Screen Engine/ASI: Audio Is The Ideal Media Platform To Market Video Streaming Services

Click here to view an 17-minute video of the key findings.

Click here to download a PDF of the slides.

A series of tracking studies measuring American use of video services reveal podcasts and AM/FM radio are ideal marketing platforms for video streamers like Amazon Prime Video, Netflix, Paramount+, Hulu, and Disney+.

Each quarter, Screen Engine/ASI, a leading market researcher for movie studios, video streamers, and TV networks, conducts a study of 2,000 Americans to understand their awareness and usage of video services. The Cumulus Media | Westwood One Audio Active Group® conducted an analysis of six recent quarterly studies spanning Spring 2023 to Fall 2024.

Key takeaways:

- Nielsen: Since 2021, video streaming’s share of TV time spent has soared from 26% to 40%

- Americans are cutting back on the number of ad-free video subscriptions while increasing the number of video services with ads

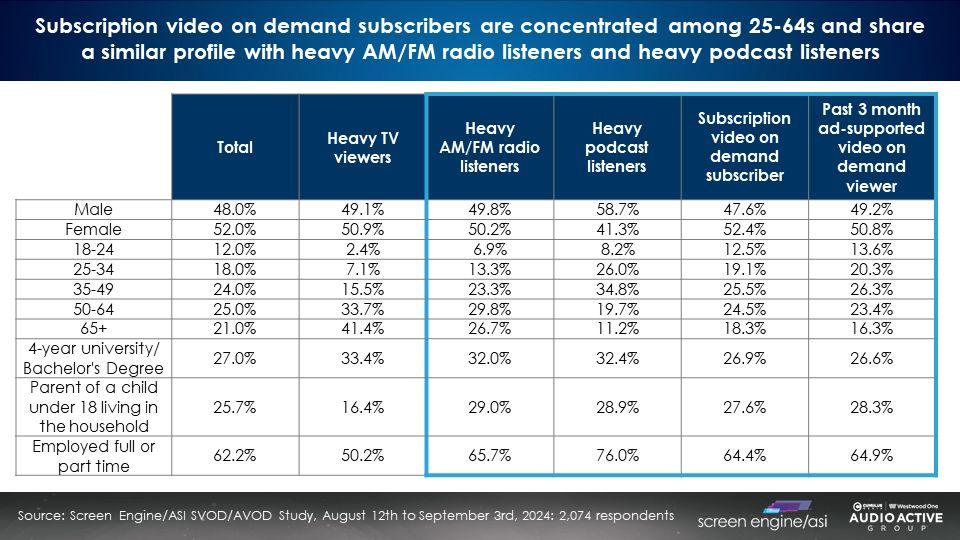

- Screen Engine/ASI: The audience profile of video streamers closely aligns with podcast and AM/FM radio listeners, not linear TV viewers

- While the profile of heavy audio consumers is a perfect match for the video streaming audience, most of the media budgets go to linear TV

- Despite massive spending on linear TV, ad recall levels for video services among heavy TV viewers are identical to those among heavy audio listeners

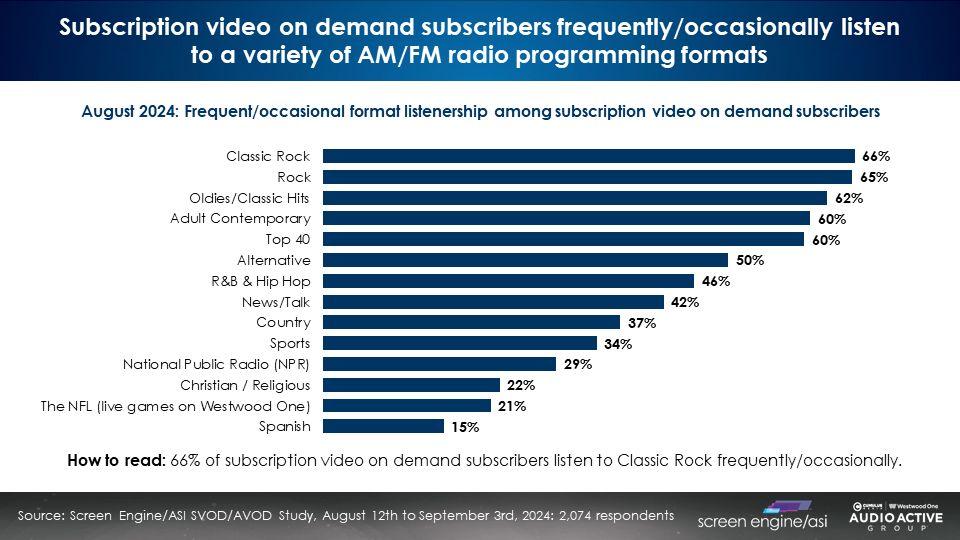

- A wide variety of AM/FM radio programming formats provide reach for the video streaming target audience

- Nielsen: At any spend level, AM/FM radio dramatically outreaches linear TV

- Nielsen Media Impact: AM/FM radio makes your TV better: Hulu experiences a +76% increase in reach with a 20% reallocation to AM/FM radio; Much of the reach growth occurs among younger demos and light TV viewers

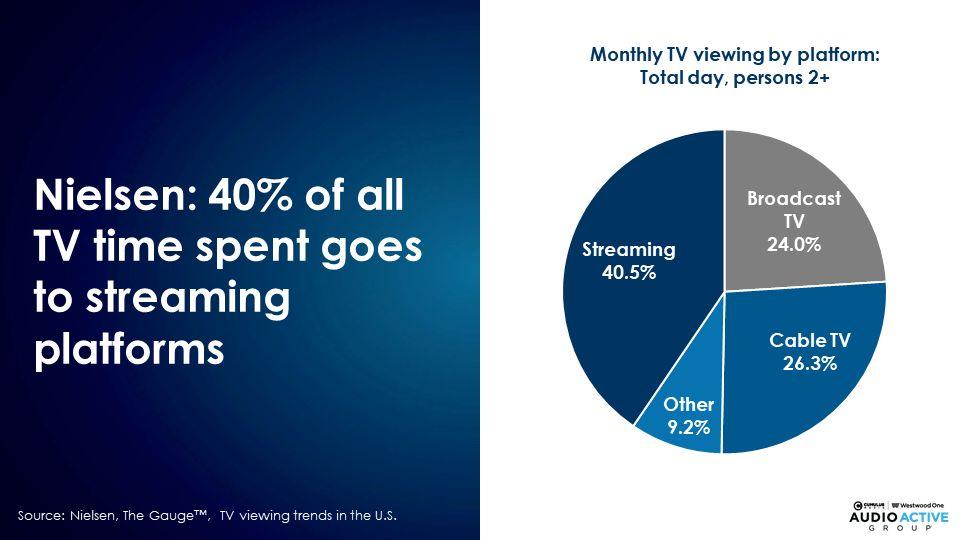

Nielsen: Since 2021, video streaming’s share of TV time spent has soared from 26% to 40%

In 2021, Nielsen launched ‘The Gauge,’ a monthly graphic report depicting the share of TV time spent with cable networks, broadcast networks, and video streaming. The Gauge reveals video streaming’s share of TV time spent has surged +54% from 26% in June 2021 to 40% in October 2024.

Video subscription services with ads audiences grow at the expense of ad-free video subscription services

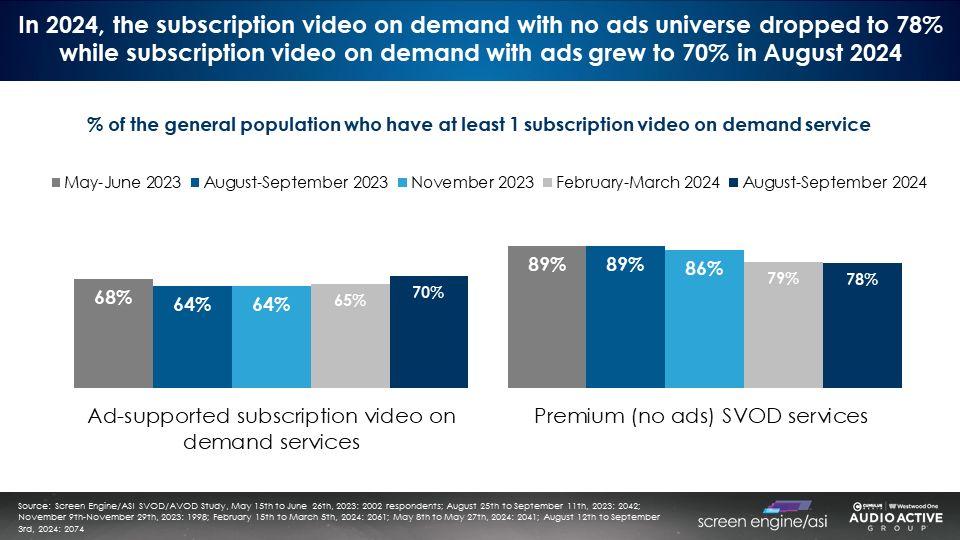

Increasingly, video services that charge a monthly subscription fee are running ads. To supplement their revenues and provide more affordable subscription options, video streamers such as Netflix and Amazon Prime Video have introduced subscription tiers with ads. On a recent earnings call, Disney CEO Robert Iger revealed that 37% of the Disney+ subscriber base has the ad-supported tier.

Screen Engine/ASI’s quarterly tracker reveals the proportion of Americans who subscribe to at least one ad-free video service has dropped from 89% in Spring 2023 to 78% in Fall 2024. At present, 70% of Americans subscribe to at least one video service with ads.

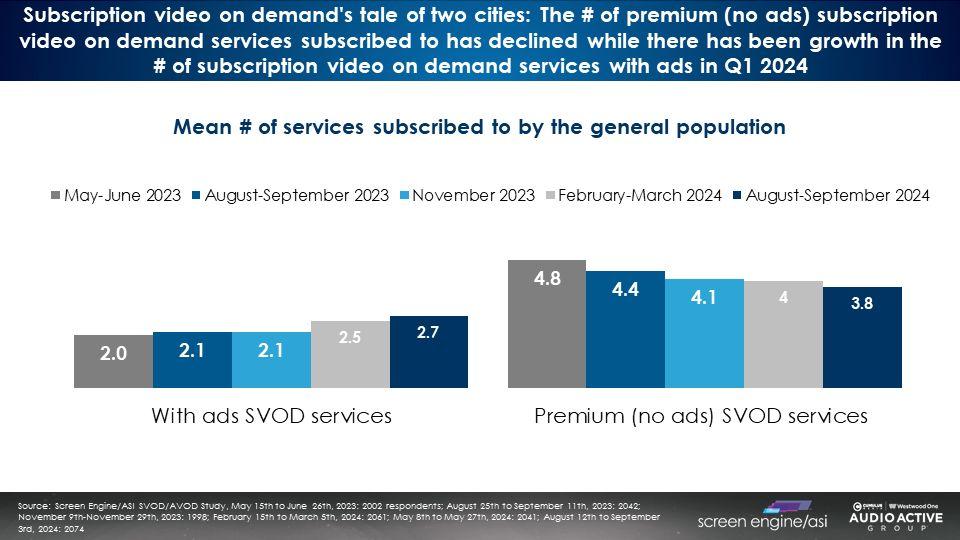

Americans are cutting back on the number of ad-free video subscriptions while increasing the number of video services with ads

Since Spring 2023, the average American has reduced their ad-free video subscriptions from 4.8 to 3.8 services. Over the same period, the average number of ad-supported video subscriptions has grown from 2 to 2.7.

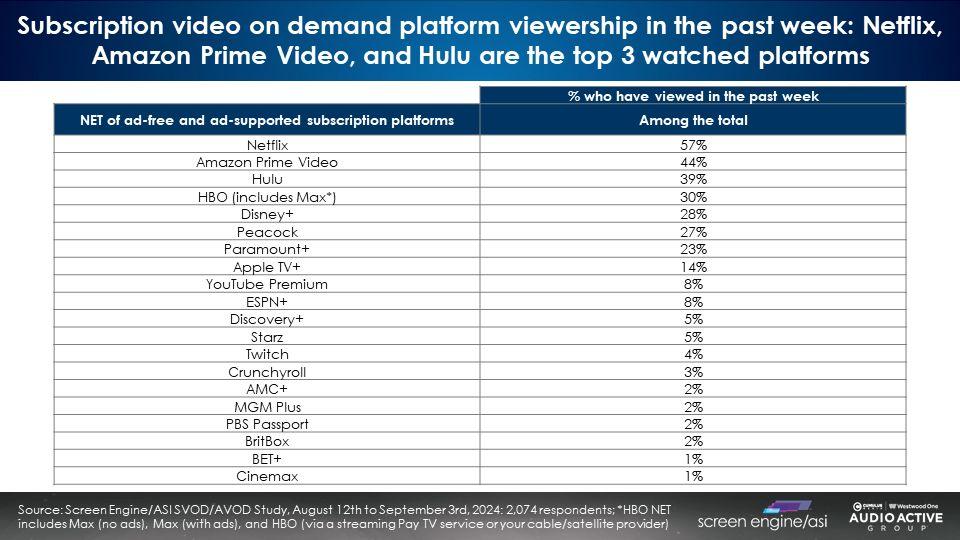

Past week viewership: Netflix, Amazon Prime Video, Hulu, HBO Max, and Disney+ are the most watched platforms

Screen Engine/ASI’s most recent August/September 2024 survey reveals Netflix leads in weekly reach (57%), followed by Amazon Prime Video (44%), Hulu (39%), HBO Max (30%), and Disney+ (28%).

Screen Engine/ASI: The audience profile of video streamers closely aligns with podcast and AM/FM radio listeners, not linear TV viewers

The age profile, presence of children, and employment levels of video streaming subscribers and viewers closely match the profile of heavy podcast and AM/FM radio listeners. Linear TV viewers are much older and less likely to be employed and have children in the home. As one media planner quipped, “Linear TV is what’s playing in God’s waiting room.”

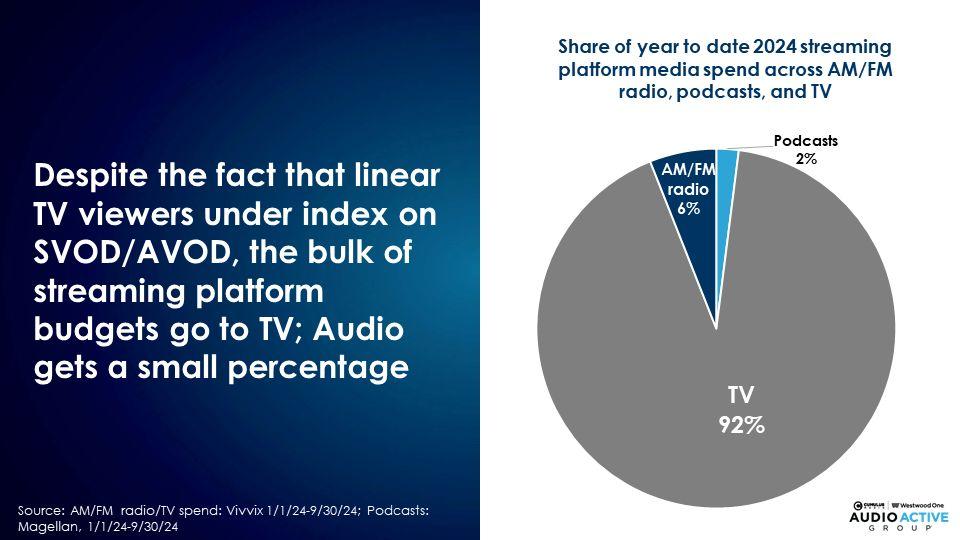

While the profile of heavy audio consumers is perfect match for the video streaming audience, most of the media budgets go to linear TV

Vivvix and Magellan report that through the first nine months of 2024, of the TV/audio spending, 92% of video streaming ad budgets went to linear TV and only 8% went to AM/FM radio and podcasts.

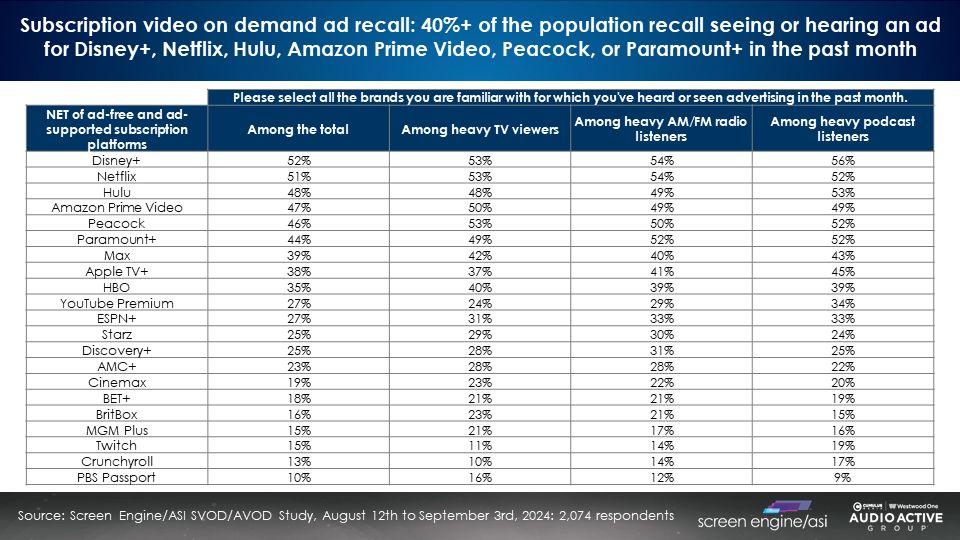

Despite massive spending on linear TV, ad recall levels for video services among heavy TV viewers are surprisingly weak and identical to ad recall levels among heavy audio listeners

With the massive spending by video streaming services on linear TV, one would think the ad recall levels among heavy TV viewers would be massive. They are not. The average streaming brand ad recall is 33% among heavy TV viewers and 33% among heavy podcast and AM/FM radio listeners.

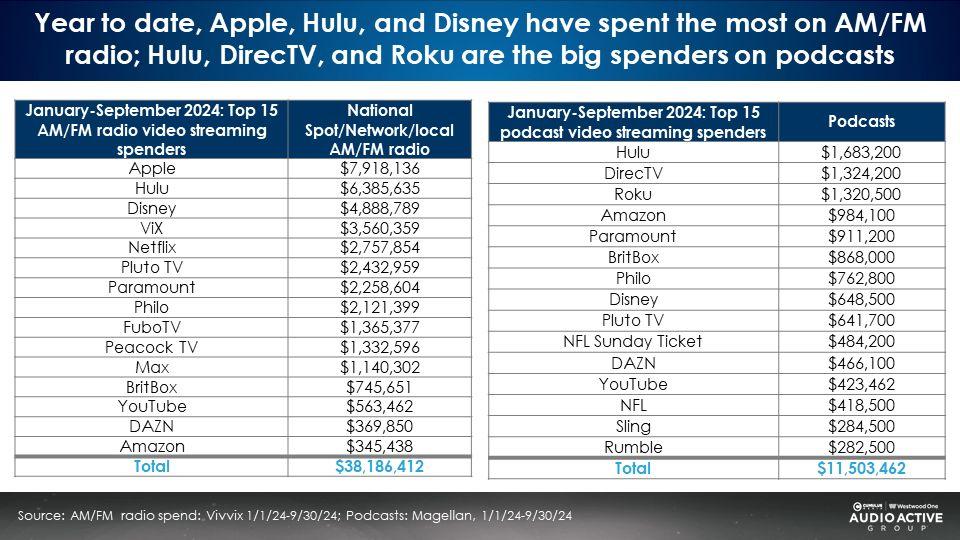

Vivvix/Magellan: For the first nine months of 2024, Apple, Hulu, Disney, and ViX were the top AM/FM radio spenders; The biggest podcast spenders were Hulu, DirecTV, Roku, and Amazon

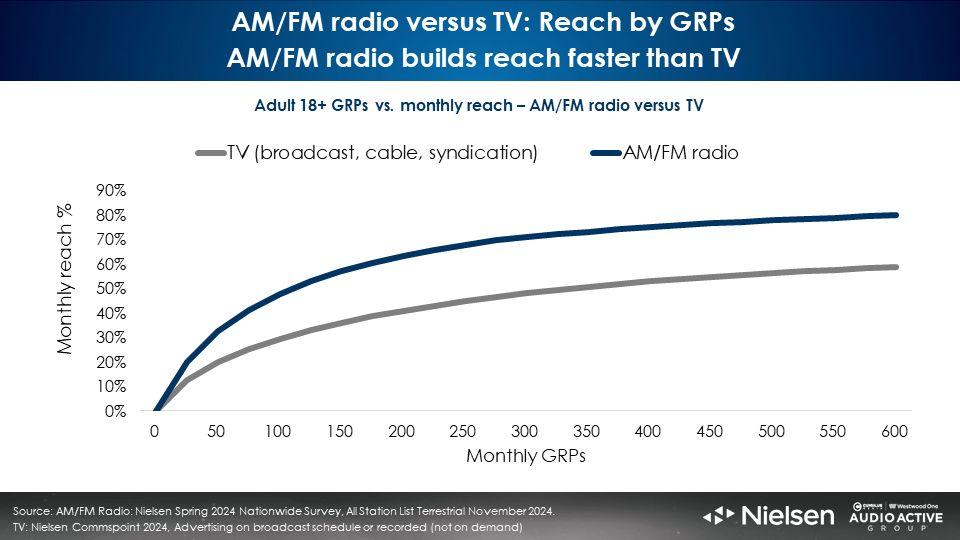

Nielsen: At any spend level, AM/FM radio dramatically outreaches linear TV

Reach is the foundation of media effectiveness, according to the World Advertising Research Center (WARC), the organization that devotes itself to the study of marketing outcomes. Nielsen reports AM/FM radio is America’s number one mass reach medium, offering significant incremental reach to linear TV investments.

Nielsen data reveals that at any level of campaign investment, AM/FM radio generates far greater monthly reach versus linear television. Video streaming brands, and any advertiser for that matter, would be well served to introduce audio into their media plan.

The gap between AM/FM radio and TV is the “golden zone of AM/FM radio’s incremental reach.” Those are the consumers reached with ads on AM/FM radio and not reached on linear TV.

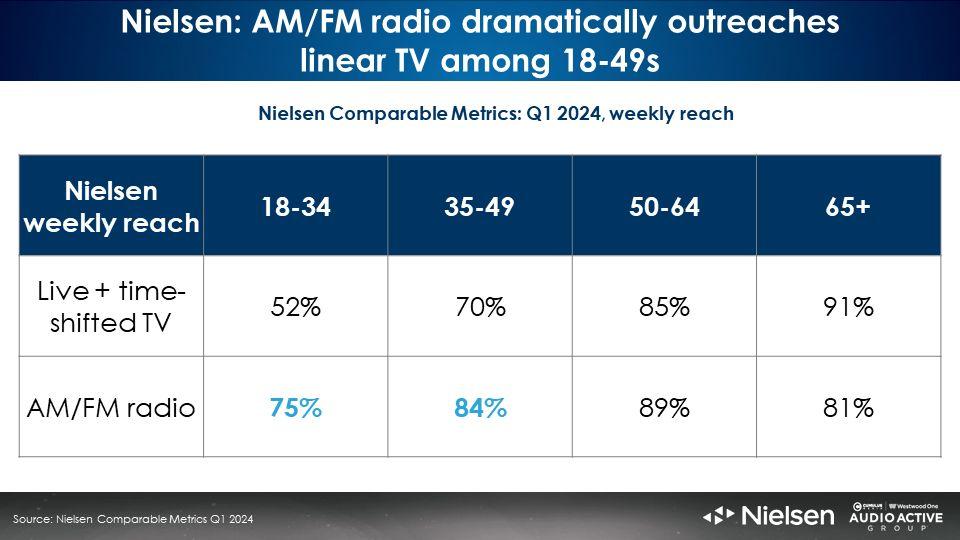

AM/FM radio makes your TV better: AM/FM radio generates the most incremental reach to linear TV among 18-49s

Nielsen’s Q1 2024 Comparable Metrics Report reveals AM/FM radio massively outreaches linear TV in 18-49 weekly reach. 18-49 is the “sweet spot” for video streaming brands and most American marketers.

A wide variety of AM/FM radio programming formats provide reach for the video streaming target audience

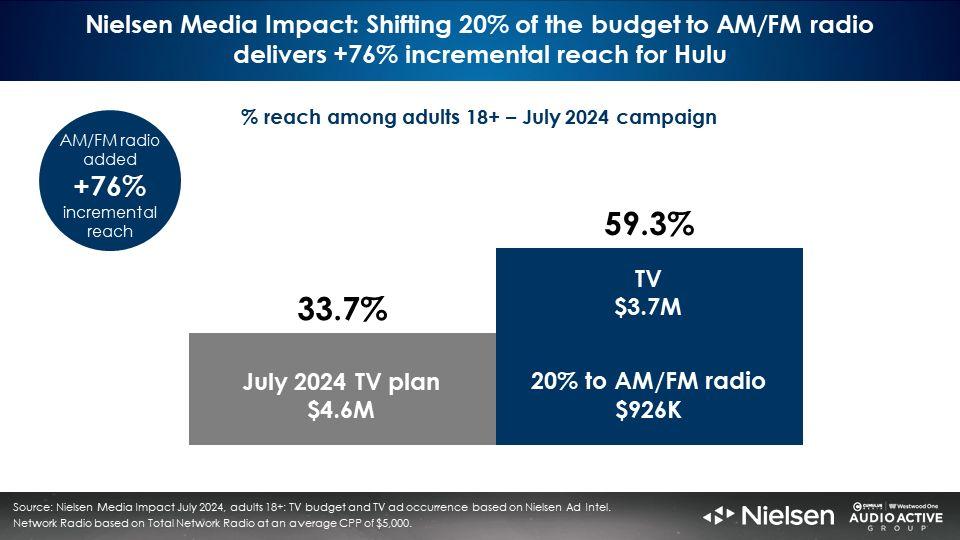

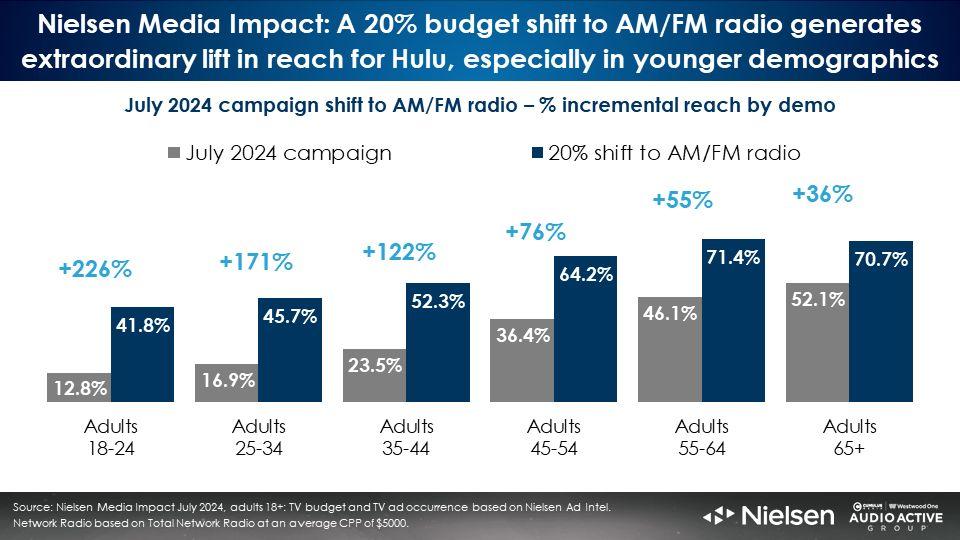

Nielsen Media Impact: AM/FM radio elevates the streaming platform media plan; Hulu experiences a +76% increase in reach with a 20% reallocation to AM/FM radio

In July of 2024, Hulu spent $4.6M on television and reached 33.7% of adults 18+, according to Nielsen Media Impact, the media planning and optimization platform. Shifting just 20% of the TV budget to AM/FM radio generates an incremental reach of +76%.

Adding AM/FM radio to the Hulu media plan generates significant younger demo incremental reach growth

The grey bars below represent the monthly reach of the Hulu TV buy. The Hulu buy reached over half of adults 65+ but lacked reach in the younger demos.

The blue bars represent the combined reach of the 80% TV and 20% AM/FM radio media plan. The 20% share shift to AM/FM radio generates astonishing lifts in reach in younger demographics:

- 18-24: +226%

- 25-54: +171%

- 35-44: +122%

- 45-54: +76%

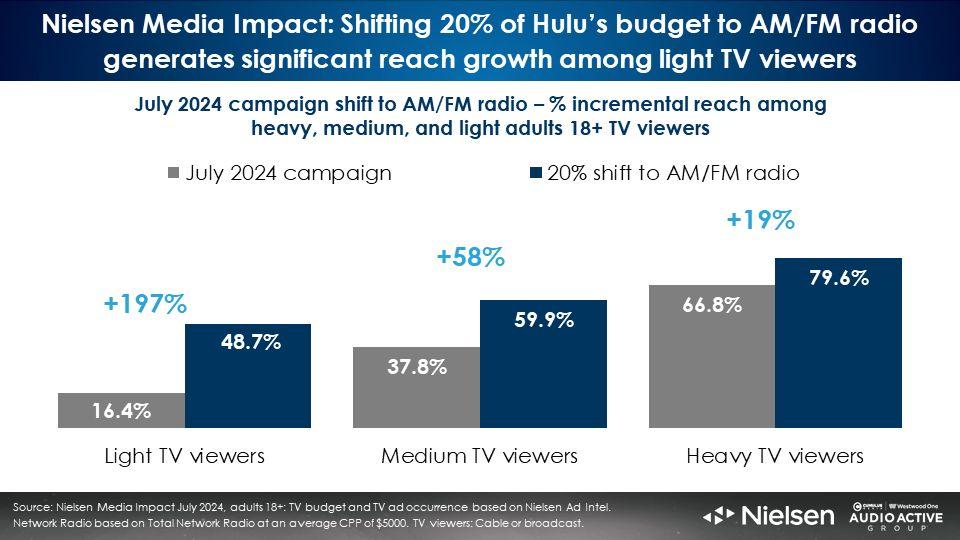

Adding AM/FM radio to Hulu’s media plan generates massive reach growth among light and medium TV viewers

A wise media planner once said, “You cannot solve your light TV viewing problem by buying more TV!”

The 20% reallocation of the Hulu media plan to AM/FM radio results in significant incremental reach increases among light (+197%) and medium (+58%) TV viewers. Younger demographics are very light users of linear television, while older demographics are heavy users of TV.

Key takeaways:

- Nielsen: Since 2021, video streaming’s share of TV time spent has soared from 26% to 40%

- Americans are cutting back on the number of ad-free video subscriptions while increasing the number of video services with ads

- Screen Engine/ASI: The audience profile of video streamers closely aligns with podcast and AM/FM radio listeners, not linear TV viewers

- While the profile of heavy audio consumers is a perfect match for the video streaming audience, most of the media budgets go to linear TV

- Despite massive spending on linear TV, ad recall levels for video services among heavy TV viewers are identical to those among heavy audio listeners

- A wide variety of AM/FM radio programming formats provide reach for the video streaming target audience

- Nielsen: At any spend level, AM/FM radio dramatically outreaches linear TV

- Nielsen Media Impact: AM/FM radio makes your TV better: Hulu experiences a +76% increase in reach with a 20% reallocation to AM/FM radio; Much of the reach growth occurs among younger demos and light TV viewers

Click here to view an 17-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.