Think Media Mix Modeling Hates AM/FM Radio? Think Again! AM/FM Radio Is A Top ROI Generator According to 2,857 Nielsen MMM Studies

Editor’s note: John Fix is responsible for returning Procter & Gamble into the world of audio advertising. Since his recent retirement from P&G, John has opened his consultancy and Westwood One is excited to be one of his early clients. At P&G, John was one of the first to be dedicated to media analytics, from planning to attribution. He was responsible for the analysis and selection of media measurement applications and planning tools. At one point, John led U.S. media mix modeling, multi-touch attribution, and market testing. In his years at P&G, they went from non-existent to first in radio over a 5-year period.

The Media Mix Modeling season is in full swing for advertisers working on a July-June fiscal year calendar.

Media Mix Modeling (MMM) is a statistical analysis that helps advertisers understand how different marketing activities impact a company’s sales and return on investment (ROI). It measures the effectiveness of marketing efforts and media channels by analyzing historical data to determine which factors contribute to sales.

MMM planning, data collection, and data validation occur over a four-month period. After that, the modeling process takes two months and the results inform planning for the next year.

This is when media suppliers get an email that informs them that next year’s planned investment has been “adjusted.” Suppliers will scramble and say things like “I didn’t even know that there was an MMM!?!” and “What data did you use?” The advertiser will sound dismissive and apologetic. What went wrong?

A post-mortem is the worst time to get feedback.

Media Mix Modeling hates AM/FM radio, right?

Actually no! Nielsen reveals AM/FM radio is a “top tier medium for ROI.”

Nielsen, a leading media mix modeler, recently released the results of a major analysis of 2,857 national, local, and international campaigns across advertiser categories where the allocation to AM/FM radio averaged a notable percentage of the total media budget.

Dave Hohman, EVP & GM Global Marketing Effectiveness at Nielsen’s Media Mix Modeling practice, concludes: “When the relative weight of impressions is large enough to be measured, radio consistently ranks as a top-tier medium for ROI. Streaming audio also performs well, albeit behind broadcast radio.”

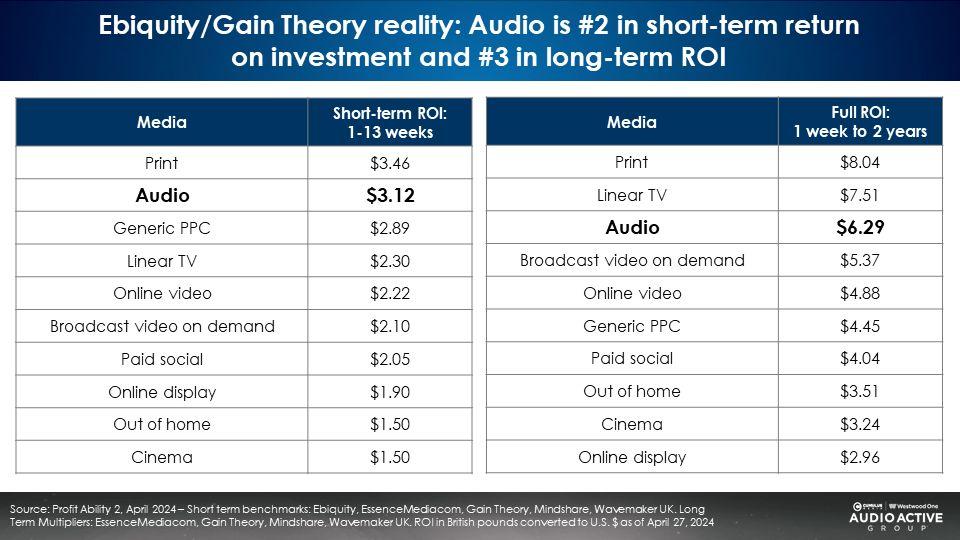

Profit Ability 2: The New Business Case for Advertising is a significant new study on marketing effectiveness from measurement firms Gain Theory and Ebiquity, along with media agencies EssenceMediacom, Mindshare, and Wavemaker UK. The study was a massive undertaking that involved analyzing $2.2 billion in media spend (2021-2023) across 142 brands, 14 sectors, and 10 media channels.

The study revealed audio has the second highest short-term return on advertising spend (within one to thirteen weeks). Audio ranks third in overall return on advertising spend (week one to two years).

A dollar invested in audio (AM/FM radio, podcasts, or streaming) would generate $3.12 of profit within one to thirteen weeks. Overall, a dollar invested in audio will return $6.29 of profit over the entire two-year period (one week to two years).

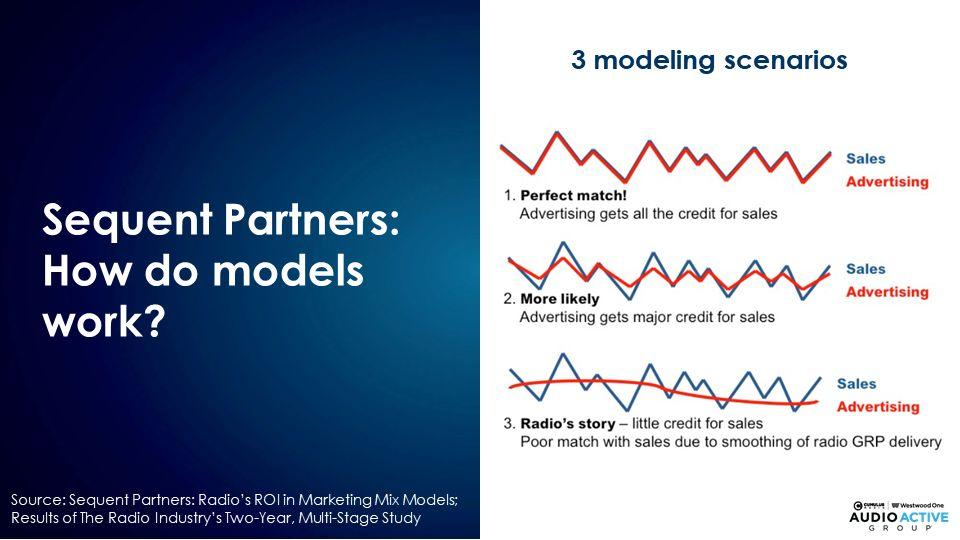

I have heard this “MMM hates audio” myth and have tried to trace its roots. The first clue I found was a study conducted by Sequent Partners in 2012 called Radio’s ROI in Marketing Mix Modeling, which reported on Arbitron (today’s Nielsen Audio) and Media Monitors work on data inputs. There is one statement that summarizes the work:

“One of the primary reasons that Radio did not fare well historically in Marketing Mix Models was that the data was not granular enough…”

The document went on to say that breaking the data down by product taxonomy, multiple campaigns/creatives, and geographies would greatly improve MMM’s ability to get a read on AM/FM radio. MMMs don’t hate AM/FM radio. MMMs hate bad data.

MMM input data – What is possible?

MMM requires very few inputs to create an answer. Any media channel can be input at a brand level with weekly planned Total Rating Point data and weekly spend estimates. Planned GRPs are not ideal. This is the reality for AM/FM radio in many MMM.

Every MMM is different. The granularity of the input data should match the variation used in creating the media plan.

The key to creating meaningful breakouts depends on the advertiser recognizing that there is value in doing so. Large media investments tend to get the highest amount of scrutiny and the most detail.

A brand that is heavy in linear TV may break out :15 vs. :30, general market vs. direct response, dayparts and each piece of creative. The brand will also produce response curves to make sure that the TV investment level is maximized.

AM/FM radio does not typically get this scrutiny. A good MMM for AM/FM radio would consider the choices made in the buying brief and seek to measure.

For example, if AM/FM radio is purchased with campaigns that target the general market, Hispanics, or African Americans, breaking the data into deliveries against the total market, Spanish Radio, and Urban Radio would aid in optimizing the mix.

Depicting deliveries against segments will help to create variation in the data as well as create useful results. Each piece of creative would have a separate read that rolls up into a total read for AM/FM radio.

The solution to the data problem: Use as-run deliveries not planned weight

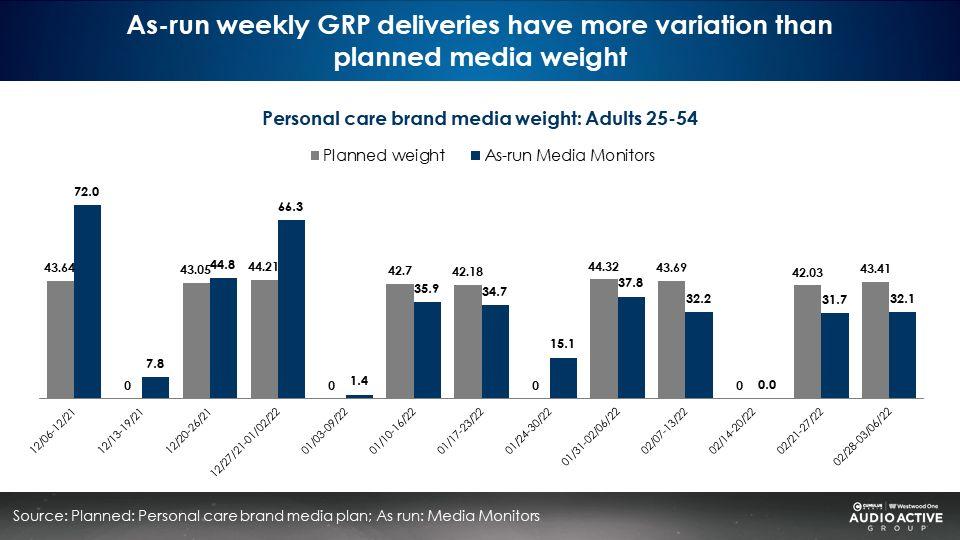

The easiest approach for an advertiser is to submit weekly planned GRP weight. As the visual below reveals, planned media weight is problematic. It creates a “smoothing effect,” which makes it difficult to correlate AM/FM radio ads with sales. The upshot? Audio gets little credit for sales.

A better approach is for the audio industry to provide as-run GRPs. In the chart below, the grey bars represent planned weekly GRPs. Notice how they never vary week to week with the exception of dark weeks.

The blue bars represent as-run weekly GRPs pulled from Media Monitors. In this potential approach, the Media Monitors ad occurrences for the entire AM/FM radio investment over a two-year period are input into ACT 1, the software system that processes Nielsen Nationwide, the AM/FM radio ratings for the entire U.S. The as-run GRPs show more variation, which is exactly what the models need.

ACT 1 is working to modify its software to improve the process of producing AM/FM radio data inputs for Media Mix Modelers. The AM/FM radio industry is also considering other solutions to produce as-run delivery log files for Media Mix Modeling data inputs.

Best practices for MMM data inputs

Nielsen’s Dave Hohman recommends the following:

“Plan for Adequate GRPs: Allocate sufficient budget to radio and other audio channels. While the appropriate levels may vary by category

Use As-Run Data, Not Planned GRPs: Many marketers rely on planned GRPs, which can differ significantly from what is actually delivered. By using As-Run GRPs—actual media delivery—you’ll get a more accurate read of radio’s performance. Nielsen’s data consistently shows the importance of this distinction.

DMA-Level Delivery Matters: Radio’s effectiveness can vary across different markets, so it’s important to evaluate media delivery at the Designated Market Area (DMA) level. Actual delivery often deviates from planned delivery, and understanding these variations can provide valuable insights for optimizing your radio campaigns.

Analyze by Week: Timing is everything, especially for media like radio that may have seasonality or other timing-related nuances. Analyzing media delivery on a weekly basis—taking into account sales events, weather conditions, or special promotions—can help explain spikes or dips in performance. This granular level of analysis is crucial for understanding the true impact of your radio investments.”

Here are some other useful data inputs:

- Product hierarchy: Company, brand, sub-brand

- Creative campaign/strategy

- Target demo: What audience was the buy against

For assistance with data inputs for your Media Mix Modeling, reach out to your broadcast media partner.

Key findings:

- Contrary to the myth that Media Mix Modeling hates AM/FM radio, Nielsen reveals AM/FM radio consistently ranks as a top tier medium for return on investment, ahead of streaming audio.

- Weight matters: The weight of the impressions needs to be large enough to be measured. Allocate sufficient budget to AM/FM radio and other audio channels.

- Using as-run deliveries rather than planned weight as this allows AM/FM radio to get more credit for sales effect.

- Provide as-run deliveries by week and by DMA.

- MMM data inputs should align with the brand’s media strategy. For example, if a brand has separate campaigns targeting African Americans and Hispanics, as-run deliveries for those strategies should be provided.

John Fix can be reached at johnfixltd@gmail.com.