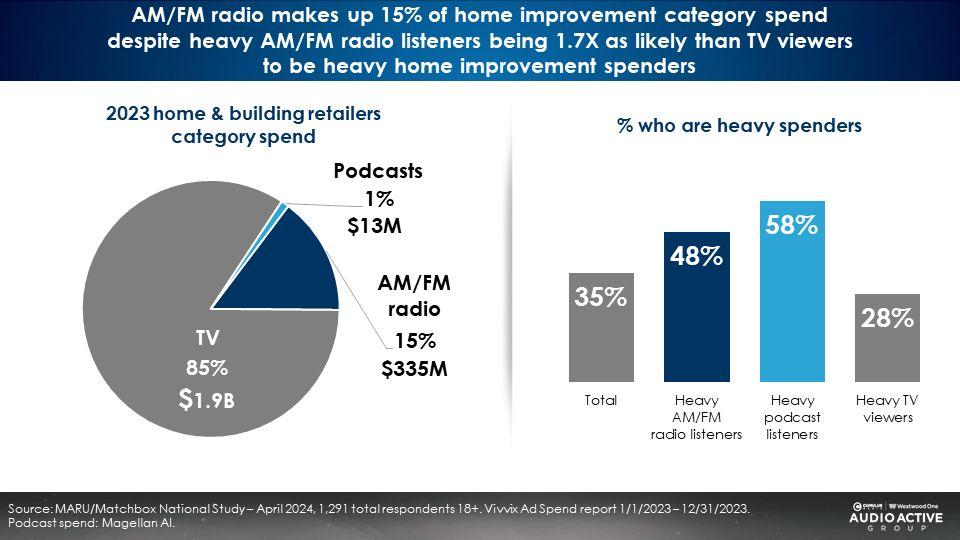

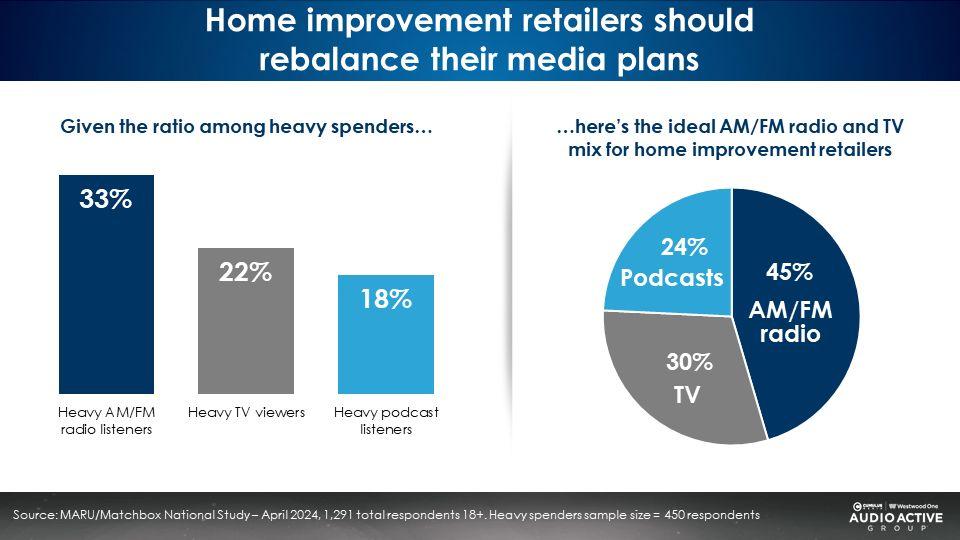

Home improvement media plans are overweight on linear TV and underweight on audio: The optimized plan should consist of 45% AM/FM radio, 30% linear TV, and 24% podcasts

Audio makes up only 16% of home improvement media plans despite being 1.7X likely than TV to be heavy category shoppers.

Optimizing the media plan to align media weight to purchaser weight yields a media plan that is 45% AM/FM radio, 30% linear TV, and 24% podcasts.

Home improvement shoppers can be reached by a variety of AM/FM radio formats and podcast genres

Key takeaways:

- Big audio users are massive home improvement shoppers: Podcast listeners and AM/FM radio listeners spend significantly more on home improvement than heavy TV viewers

- Audio is an ideal media platform to tout home improvement e-commerce as heavy AM/FM radio and podcast listeners are more likely to shop online

- AM/FM radio generates significant incremental reach for home improvement TV campaigns: Recent TV campaigns for The Home Depot saw significant lift in reach with the addition of AM/FM radio, especially among younger demos

- AM/FM radio generates three times the sales lift of TV in a historic Nielsen TV and AM/FM radio sales effect study for a home improvement retailer

- Home improvement media plans are overweight on linear TV and underweight on audio: The optimized plan should consist of 45% AM/FM radio, 30% linear TV, and 24% podcasts

- There is a wide variety of podcast genres and AM/FM radio programming formats with a rich concentration of home improvement shoppers

Click here to view a 16-minute video of the key takeaways.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.