Seven Marketing Strategies For An Uncertain Economy: How A Focus On Emotional Campaigns And A Budget Shift To AM/FM Radio Can Keep Brands Afloat

Click here to view a 17-minute video of the key findings.

Click here to download a PDF of the slides.

Marketing decisions can be difficult during periods of economic uncertainty. Thankfully, there is a treasure trove of marketing effectiveness best practices from prior economic cycles that can help advertisers stay relevant and protect future sales.

Here are seven best practices for how advertisers can proceed:

- Ensure share of voice exceeds share of market

- Continue to advertise: According to the World Advertising Research Center (WARC)/Millward Brown, it can take up to 5 years for brands to recover from “going dark”

- Prioritize creative for more memorable brand effects: Superior creative can generate outsized lifts on ROI and sales effect

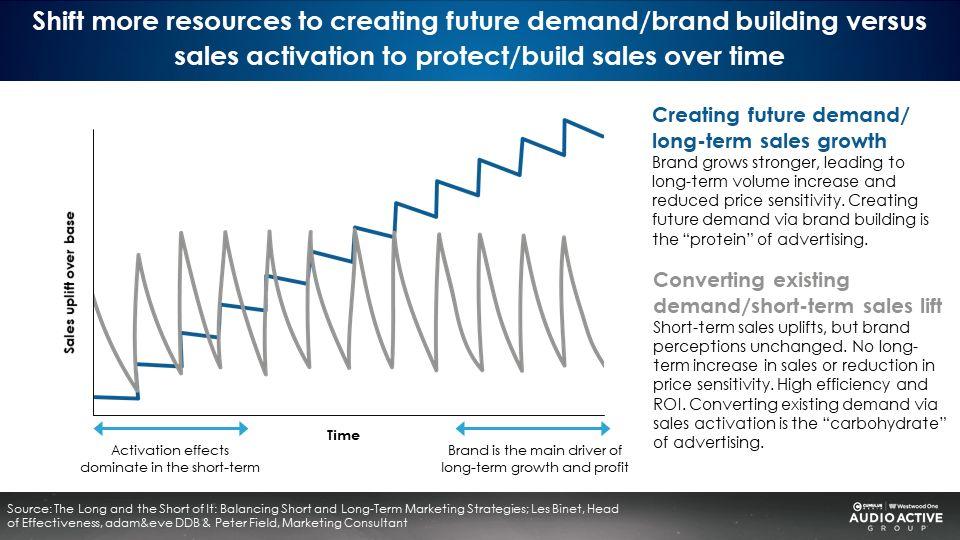

- Shift more resources to creating future demand/brand building versus converting existing demand via sales activation

- Place a greater emphasis on emotional campaigns to build your brand more strongly; Make people feel something: Your ads should put a lump in the throat or cause happiness, surprise, or laughter

- Shift budget to AM/FM radio to grow reach even if total budgets are reduced

- Focus on, and keep in touch with, the customer, a brand’s biggest asset

Leading marketing effectiveness leaders and firms offer studies, insights, and strategies on how to market during uncertain times

We consulted significant studies from the giants of marketing effectiveness: Kantar, the Ehrenberg-Bass Institute for Marketing Science, the World Advertising Research Center (WARC), the Advertising Research Foundation, the Institute for the Practitioners of Advertising, and the work of Peter Field and Les Binet, the “godfathers of marketing effectiveness.”

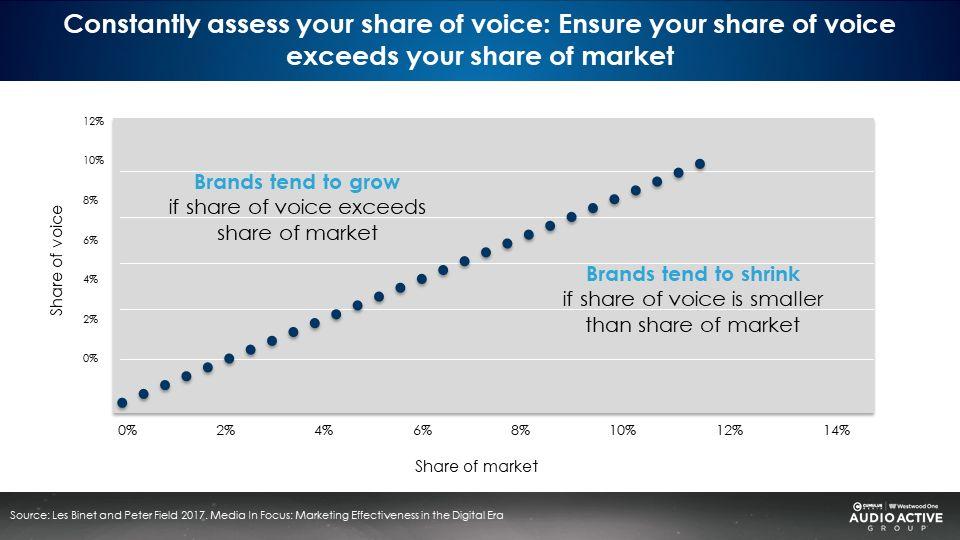

1. Ensure share of voice exceeds share of market

The relationship between share of voice (share of category spend) and share of market can predict if a brand grows, declines, or remains stable.

Share of voice is the brand ad spend divided by category ad spend. Share of market is a brand or retailer’s revenue divided by category sales.

Compare share of voice to share of market to project future sales.

- If share of voice exceeds share of market, brands tend to grow.

- If share of voice is similar to share of market, brands tend to be stable.

- If share of voice is smaller than share of market, brands tend to shrink.

According to Millward Brown, during times of economic uncertainty, keeping a high share of voice is effective. In Marketing During Recession: To Spend or Not to Spend, they state, “If you increase your marketing investment at a time when competitors are reducing theirs, you should substantially increase the saliency of your brand. This could help you establish an advantage that could be maintained for many years.” Even if you maintain some level of advertising while others are not, you can benefit your brand.

2. Continue to advertise: According to WARC/Millward Brown, it can take up to 5 years for brands to recover from “going dark”

Economic instability can trigger the impulse to pull advertising. If there is less spending by consumers, logic would dictate that there would be less of a need to advertise due to the lower numbers of customers.

The Advertising Research Foundation states otherwise in their When Brands Go Dark report: “During recessions, companies must understand customers’ shifting needs and then adjust their communications strategies and offerings. Marketers should segment customers according to their recession psychology (from fearful to carefree) and how they categorize their purchases (from essentials to expendables).”

An economic recession is handled differently depending on the consumer. Some save. Some spend. Instead of a blanket decision to go dark, marketers must take the time to understand the different consumer segments.

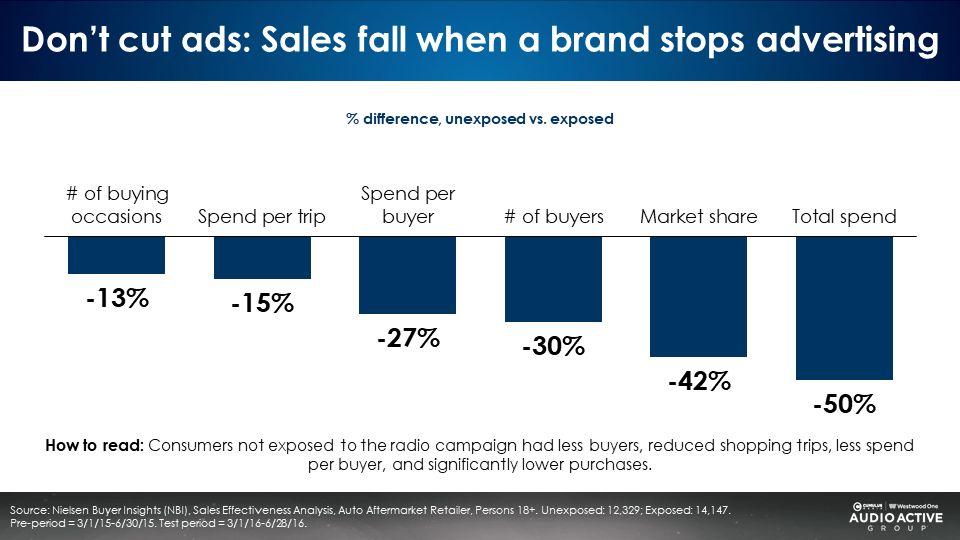

Going dark is risky. According to a Nielsen ROI study commissioned by Westwood One for a retailer, cutting ads is detrimental across the board. Among those not exposed to AM/FM radio ads, the retailer saw decreases in the number of buying occasions (-13%), spend per trip (-15%), spend per buyer (-27%), number of buyers (-30%), market share (-42%), and total consumer spend (-50%).

The Advertising Research Foundation reports that continuing to market during recessions is “strongly associated with positive shareholder value, customer loyalty, and superior long-term profitability.” WARC/Millward Brown warn that “it can take up to five years to recover from budget-cutting during a recession.”

Continuing to advertise endears brands to consumers. Cutting spend can be disastrous to long-term branding efforts.

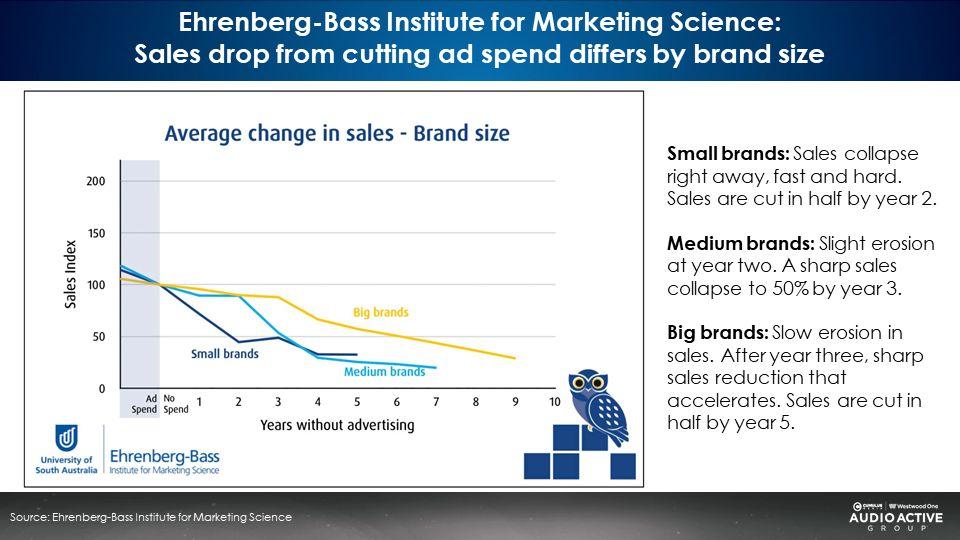

The smaller the brand, the sharper the sales collapse when advertising stops

The Ehrenberg-Bass Institute for Marketing Science studied the sales effect of brands that had stopped advertising. Their research reveals sharpness of sales decay varies by brand size.

- Small brands: Sales collapse right away, fast and hard. Sales are cut in half by year 2.

- Medium brands: Slight erosion at year two. A sharp sales collapse to 50% by year 3.

- Big brands: Slow erosion in sales. After year three, sharp sales reduction that accelerates. Sales are cut in half by year 5.

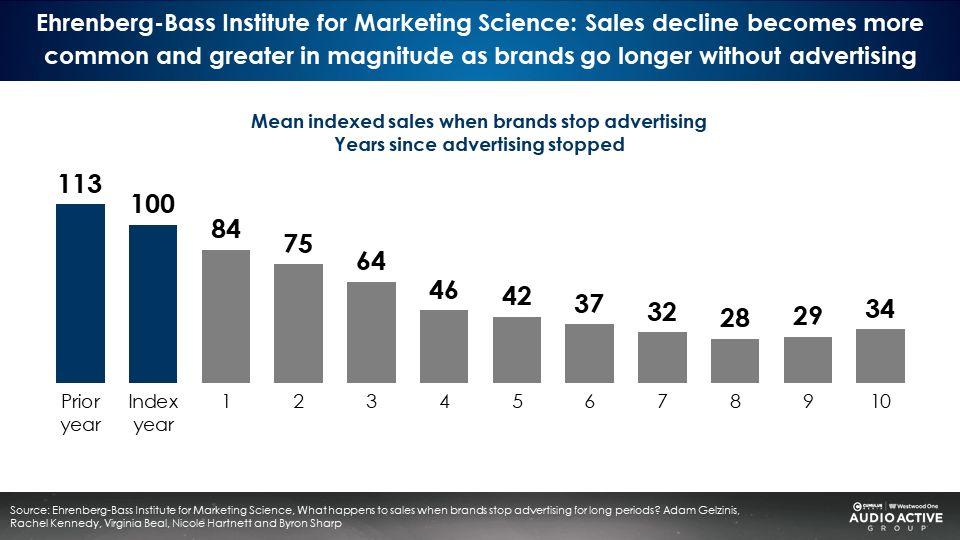

Ehrenberg-Bass research reveals the longer brands go without advertising, the greater the sales collapse.

3. Optimize creative for more memorable brand effects

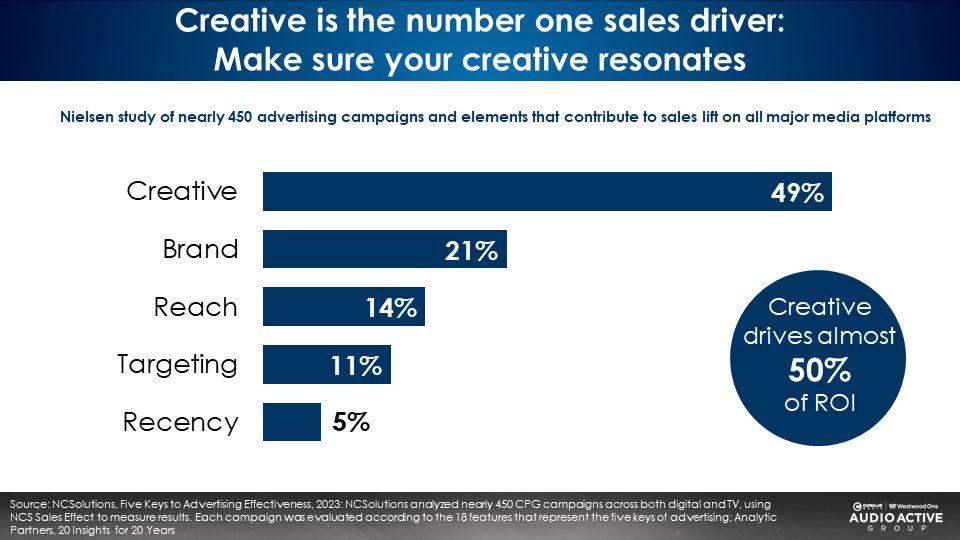

Creative is critical to the success of ad campaigns. According to a NCSolutions study of nearly 450 TV, digital, and audio campaigns, creative is the number one sales driver. Creative contributes 49% of the total sales lift.

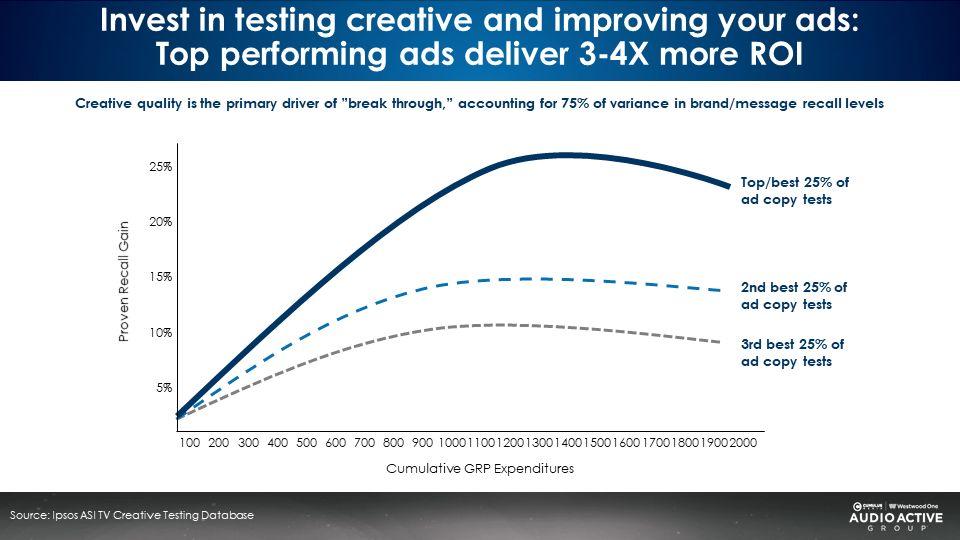

Creative might seem frivolous to focus on during periods of economic uncertainty but making quality creative a priority can pay dividends even when overall spend is decreased. A large study conducted over many categories found creative had five times as much impact on profit as budget allocation.

WARC/Millward Brown find that “more memorable creative can maintain or increase ad awareness levels, even with a lower spend.” Developing creative that resonates with consumers is time well spent for brands during times of economic uncertainty.

4. Shift more resources to creating future demand/brand building versus converting existing demand via sales activation

Marketers have two important jobs: creating future demand and converting existing demand.

Converting existing demand is advertising to that relatively small group of consumers who are ready to buy and capturing as large a share as possible of them for a product. It is estimated only 1-5% of people are “in the market” at any one period of time. John Dawes of the Ehrenberg-Bass Institute of Marketing Science estimates 5%. Podcast attribution reveals only 1% convert.

Creating future demand advertises to that much larger group of consumers who are not in the market and are not ready to buy now but will be in the future. The goal is making them feel familiar with and positively toward an advertiser in order to get them to gravitate toward them when they enter the category.

Creating future demand is like planting new apple trees. It takes time and patience for new trees to bear fruit.

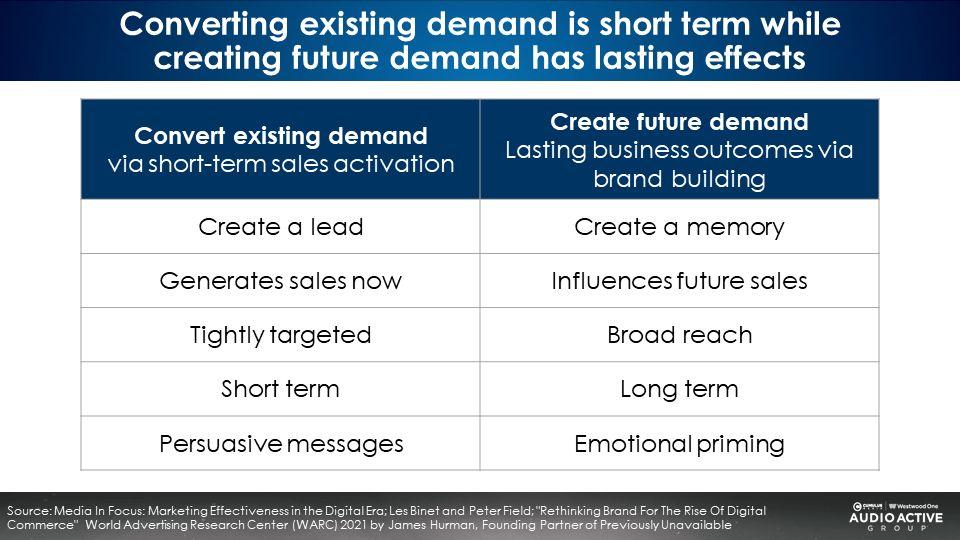

Converting existing demand and creating future demand require different creative/copy approaches and different media strategies

James Hurman, in his book Future Demand writes, “Converting Existing Demand is most efficiently achieved by tightly targeting those ‘in the market’ with rational messaging of product and price information that persuades them to choose our product over others.

Sales event or promotional copy does not work on the large group of consumers who are not in the market and not ready to buy now. Creating future demand is about creating positive memories.

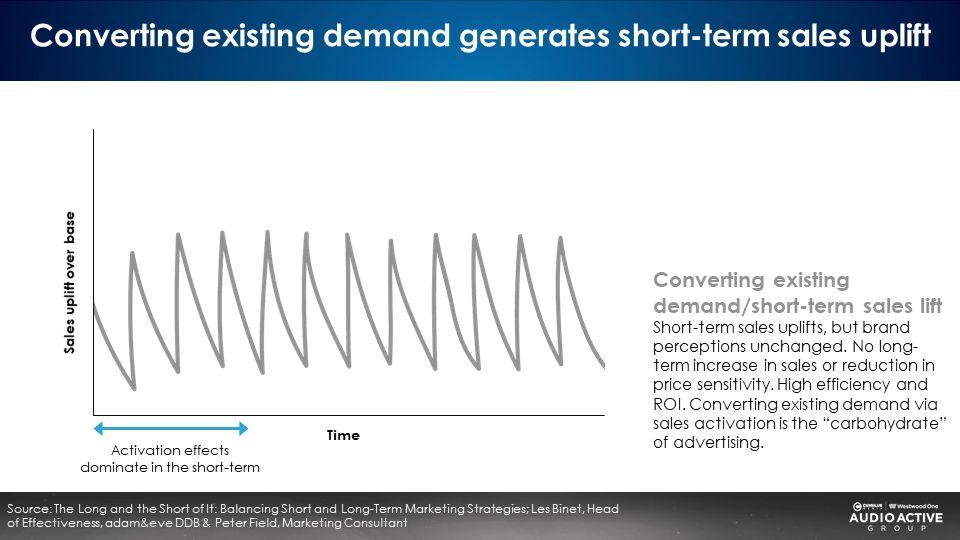

Converting existing demand has short-term impact but little long-term benefit: Sales events and promotions are the carbohydrates of advertising

Les Binet and Peter Field, the “godfathers of marketing effectiveness,” describe the sales effect of promotional strategies converting existing demand. Sales event advertising creates sharp short-term sales uplifts followed by quick drop offs. The grey line below represents sales from promotional events which generate sales “sugar highs” followed by quick crashes.

Creating future demand creates sustained long-term sales and profit growth

While the grey line below represents the sales effect of converting existing demand, the blue line represents the sales effect of creating future demand with brand building advertising. Creating future demand is the strategy for long-term growth.

Binet and Field recommend marketers allocate 40% of their marketing budgets to converting existing demand via sales events. They recommend 60% of marketing budgets be devoted to creating future demand via brand building advertising.

Creating future demand is the protein of advertising

As a business becomes better known, its brand grows stronger, leading to long-term volume increases and reduced price sensitivity. Creating future demand via brand building is the “protein” of advertising.

Millward Brown advises, “Don’t price promote unless you can cut costs or live with lower margins. It’s tempting to cut prices in order to retain price-sensitive shoppers, but this can be a risky strategy. If your brand offers a compelling rational or emotional advantage over the competition, people who are forced to switch to cheaper brands are likely to buy your brand again when the recession is over.”

During an uncertain economy, brands need to look at their long-term sales strategies. Short-term sales spikes won’t ensure brand longevity.

Focus instead on developing a deeper relationship with consumers through branding campaigns that will take root and make a lasting impact. The economy bounces back. When spending resumes, the results of strong branding campaigns can start to reveal themselves.

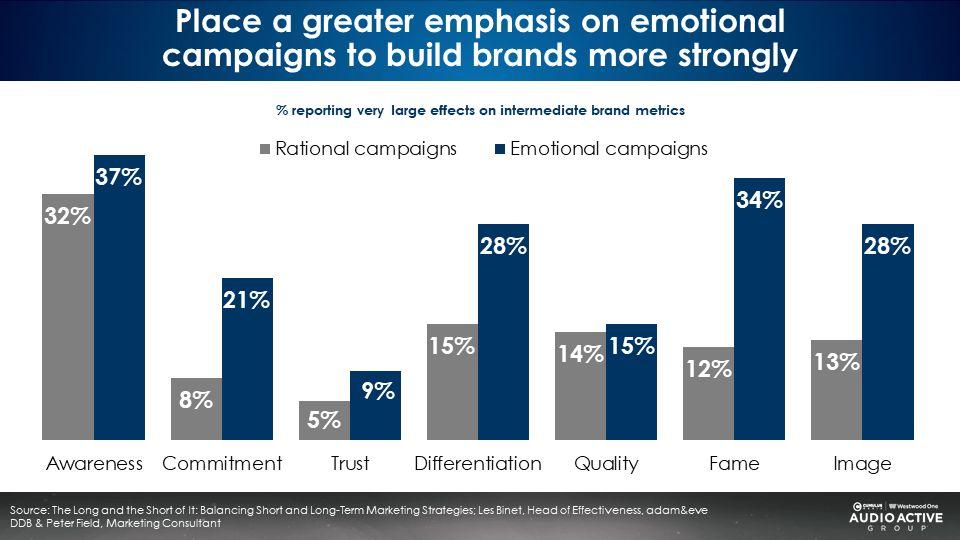

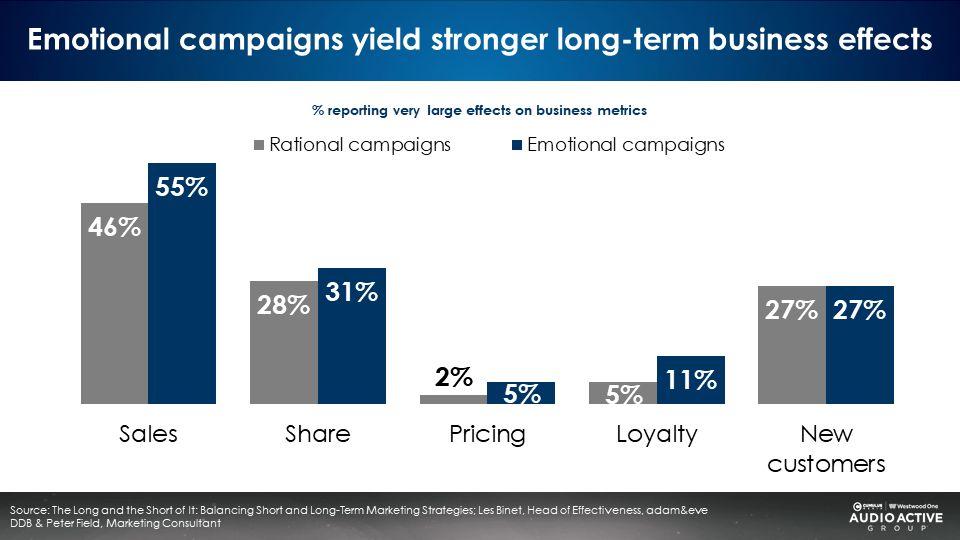

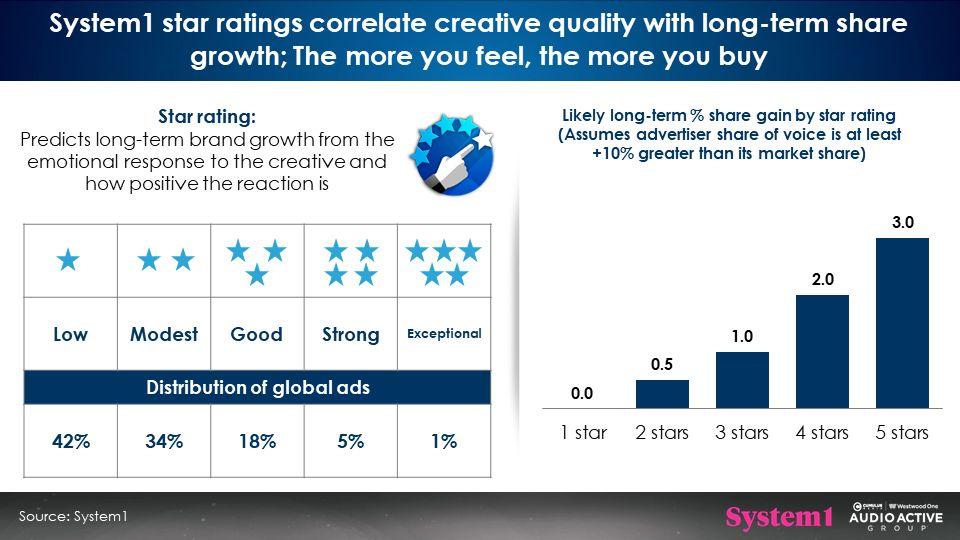

5. Place a greater emphasis on emotional campaigns to build your brand more strongly; Make people feel something: Your ads should put a lump in the throat or cause happiness, surprise, or laughter

Across all metrics, Binet and Field find emotional campaigns result in very large brand effects among consumers, far outweighing the impact of rational campaigns. Awareness, commitment, trust, differentiation, quality, fame, and image are all see stronger performance from emotional campaigns compared to their rational campaign counterparts.

Not only does a shift to emotion-based creative improve brand equity, it also generates stronger business outcomes. Binet and Field’s research found emotion-based campaigns drive greater sales, share, pricing power, and loyalty versus rational campaigns.

System1, the leading creative effectiveness measurement firm, assigns one to five stars to an ad to quantify amount of positive emotion. The greater the star score, the greater the long-term market share growth. The more you feel, the more you buy.

Putting a stronger emphasis on campaigns that show empathy and touch consumers on an emotional level will build a brand more strongly. Emotions, feelings, and associations are more important than the message.

For an example of a brand exercising empathy for their customers, look no further than the Ford Motor Company. Last week, the brand announced it will offer employee pricing – a discounted rate available to its workers – to all customers. The program is called the “From America for America” plan and is available to U.S. shoppers. In addition to showing compassion to their customers, the move creates strong positive emotional connections for the brand.

6. Shift budget to AM/FM radio to grow reach even if total budgets are reduced

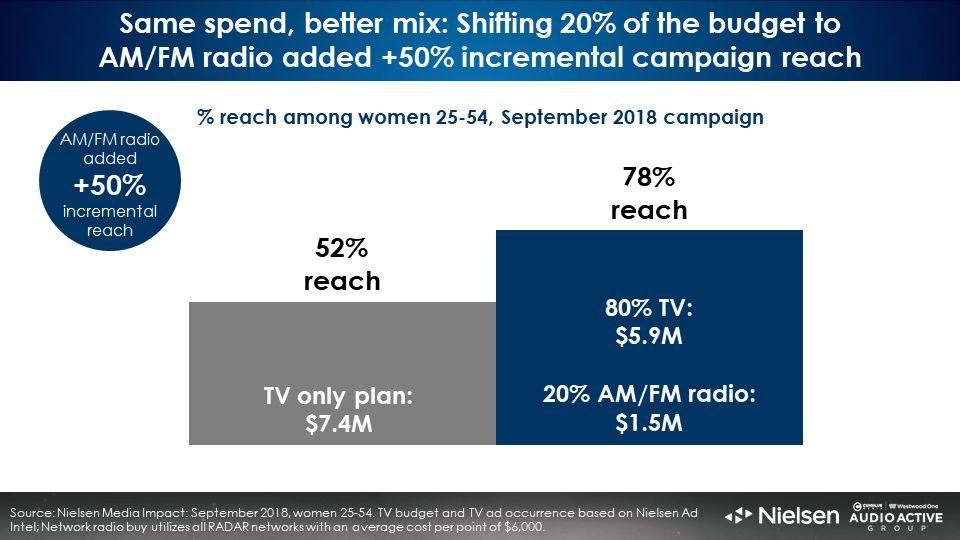

Using Nielsen Media Impact, a cross-platform media planning and optimization platform, it is possible to definitively prove how shifting a small portion of a budget from TV to AM/FM radio adds incremental reach.

For example, a $7.4 million TV investment for a furnishings retailer generates 52% reach among the target consumer, women 25-54. The same spend with a 20% reallocation to AM/FM radio adds +50% incremental reach to the total campaign.

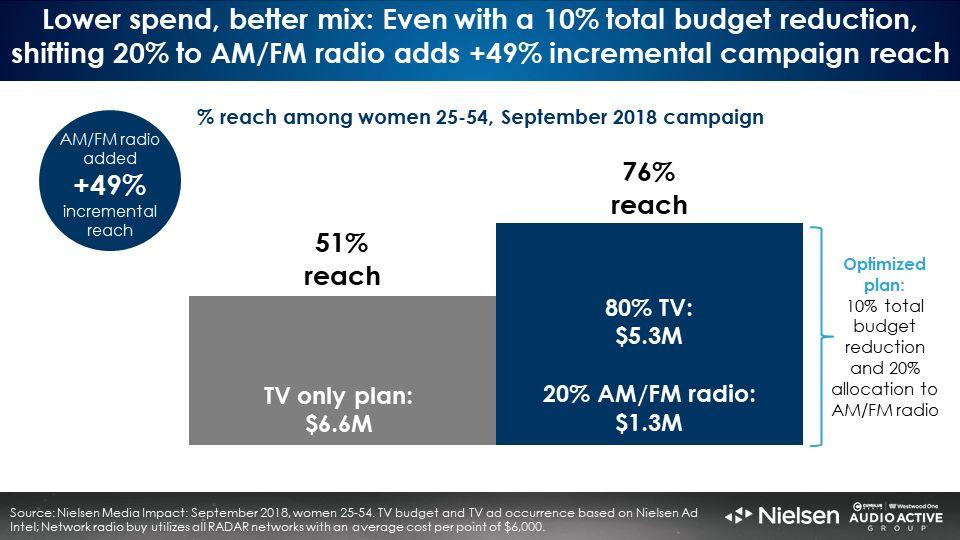

During times of economic uncertainly, budgets tend to be reduced. However, even with a lower spend, AM/FM radio’s impact on a TV campaign is significant.

A reduction of the furnishings retailer’s budget by 10% means a $6.6 million TV only plan generates 51% reach. Reallocating 20% of the budget to AM/FM radio, even with a reduced overall spend, still generates +49% incremental reach.

A cut in spend isn’t necessarily detrimental to campaign reach. By using an optimized plan of reallocated dollars, advertisers can utilize AM/FM radio’s power as a mass reach medium to make up for losses elsewhere. Shifting 20% of the TV budget to AM/FM radio lifts reach from 51% to 76%.

7. Focus on, and keep in touch with, the customer, a brand’s biggest asset

Millward Brown advises that service providers ensure “marketing activities are focused correctly on your most valuable, loyal, and satisfied customers. Keep them happy and reward their loyalty. If you contact with customers through monthly billing statements (one piece of mail you can count on people to open), use that vehicle to deliver special offers, relevant news and information.”

Uncertain economies are complicated. While the impulse to pull back on spending might be strong, the results are more layered than brands might assume. Instead of cutting budgets, do as Andrea Brimmer, Chief Marketing and Public Relations Officer at Ally recommends when she says, “Lean into your brand and don’t cut back on spending.”

Focus on share of voice, optimized creative, and brand building and emotional campaigns. With stronger branding and a shift in budget to AM/FM radio, advertisers can strategically weather an uncertain economy.

Marketing strategies for an uncertain economic outlook:

- Ensure share of voice exceeds share of market

- Continue to advertise: According to the World Advertising Research Center (WARC)/Millward Brown, it can take up to 5 years for brands to recover from “going dark”

- Prioritize creative for more memorable brand effects: Superior creative can generate outsized lifts on ROI and sales effect

- Shift more resources to creating future demand/brand building versus converting existing demand via sales activation

- Place a greater emphasis on emotional campaigns to build your brand more strongly; Make people feel something: Your ads should put a lump in the throat or cause happiness, surprise, or laughter

- Shift budget to AM/FM radio to grow reach even if total budgets are reduced

- Focus on, and keep in touch with, the customer, a brand’s biggest asset

Sources:

- How Not To Plan: 66 Ways To Screw It Up, Les Binet and Sarah Carter

- Marketing During Recession: To Spend Or Not To Spend? Millward Brown Points of View

- Marketing During Recession; Survival Tactics, Millward Brown Points of View

- Media In Focus: Marketing Effectiveness In the Digital Era, Les Binet and Peter Field

- When Brands Go Dark, Advertising Research Foundation

- What Happens If I Stop Advertising? WARC

- The Long And the Short of it: Balancing Short And Long-Term Marketing Strategies, Les Binet and Peter Field

- Effectiveness In Context, Les Binet and Peter Field

- Advertising In A Downturn: A Report of Key Findings From An IPA Seminar

- Modern Marketing Dilemmas: How Should Marketers Stand Up To Recession? Kantar

Click here to view a 17-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.