Financial Services: Seven Case Studies Reveal Audio Is A Powerful Brand Builder And Sales Driver

Click here to view a 15-minute video of the key findings.

Click here to download a PDF of the slides.

Seven consumer studies commissioned by the Cumulus Media | Westwood One Audio Active Group® over an eight-year period find audio listeners are a rich source of in-market financial consumers and drive significant top and bottom funnel impact. All the studies examined the total effect of the entire AM/FM radio and podcast campaigns.

Key takeaways:

- Compared to TV viewers, audio listeners are far more likely own investment assets, to be in the market for financial services, and be interested in the category.

- Despite massive TV spending by financial service marketers, TV viewers exhibit low brand equity for financial service brands and weak interest in the category due to the older skew of TV audiences.

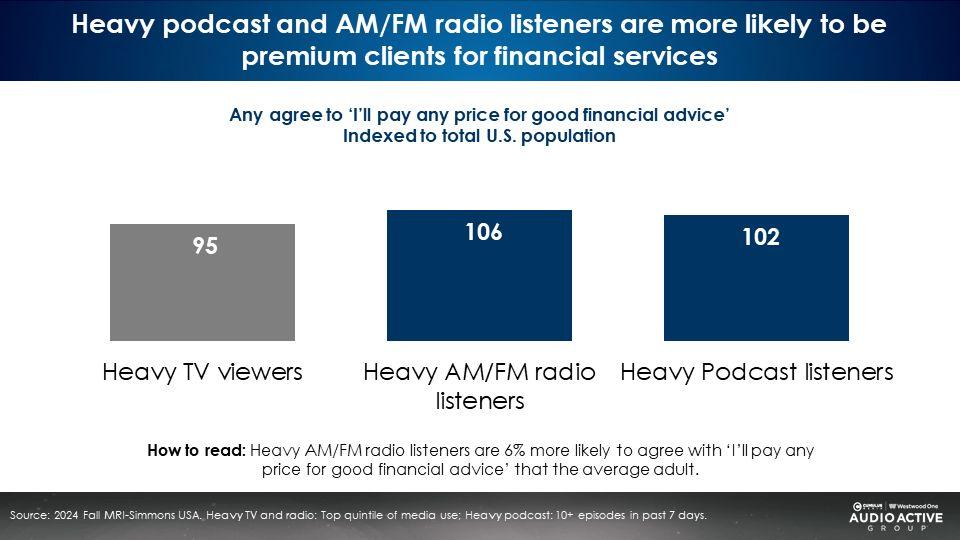

- MRI-Simmons: Heavy podcast and AM/FM radio listeners are the ideal audiences for financial brands as they are more likely to be premium clients willing to pay for financial services.

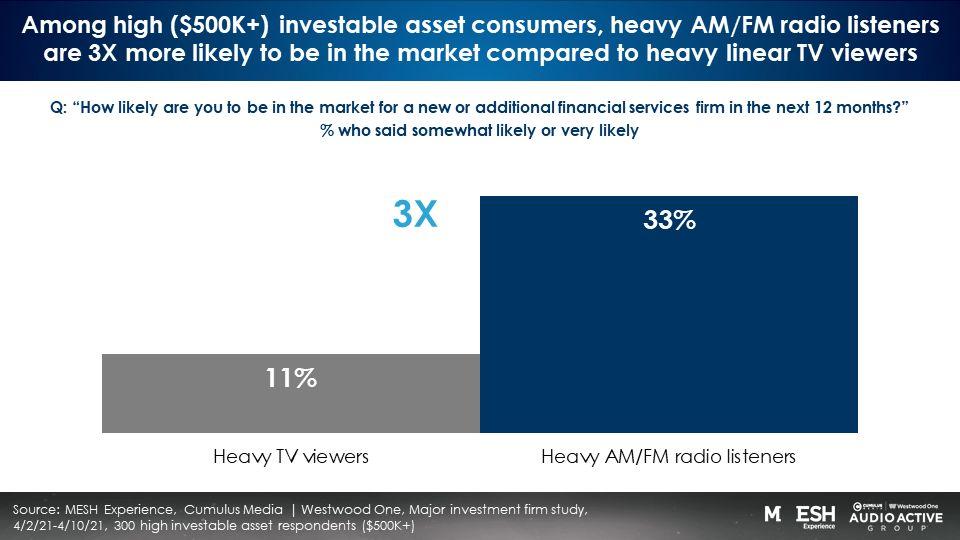

- Case study #1: MESH Experience: Among consumers with $500K+ of investable assets, heavy AM/FM radio listeners are three times more likely than heavy TV viewers to be in the market for a new or additional financial services company.

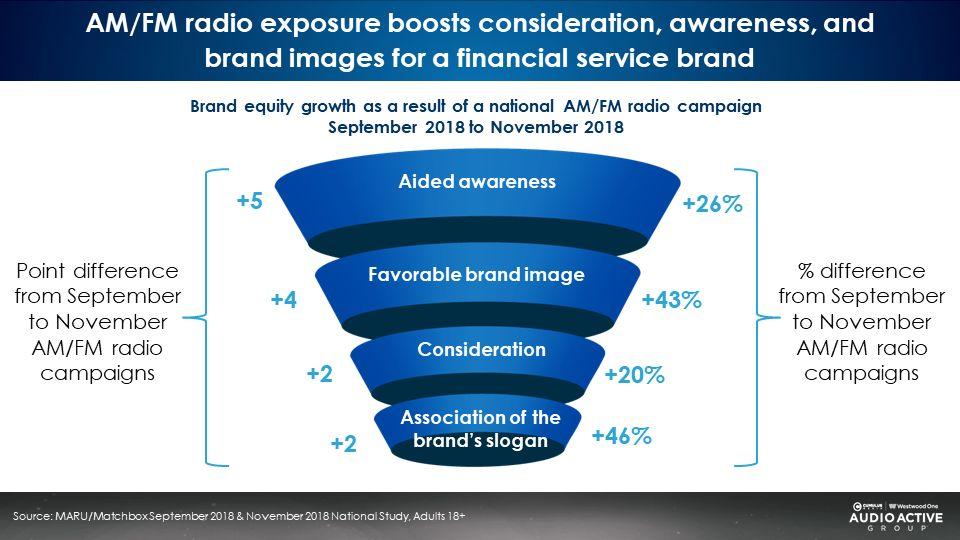

- Case study #2: AM/FM radio drives strong growth in top funnel measures such as awareness, favorability, and consideration.

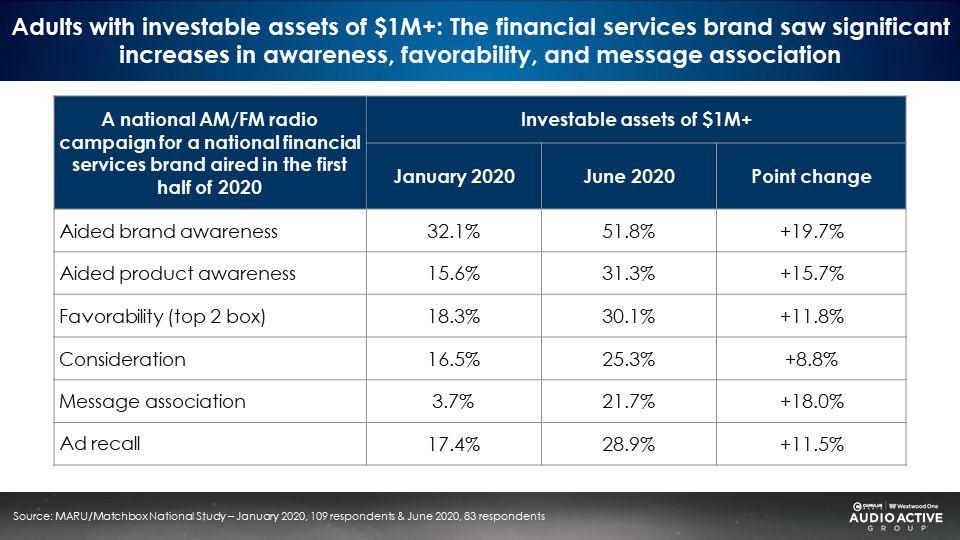

- Case study #3: A MARU/Matchbox study of consumers with $1M+ of investable assets found over a six-month period, an AM/FM radio campaign generated double-digit lifts in most measures of brand equity.

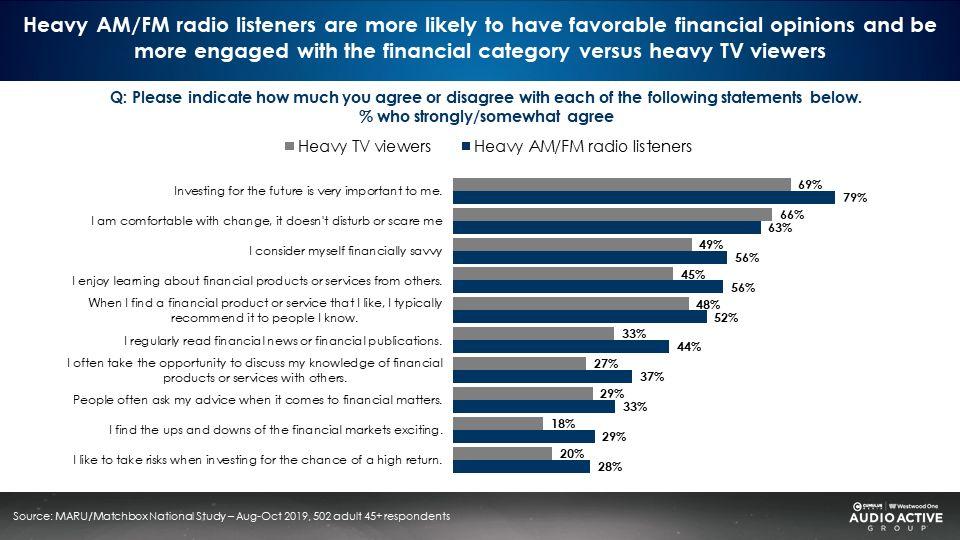

- Case study #4: Heavy AM/FM radio listeners are more likely to be active investors and more engaged with the financial category versus heavy TV viewers.

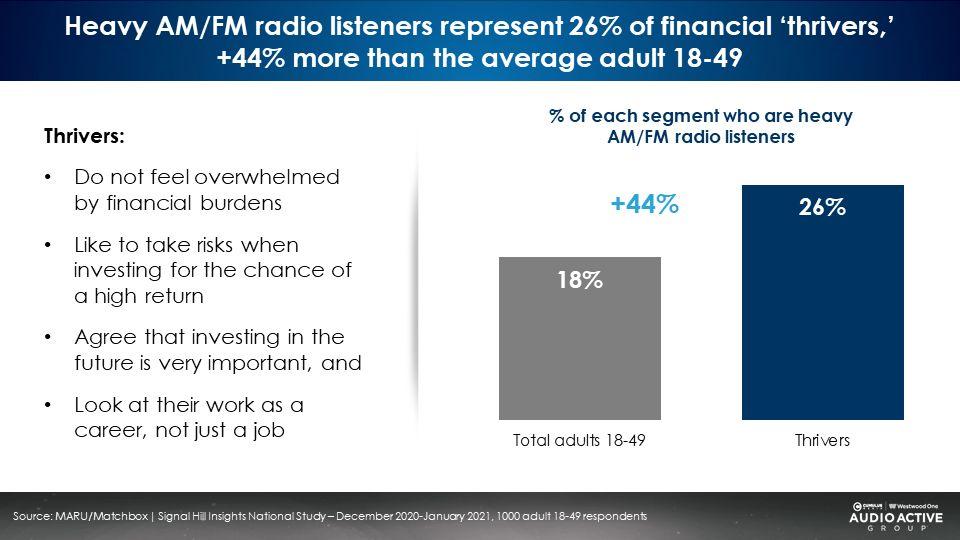

- Case study #5: Financial “thrivers” are +44% more likely to be heavy AM/FM radio listeners. “Thrivers” like taking investing risks and agree that investing is important.

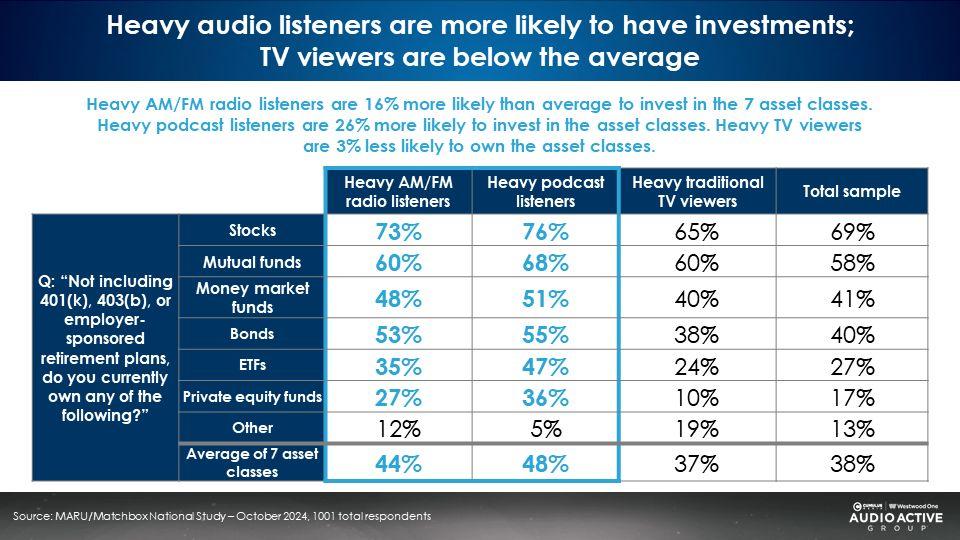

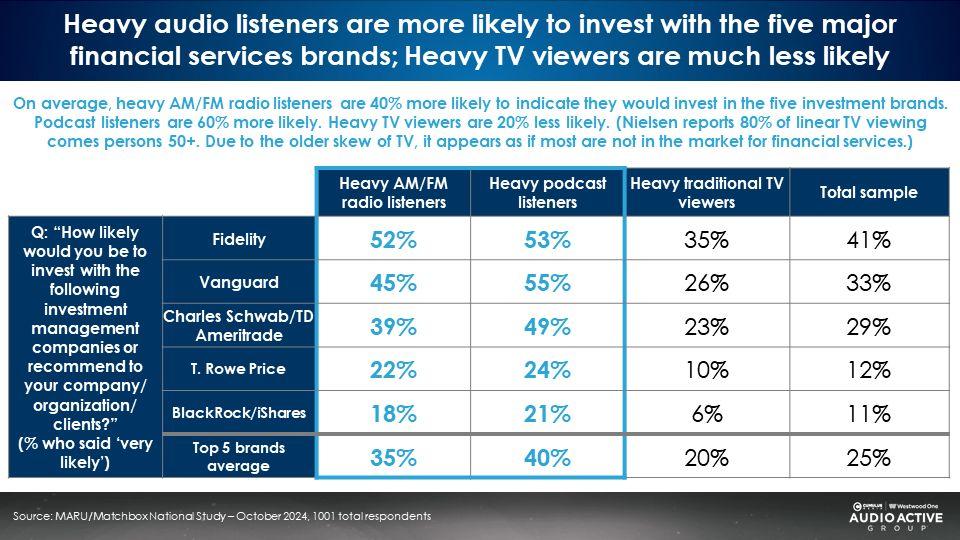

- Case study #6: Compared to TV viewers, audio listeners are much more likely to have investments across a broad array of assets classes and more likely to invest in major financial brands.

- Case study #7: Harris Poll Brand Tracker: A Westwood One NFL AM/FM radio campaign generates significant brand equity impact far stronger than among TV viewers.

Despite massive TV spending by financial service marketers, TV viewers exhibit low brand equity for financial service brands and weak interest in the category due to the older skew of TV audiences

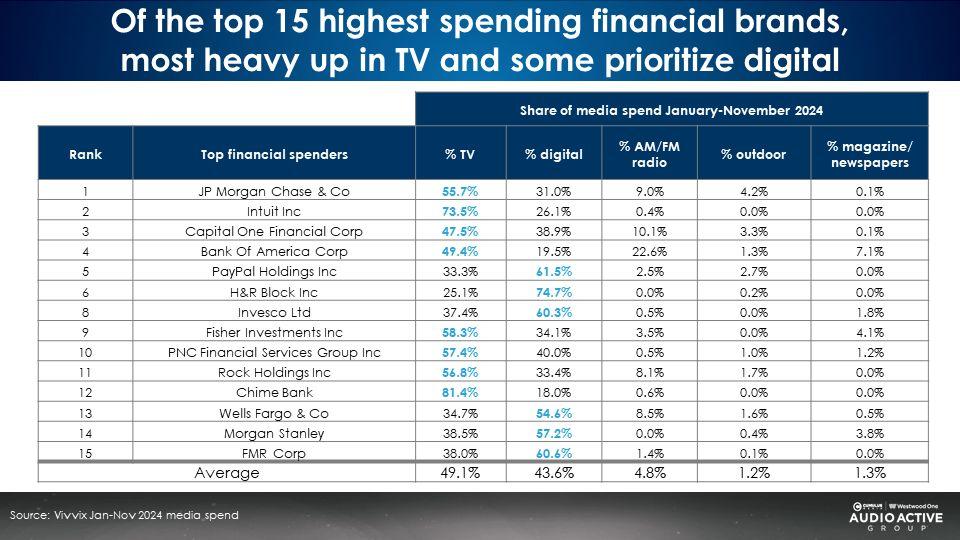

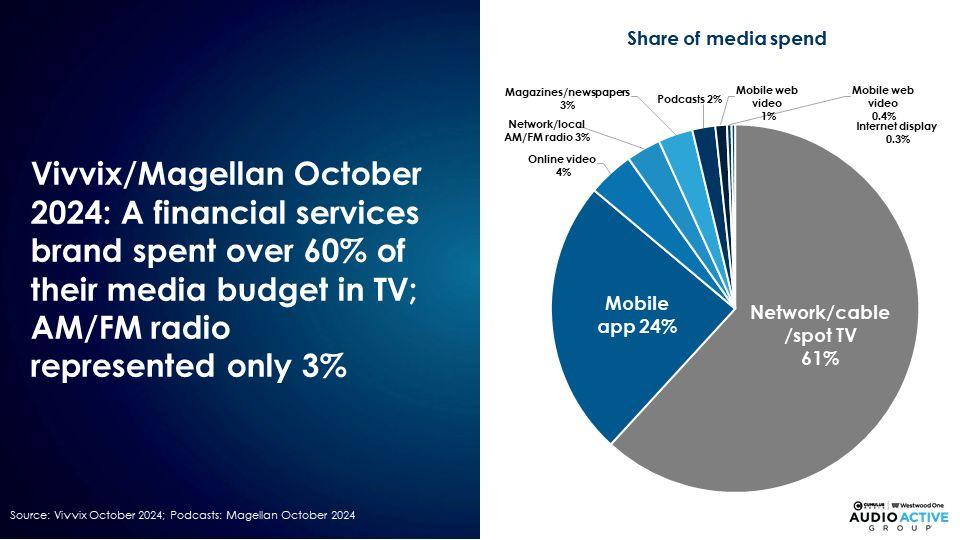

Vivvix reports the top spending financial services brands devote half of their media plans to TV, 44% to digital, and only 5% to AM/FM radio.

MRI-Simmons: Heavy podcast and AM/FM radio listeners are the ideal audiences for financial brands as they are more likely to be premium clients willing to pay for financial services

Audio listeners are more likely than the U.S. average to indicate they would “pay any price for good financial advice.” TV viewers are less likely.

Audio content with the ideal profile for financial brands

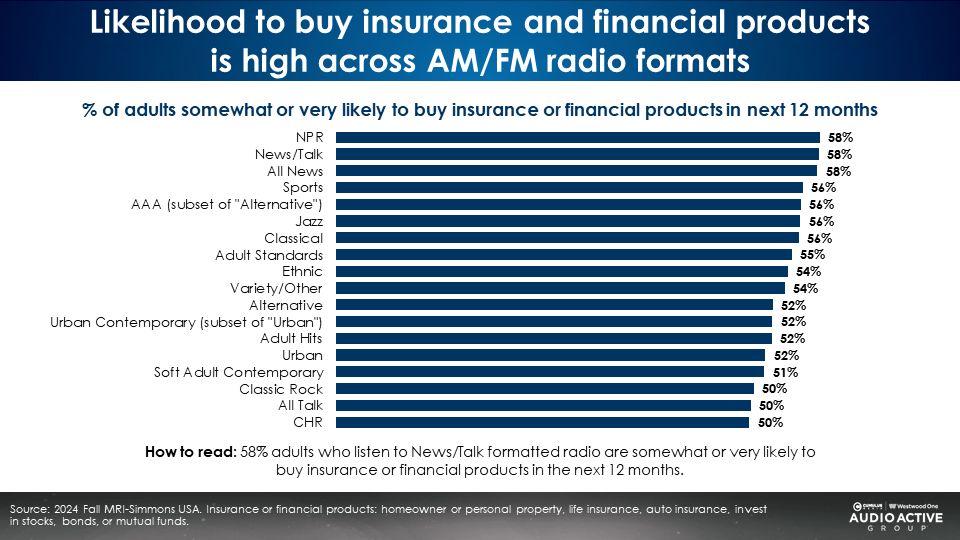

There is a broad array of AM/FM radio programming formats with in-market consumers that offer significant reach for financial marketers.

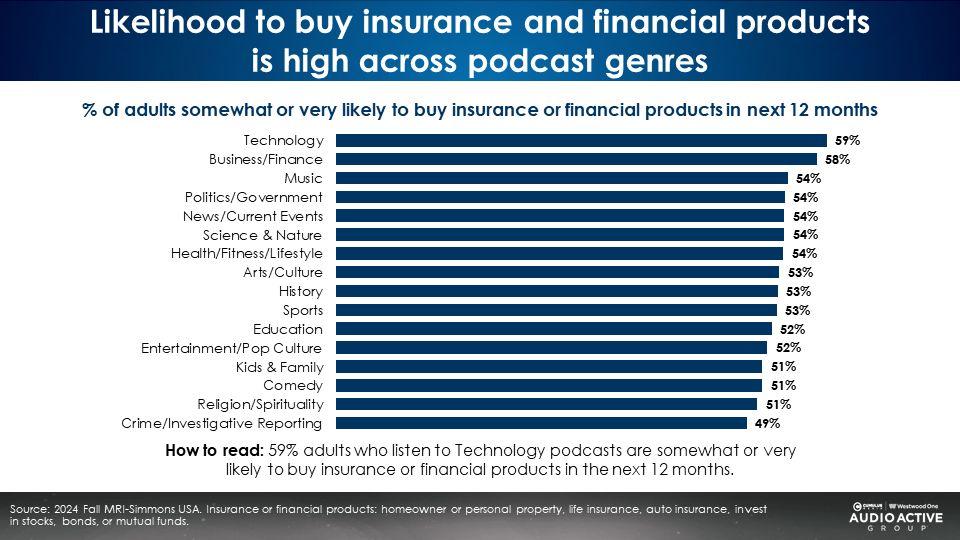

There is an equally large selection of podcast genres with consumers who are in the market for financial services over the next year. The worst podcast media plan for financial services brands only buys a handful of podcasts directly related to financial planning investments. This “pinprick” plan is ineffective. The media weight is insufficient.

Consumers in the market for financial services are found across a vast array of podcast genres. To build a brand and drive sales, marketers must “remind the many, not lecture the few.”

Case study #1: MESH Experience: Among consumers with $500K+ of investable assets, heavy AM/FM radio listeners are three times more likely than heavy TV viewers to be in the market for a new or additional financial services company

A study of high investable asset consumers ($500+) conducted in 2021 by MESH Experience found AM/FM radio listeners are more likely than TV viewers to be in the market for a financial services firm in the next year.

33% of heavy AM/FM radio listeners say they are somewhat or very likely to be in the market for a new or additional financial services firm. Only 11% of heavy TV viewers said they were in-market. The reason? Demography.

According to Nielsen, half of linear TV viewers are over the age of 65. As such, these older viewers are most likely happy with their choice of their financial services firm and well into their retirement.

Since AM/FM radio is the soundtrack of the American worker, AM/FM radio listeners are much younger and more likely to be employed and still have kids in the household. In short, they are more interested in the financial services category and are much better prospects for financial brands.

Case study #2: AM/FM radio drives strong growth in top funnel measures such as awareness, favorability, and consideration

A MARU/Matchbox study of a financial services brand revealed AM/FM radio ads drove double-digit increases in awareness, brand image, consideration, and slogan association.

Case study #3: A MARU/Matchbox study of consumers with $1M+ of investable assets found over a six-month period, an AM/FM radio campaign generated double-digit lifts in most measures of brand equity

Case study #4: Heavy AM/FM radio listeners are more likely to be active investors and more engaged with the financial category versus heavy TV viewers

A MARU/Matchbox study of adults 45+ reveals across a variety of statements about financial literacy, category passion, and interest, heavy AM/FM radio listeners have more favorable opinions versus heavy TV viewers.

56% of heavy AM/FM radio listeners say they “enjoy learning about financial products and services from others” versus only 45% among heavy TV viewers.

Those who say “investing for the future is very important to me” are more likely to be heavy AM/FM radio listeners (79%) than heavy TV viewers (69%).

Case study #5: Financial “thrivers” are +44% more likely to be heavy AM/FM radio listeners; “Thrivers” like taking investing risks and agree that investing is important

A MARU/Matchbox and Signal Hill Insights study revealed AM/FM radio delivered the key target for the financial services brand – thrivers. Compared to the average adult 18-49, financial “thrivers” are +44% more likely to be heavy AM/FM radio listeners. Thrivers do not feel overwhelmed by financial burdens, like to take investing risks, agree that investing is important, and consider their work a career versus a job.

Case study #6: Compared to TV viewers, audio listeners are much more likely to have investments across a broad array of assets classes and more likely to invest in major financial brands

Audio is an ideal media platform for financial service brands. A study recently conducted in October 2024 by MARU/Matchbox of 1,000 Americans found podcast listeners are 30% more likely than TV viewers to own seven types of investments. AM/FM radio listeners are 19% more likely than TV viewers.

Despite significant spend on TV, MARU/Matchbox found audio listeners are twice as likely as TV viewers to indicate they would be likely to invest with five of the biggest names in financial services.

For example, 52% of heavy AM/FM radio listeners and 53% of heavy podcast listeners say they would be very likely to invest in Fidelity compared to only 35% of heavy TV viewers. This is despite spending 27 times more on TV versus AM/FM radio.

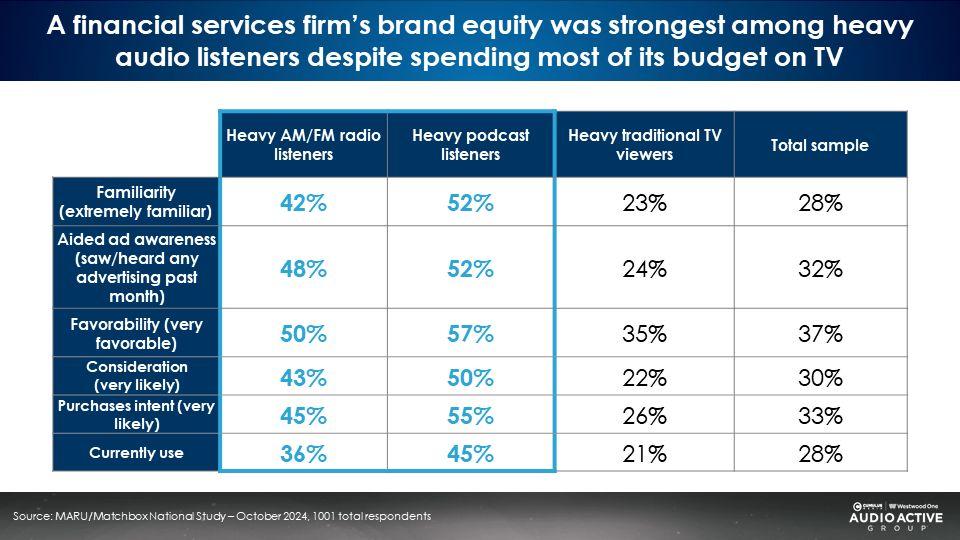

The MARU/Matchbox study also revealed much stronger brand equity for the financial services brand that advertised on AM/FM radio among audio listeners versus TV viewers. This is despite massive spending on television.

Audio platforms drive impact among financial services business to business segments such as advisors, plan sponsors, and consultants

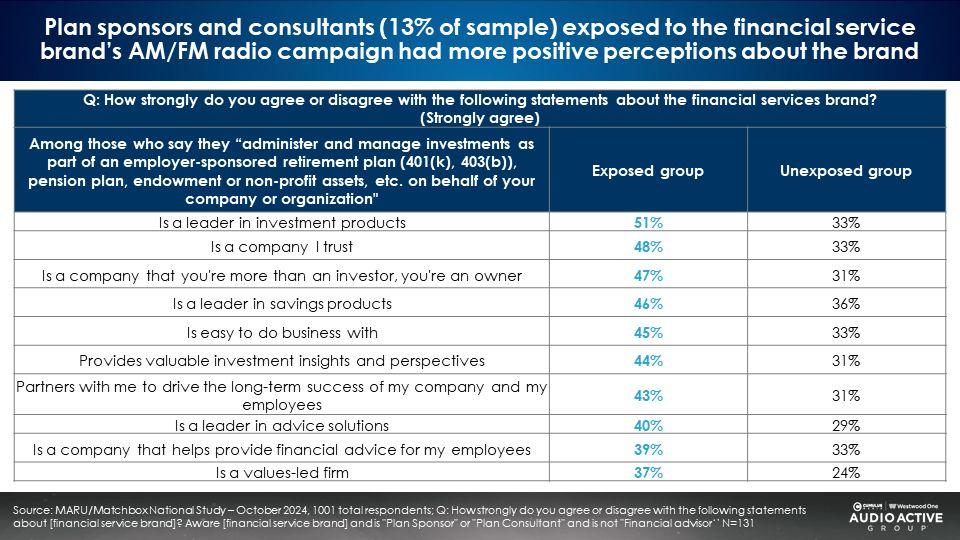

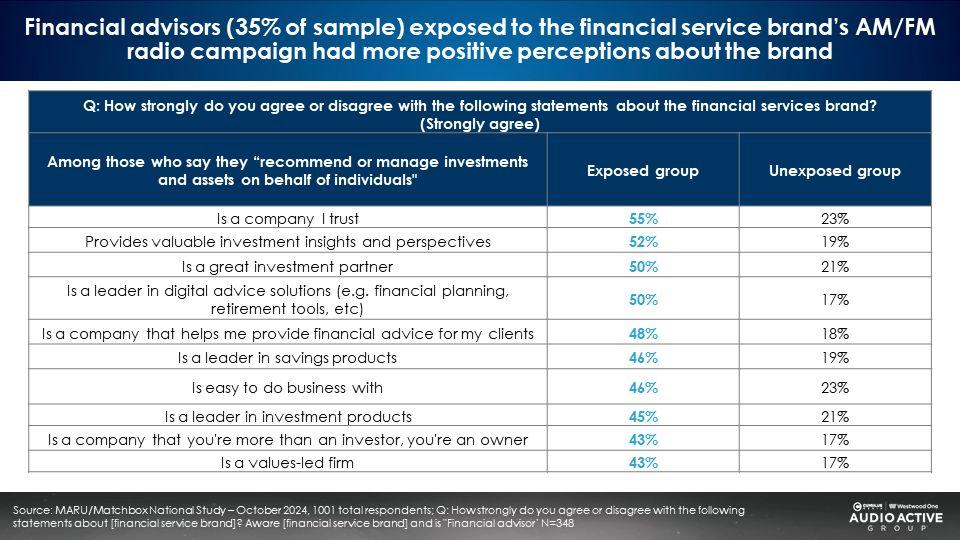

The October 2024 MARU/Matchbox study found financial plan sponsors and consultants exposed to an AM/FM radio campaign developed strong brand associations for the financial services firm compared to those not exposed to the campaign.

The AM/FM radio campaign also generated strong brand equity performance among financial advisors.

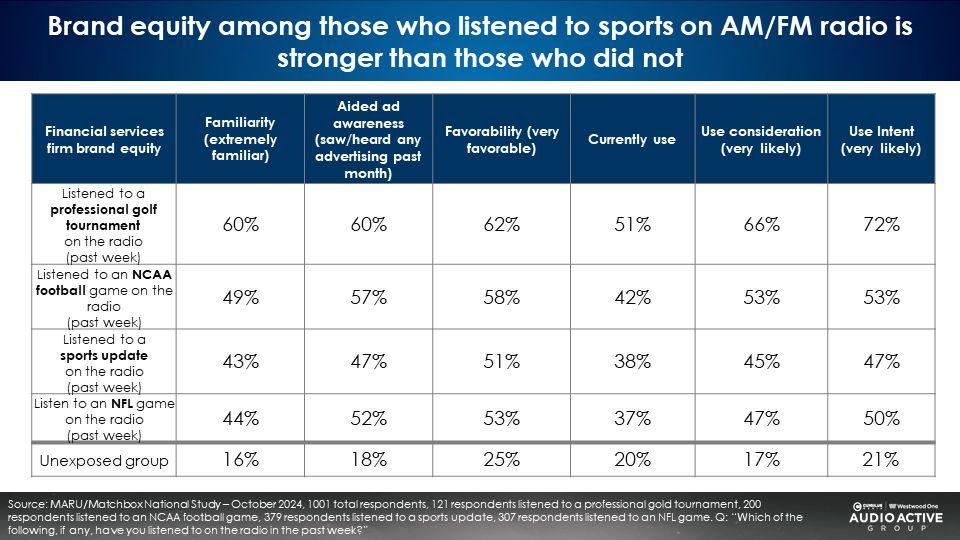

AM/FM radio sports play-by-play provides an excellent environment for financial service marketers

The MARU/Matchbox study also found the financial brand generated strong impact across a wide variety of Westwood One sports play-by-play platforms including golf, NCAA football, sports updates, and the NFL.

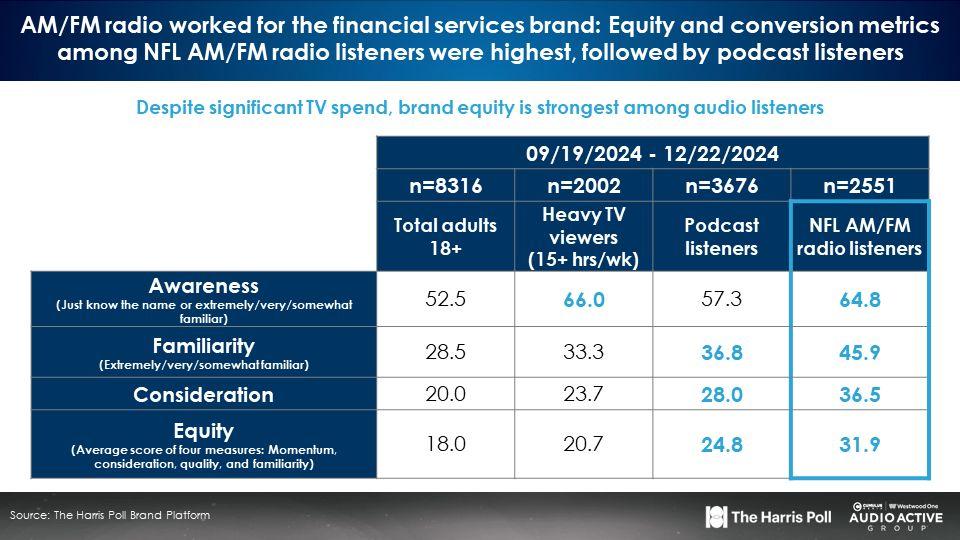

Case study #7: Harris Poll Brand Tracker: A Westwood One NFL AM/FM radio campaign generates significant brand equity impact far stronger than among TV viewers

A financial services brand recently conducted an AM/FM radio campaign in Westwood One’s NFL audio coverage. Historically, Vivvix/Magellan ad spending reporting reveals the brand spends the vast majority of its media plan on TV.

Despite the TV media spend eclipsing the audio media spend, brand the Harris Poll Brand Tracker revealed brand equity to be highest among audio consumers.

Key takeaways:

- Compared to TV viewers, audio listeners are far more likely own investment assets, to be in the market for financial services, and be interested in the category.

- Despite massive TV spending by financial service marketers, TV viewers exhibit low brand equity for financial service brands and weak interest in the category due to the older skew of TV audiences.

- MRI-Simmons: Heavy podcast and AM/FM radio listeners are the ideal audiences for financial brands as they are more likely to be premium clients willing to pay for financial services.

- Case study #1: MESH Experience: Among consumers with $500K+ of investable assets, heavy AM/FM radio listeners are three times more likely than heavy TV viewers to be in the market for a new or additional financial services company.

- Case study #2: AM/FM radio drives strong growth in top funnel measures such as awareness, favorability, and consideration.

- Case study #3: A MARU/Matchbox study of consumers with $1M+ of investable assets found over a six-month period, an AM/FM radio campaign generated double-digit lifts in most measures of brand equity.

- Case study #4: Heavy AM/FM radio listeners are more likely to be active investors and more engaged with the financial category versus heavy TV viewers.

- Case study #5: Financial “thrivers” are +44% more likely to be heavy AM/FM radio listeners. “Thrivers” like taking investing risks and agree that investing is important.

- Case study #6: Compared to TV viewers, audio listeners are much more likely to have investments across a broad array of assets classes and more likely to invest in major financial brands.

- Case study #7: Harris Poll Brand Tracker: A Westwood One NFL AM/FM radio campaign generates significant brand equity impact far stronger than among TV viewers.

Click here to view a 15-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.