Wayfair’s Campaign Reach Explodes With A Reallocation From Linear TV to AM/FM Radio; Home Improvement Online Shoppers Are Best Reached With AM/FM Radio And Podcasts

Click here to view a 14-minute video of the key findings.

Click here to download a PDF of the slides.

Through the first half of 2024, online home improvement purchases have reached an all-time high representing nearly 29% of all purchases, according to a study by Open Brand for the Home Improvement Research Institute. Current online home improvement purchases have even surpassed the 2020 pandemic era.

Online shopping momentum for home improvement will continue

An April 2024 study of 1,291 consumers commissioned by the Cumulus Media | Westwood One Audio Active Group® conducted by MARU/Matchbox revealed 31% say they will shop online and in-store about the same amount. 14% say they will shop online more often.

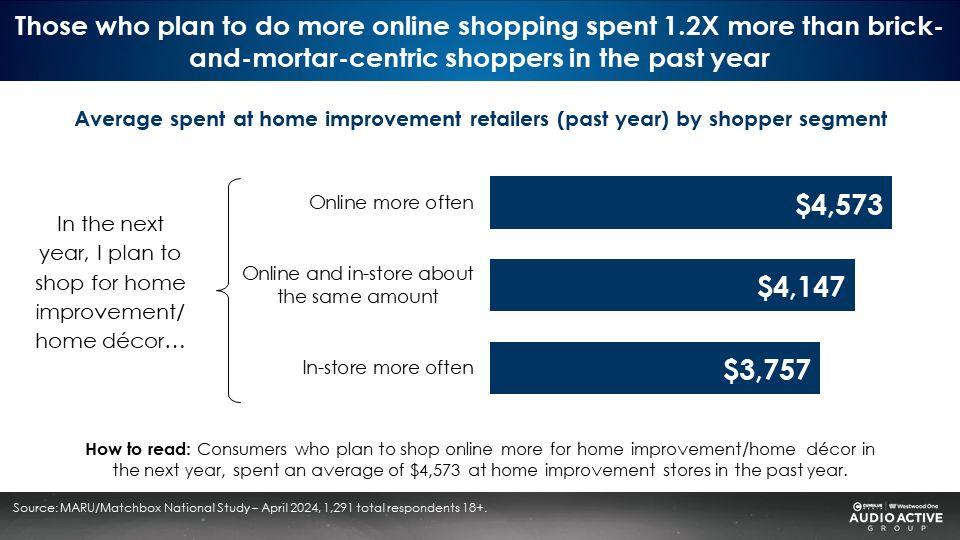

Online home improvement shoppers spend more

Those who say they intend to shop more online spent $4,573 in the past year. Shoppers who say they will spend more in-store spent less ($3,757) on home improvement in the past year.

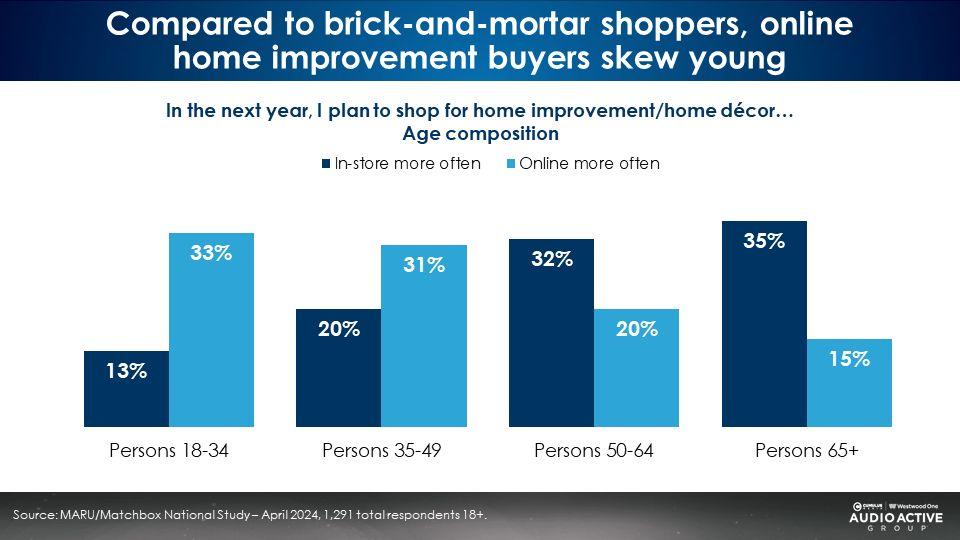

Compared to brick-and-mortar shoppers, online home improvement buyers skew young (18-49); In-store shoppers skew much older (50+)

64% of consumers who say they intend to shop most online are 18-49 versus only 33% of those who shop most in store. Those who say they will be spending more in-store skew older, with 67% over the age of 50.

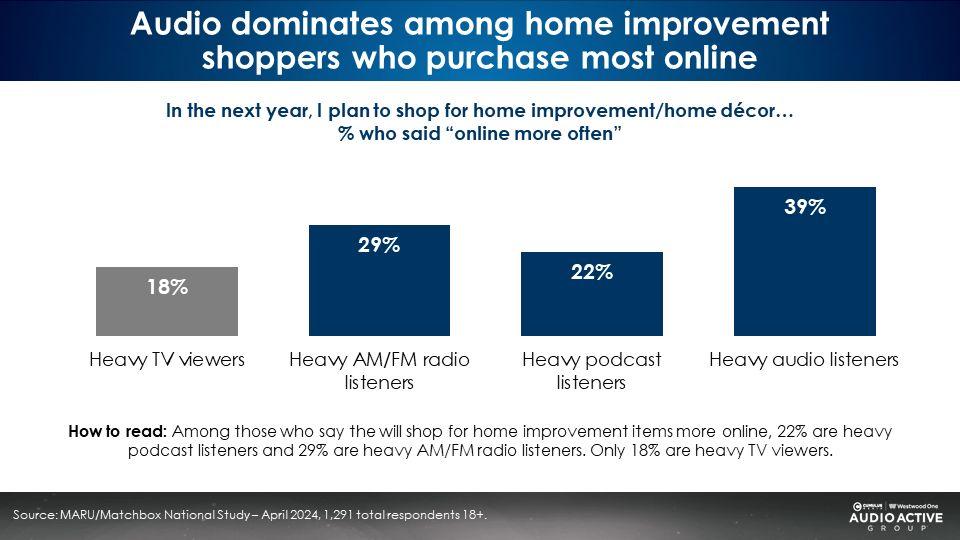

Audio dominates media use among home improvement shoppers who purchase most online

Among those who shop online most for home improvement, podcasts and AM/FM radio are consumed more than TV. 29% of online home improvement shoppers are heavy AM/FM radio listeners and 22% are heavy podcast listeners. Fewer online shoppers are heavy TV viewers (18%). Among those who shop online most for home improvement, 39% are heavy audio listeners.

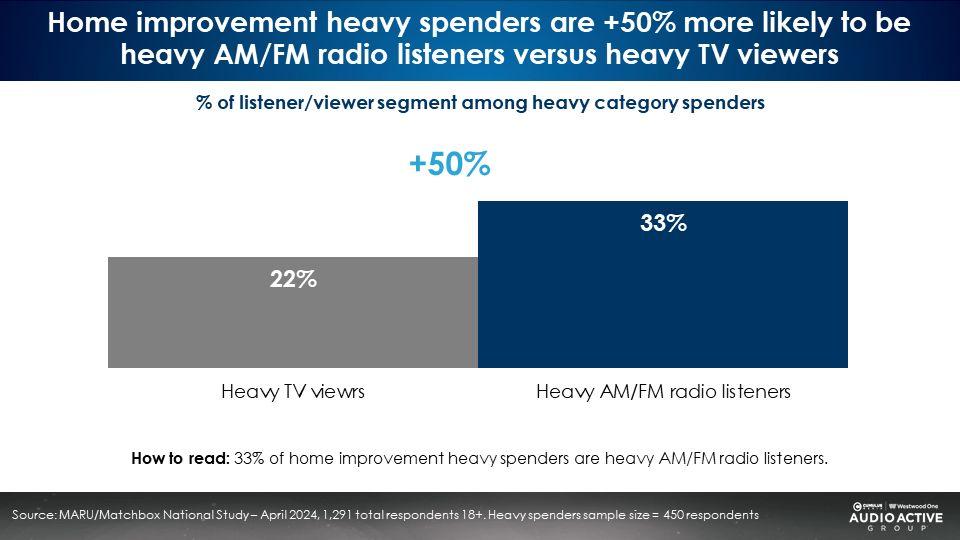

Home improvement heavy spenders (online + in store) are 50% more likely to be heavy AM/FM heavy listeners than heavy TV viewers

Consumers who spent $2,500 or more in the past year online or in store are heavy home improvement shoppers who represent 48% of shopping trips. 50% more home improvement big spenders are heavy AM/FM radio listeners (33%) than heavy TV viewers (22%).

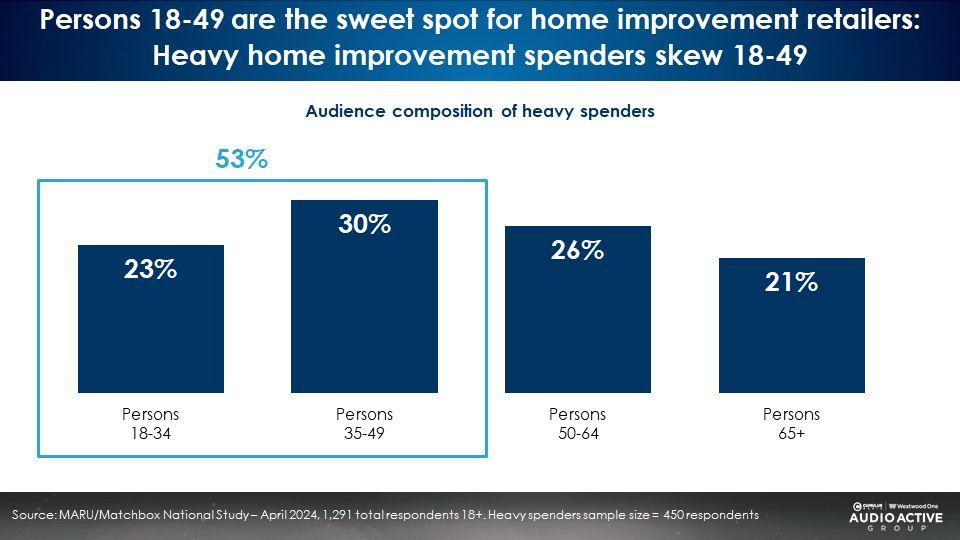

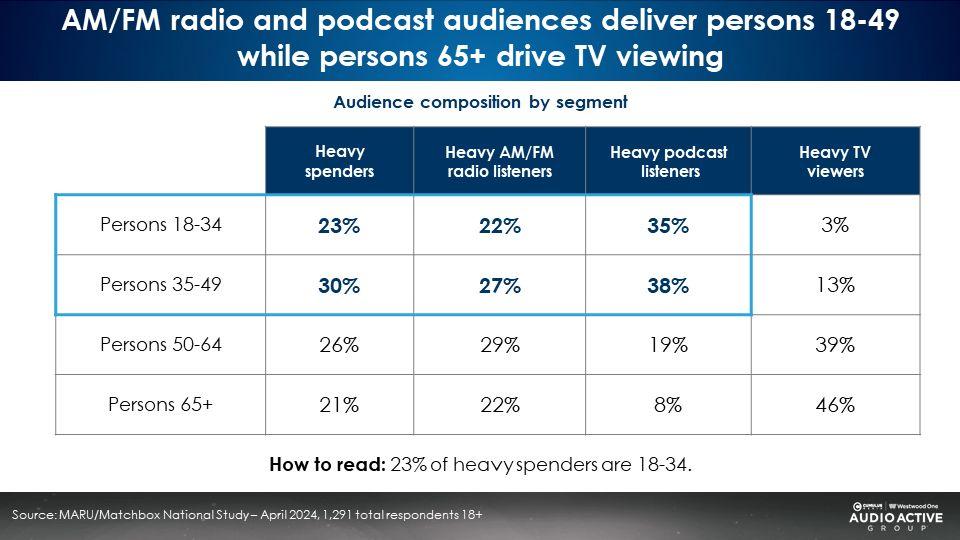

The younger skew of heavy home improvement shoppers explains why AM/FM radio outperforms TV

The audience profile of podcasts and AM/FM radio more closely align with heavy home improvement shoppers. The profile of TV viewers is far older skewing than heavy home improvement shoppers.

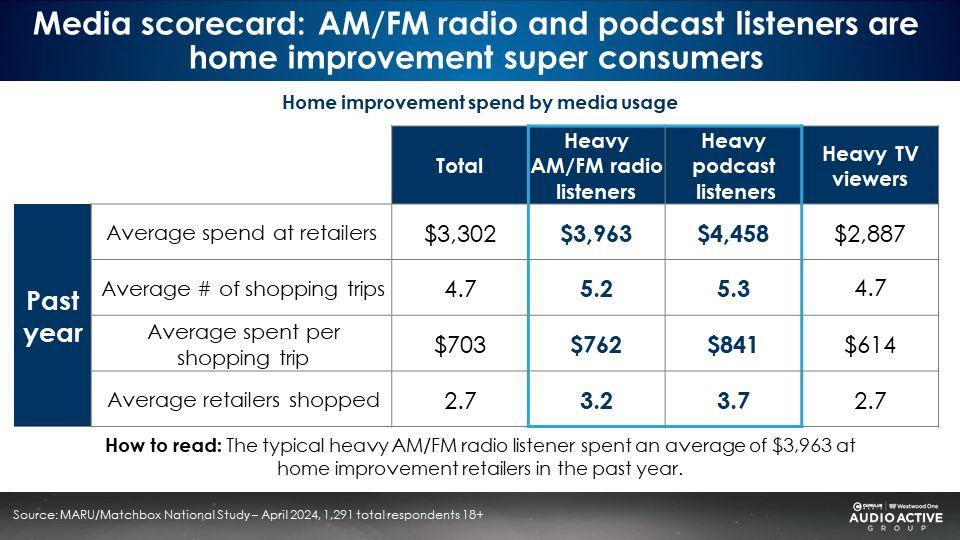

Big audio users are massive home improvement shoppers

The MARU/Matchbox study revealed audio listeners purchase from more retailers, shop more often, and spend more than average.

In the past year, podcast listeners spent 1.5X more than heavy TV viewers on home improvement ($4,458 versus $2,887). Heavy AM/FM radio listeners spend 1.4X more than heavy TV viewers ($3,963 versus $2,887).

Versus heavy TV viewers, heavy AM/FM radio listeners shop more retailers (3.2 versus 2.7) and make more shopping trips (5.2 versus 4.7). Podcast listeners also outperform TV viewers in home improvement purchases by sizable margins. Of all media, podcast listeners shop at the greatest number of home improvement retailers.

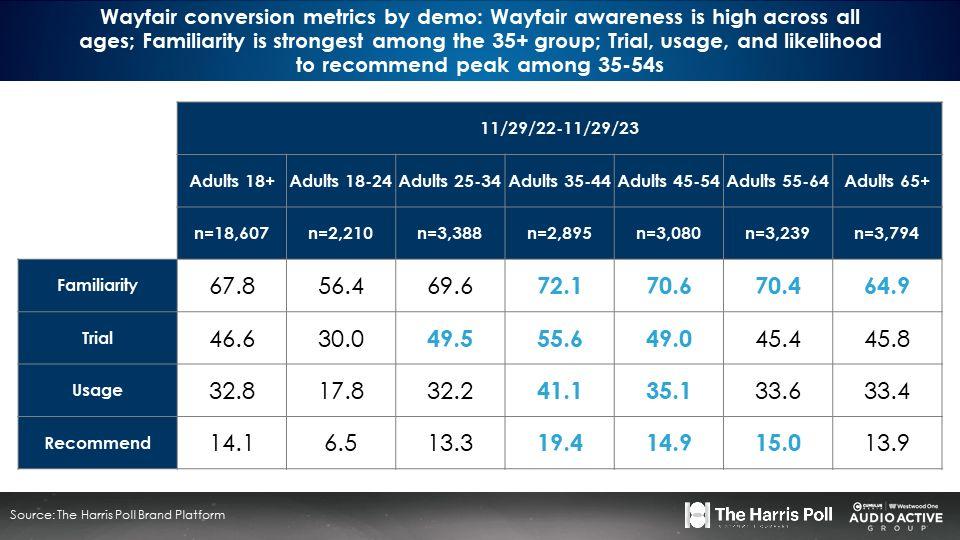

Wayfair brand equity: Familiarity is strongest among 36-64s; Usage is strongest among 35-54s and families with kids and $100K+ income

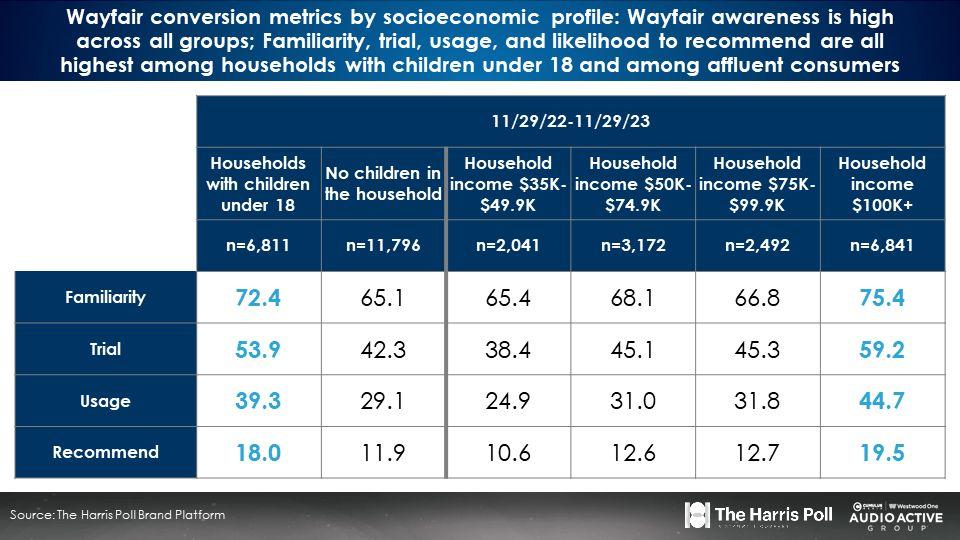

The Cumulus Media | Westwood One’s Audio Active Group®, conducted an analysis of Wayfair’s brand equity using The Harris Poll Brand Tracker over a one-year period from November 2022 to November 2023 based on 18,607 respondents.

From a demographic standpoint, Wayfair’s familiarity is strongest among 35-64s. Those who have tried the brand are 25-54 but usage is strongest among 35-54s, with very high trial and usage among 35-44s.

Wayfair’s brand equity is strongest among households with kids and $100K+ incomes.

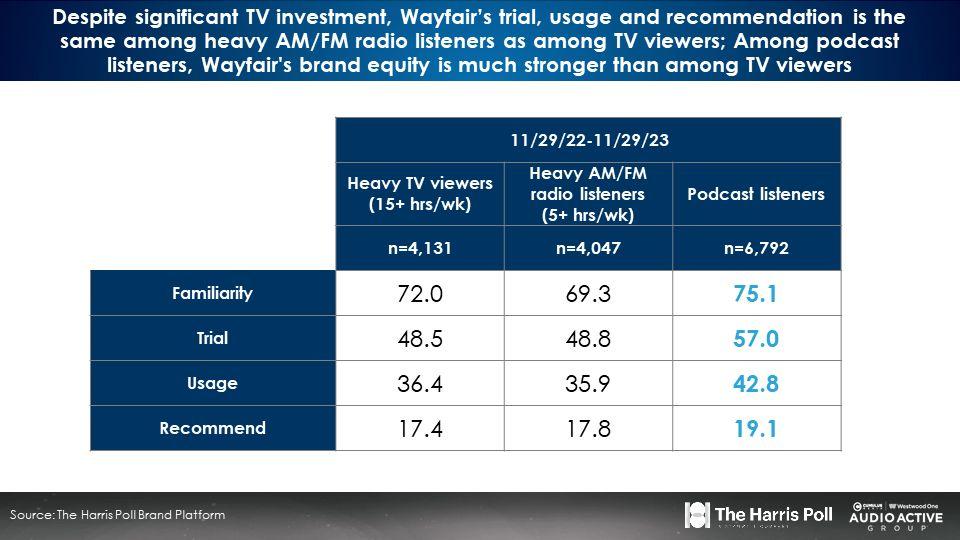

Despite spending significantly on TV and little on audio, Wayfair’s brand equity is strongest among podcast listeners; Wayfair’s brand equity among AM/FM radio listeners is the same as TV, despite not spending on AM/FM radio

Wayfair’s trial, usage, and recommendation levels are the same among TV and AM/FM radio listeners despite zero spend on AM/FM radio and heavy spending on TV. What gives?

Compared to TV viewers, the MARU/Matchbox research reveals AM/FM radio listeners are far more likely to shop online for home improvement and home décor. Compared to TV viewers, audio listeners purchase from more retailers, shop more often, and spend more than average.

Wayfair has a huge opportunity to leverage audio as a key media platform

AM/FM radio affords Wayfair with a giant media platform to drive its brand and sales with an audience far more likely to purchase online. The starting point with the AM/FM radio audience is brand equity, which is virtually the same as among the TV audience.

With AM/FM radio, Wayfair “cannot fall off the floor.” Brand equity has nowhere to go but up!

When it comes to podcasts, Wayfair has a massive opportunity. Among the podcast audience Wayfair has outsized brand familiarity, trial, usage, and recommendation. Imagine if Wayfair spent on podcasts like it does on TV?

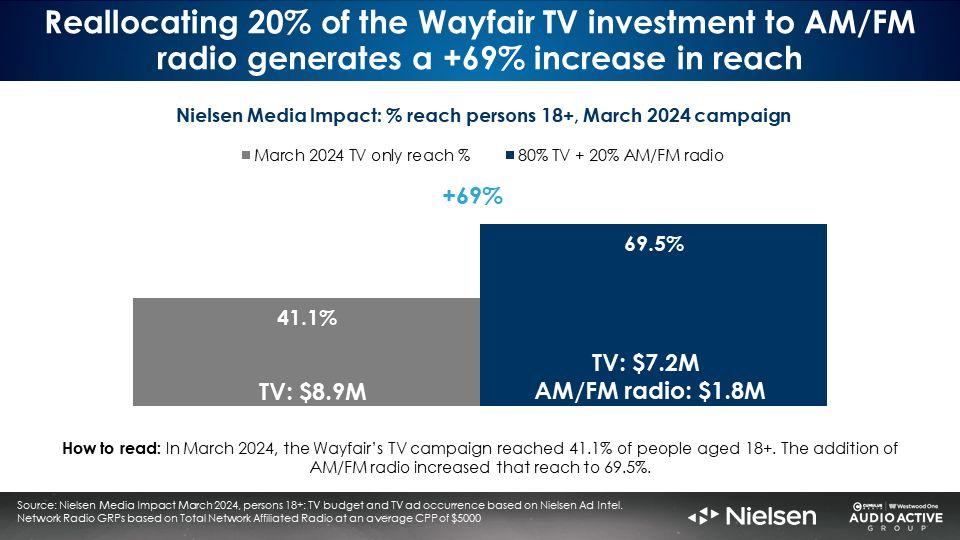

Nielsen Media Impact: Shifting 20% of Wayfair’s TV media plan to AM/FM radio causes campaign reach to explode

As a leading online retailer for home improvement and home décor, Wayfair seeks to build their brand and awareness to drive consideration and purchases. An analysis of Wayfair’s media plan was conducted via Nielsen Media Impact, the media planning and optimization platform.

In March of 2024, Wayfair invested $8.9M in linear TV. The campaign reached 41% of total U.S. adults 18+. A significant impact, no doubt, yet 60% of the U.S. were not reached.

Could a reallocation of a portion of Wayfair’s linear TV investment to AM/FM radio grow Wayfair’s monthly reach? A Nielsen Media Impact optimization examined shifting 20% of Wayfair’s TV spend to AM/FM radio.

The result? Wayfair’s monthly reach soars from 41% to 70%, a +69% increase for the same investment!

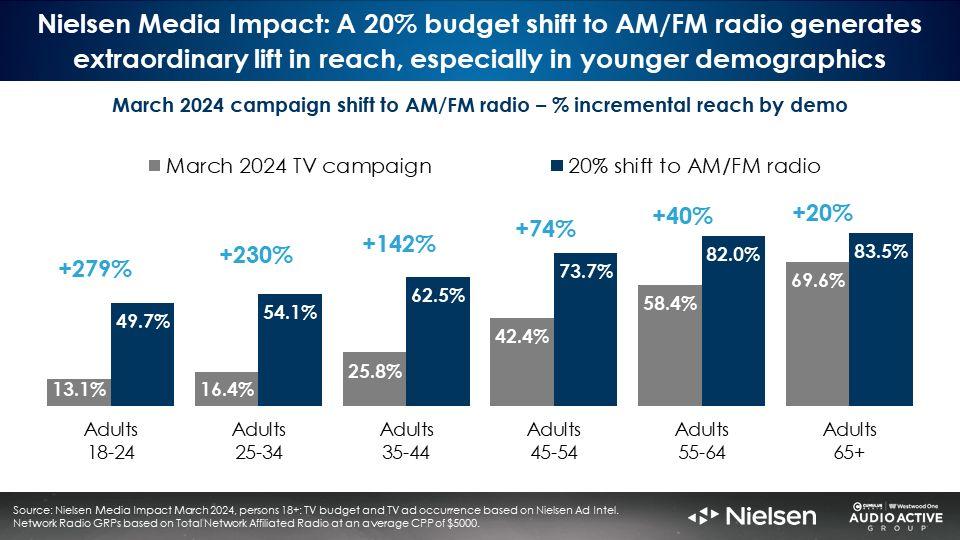

Nielsen Media Impact: A reallocation to AM/FM radio generates a massive reach lift among young demographics

Shifting 20% of the linear TV plan to AM/FM radio generates stunning monthly reach growth:

- 25-34 monthly reach surges 3X from 16% to 54%

- 35-44 monthly reach more than doubles from 26% to 63%

- 45-54 monthly reach soars +74% from 42% to 74%

- 55-64 monthly reach jumps +40% (58% to 82%)

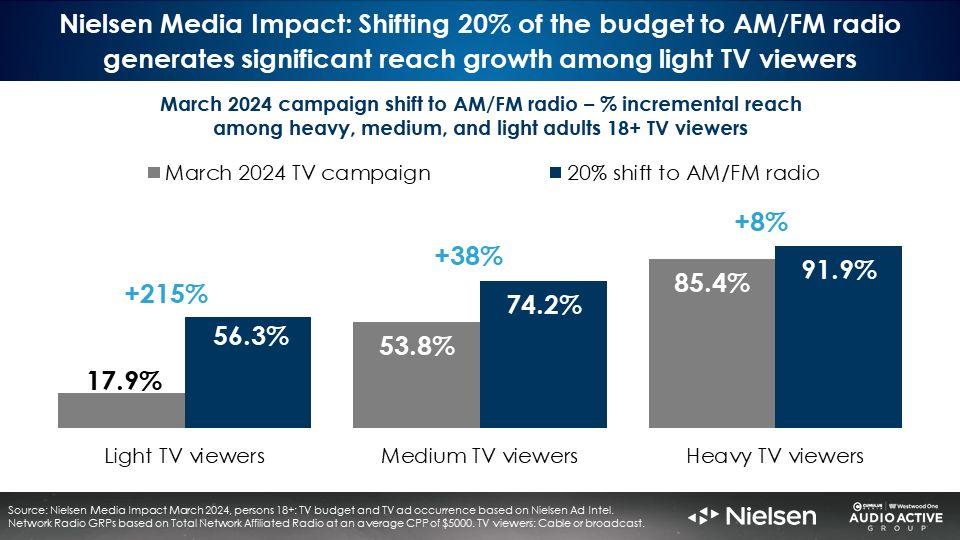

AM/FM radio’s superpower: Reaching light and medium TV viewers

A wise media planner once said, “You cannot solve the light TV viewing problem by buying more TV!”

Nielsen Media Impact reveals shifting 20% of Wayfair’s TV budget to AM/FM radio causes monthly reach to explode 3X among light TV viewers (18% to 56%). Among medium TV viewers, the shift to AM/FM radio increases Wayfair’s monthly reach by +38%.

Even among heavy TV viewers, those with the greatest opportunity to see Wayfair TV ads, the shift to AM/FM radio increased monthly reach by +8%.

Key findings:

- Audio dominates among home improvement shoppers who purchase most online

- The younger skew of online home improvement shoppers explains why AM/FM radio outperforms TV

- Harris Poll Brand Tracker: Wayfair familiarity is strongest among 35-64s; Usage is strongest among 35-54s and families with kids and $100K+ household incomes

- Harris Poll Brand Tracker: Wayfair’s brand equity among AM/FM radio listeners is the same as TV despite not spending on AM/FM radio; Wayfair’s brand equity is strongest among podcast listeners

- Nielsen Media Impact: Shifting 20% of Wayfair’s TV budget to AM/FM radio causes campaign reach to explode by +69%, especially among younger demographics and among light/medium TV viewers

Click here to view a 14-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.