AM/FM Radio Powers Tax Preparation Brand Advertising Effectiveness According To Four New Studies; Despite Spending 12X On TV Versus AM/FM Radio, Brand Familiarity Is Greater Among Heavy AM/FM Radio Listeners Than Among Heavy TV Viewers

Click here to view a 15-minute video of the key findings.

Click here to download a PDF of the full deck.

The Cumulus Media | Westwood One Audio Active Group® fielded a series of studies to measure the impact of multiple tax preparation services’ AM/FM radio campaigns in 2024:

- LeadsRx site and search attribution measured the impact of the entire AM/FM radio campaign for several tax preparation services

- MARU/Matchbox brand study examined brand equity and AM/FM radio campaign effect

- Motionworks location attribution quantified the impact of AM/FM radio campaigns on visitation to tax preparation offices

- MyTelescope share of search quantified how the brand strength of tax preparation brands drove search traffic

Here are the key findings:

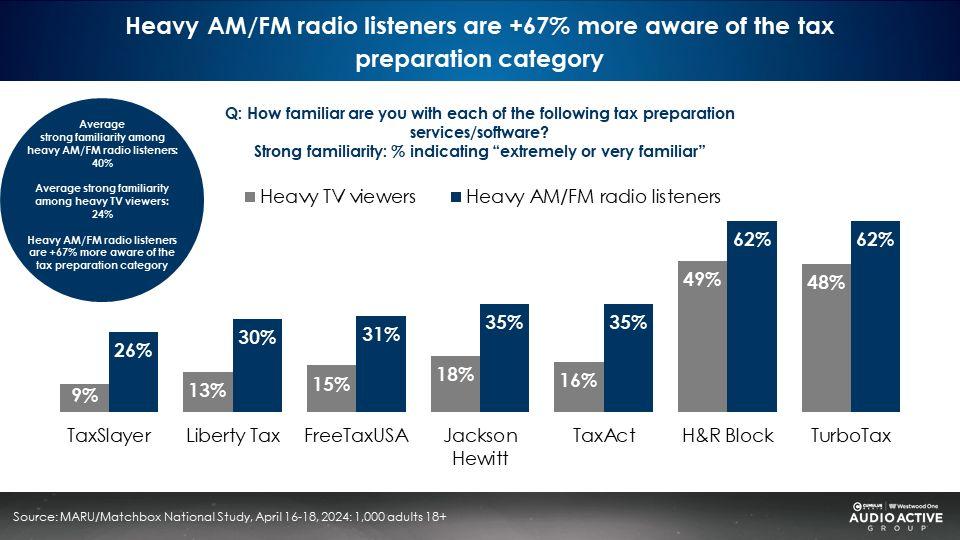

- Despite spending 12X on TV versus AM/FM radio, tax preparation brand familiarity is much stronger among AM/FM radio listeners than among TV viewers.

- AM/FM radio is an ideal media platform for the tax preparation category: Compared to TV viewers, AM/FM radio listeners are far more likely use tax preparation services.

- Tax preparation campaigns on AM/FM radio can be measured: Search and site attribution, brand effect, location visitation, and share of search measurement all quantified the positive impact of the AM/FM radio advertising.

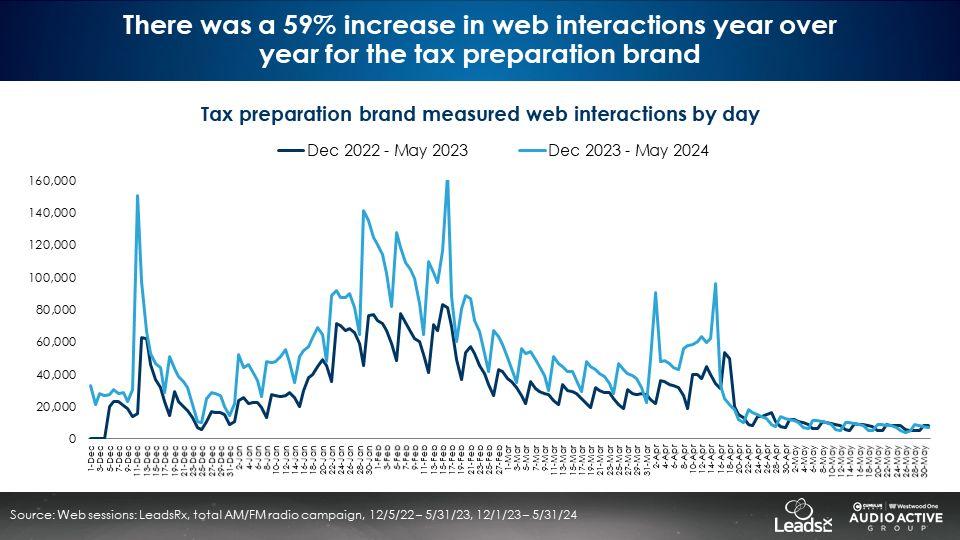

- AM/FM radio drives significant website visitation early in the tax season (January/February): Versus the 2023 tax season, LeadsRx reported a 59% growth in website traffic for the brand.

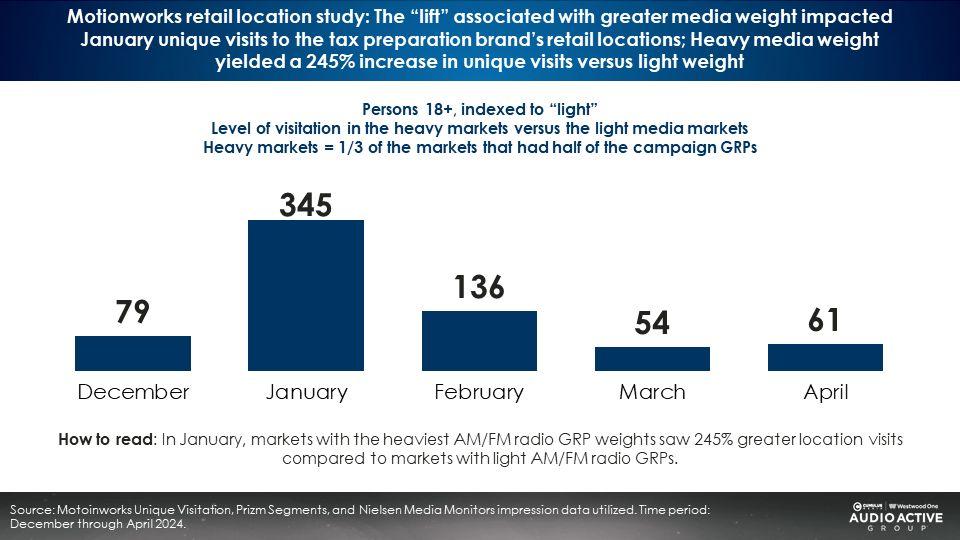

- Media weight matters: Motionworks found location visitation surged in DMA markets where the AM/FM radio campaign was heaviest.

- AM/FM radio worked. Easy to mind, easy to find: Tax preparation brand familiarity was 67% stronger among heavy AM/FM radio listeners compared to heavy TV viewers.

- Brand awareness drives search; you have to be known before you’re needed: Strong brands are not built on clicks but on memories.

Despite spending 12X on TV versus AM/FM radio, tax preparation brand familiarity is greater among heavy AM/FM radio listeners and heavy TV viewers

Several years of market studies reveal that AM/FM radio listeners are bigger users of tax preparation services and are far more engaged with the tax prep category. Despite this, tax prep ad spend is significantly overinvested on TV and massively underinvested on AM/FM radio.

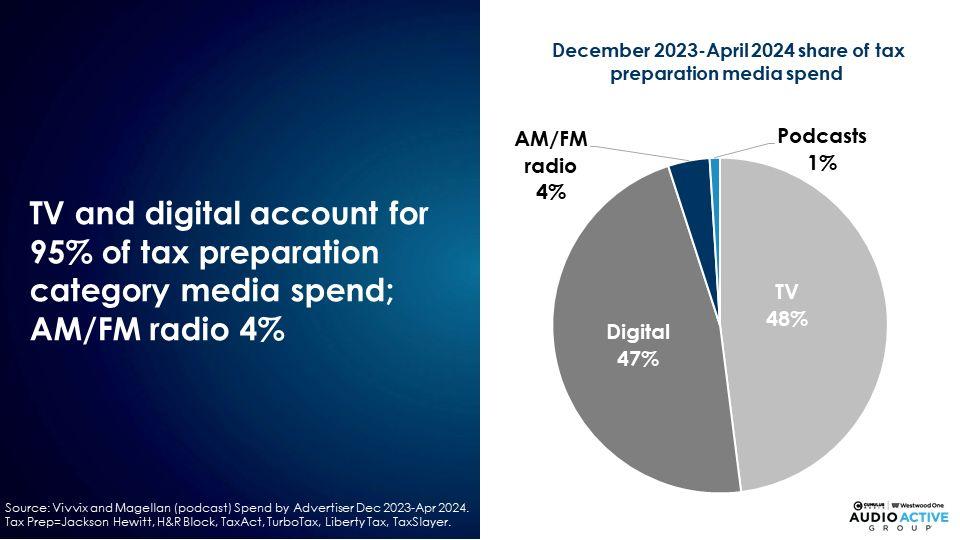

Vivvix advertising expenditure data for the 2024 tax season reveals most category investment occurred on TV and digital. TV spend was 12X AM/FM radio.

One would think with the significant TV spend, tax preparation brands would have massive familiarity among heavy TV viewers. That is not the case.

Amazingly, brand familiarity among heavy AM/FM radio listeners is stronger than among heavy TV viewers! How is this possible?

One theory is that TV viewers are far less interested and far less engaged with the tax prep category. No matter how many TV ads are rained down on viewers, the TV ads don’t resonate as well as the AM/FM radio ads among the AM/FM radio audience.

It is stunning that tax preparation brands have far stronger familiarity among AM/FM radio listeners despite massive overspending on TV.

AM/FM radio listeners are more likely to be users of tax preparation services

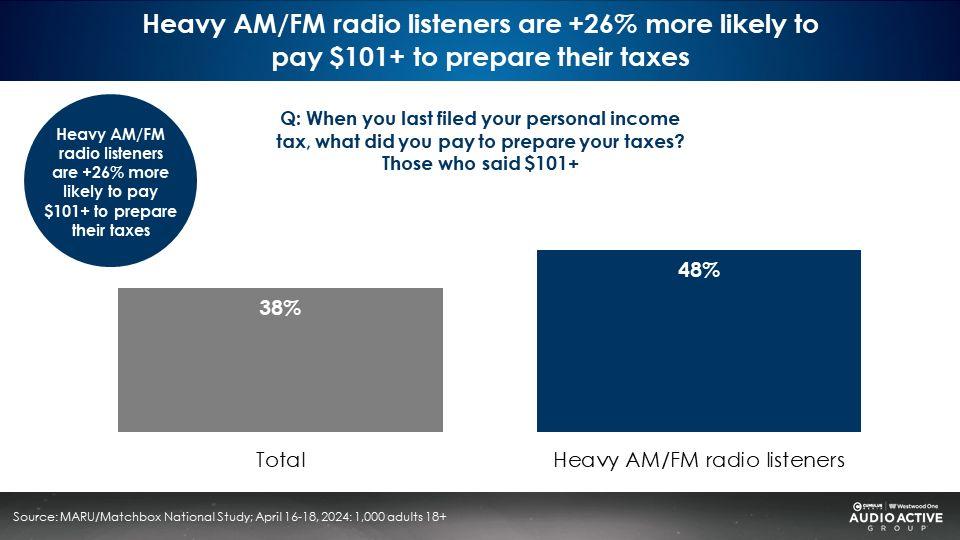

According to an April 2024 MARU/Matchbox study of 1,000 respondents, heavy AM/FM radio listeners are 26% more likely to pay $101 or more dollars for tax preparation services versus the total U.S.

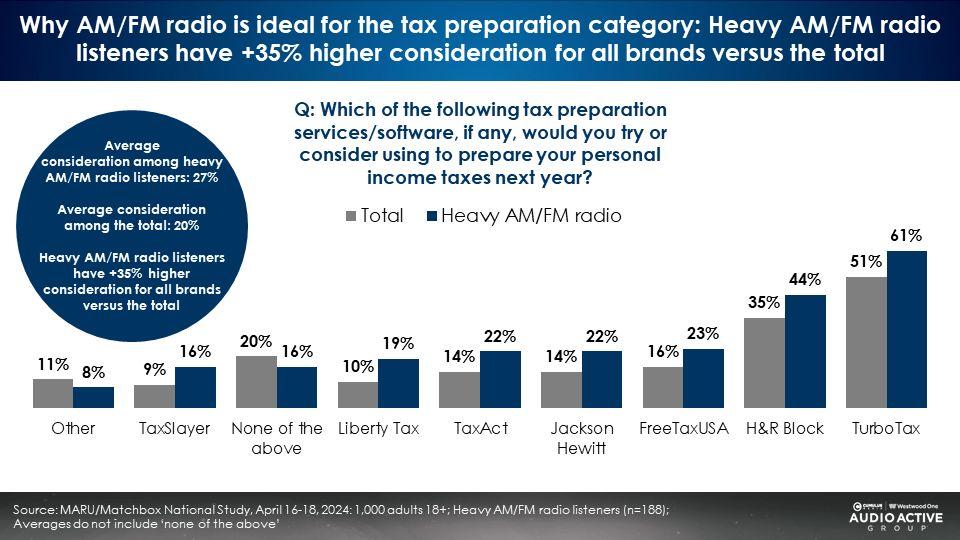

Compared to the U.S. average, heavy AM/FM radio listeners are 35% more likely to consider using all of the major tax preparation services.

AM/FM radio ads drive site traffic for tax preparation brands

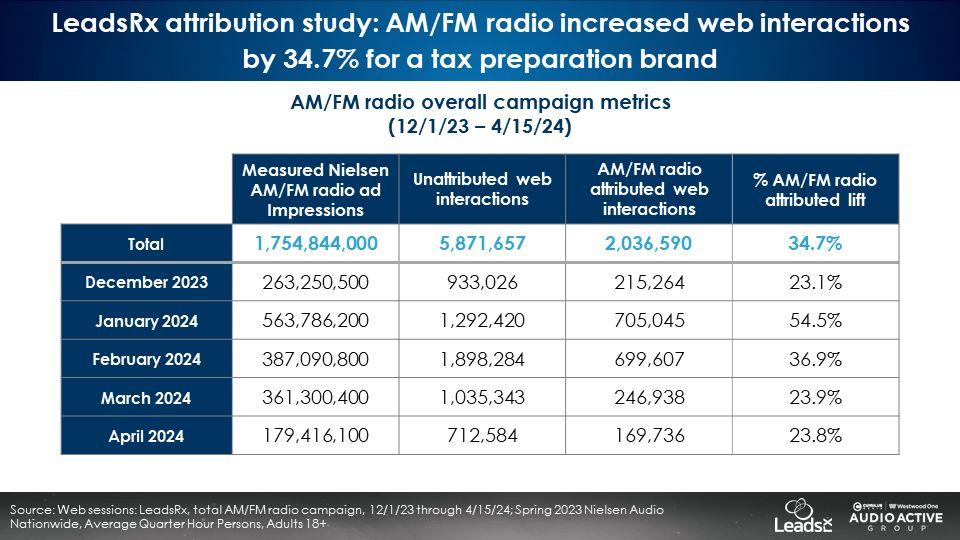

LeadsRx, a leading attribution firm, utilizes a multi-touch approach for a comprehensive examination of each advertising medium’s impact on a brand’s search and site traffic. Online behavior is matched to minute-level AM/FM radio ad occasions and to digital channels using the LeadsRx Universal Tracking Pixel.

LeadsRx conducted an attribution study for the entire AM/FM radio buy measuring the impact of all AM/FM radio ads from all vendors captured by Media Monitors. AM/FM radio generated a 35% increase in website traffic for the tax preparation brand. Web interactions peaked in January and February, coinciding with the heaviest AM/FM radio investment.

Versus the 2023 tax season, LeadsRx reported a 59% growth in website traffic for the brand in 2024

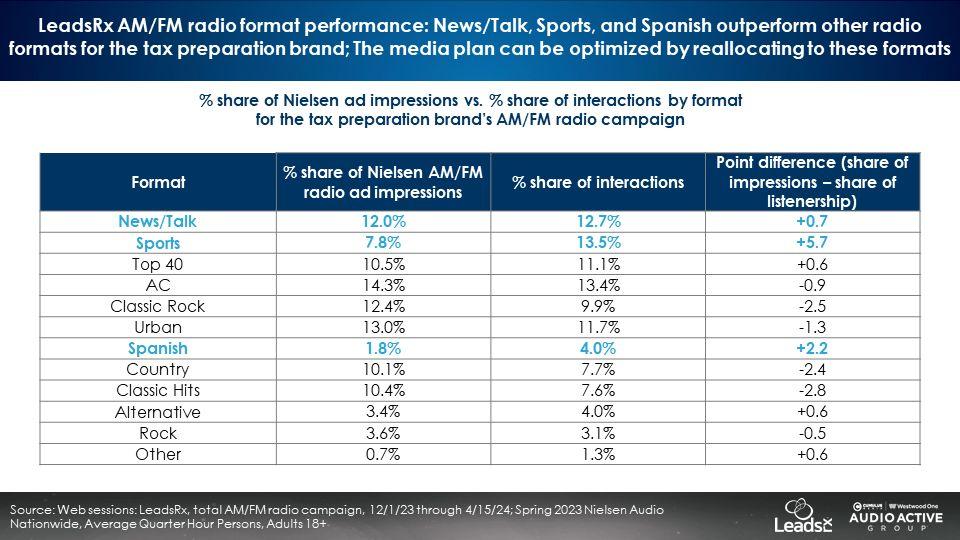

News/Talk, Sports, Spanish, Top 40, and Alternative AM/FM radio programming formats outperform in driving site traffic for the tax preparation brand

Motionworks found location visitation surged in DMA markets where the AM/FM radio campaign was heaviest

Motionworks, a leader in location-based attribution, found the tax preparation service brand experienced a visitation activity spike in January.

Markets with heavy AM/FM radio campaign investment received significantly greater location visitation activity for the tax preparation brand than markets with light media weight. In January, markets with the heaviest AM/FM radio weight saw 245% greater location visits compared to DMA markets with the lightest AM/FM radio weight.

Brand awareness drives search: You have to be known before you’re needed

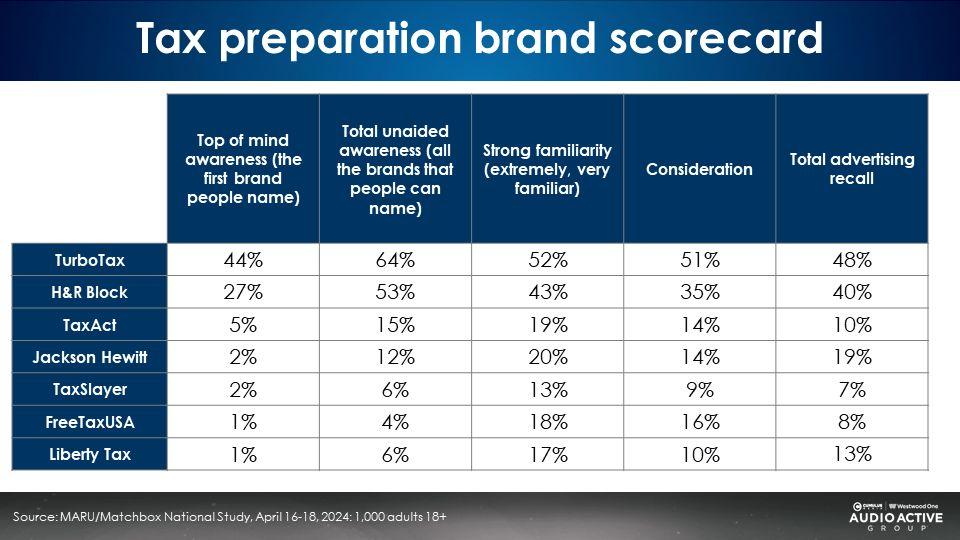

Here’s the brand equity scorecard of the tax preparation category based on the April 2024 MARU/Matchbox category study. The category consists of two well-known brands, a few mid-tier brands, and some smaller brands.

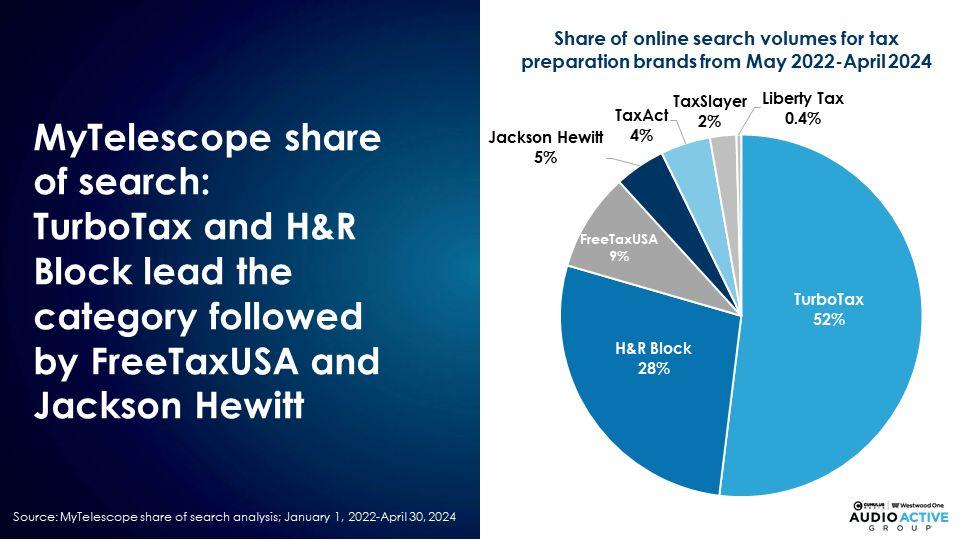

MyTelescope, a search analytics firm, reveals TurboTax and H&R Block have the greatest share of search over the last two years. Next are Jackson Hewitt and FreeTaxUSA.

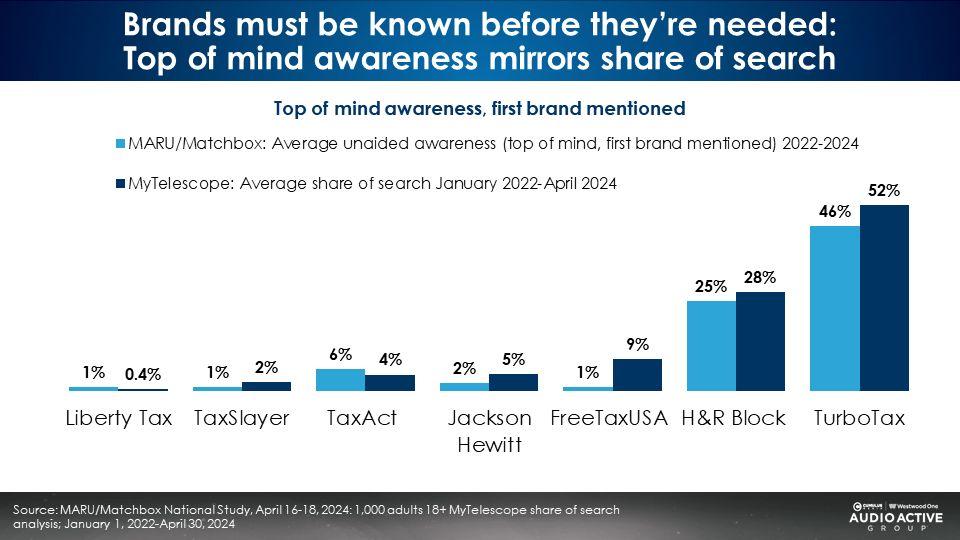

Top of mind awareness mirrors share of search

In the MARU/Matchbox brand study, consumers were asked to name tax preparation brands they could think of. There were not provided a list and had to respond unaided. The first brand they mention generates the “top of mind” awareness.

The most powerful search engine in the world is your memory. Comparing top of mind awareness for each tax preparation brand to the share of search reveals a stunning relationship. The stronger the top of mind awareness, the greater the share of search.

Jon Lombardo: Strong brands are not built on clicks, but on memories

He continues, “This is in some sense the double benefit of brand. It’s more likely to come to mind and even if you do click, you’re still going to click on the strongest brand. It explains what’s really important in marketing is not bottom of funnel, lead generation clicks. It’s top of funnel, brand building memory. That’s the fundamental idea.”

Key findings:

- Despite spending 12X on TV versus AM/FM radio, tax preparation brand familiarity is much stronger among AM/FM radio listeners than among TV viewers.

- AM/FM radio is an ideal media platform for the tax preparation category: Compared to TV viewers, AM/FM radio listeners are far more likely use tax preparation services.

- Tax preparation campaigns on AM/FM radio can be measured: Search and site attribution, brand effect, location visitation, and share of search measurement all quantified the positive impact of the AM/FM radio advertising.

- AM/FM radio drives significant website visitation early in the tax season (January/February): Versus the 2023 tax season, LeadsRx reported a 59% growth in website traffic for the brand.

- Media weight matters: Motionworks found location visitation surged in DMA markets where the AM/FM radio campaign was heaviest.

- AM/FM radio worked. Easy to mind, easy to find: Tax preparation brand familiarity was 67% stronger among heavy AM/FM radio listeners compared to heavy TV viewers.

- Brand awareness drives search; you have to be known before you’re needed: Strong brands are not built on clicks but on memories.

Click here to view a 15-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.