In 2025, Total U.S. AM/FM Radio Listening Levels To Grow An Estimated 10% Due To Nielsen Portable People Meter Crediting Enhancement; AM/FM Radio To Surpass TV In 25-54 Average Audience

Click here to view a 13-minute video of the key findings.

Click here to download a PDF of the slides.

In a series of private meetings with customers, Nielsen has revealed potential plans to enhance the way it generates average quarter-hour audiences in the 48 markets which utilize the Portable People Meter. According to impact data that Nielsen provided to clients, comparisons show that crediting to AM/FM radio listening in local PPM markets will increase by +24%. For national marketers and media agencies, the expected impact in 2025 will be a +10% increase in total U.S. listening levels.

Nielsen is in discussion with clients and industry leaders to potentially shift quarter-hour listening credit to 3 minutes from the current 5 minutes in Portable People Meter markets.

Four implications of listening increases based on early estimates*:

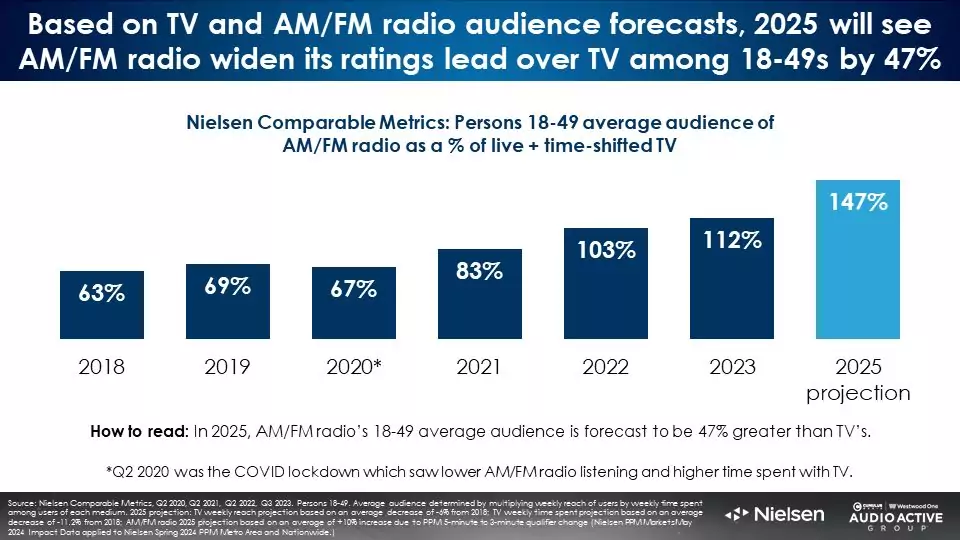

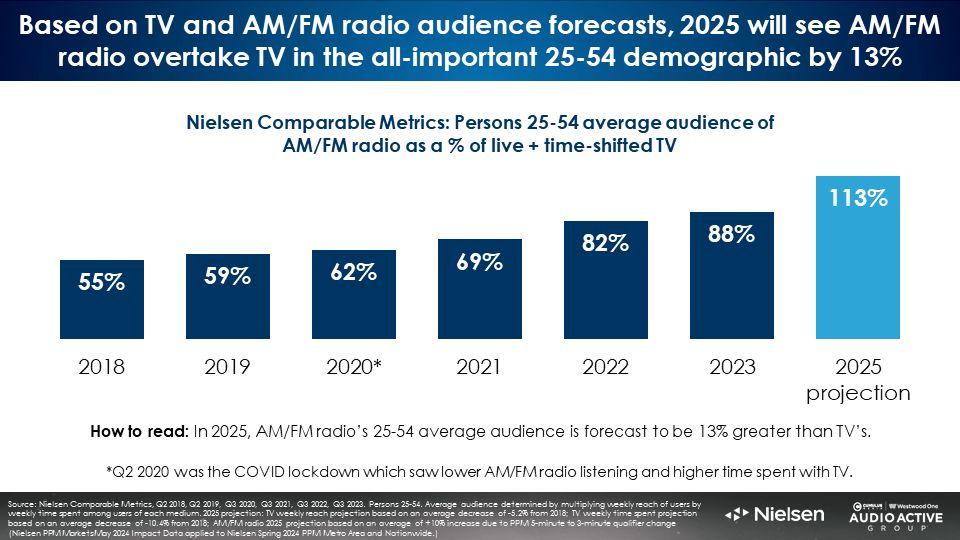

1. The trend of AM/FM radio surpassing TV in ratings will accelerate: Over the last five years, AM/FM radio has overtaken linear TV in ratings. As of 2023, AM/FM radio’s 18-49 ratings were 12% greater than TV. Among 25-54s the gap between TV and AM/FM radio ratings has been steadily closing. Based on TV and AM/FM radio audience forecasts, 2025 will see AM/FM radio overtake TV in the all-important 25-54 demographic by 13% and widen its ratings lead over TV among 18-49s by 47%.

2. 2025 post-buy analyses will overachieve 2024 media plans: In PPM markets, expect up to +24% increases in audience deliveries based on prior year schedules. For local buys, outcomes will vary by demographic, markets utilized, and AM/FM radio programming format mix. For total U.S. media plans using Nielsen’s Nationwide survey, deliveries will grow by +10%. Differences will result due the mix of diary versus PPM market composition in network lineups as well as AM/FM radio programming format mix.

3. AM/FM radio, already America’s number one mass reach media, will experience reach growth in advertising schedules: With an estimated daily reach growth of +7% and weekly week growth of +4%, reach and frequency analyses are expected to experience growth. Since reach is the foundation of advertising effectiveness, this will benefit marketers’ sales growth.

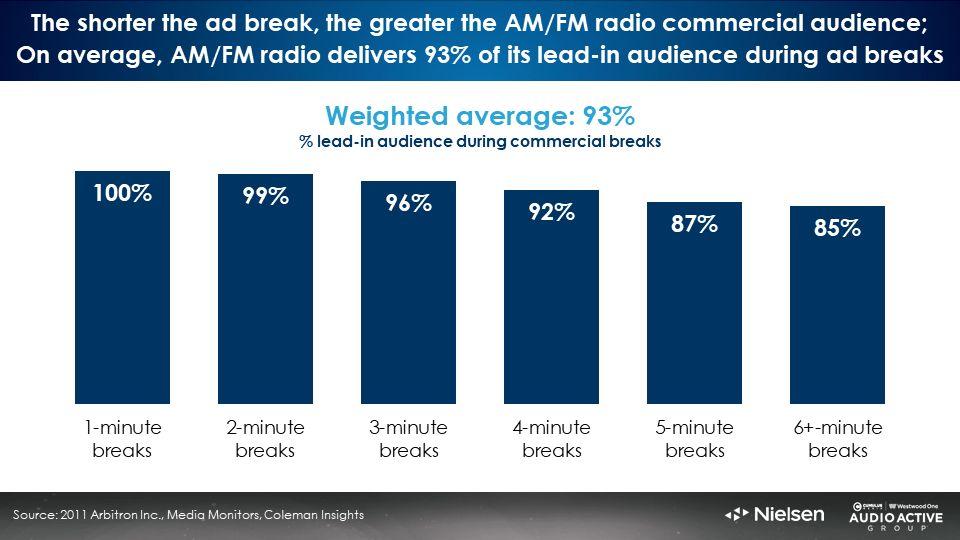

4. AM/FM radio ads will become more effective as stations increase the number of commercial breaks with shorter durations: Since the introduction of the Portable Meter, most AM/FM radio stations schedule their two commercial breaks around :15 and :45 past the hour. This strategy was designed to maximize 5-minute listening durations.

With a 3-minute quarter hour qualification, stations could create more breaks of shorter duration. This will significantly benefit advertisers.

A massive Portable People Meter study of 17,896,325 unique commercial breaks involving 61,902,473 minutes of advertising conducted by Nielsen, Media Monitors, and Coleman Research reveals the shorter the ad break, the greater the audience retention.

Two-minute ad breaks retain 99% of the lead-in audience. Six-minute ad breaks retain 85% of the lead in audience.

Creating more ad breaks of shorter duration generates larger commercial audiences. Advertisers stand out more in shorter breaks. Growing audience deliveries for AM/FM radio ads improves marketing effectiveness and grows sales effect.

The “5 minutes of listening gets a quarter-hour of listening” edit rule dates back to the 1960s

Since the debut of the Arbitron’s AM/FM radio measurement service in the 1960s, a quarter-hour of listening was credited with a least five minutes of listening in the fifteen-minute period. The “5-minute” edit rule was maintained even when Arbitron rolled out the Portable People Meter into the top 48 markets in 2010.

Nielsen: 23% of all AM/FM radio listening occasions are three or four minutes

Recent analysis of Portable Meter tuning revealed nearly a quarter of all listening occasions are three or four minutes. Under the current edit rules, none of that listening is credited. Nielsen indicates this listening should be included in PPM market reporting.

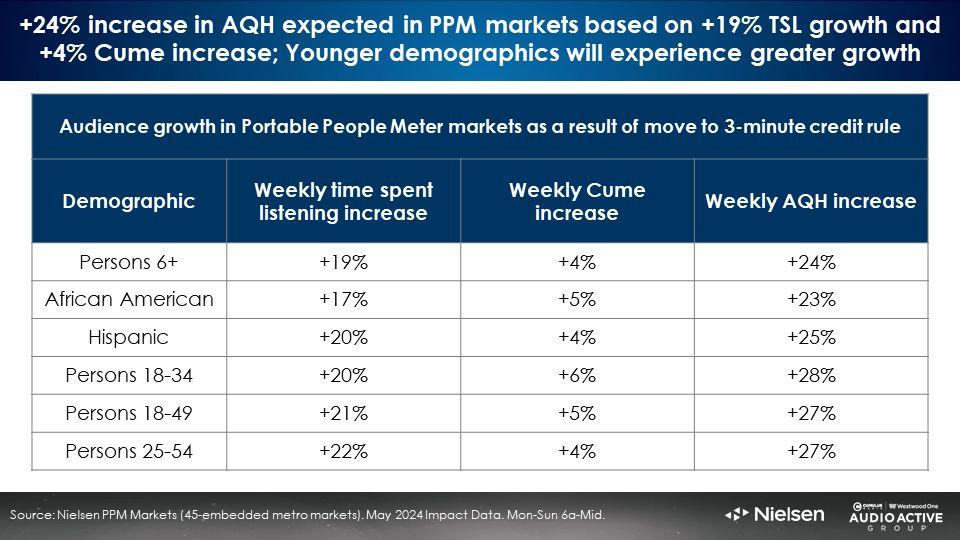

+24% increase in AQH expected in PPM markets based on +19% TSL growth and +4% Cume increase; Younger demographics will experience greater growth

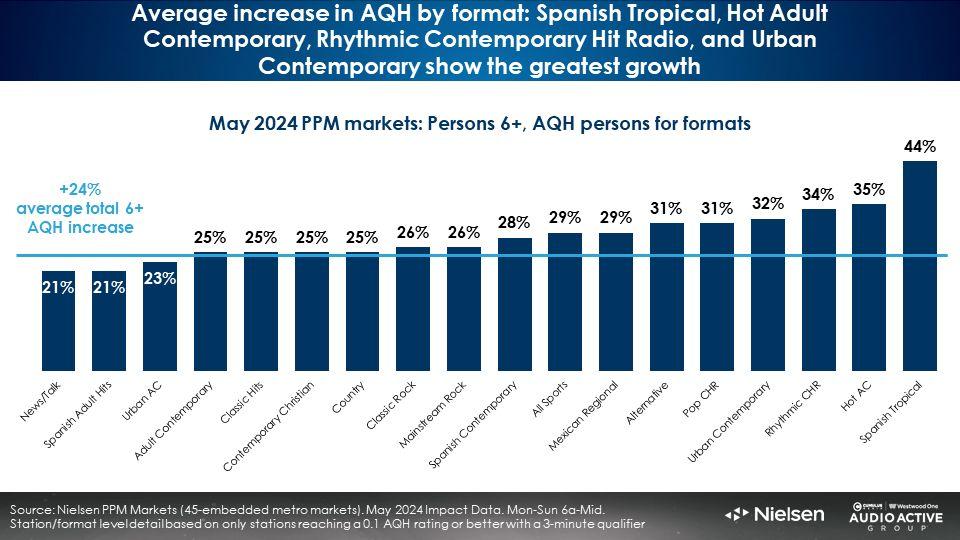

Nielsen recently reprocessed all 48 of the May 2024 markets, comparing the listening estimates based on the existing 5-minute edit rule and the proposed 3-minute edit rule. Overall, most of the +24% growth in listening is due to time spent listening growth but reach is up by mid-single digits in all demographics.

Compared to the total 6+ AQH increase of +24%, younger demographics experience higher growth. 18-34s grow by +28% and persons 18-49 and 25-54 will experience +27% AQH increases in Portable People Meter markets.

Across the 48 markets, listening lift was very consistent. +29% represented the markets with the greatest listening growth and +22% increases were found in markets with the least growth.

The implementation date of this PPM enhancement has not yet been determined but marketers and media agencies can expect to see elevated listening in 2025. While local Portable People Markets can anticipate a +24% AQH growth, what can national advertisers expect?

Total U.S. AM/FM radio listening is forecast to grow +10% in 2025

Network radio advertisers transact on Nielsen’s national audience service called “Nielsen Nationwide.” Scott Anekstein, VP of Research at Westwood One, conducted a national AQH projection utilizing the uplifted PPM markets and the existing diary markets. (PPM metro markets represent about a third of total U.S. population.)

Scott combined Nielsen’s PPM AQH audiences with the May 2024 reprocessed tuning using the new 3-minute edit rule with diary audiences from the Spring 2024 Nationwide survey.

Comparisons with the reprocessed data showed:

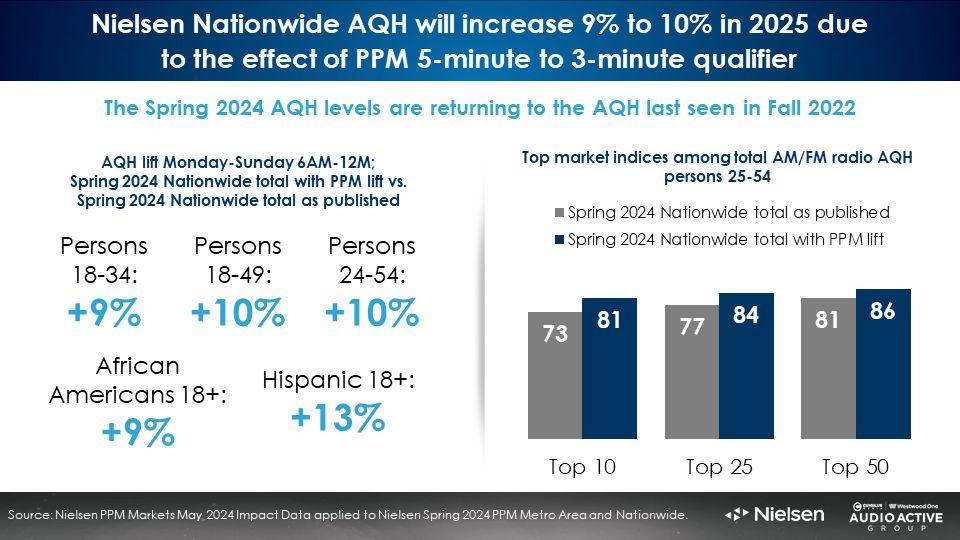

- Overall, 18-49 and 25-54 total U.S. AQH listening is slated to grow +10%.

- Persons 18-34 and 18+ African American listening should grow +9%.

- Hispanic 18+ audiences are forecast to increase +13%. The Hispanic growth is higher since a greater proportion of the U.S. Hispanic population are present in the Portable People Meter markets.

Top market indices will increase by five to eight points due to the effects of the PPM 3-minute listening qualification

Network radio advertisers often assess the proportion of impressions that are generated by the largest markets. PPM markets have always had lower listening levels than diary markets due to the more exact nature of the Portable People Meter listening capture.

At present, 25-54 listening levels in the top 50 markets are -19% lower than the total U.S. This is due to the fact the PPM method represents the vast majority of AM/FM radio listening in the top 50 markets.

Top U.S. markets do not listen to less AM/FM radio. They are measured in a more precise manner, which generates lower listening levels. In 2025, 25-54 listening in the top 50 markets will be -14% lower than the total U.S.

The top market index for all AQH listening in the top ten markets will grow by 8 points. The top 25 markets should expect a six-point lift in top market index while top 50 markets should clock a five-point increase.

Higher growth for younger skewing formats

Spanish Tropical, Hot Adult Contemporary, Rhythmic Contemporary Hit Radio, and Urban Contemporary will show the greatest potential average quarter-hour audience growth.

Four Implications of listening increases based on early estimates:

1. The trend of AM/FM radio surpassing TV in ratings will accelerate: Over the last five years, AM/FM radio has overtaken linear TV in ratings. As of 2023, AM/FM radio’s 18-49 ratings were 12% greater than TV. Among 25-54s the gap between TV and AM/FM radio ratings has been steadily closing. Based on TV and AM/FM radio audience forecasts, 2025 will see AM/FM radio overtake TV in the all-important 25-54 demographic by 13% and widen its ratings lead over TV among 18-49s by 47%.

2. 2025 post-buy analyses will overachieve 2024 media plans: In PPM markets, expect up to +24% increases in audience deliveries based on prior year schedules. For local buys, outcomes will vary by demographic, markets utilized, and AM/FM radio programming format mix. For total U.S. media plans using Nielsen’s Nationwide survey, deliveries will grow by +10%. Differences will result due the mix of diary versus PPM market composition in network lineups as well as AM/FM radio programming format mix.

3. AM/FM radio, already America’s number one mass reach media, will experience reach growth in advertising schedules: With an estimated daily reach growth of +7% and weekly week growth of +4%, reach and frequency analyses are expected to experience growth. Since reach is the foundation of advertising effectiveness, this will benefit marketers’ sales growth.

4. AM/FM radio ads will become more effective as stations increase the number of commercial breaks with shorter durations: Since the introduction of the Portable Meter, most AM/FM radio stations schedule their two commercial breaks around :15 and :45 past the hour. This strategy was designed to maximize 5-minute listening durations.

With a 3-minute quarter hour qualification, stations could create more breaks of shorter duration. This will significantly benefit advertisers. Creating more ad breaks of shorter duration generates larger commercial audiences. Advertisers stand out more in shorter breaks. Growing audience deliveries for AM/FM radio ads improves marketing effectiveness and grows sales effect.

*Note: Forecasts stated in this blog are based on estimates using Nielsen impact data from May 2024.

Click here to view a 13-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.